Zuari Agro Chemicals Experiences Technical Trend Shifts Amid Market Volatility

2025-04-03 08:01:53Zuari Agro Chemicals, a microcap player in the fertilizers industry, has recently undergone an evaluation revision reflecting its current market dynamics. The company's stock price has shown notable fluctuations, with a current price of 200.95, up from a previous close of 189.10. Over the past year, the stock has reached a high of 268.00 and a low of 151.00, indicating significant volatility. In terms of technical indicators, the MACD suggests a bearish trend on a weekly basis, while the monthly outlook is mildly bearish. The Bollinger Bands present a mixed picture, with a mildly bearish stance weekly and a bullish perspective monthly. Moving averages indicate a mildly bearish trend on a daily basis, while the KST reflects a bearish sentiment weekly and mildly bearish monthly. When comparing the company's performance to the Sensex, Zuari Agro Chemicals has shown a strong return over the past three years, ...

Read MoreZuari Agro Chemicals Faces Bearish Technical Trends Amid Market Volatility

2025-03-26 08:01:33Zuari Agro Chemicals, a microcap player in the fertilizers industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 185.00, down from a previous close of 193.60, with a 52-week high of 268.00 and a low of 151.00. Today's trading saw a high of 193.30 and a low of 185.00, indicating some volatility within the session. The technical summary for Zuari Agro Chemicals reveals a bearish sentiment across various indicators. The MACD shows a bearish trend on a weekly basis, while the monthly perspective is mildly bearish. Similarly, the Bollinger Bands and KST indicators also reflect bearish tendencies. The moving averages on a daily basis align with this sentiment, indicating a consistent trend in the same direction. In terms of performance, the company has shown mixed results compared to the Sensex. Over the past week, Zuari Agro Chemicals h...

Read MoreZuari Agro Chemicals Faces Mixed Technical Trends Amid Market Evaluation Revision

2025-03-25 08:01:51Zuari Agro Chemicals, a microcap player in the fertilizers industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 193.60, showing a notable increase from the previous close of 188.85. Over the past year, Zuari Agro has experienced a stock return of 7.23%, slightly outperforming the Sensex, which recorded a return of 7.07% in the same period. The technical summary indicates a mixed outlook, with various indicators suggesting a mildly bearish trend on both weekly and monthly bases. The MACD and KST metrics are bearish on a weekly basis, while the moving averages also reflect a mildly bearish stance. Notably, the Bollinger Bands and Dow Theory corroborate this sentiment, indicating a cautious market environment. In terms of performance, Zuari Agro has shown resilience over longer periods, with a remarkable 323.63% return over the past ...

Read MoreZuari Agro Chemicals Faces Short-Term Challenges Amid Long-Term Resilience in Fertilizers Sector

2025-02-27 10:31:10Zuari Agro Chemicals, a microcap player in the fertilizers industry, has experienced notable stock activity today. The company currently holds a market capitalization of Rs 795.00 crore and has a price-to-earnings (P/E) ratio of 3.65, significantly lower than the industry average of 31.64. Over the past year, Zuari Agro Chemicals has seen a decline of 16.04%, contrasting with the Sensex's positive performance of 2.03%. In the short term, the stock has dropped by 0.81% today, while the Sensex has only slightly decreased by 0.03%. Weekly and monthly performances also reflect a downward trend, with losses of 2.82% and 0.63%, respectively. Despite these recent challenges, the company has shown resilience over a longer horizon, with a three-year performance of 56.87% and a five-year performance of 119.84%, both outperforming the Sensex. Technical indicators suggest a bearish sentiment in the short term, with ...

Read MoreZuari Agro Chemicals Faces Technical Trend Shifts Amid Mixed Performance Indicators

2025-02-25 10:29:32Zuari Agro Chemicals, a microcap player in the fertilizers industry, has recently undergone an evaluation revision reflecting shifts in its technical indicators. The company's current price stands at 189.50, slightly down from the previous close of 189.70. Over the past year, Zuari has faced challenges, with a stock return of -16.78%, contrasting with a positive return of 2.08% for the Sensex during the same period. The technical summary indicates a bearish sentiment in several key metrics. The MACD shows bearish trends on both weekly and monthly scales, while Bollinger Bands also reflect a bearish outlook. The KST aligns with this sentiment, indicating bearish conditions on both timeframes. However, the daily moving averages suggest a mildly bullish stance, highlighting some short-term resilience. In terms of performance, Zuari Agro Chemicals has experienced a notable decline year-to-date, with a return ...

Read More

Zuari Agro Chemicals Reports 25.29% Net Profit Growth Amid Financial Challenges

2025-02-08 08:45:10Zuari Agro Chemicals has experienced a recent evaluation adjustment, influenced by its financial performance and market conditions. The company reported a significant increase in net profit for the quarter ending December 2024, alongside strong sales figures, although it continues to grapple with a high debt-to-equity ratio and declining long-term growth in net sales.

Read More

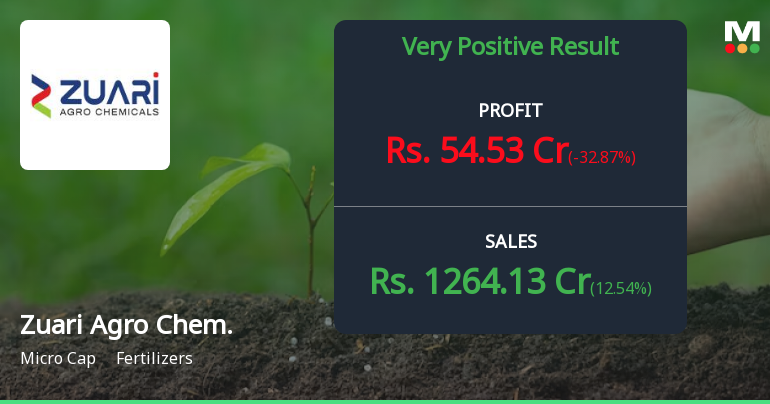

Zuari Agro Chemicals Reports Strong Q4 Results with Significant Profit Growth and Sales Momentum

2025-02-06 18:18:33Zuari Agro Chemicals has announced its financial results for the quarter ending December 2024, highlighting a significant profit before tax of Rs 95.13 crore and record net sales of Rs 1,264.13 crore. The company also reported improved operating profit to interest ratio and growth in profit after tax, indicating a favorable operational environment.

Read More

Zuari Agro Chemicals Reports Q2 FY24 Turnaround Amid Ongoing Financial Challenges

2025-02-03 18:23:53Zuari Agro Chemicals has recently adjusted its evaluation, reflecting improved financial performance in Q2 FY24 after two quarters of losses. Key metrics, including Profit Before Tax and Profit After Tax, reached record highs. However, the company continues to grapple with high debt levels and inconsistent sales growth.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

08-Apr-2025 | Source : BSEPFA Compliance Certificate - under Reg 74(5) of SEBI (DP) Regulations 2018

Disclosure In Terms Of Regulation 30 Of SEBI (Listing Obligations And Disclosure Requirements) Regulations 2015 - Intimation For Early Redemption Of 500 Non-Convertible Debentures (Ncds) Of Rs.10 Lakhs Each Issued By The Company

04-Apr-2025 | Source : BSEPFA Disclosure for early redemption of Unlisted 500 NCDs of Rs.10 Lakhs each aggregating to Rs.50 Crore.

Announcement under Regulation 30 (LODR)-Newspaper Publication

28-Mar-2025 | Source : BSENotice of Postal Ballot- Newspaper advertisement

Corporate Actions

No Upcoming Board Meetings

Zuari Agro Chemicals Ltd has declared 10% dividend, ex-date: 13 Jul 17

No Splits history available

No Bonus history available

No Rights history available