Adani Power Outperforms Sector Amid Mixed Market Trends and Volatility

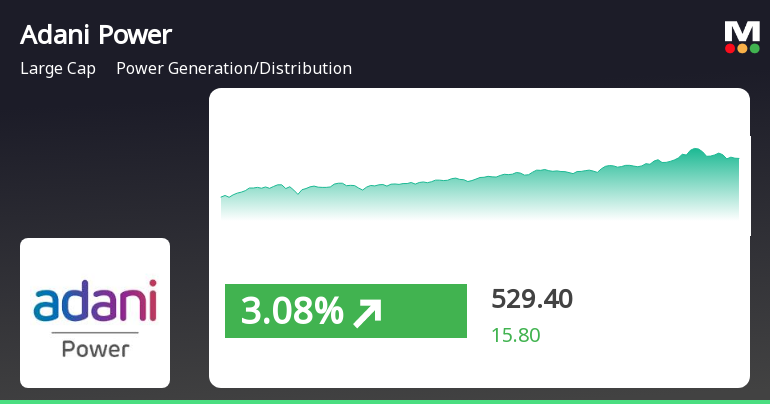

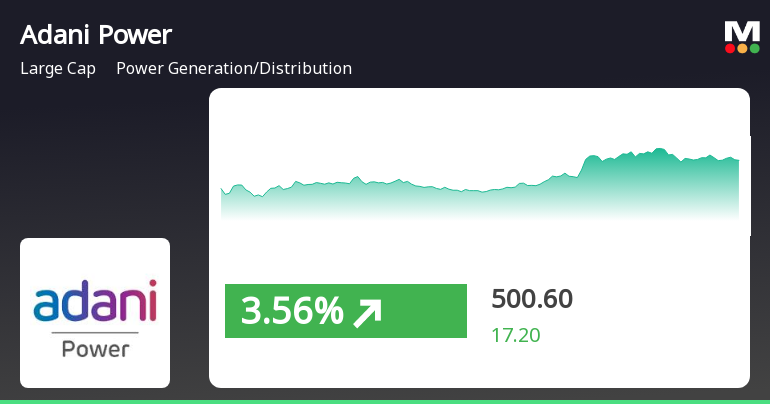

2025-04-03 11:20:28Adani Power has demonstrated notable activity, gaining 3.94% on April 3, 2025, and outperforming its sector. The stock has recorded consecutive gains over two days, totaling 5.78%. While it remains above several short-term moving averages, it is below the 200-day moving average, indicating mixed long-term performance.

Read More

Adani Power Shows Signs of Trend Reversal Amid Broader Market Recovery

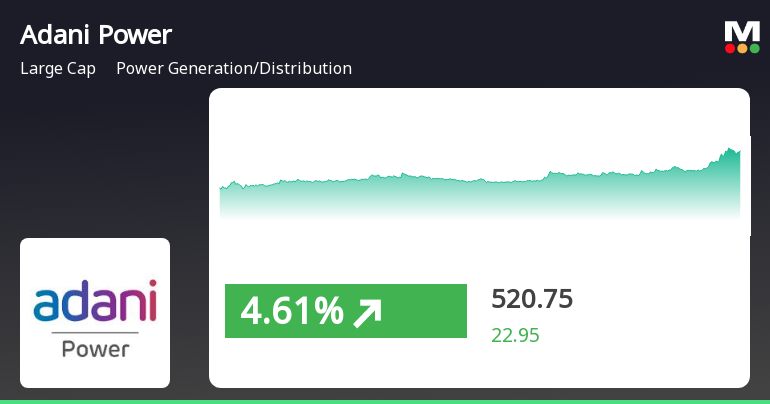

2025-03-27 15:05:29Adani Power experienced a notable increase on March 27, 2025, outperforming its sector after two days of decline. The stock's performance varied across different moving averages, indicating mixed trends. Meanwhile, the broader market saw a significant recovery, with small-cap stocks leading the gains.

Read More

Adani Power Faces Mixed Performance Amid Broader Market Resilience and Mega-Cap Gains

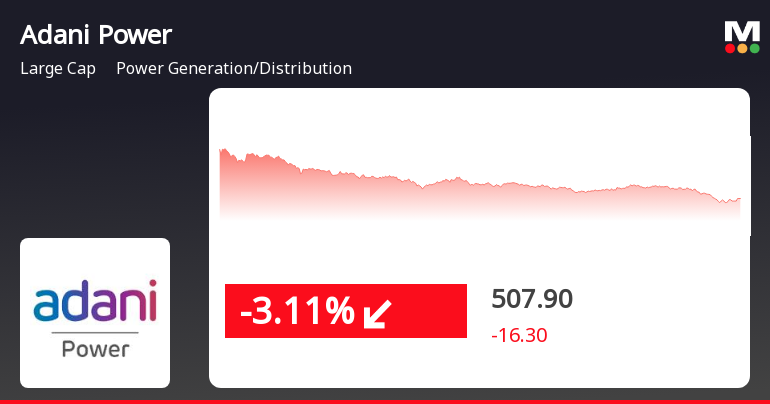

2025-03-25 15:35:28Adani Power's stock declined on March 25, 2025, reversing gains from the previous days. While it remains above some moving averages, it is below others, indicating mixed performance. Year-to-date, the stock has decreased, contrasting with the Sensex's slight drop, though it has seen significant long-term growth.

Read MoreAdani Power Sees High Trading Activity Amid Shifts in Investor Engagement

2025-03-10 13:00:04Adani Power Ltd, a prominent player in the power generation and distribution sector, has emerged as one of the most active equities today. The stock, trading under the symbol ADANIPOWER, recorded a total traded volume of 7,599,374 shares, with a total traded value of approximately Rs 3,974.40 crore. Opening at Rs 506.15, the stock reached an intraday high of Rs 535.65, reflecting a notable increase of 5.83% during the trading session. Currently, the last traded price stands at Rs 518.10, marking a 2.14% gain for the day, which outperformed the sector's average return of 1.53% and the Sensex's return of 0.18%. Despite this positive performance, there has been a decline in investor participation, with delivery volume dropping by 14.28% compared to the five-day average. The stock's liquidity remains robust, supporting trade sizes of up to Rs 5.44 crore. Additionally, while the stock is trading above its 5-...

Read More

Adani Power Shows Strong Short-Term Gains Amid Mixed Market Trends

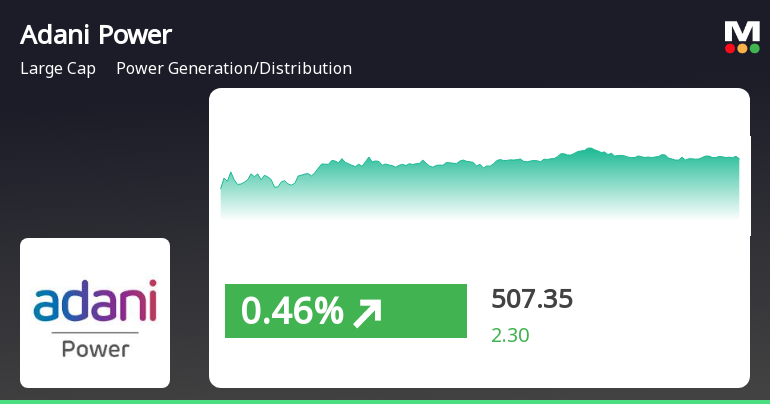

2025-03-10 10:50:24Adani Power has experienced notable gains, outperforming its sector and achieving consecutive increases over two days. While its current price exceeds several short-term moving averages, it remains below longer-term averages. Despite a challenging year-to-date performance, the stock has shown significant long-term growth over three and five years.

Read More

Adani Power Shows Positive Momentum Amidst Mixed Market Conditions

2025-03-05 10:55:31Adani Power has demonstrated strong performance, gaining 3.62% on March 5, 2025, and outperforming its sector. The stock has risen consecutively over three days, reaching an intraday high of Rs 503.6. Despite mixed moving averages, the broader market shows positive momentum, particularly in the small-cap segment.

Read MoreAdani Power Faces Technical Trend Shifts Amid Market Evaluation Revision

2025-03-04 08:00:06Adani Power, a prominent player in the power generation and distribution sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 483.00, showing a slight increase from the previous close of 478.75. Over the past year, the stock has experienced a decline of 13.22%, contrasting with a modest drop of 0.98% in the Sensex during the same period. In terms of technical indicators, the weekly MACD remains bearish, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) shows no significant signals on both weekly and monthly charts. Bollinger Bands indicate a mildly bearish trend, and moving averages on a daily basis also reflect bearish sentiment. The KST presents a mildly bullish stance on a weekly basis but shifts to mildly bearish on a monthly scale. Despite recent fluctuations, Adani Power has demonstrated resilience...

Read MoreAdani Power Faces Technical Trend Shifts Amid Market Volatility and Mixed Signals

2025-03-03 08:00:08Adani Power, a prominent player in the power generation and distribution sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 478.75, down from a previous close of 497.45, with a notable 52-week high of 896.75 and a low of 430.85. Today's trading saw a high of 501.50 and a low of 473.00, indicating some volatility in its performance. The technical summary for Adani Power reveals a bearish sentiment across various indicators. The MACD shows a bearish trend on a weekly basis, while the monthly outlook is mildly bearish. Bollinger Bands also reflect a bearish stance, and moving averages indicate a bearish trend on a daily basis. The KST presents a mildly bullish signal weekly but shifts to mildly bearish monthly, suggesting mixed signals in the short term. In terms of performance, Adani Power's returns have varied significantly over di...

Read MoreAdani Power Faces Bearish Technical Trends Amid Market Volatility and Mixed Performance

2025-03-02 08:00:08Adani Power, a prominent player in the power generation and distribution sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 478.75, down from a previous close of 497.45, with a 52-week high of 896.75 and a low of 430.85. Today's trading saw a high of 501.50 and a low of 473.00, indicating some volatility. The technical summary for Adani Power reveals a bearish sentiment across various indicators. The MACD shows a bearish trend on a weekly basis, while the monthly perspective is mildly bearish. Bollinger Bands also reflect a bearish stance for both weekly and monthly evaluations. Moving averages indicate a bearish trend on a daily basis, while the KST presents a mildly bullish outlook weekly but shifts to mildly bearish monthly. In terms of performance, Adani Power's returns have shown a mixed picture compared to the Sensex. Over t...

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

04-Apr-2025 | Source : BSEAdani Power Limited has submitted to the Exchange Certificate under regulation 74(5) of SEBI (DP) Regulations

Sanction Of The Scheme Of Amalgamation Of Adani Power (Jharkhand) Limited With Adani Power Limited By Honble NCLT

04-Apr-2025 | Source : BSEAdani Power Limited has informed the Exchange about sanction of the Scheme of Amalgamation of Adani Power (Jharkhand) Limited with Adani Power Limited by Honble NCLT

Announcement Under Regulation 30 (LODR) - Change In Senior Management Personnel

01-Apr-2025 | Source : BSEAdani Power Limited has informed the Exchange about change in Senior Management Personnel

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available