Antony Waste Handling Cell Adjusts Evaluation Amidst Financial Performance Challenges

2025-04-02 08:39:54Antony Waste Handling Cell has experienced a recent evaluation adjustment, reflecting changes in its market standing. The company, categorized as a small-cap stock, shows key financial metrics including a PE ratio of 21.07 and a debt-to-EBITDA ratio of 1.36, indicating its operational efficiency and debt servicing capability.

Read MoreAntony Waste Handling Cell Adjusts Valuation Grade Amid Strong Competitive Metrics

2025-04-02 08:03:04Antony Waste Handling Cell has recently undergone a valuation adjustment, reflecting its current financial metrics and market position. The company, operating in the miscellaneous sector, has reported a PE ratio of 21.07 and an EV to EBITDA ratio of 10.45, indicating a competitive stance in its industry. Its price to book value stands at 2.55, while the EV to sales ratio is recorded at 2.09. In terms of profitability, Antony Waste has demonstrated a return on capital employed (ROCE) of 11.27% and a return on equity (ROE) of 11.59%, showcasing its efficiency in generating returns from its investments. When compared to its peers, Antony Waste's valuation metrics appear favorable. For instance, while Nirlon and KDDL Ltd are positioned at higher valuation levels, Antony Waste maintains a more attractive profile with lower PEG and EV to EBITDA ratios. This comparative analysis highlights the company's solid ...

Read More

Antony Waste Handling Cell Faces Financial Challenges Amid Reassessment of Market Position

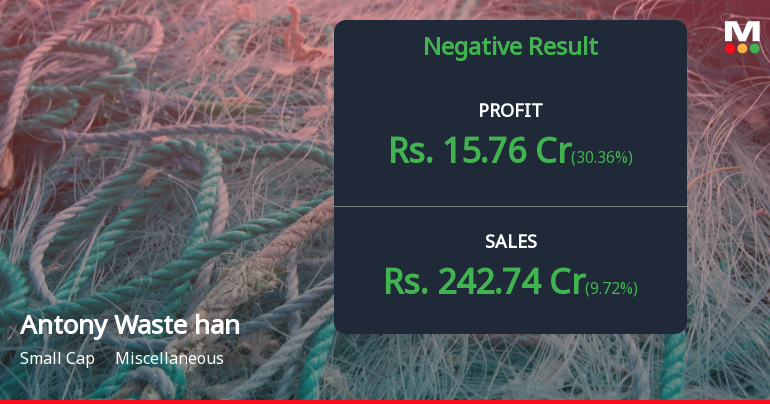

2025-03-03 19:01:30Antony Waste Handling Cell has experienced a recent evaluation adjustment, reflecting a reassessment of its financial metrics amid ongoing challenges. The company, categorized as small-cap, has reported negative results for five consecutive quarters, raising concerns about its long-term growth potential despite some positive indicators in debt servicing.

Read MoreAntony Waste Handling Cell Shows Mixed Technical Trends Amid Market Volatility

2025-02-28 08:01:34Antony Waste Handling Cell, a small-cap player in the miscellaneous industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 544.40, slightly down from the previous close of 554.00. Over the past year, the stock has seen a high of 902.25 and a low of 408.45, indicating significant volatility. The technical summary reveals a bearish sentiment in the weekly MACD and Bollinger Bands, while the monthly indicators show a mildly bearish trend in MACD and a sideways movement in Bollinger Bands. The daily moving averages also reflect a bearish stance. Notably, the KST shows a contrasting bullish trend on a monthly basis, suggesting mixed signals in the longer term. In terms of performance, Antony Waste Handling Cell has experienced a decline of 11.76% year-to-date, compared to a 4.51% drop in the Sensex. However, over a three-year period, the...

Read More

Antony Waste Handling Cell Faces Ongoing Financial Challenges Amidst Market Evaluation Adjustments

2025-02-25 18:29:45Antony Waste Handling Cell has recently experienced an evaluation adjustment amid ongoing financial challenges, including negative performance in the third quarter of FY24-25. Key metrics indicate low return on capital employed and debtors turnover, although the company maintains a strong capacity to service its debt.

Read More

Antony Waste Handling Cell Faces Financial Challenges Amidst Long-Term Growth Concerns

2025-02-20 18:13:25Antony Waste Handling Cell has experienced a recent evaluation adjustment amid a challenging financial performance for the third quarter of FY24-25. The company has reported negative results for five consecutive quarters, with key performance indicators reflecting concerns about its long-term growth potential, despite a strong capacity to manage debt.

Read More

Antony Waste Handling Cell Reports Mixed Financial Results Amid Rising Costs and Profitability Challenges

2025-02-14 19:57:51Antony Waste Handling Cell reported its financial results for the quarter ending December 2024, showcasing record net sales and operating profit. However, challenges emerged with increased interest expenses, a decline in profit after tax, and a lower debtors turnover ratio, indicating mixed performance dynamics.

Read More

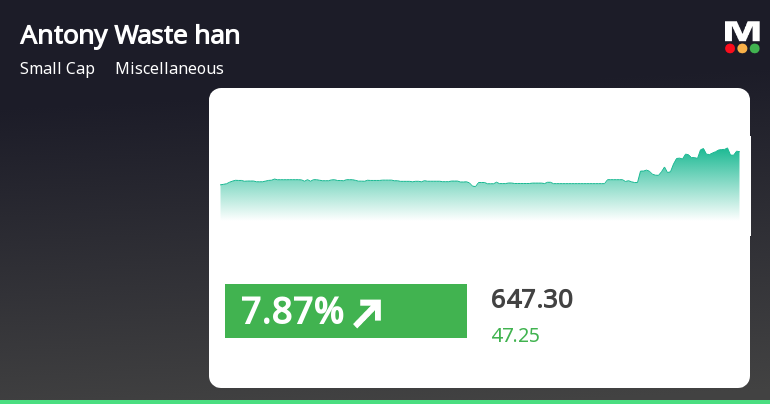

Antony Waste Handling Cell Shows Strong Performance Amid Market Volatility

2025-02-04 12:05:25Antony Waste Handling Cell has demonstrated notable activity, outperforming its sector and achieving consecutive gains over two days. The stock reached an intraday high, showcasing significant volatility and active trading. Its performance over the past month contrasts with a decline in the broader market, indicating resilience amid fluctuations.

Read More

Antony Waste Handling Cell Shows Strong Performance Amid Market Volatility

2025-02-04 12:05:25Antony Waste Handling Cell has demonstrated notable activity, outperforming its sector and achieving consecutive gains over two days. The stock reached an intraday high, showcasing significant volatility and active trading. Its performance over the past month contrasts with a decline in the broader market, indicating resilience amid fluctuations.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

07-Apr-2025 | Source : BSEPlease find attached intimation w.r.t certificate under regarding Reg 74(5) of SEBI (DP) Regulations 2018

Closure of Trading Window

28-Mar-2025 | Source : BSEPlease find attached Intimation w.r.t to closure to Trading Window.

Announcement under Regulation 30 (LODR)-Scheme of Arrangement

27-Mar-2025 | Source : BSEPlease find attached intimation w.r.t approval of scheme of Merger by Absorption of AG Enviro Infra Projects Private Limited (Transferor Company) with Antony Waste handling cell limited (Transferee Company)(Company) and their respective Shareholders and Creditors in terms of provisions of Section 230 to 232 and other applicable provisions if any of the Companies Act 2013 (Scheme).

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available