BF Utilities Ltd Experiences Significant Trading Surge Amidst Strong Market Activity

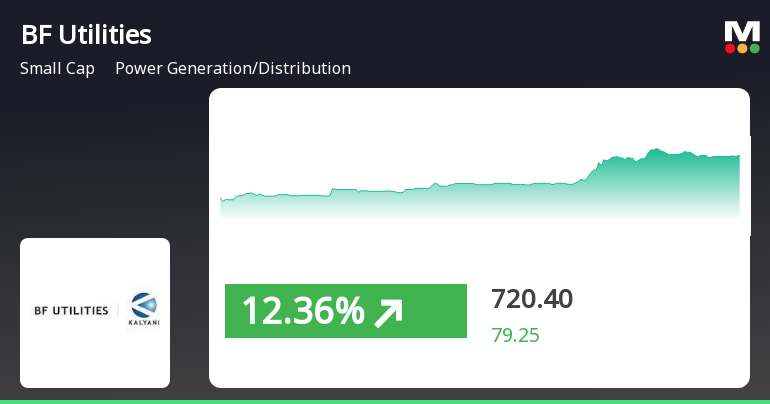

2025-03-28 10:00:11BF Utilities Ltd, a small-cap player in the Power Generation and Distribution industry, has shown remarkable activity today, hitting its upper circuit limit. The stock reached an intraday high of Rs 796, reflecting a significant increase of 17.15% or Rs 110.75 from its last traded price of Rs 756.5. This surge comes as the stock outperformed its sector by 2.33%, marking a strong performance in a challenging market environment. The stock has been on a positive trajectory, gaining for the last two days and accumulating a total return of 21.72% during this period. Today's trading saw a total volume of approximately 13.55 lakh shares, resulting in a turnover of Rs 98.68 crore. The stock's price band allowed for a 20% fluctuation, with a low of Rs 635 recorded earlier in the day. In terms of moving averages, BF Utilities is currently above its 5-day, 20-day, and 50-day averages, although it remains below the 1...

Read MoreBF Utilities Faces Mixed Technical Trends Amidst Market Evaluation Revision

2025-03-28 08:00:50BF Utilities, a small-cap player in the power generation and distribution sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 765.30, showing a notable increase from its previous close of 641.15. Over the past year, BF Utilities has experienced a 1.65% return, contrasting with the Sensex's 6.32% gain, indicating a divergence in performance. The technical summary reveals a mixed outlook, with various indicators suggesting a mildly bearish trend. The MACD shows bearish signals on a weekly basis, while the monthly perspective leans towards a mildly bearish stance. The Bollinger Bands and moving averages also reflect similar sentiments, indicating cautious market behavior. However, the Dow Theory presents a mildly bullish view on a weekly basis, suggesting some underlying strength. In terms of returns, BF Utilities has demonstrated sig...

Read MoreBF Utilities Adjusts Valuation Amid Strong Performance and Competitive Metrics

2025-03-28 08:00:13BF Utilities, a small-cap player in the power generation and distribution sector, has recently undergone a valuation adjustment. The company's current price stands at 765.30, reflecting a notable increase from the previous close of 641.15. Over the past week, BF Utilities has demonstrated a strong performance with a stock return of 17.24%, significantly outpacing the Sensex's return of 1.65%. Key financial metrics for BF Utilities include a PE ratio of 19.12 and an impressive return on equity (ROE) of 114.58%, indicating robust profitability. The company also boasts a return on capital employed (ROCE) of 56.32%, showcasing effective capital utilization. In comparison to its peers, BF Utilities maintains a competitive edge, particularly in its PE ratio, which is lower than that of some companies in the sector, such as Guj Inds. Power, which has a PE of 13.15, and Ravindra Energy, which presents a significan...

Read MoreBF Utilities Ltd Experiences Notable Stock Surge Amid Increased Investor Participation

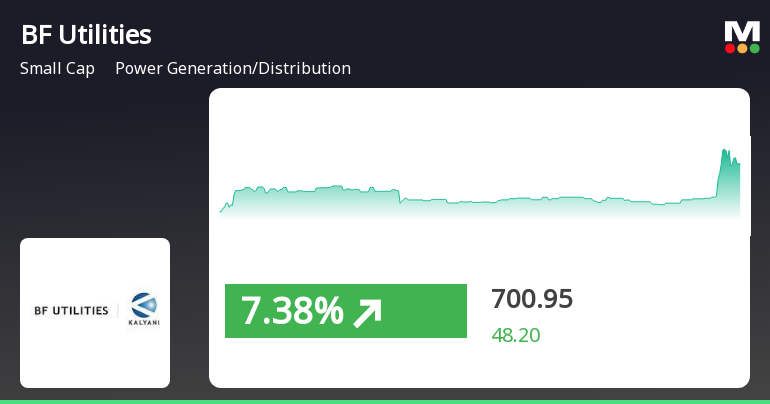

2025-03-27 15:00:04BF Utilities Ltd, a small-cap player in the Power Generation and Distribution sector, has made headlines today by hitting its upper circuit limit. The stock reached an impressive intraday high of Rs 774.9, reflecting a significant change of Rs 121.1, or 18.75%, from the previous trading session. This surge comes after two days of consecutive declines, marking a notable trend reversal. The stock traded within a wide range of Rs 139.9, with a low of Rs 635.0, and recorded a total traded volume of approximately 11.53 lakh shares, resulting in a turnover of Rs 83.26 crore. The performance today has outpaced the sector by 17.15%, showcasing strong momentum. Despite high volatility, with an intraday fluctuation of 7.27%, the stock's weighted average price indicates that more volume was traded closer to its low price. Additionally, delivery volume has increased by 10.56% compared to the five-day average, suggest...

Read More

BF Utilities Shows Resilience Amid Mixed Performance and Market Fluctuations

2025-03-27 11:45:17BF Utilities saw a significant rise on March 27, 2025, reversing two days of decline and outperforming its sector. While the stock is above its short-term moving averages, it lags behind longer-term ones. Despite recent gains, it faces challenges with notable year-to-date and three-month declines compared to the Sensex.

Read More

BF Utilities Shows Strong Short-Term Gains Amid Broader Market Recovery

2025-03-21 14:45:16BF Utilities experienced notable trading activity, achieving an intraday high and demonstrating significant volatility. The stock's performance over the past week has been strong compared to the broader market, although it has faced challenges year-to-date. Meanwhile, the Sensex rebounded sharply, with small-cap stocks leading gains.

Read MoreBF Utilities Adjusts Valuation Grade Amid Competitive Industry Positioning and Strong Metrics

2025-03-18 08:00:14BF Utilities, a small-cap player in the power generation and distribution sector, has recently undergone a valuation adjustment. The company's current price stands at 589.45, reflecting a notable shift from its previous close of 614.75. Over the past year, BF Utilities has experienced a decline of 18.04%, contrasting with a modest 2.10% gain in the Sensex. Key financial metrics for BF Utilities reveal a PE ratio of 14.73 and an EV to EBITDA ratio of 4.93, indicating a competitive position within its industry. The company's return on capital employed (ROCE) is a robust 56.32%, while its return on equity (ROE) is exceptionally high at 114.58%. These figures suggest strong operational efficiency and profitability. In comparison to its peers, BF Utilities maintains a favorable valuation profile. While other companies in the sector, such as RattanIndia Power and Guj Industries Power, also show attractive valua...

Read More

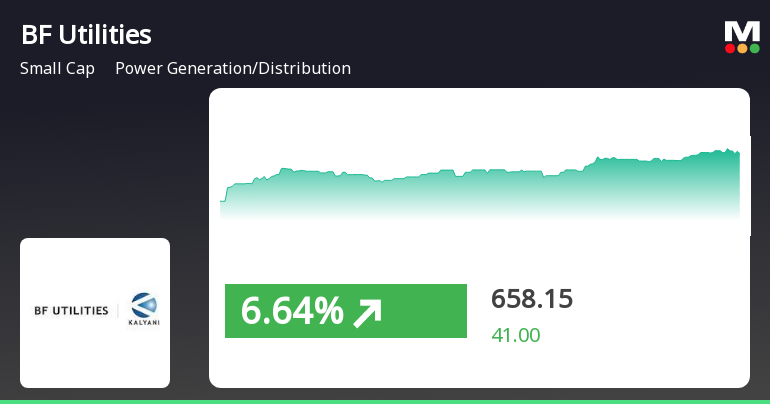

BF Utilities Outperforms Sector Amid Mixed Long-Term Performance Indicators

2025-03-05 12:45:16BF Utilities has experienced significant activity, gaining 7.01% on March 5, 2025, and outperforming its sector. The stock has seen a two-day total return of 11.22% and reached an intraday high of Rs 660.9. However, it remains below several longer-term moving averages and has a year-to-date decline of 31.92%.

Read MoreBF Utilities Adjusts Valuation Grade Amid Competitive Industry Metrics and Performance Challenges

2025-03-04 08:00:20BF Utilities, a small-cap player in the power generation and distribution sector, has recently undergone a valuation adjustment. The company currently exhibits a price-to-earnings (P/E) ratio of 14.84 and an EV to EBITDA ratio of 4.96, indicating its financial metrics are competitive within the industry. The PEG ratio stands at 0.80, suggesting a favorable growth outlook relative to its earnings. In terms of performance, BF Utilities has faced challenges in the short term, with a year-to-date return of -38.77%, significantly underperforming the Sensex, which has seen a decline of only 6.47% in the same period. However, over a longer horizon, the company has demonstrated resilience, with a three-year return of 83.96%, outperforming the Sensex's 32.64% return. When compared to its peers, BF Utilities maintains a more attractive valuation profile, particularly against companies like RattanIndia Power, which ...

Read MoreBoard Meeting Outcome for Outcome Of Board Meeting

09-Apr-2025 | Source : BSEOutcome of Board meeting held on April 09 2025 for approval of unaudited financial results for the quarter ended December 31 2024

Results - Financial Results For The Quarter Ended Dec 31 2024

09-Apr-2025 | Source : BSEApproval of consolidated financial results for the quarter ended December 31 2024

Integrated Filing (Financial)

09-Apr-2025 | Source : BSEUnaudited Consolidated financial results for the quarter ended December 31 2024

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available