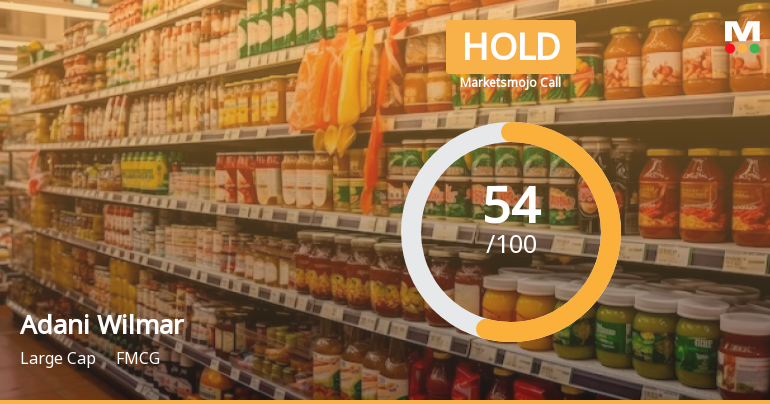

Adani Wilmar Adjusts Valuation Grade Amid Strong Financial Performance and Market Positioning

2025-04-02 08:03:07Adani Wilmar, a prominent player in the FMCG sector, has recently undergone a valuation adjustment, reflecting its strong financial metrics and market position. The company currently boasts a PE ratio of 28.97 and an EV to EBITDA ratio of 14.01, indicating a solid earnings performance relative to its enterprise value. Additionally, its PEG ratio stands at a notably low 0.04, suggesting favorable growth prospects compared to its valuation. In terms of return on capital employed (ROCE), Adani Wilmar reports an impressive 22.20%, while its return on equity (ROE) is recorded at 10.98%. These figures highlight the company's effective use of capital and shareholder equity. When compared to its peers, Adani Wilmar's valuation metrics present a more attractive profile. Competitors such as Hindustan Unilever and Nestle India exhibit significantly higher PE ratios, indicating a premium valuation in the market. This...

Read More

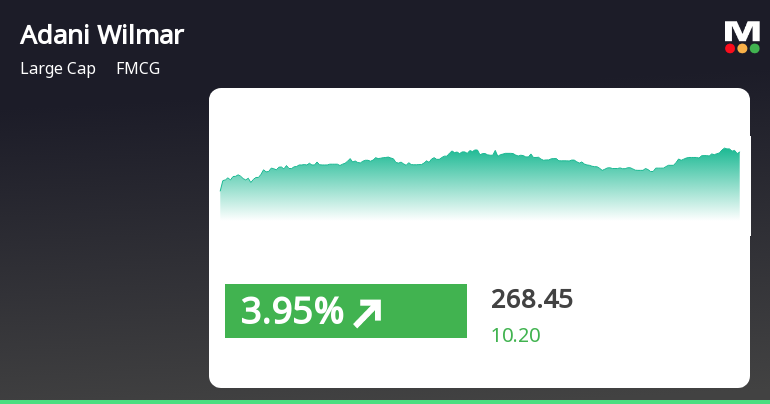

Adani Wilmar Outperforms Sector Amid Broader Market Decline and Mixed Trends

2025-04-01 11:40:55Adani Wilmar has demonstrated strong performance, achieving gains for three consecutive days and outperforming its sector. The stock's current price is above several short-term moving averages, although it lags behind longer-term averages. Despite broader market challenges, Adani Wilmar has shown resilience over the past week.

Read More

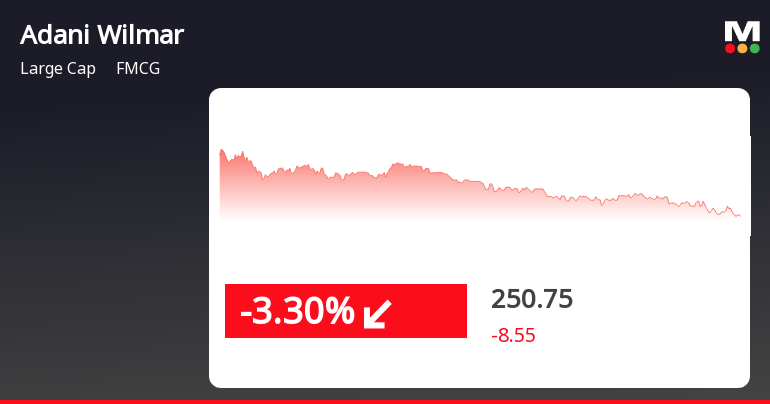

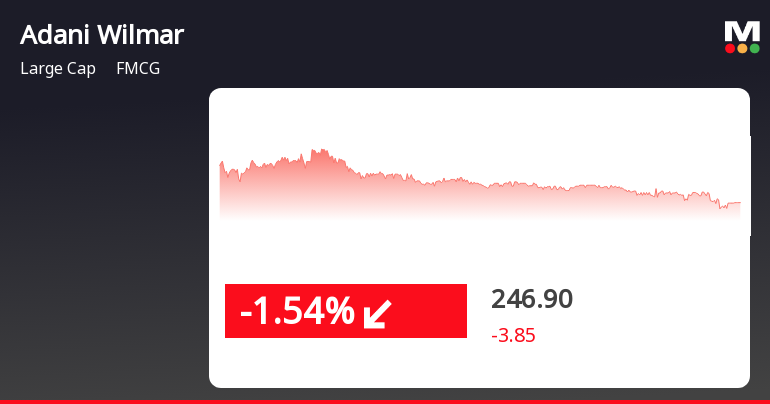

Adani Wilmar Faces Continued Stock Decline Amid Broader Market Trends

2025-03-26 15:05:27Adani Wilmar's stock has declined for three consecutive days, reflecting a total drop of 4.97%. Currently trading below key moving averages, the company has underperformed compared to the broader market. Over the past month, its stock is down 2.49%, while year-to-date, it has fallen 18.57%.

Read More

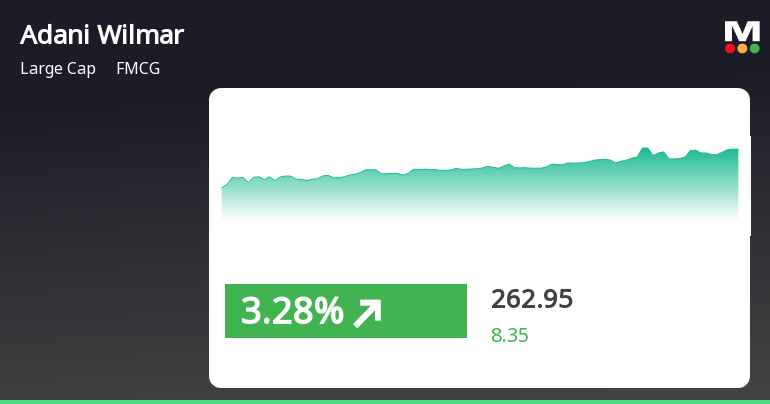

Adani Wilmar Shows Mixed Performance Amid Broader Market Rebound Trends

2025-03-21 10:50:29Adani Wilmar has demonstrated significant activity, outperforming its sector and reaching an intraday high. The stock is above its short-term moving averages but below longer-term ones, indicating mixed performance. Over the past week, it has outperformed the Sensex, though it has declined over the past year.

Read More

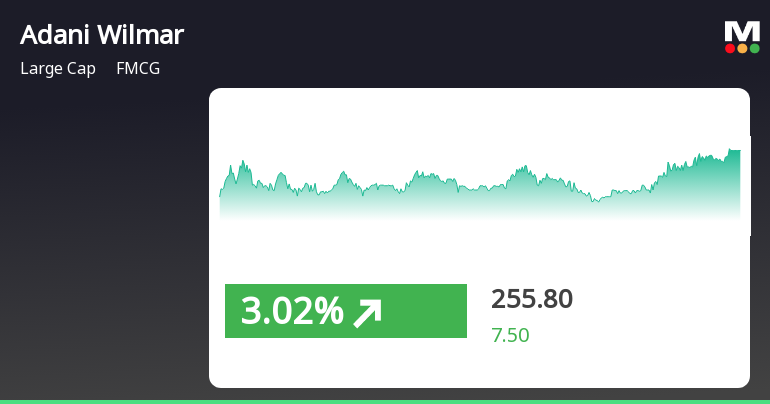

Adani Wilmar Outperforms Sector Amid Broader Market Gains and Mid-Cap Surge

2025-03-19 15:50:26Adani Wilmar has demonstrated significant activity, achieving a notable gain today and outperforming its sector. The stock has seen consecutive gains over the past two days and reached an intraday high. However, its performance over the past year contrasts with broader market trends, showing a decline.

Read More

Adani Wilmar Reports Strong Financial Growth Amid Management Efficiency Challenges

2025-03-19 08:12:32Adani Wilmar has recently adjusted its evaluation following a strong financial performance in Q3 FY24-25, with notable growth in net sales, operating profit, and net profit. However, challenges in management efficiency and a negative stock return over the past year highlight ongoing concerns despite a low debt-to-equity ratio.

Read MoreAdani Wilmar Faces Mixed Technical Trends Amidst Competitive Market Challenges

2025-03-19 08:05:09Adani Wilmar, a prominent player in the FMCG sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 248.30, showing a slight increase from the previous close of 245.25. Over the past year, the stock has faced challenges, with a notable decline of 26.41%, contrasting sharply with a 3.51% gain in the Sensex during the same period. The technical summary indicates a mixed outlook, with various indicators suggesting a cautious stance. The MACD shows bearish tendencies on a weekly basis, while the monthly perspective leans mildly bearish. The Bollinger Bands also reflect a mildly bearish trend, aligning with the daily moving averages, which are currently bearish. However, the KST and Dow Theory present a mildly bullish outlook on a weekly basis, indicating some underlying strength. In terms of performance, Adani Wilmar's returns have lagged...

Read More

Adani Wilmar Faces Ongoing Struggles Amid Broader Market Resilience

2025-03-12 12:35:29Adani Wilmar has faced significant challenges, with a 3.27% decline on March 12, 2025, underperforming the broader market. The stock is trading below all major moving averages and has seen a 19.25% drop over the past three months, reflecting ongoing struggles in a tough market environment.

Read More

Adani Wilmar Reports Strong Profit Growth Amidst Management Efficiency Concerns

2025-03-11 08:21:55Adani Wilmar has recently experienced an evaluation adjustment amid strong financial performance for Q3 FY24-25, marked by a 39.46% increase in net profit and growth in net sales and operating profit. However, challenges in management efficiency and market sentiment persist, alongside a low mutual fund stake and conservative debt levels.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

07-Apr-2025 | Source : BSECompliance Certificate under Regulation 74(5) of SEBI (DP) Regulations 2018.

Announcement under Regulation 30 (LODR)-Press Release / Media Release

07-Apr-2025 | Source : BSEPress release titled - Alife expands its personal care portfolio with Gondhoraj & Neem soap in West Bengal.

Quarterly Updates For Q4FY25

03-Apr-2025 | Source : BSEPlease find attached Quarterly Updates for Q4 FY25.

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available