Brady & Morris Engineering Adjusts Valuation Amid Competitive Industry Dynamics

2025-03-19 08:00:13Brady & Morris Engineering Company has recently undergone a valuation adjustment, reflecting its current market position within the engineering sector. The company's price-to-earnings ratio stands at 28.56, while its price-to-book value is notably high at 9.61. Other key metrics include an EV to EBIT ratio of 20.98 and an EV to EBITDA ratio of 19.61, indicating a robust operational performance. The company's return on capital employed (ROCE) is impressive at 48.37%, and its return on equity (ROE) is also strong at 33.66%. These figures suggest that Brady & Morris is effectively utilizing its capital to generate earnings. In comparison to its peers, Brady & Morris exhibits a higher valuation profile, particularly when looking at the price-to-earnings and EV to EBITDA ratios. For instance, BMW Industries and Gensol Engineering show significantly lower valuations, which may indicate a more favorable investme...

Read MoreBrady & Morris Engineering Adjusts Valuation Amid Strong Performance Metrics and Competitive Landscape

2025-03-07 08:00:45Brady & Morris Engineering Company, a microcap player in the engineering sector, has recently undergone a valuation adjustment. The company's current price stands at 1196.90, reflecting a notable increase from the previous close of 1108.70. Over the past year, Brady & Morris has demonstrated a robust stock return of 68.32%, significantly outperforming the Sensex, which recorded a mere 0.34% return in the same period. Key financial metrics reveal a PE ratio of 28.41 and an EV to EBITDA ratio of 19.51, indicating a strong market position. The company's return on capital employed (ROCE) is impressive at 48.37%, while the return on equity (ROE) stands at 33.66%. These figures suggest effective management and operational efficiency. In comparison to its peers, Brady & Morris holds a relatively high valuation, with competitors like Axtel Industries and Permanent Magnet also categorized similarly. However, compa...

Read More

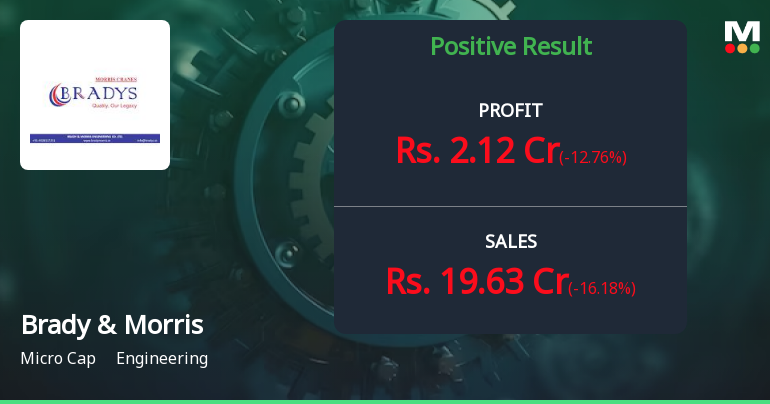

Brady & Morris Engineering Reports Flat Q3 Performance Amid Market Challenges

2025-02-11 19:03:32Brady & Morris Engineering Company has experienced a recent evaluation adjustment amid flat financial performance for Q3 FY24-25, with net sales at Rs 19.63 crore. Despite challenges, the company maintains high management efficiency, reflected in a strong return on equity of 34.50% and consistent returns over the past three years.

Read More

Brady & Morris Engineering Faces Flat Q3 FY24-25 Performance Amid Mixed Financial Indicators

2025-02-10 18:50:35Brady & Morris Engineering Company has recently experienced a change in evaluation, reflecting its current position amid mixed financial results. The latest quarter showed flat performance, with net sales declining and the lowest recorded PBDIT. Despite these challenges, the company demonstrates strong management efficiency and a fair stock valuation.

Read More

Brady & Morris Engineering Reports Mixed Financial Results for December Quarter

2025-02-06 14:32:05Brady & Morris Engineering Company announced its financial results for the quarter ending December 2024, highlighting a significant increase in cash reserves and improved receivables management. However, the company faced challenges with declining net sales and reduced operating profit, marking a difficult period in its recent performance.

Read MoreShareholder Meeting / Postal Ballot-Scrutinizers Report

01-Apr-2025 | Source : BSEVoting Result of Postal Ballot along with Scrutinizers Report

Shareholder Meeting / Postal Ballot-Outcome of Postal_Ballot

31-Mar-2025 | Source : BSEProceedings of the Postal Ballot pursuant to Regulation 30 of SEBI (LODR) Regulations 2015.

Disclosure Under Regulation 30 (Listing Obligations And Disclosure Requirements) Regulations 2015

27-Mar-2025 | Source : BSEDisclosure under Regulation 30 (LODR) Regulations 2015

Corporate Actions

No Upcoming Board Meetings

Brady & Morris Engineering Company Ltd has declared 15% dividend, ex-date: 09 Sep 10

No Splits history available

Brady & Morris Engineering Company Ltd has announced 1:2 bonus issue, ex-date: 03 Jan 08

No Rights history available