Canara Bank Outperforms Sector Amid Broader Market Volatility and Small-Cap Gains

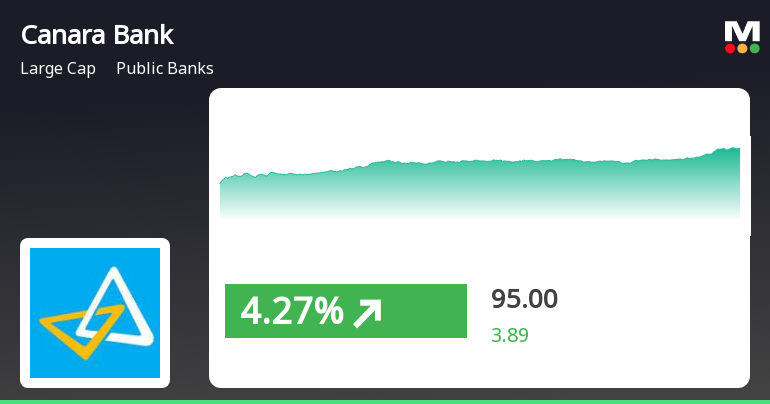

2025-04-03 13:50:21Canara Bank has demonstrated notable performance, gaining 4.19% on April 3, 2025, and outperforming its sector. The stock has seen consecutive gains over three days, reaching an intraday high of Rs 95. The bank maintains a strong dividend yield of 3.53% amid broader market volatility.

Read MoreCanara Bank Shows Resilience Amid Market Decline with Strong Trading Activity

2025-04-01 11:00:12Canara Bank, a prominent player in the public banking sector, has emerged as one of the most active equities today, with a total traded volume of 30,188,247 shares and a total traded value of approximately Rs 270.97 crores. The stock opened at Rs 89.65, matching its previous close, and reached a day high of Rs 91.18 before settling at a last traded price of Rs 89.11. In terms of performance, Canara Bank has outperformed its sector by 0.78%, while the broader market, represented by the Sensex, saw a decline of 1.16%. The stock's performance today reflects a 1D return of 0.87%, contrasting with the sector's 1D return of -1.19%. Despite this positive movement, there has been a notable decrease in investor participation, with delivery volume dropping by 18.91% compared to the five-day average. Canara Bank maintains a high dividend yield of 3.62% at the current price, indicating a solid return for shareholder...

Read MoreCanara Bank Sees Surge in Trading Activity and Investor Participation Today

2025-03-28 11:00:04Canara Bank, a prominent player in the public banking sector, has emerged as one of the most active equities today, with a total traded volume of 9,464,847 shares and a total traded value of approximately Rs 85.58 crore. The stock opened at Rs 89.65 and has shown notable movement, reaching a day high of Rs 91.18 and a day low of Rs 89.39, with the last traded price recorded at Rs 90.95. In terms of performance, Canara Bank has outperformed its sector by 0.82%, marking a consecutive gain over the last two days with a total return of 4.13% during this period. The stock's current price is above its 5-day, 20-day, and 50-day moving averages, although it remains below the 100-day and 200-day moving averages. Investor participation has also seen a significant uptick, with a delivery volume of 3.25 crore shares on March 27, reflecting a 142.59% increase compared to the 5-day average. Additionally, the stock boa...

Read MoreCanara Bank's Technical Indicators Signal Mixed Trends Amid Market Evaluation Revision

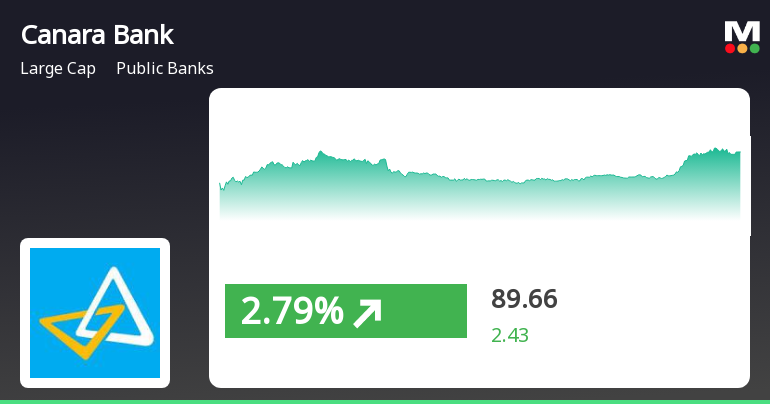

2025-03-28 08:03:17Canara Bank, a prominent player in the public banking sector, has recently undergone an evaluation revision reflecting its current market dynamics. The bank's stock price is currently at 89.66, showing a notable increase from the previous close of 87.23. Over the past year, Canara Bank has experienced a significant decline of 20.50%, contrasting sharply with the Sensex's gain of 6.32% during the same period. However, the bank's performance over a three-year horizon has been impressive, with a return of 99.16%, significantly outpacing the Sensex's 35.29% return. In terms of technical indicators, the weekly MACD and KST are currently bearish, while the monthly indicators show a mildly bearish trend. The Bollinger Bands and moving averages also reflect a mildly bearish sentiment. Despite these trends, the Dow Theory indicates a mildly bullish outlook on a weekly basis. The recent performance metrics highligh...

Read More

Canara Bank Experiences Notable Rebound Amid Mixed Long-Term Performance Trends

2025-03-27 15:35:24Canara Bank experienced a notable rebound on March 27, 2025, reversing two days of decline and outperforming its sector. The stock is currently above several short-term moving averages and offers a high dividend yield. Despite recent challenges, it has shown substantial growth over the past three and five years.

Read MoreCanara Bank Sees Surge in Open Interest Amid Increased Trading Activity

2025-03-27 15:00:20Canara Bank has experienced a significant increase in open interest today, reflecting heightened activity in its trading. The latest open interest stands at 87,384 contracts, marking an increase of 8,405 contracts or 10.64% from the previous open interest of 78,979. The trading volume for the day reached 50,349 contracts, indicating robust participation in the market. In terms of price performance, Canara Bank's stock has shown a positive trend after two consecutive days of decline. The stock touched an intraday high of Rs 89.75, representing a gain of 2.88% for the day. Currently, the stock is trading above its 5-day and 20-day moving averages, although it remains below the 50-day, 100-day, and 200-day moving averages. Despite a decline in delivery volume, which fell by 25.7% compared to the 5-day average, the stock maintains a high dividend yield of 3.69%. With a market capitalization of Rs 79,867.08 cr...

Read MoreCanara Bank Shows Increased Trading Activity Amidst Market Dynamics and Investor Trends

2025-03-27 13:00:04Canara Bank, a prominent player in the public banking sector, has emerged as one of the most active equities today, with a total traded volume of 17,991,916 shares and a total traded value of approximately Rs 159.16 crores. The stock opened at Rs 87.10 and reached a day high of Rs 89.75, while the day low was recorded at Rs 86.80. As of the latest update, the last traded price (LTP) stands at Rs 87.75, reflecting a modest increase of 0.53% for the day. This uptick comes after two consecutive days of decline, indicating a potential trend reversal. Canara Bank's performance today aligns closely with the sector, which saw a 1D return of 0.57%, while the broader Sensex returned 0.46%. Notably, the stock's delivery volume has seen a decline of 25.7% compared to the five-day average, suggesting a decrease in investor participation. With a market capitalization of Rs 79,549.61 crores, Canara Bank maintains a hig...

Read MoreCanara Bank's Technical Indicators Signal Mixed Outlook Amid Market Volatility

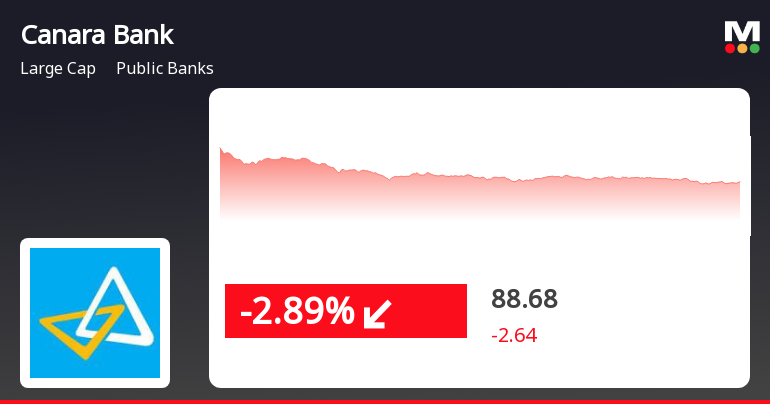

2025-03-26 08:04:05Canara Bank, a prominent player in the public banking sector, has recently undergone an evaluation revision reflecting its current market dynamics. The bank's stock is currently priced at 88.44, down from a previous close of 91.32, with a 52-week high of 129.35 and a low of 78.58. Today's trading saw a high of 92.49 and a low of 88.06, indicating some volatility. The technical summary for Canara Bank reveals a mixed outlook across various indicators. The MACD shows bearish tendencies on a weekly basis, while the monthly perspective is mildly bearish. The Relative Strength Index (RSI) indicates no significant signals for both weekly and monthly assessments. Bollinger Bands and KST also reflect a mildly bearish trend monthly, while moving averages indicate a bearish stance on a daily basis. In terms of performance, Canara Bank's stock return over the past week stands at 5.39%, outperforming the Sensex, whic...

Read More

Canara Bank Faces Decline Amid Broader Market Resilience and Mixed Performance Trends

2025-03-25 13:35:20Canara Bank experienced a decline on March 25, 2025, reversing a five-day gain streak. The stock is currently above its short-term moving averages but below longer-term ones. Despite a high dividend yield, its performance over the past year contrasts sharply with the broader market's gains.

Read MoreHalf Yearly Statement Of Outstanding Bonda As On 31.03.2025.

04-Apr-2025 | Source : BSEHalf Yearly Statement of Outstanding Bonds as on 31.03.2025.

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

03-Apr-2025 | Source : BSECertificate of RTA in compliance of Regulation 74(5) of the SEBI (Depositories and Participants) Regulations 2018.

Announcement under Regulation 30 (LODR)-Change in Management

03-Apr-2025 | Source : BSEChange in Management Revised Filing

Corporate Actions

No Upcoming Board Meetings

Canara Bank has declared 161% dividend, ex-date: 14 Jun 24

Canara Bank has announced 2:10 stock split, ex-date: 15 May 24

No Bonus history available

Canara Bank has announced 1:10 rights issue, ex-date: 17 Feb 17