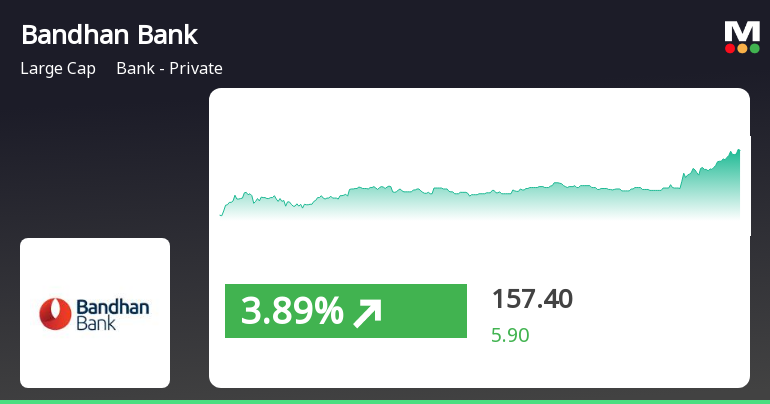

Bandhan Bank Demonstrates Resilience Amid Market Fluctuations with Strong Stock Performance

2025-04-03 13:50:26Bandhan Bank's stock has demonstrated strong performance, gaining 3.3% on April 3, 2025, and achieving a total return of 6.9% over three days. The bank's stock is above several moving averages, indicating positive momentum, while its year-to-date performance remains slightly negative compared to the broader market.

Read More

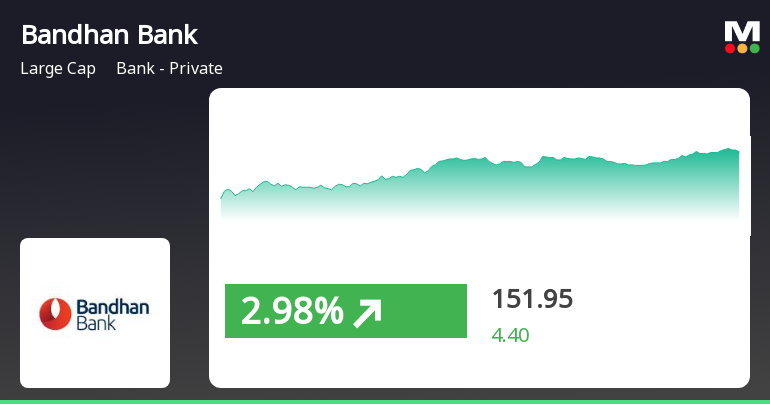

Bandhan Bank Outperforms Sector Amid Broader Market Decline, Shows Strong Short-Term Gains

2025-03-26 11:35:25Bandhan Bank has experienced significant activity, outperforming its sector while the broader market faces a slight decline. The stock has shown a strong upward trend over the past week, reaching an intraday high and reflecting mixed signals in longer-term moving averages. Year-to-date, it remains down, contrasting with the Sensex's gains.

Read MoreBandhan Bank Faces Mixed Technical Trends Amidst Market Evaluation Revision

2025-03-17 08:01:20Bandhan Bank, a prominent player in the private banking sector, has recently undergone an evaluation revision reflecting its current market dynamics. The bank's stock is currently priced at 139.65, down from a previous close of 141.85, with a notable 52-week high of 222.30 and a low of 128.15. In terms of technical indicators, the weekly MACD shows a mildly bullish trend, while the monthly perspective remains bearish. The Relative Strength Index (RSI) indicates a bullish stance on a weekly basis, but lacks a clear signal for the monthly timeframe. Bollinger Bands and KST metrics are bearish across both weekly and monthly evaluations, suggesting caution in the market. Additionally, moving averages indicate a bearish trend on a daily basis, while the On-Balance Volume (OBV) shows no significant trend weekly but is mildly bullish monthly. When comparing Bandhan Bank's performance to the Sensex, the bank has...

Read MoreBandhan Bank Experiences Technical Trend Adjustments Amidst Market Performance Challenges

2025-03-13 08:02:21Bandhan Bank, a prominent player in the private banking sector, has recently undergone a technical trend adjustment, reflecting shifts in its market performance. The bank's current price stands at 141.85, slightly above the previous close of 140.15, with a 52-week high of 222.30 and a low of 128.15. In terms of technical indicators, the MACD shows a mildly bullish trend on a weekly basis but shifts to bearish on a monthly scale. The Relative Strength Index (RSI) indicates no significant signals for both weekly and monthly assessments. Bollinger Bands reflect a bearish stance weekly, while the monthly view is mildly bearish. Daily moving averages also suggest a bearish trend, and the KST aligns with this sentiment, indicating bearish conditions on both weekly and monthly evaluations. When comparing Bandhan Bank's performance to the Sensex, the bank has faced notable challenges. Over the past year, it has...

Read MoreBandhan Bank Experiences Technical Trend Adjustments Amidst Market Performance Challenges

2025-03-13 08:02:21Bandhan Bank, a prominent player in the private banking sector, has recently undergone a technical trend adjustment, reflecting shifts in its market performance. The bank's current price stands at 141.85, slightly above the previous close of 140.15, with a 52-week high of 222.30 and a low of 128.15. In terms of technical indicators, the MACD shows a mildly bullish trend on a weekly basis but shifts to bearish on a monthly scale. The Relative Strength Index (RSI) indicates no significant signals for both weekly and monthly assessments. Bollinger Bands reflect a bearish stance weekly, while the monthly view is mildly bearish. Daily moving averages also suggest a bearish trend, and the KST aligns with this sentiment, indicating bearish conditions on both weekly and monthly evaluations. When comparing Bandhan Bank's performance to the Sensex, the bank has faced notable challenges. Over the past year, it has...

Read MoreBandhan Bank has emerged as one of the most active stock puts today amid bearish trends.

2025-03-11 11:00:07Bandhan Bank Ltd., a prominent player in the private banking sector, has emerged as one of the most active stocks in the options market today, particularly in put options. The underlying stock, BANDHANBNK, is currently valued at Rs 139.22. Notably, there were 3,657 put contracts traded with a premium turnover of approximately Rs 15.69 crore, indicating significant activity in this segment. The options have a strike price of Rs 140 and are set to expire on March 27, 2025, with an open interest of 1,266 contracts. In terms of price performance, Bandhan Bank has underperformed its sector by 4.77%, reflecting a broader trend of decline, as the stock has experienced a consecutive fall over the past two days, resulting in a total return of -6.19%. Today, the stock opened with a gap down of 2.14% and reached an intraday low of Rs 138.27, marking a decline of 6.56%. The weighted average price indicates that more v...

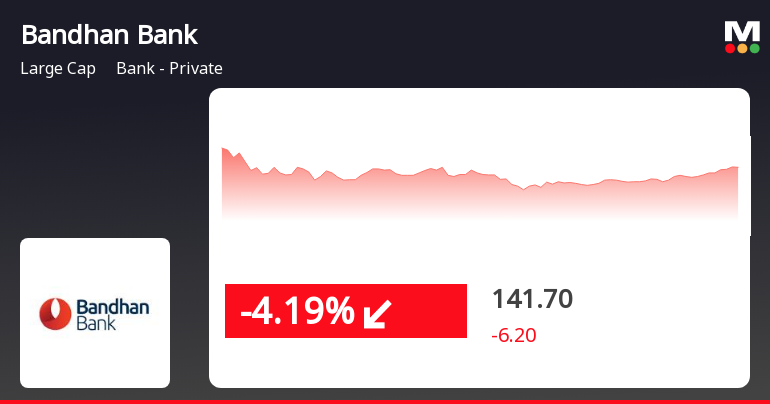

Read MoreBandhan Bank Faces Trading Challenges Amid Declining Stock Performance and Volume Activity

2025-03-11 10:00:16Bandhan Bank Ltd., a prominent player in the private banking sector, has emerged as one of the most active equities by volume today. The stock, trading under the symbol BANDHANBNK, recorded a total traded volume of 5,593,944 shares, with a total traded value of approximately Rs 79.25 crore. As of the latest update, Bandhan Bank's stock opened at Rs 144.80, reflecting a loss of 2.14% from the previous close of Rs 147.97. Throughout the trading session, the stock reached a day high of Rs 145.19 and a day low of Rs 139.80, marking a decline of 5.52% at its lowest point. The stock has been on a downward trend, having underperformed its sector by 4.98% today and experiencing a consecutive fall over the last two days, resulting in a total return decline of 6.57%. Additionally, Bandhan Bank is currently trading below its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, indicating a challenging marke...

Read More

Bandhan Bank Faces Continued Stock Decline Amid Broader Market Challenges

2025-03-11 09:35:26Bandhan Bank's stock has declined for two consecutive days, with a notable drop today. The bank's performance has lagged behind its sector and the broader market, showing significant declines over the past week, three months, and five years. Current moving averages indicate mixed performance relative to short-term trends.

Read MoreBandhan Bank Faces Mixed Technical Trends Amid Market Evaluation Revision

2025-03-07 08:03:31Bandhan Bank, a prominent player in the private banking sector, has recently undergone an evaluation revision reflecting its current market dynamics. The bank's stock is currently priced at 149.35, showing a slight increase from the previous close of 147.40. Over the past year, Bandhan Bank has faced challenges, with a notable decline of 23.35%, contrasting with a modest gain of 0.34% in the Sensex during the same period. In terms of technical indicators, the bank's performance shows a mixed picture. The MACD readings indicate bearish trends on both weekly and monthly bases, while the Bollinger Bands suggest a mildly bearish stance. The daily moving averages also reflect a mildly bearish outlook. However, the On-Balance Volume (OBV) metrics indicate a mildly bullish trend on both weekly and monthly scales, suggesting some underlying strength despite the overall bearish sentiment. The bank's performance ov...

Read MoreGrant Of Equity Stock Options

07-Apr-2025 | Source : BSEGrant of 1798840 Equity Stock Options.

Unaudited Financial Figures For The Quarter/Year Ended March 31 2025

03-Apr-2025 | Source : BSEUnaudited Financial Figures for the quarter/year ended March 31 2025.

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

02-Apr-2025 | Source : BSECertificate in terms of Regulation 74(5) of SEBI (DP) Regulations 2018

Corporate Actions

No Upcoming Board Meetings

Bandhan Bank Ltd. has declared 15% dividend, ex-date: 11 Aug 23

No Splits history available

No Bonus history available

No Rights history available