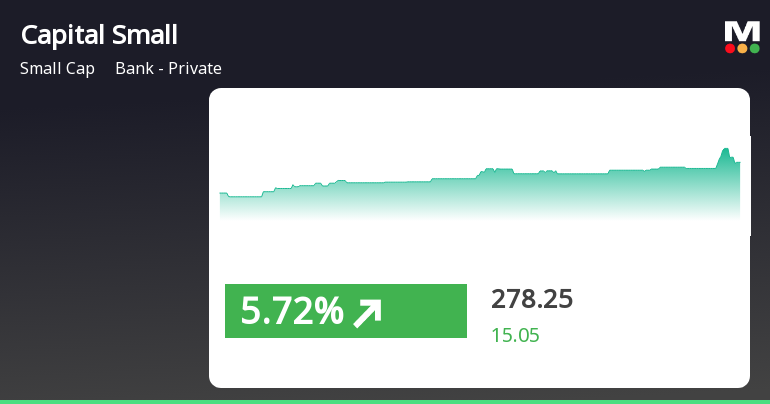

Capital Small Finance Bank Shows Signs of Momentum Amid Broader Market Gains

2025-04-02 14:35:27Capital Small Finance Bank has experienced notable gains, outperforming its sector recently. The stock has shown consecutive increases over two days and reached a significant intraday high. Despite a decline over the past year, its recent performance indicates a potential shift in momentum amid a rising broader market.

Read MoreCapital Small Finance Bank Faces Mixed Technical Indicators Amid Market Volatility

2025-04-02 08:10:43Capital Small Finance Bank, a small-cap player in the private banking sector, has recently undergone an evaluation revision reflecting its current market dynamics. The bank's technical indicators present a mixed picture, with the MACD showing bearish signals on a weekly basis, while the Dow Theory indicates a mildly bullish trend over the same period. The Relative Strength Index (RSI) remains neutral, suggesting a lack of significant momentum in either direction. In terms of price performance, Capital Small Finance Bank's stock is currently trading at 263.20, up from a previous close of 258.00. The stock has experienced a 52-week high of 406.70 and a low of 250.00, indicating notable volatility. Today's trading saw a high of 268.05 and a low of 256.00, further emphasizing the stock's fluctuating nature. When comparing the bank's returns to the Sensex, the data reveals a challenging performance over variou...

Read More

Capital Small Finance Bank Faces Market Pressure Amidst Strong Long-Term Growth Indicators

2025-03-12 11:08:33Capital Small Finance Bank is facing notable market activity, trading near its 52-week low after a four-day decline. The bank reported a one-year drop in stock value, contrasting with the Sensex's slight gain. Despite challenges, it shows strong long-term growth and maintains a low Gross NPA ratio.

Read More

Capital Small Finance Bank Hits All-Time Low Amidst Market Volatility and Declining Performance

2025-03-12 11:02:15Capital Small Finance Bank's stock has faced notable volatility, recently hitting an all-time low. It has declined consecutively over four days, trading below key moving averages. Despite this, the bank reports a low gross NPA ratio and strong annual net profit growth, with attractive valuation metrics compared to peers.

Read More

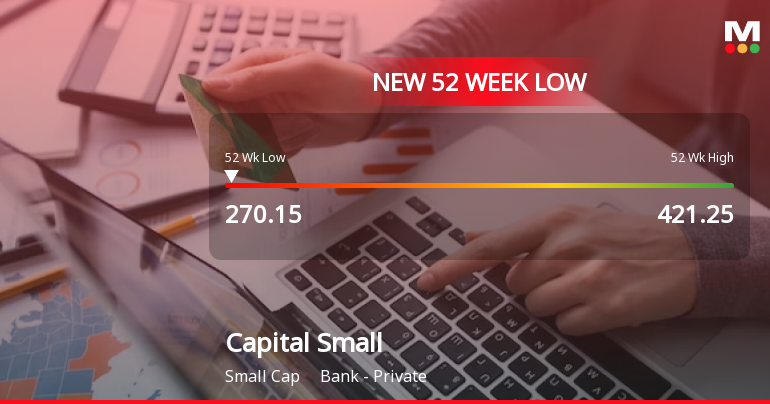

Capital Small Finance Bank Hits 52-Week Low Amid Sustained Downward Trend

2025-03-03 09:38:00Capital Small Finance Bank has reached a new 52-week low, reflecting a significant decline and underperformance compared to its sector. The stock has faced consecutive losses over the past week and is trading below multiple moving averages, indicating a sustained downward trend amid a challenging market environment.

Read More

Capital Small Finance Bank Hits 52-Week Low Amid Sustained Bearish Trend

2025-02-28 09:39:34Capital Small Finance Bank has reached a new 52-week low, continuing a downward trend over the past six days with a total loss of 5.44%. The stock has underperformed its sector and is trading below key moving averages, reflecting ongoing challenges in the market.

Read More

Capital Small Finance Bank Shows Strong Performance Amidst Stock Challenges and Market Evaluation

2025-02-17 14:10:32Capital Small Finance Bank has recently adjusted its evaluation, reflecting its current market position and financial metrics. The bank reported strong third-quarter performance for FY24-25, with a Gross NPA ratio of 2.67% and a net profit growth rate of 41.90%, indicating solid lending practices and potential for long-term growth.

Read More

Capital Small Finance Bank Reports Strong Q3 FY24-25 Results Amid Income Sustainability Concerns

2025-01-29 19:02:35Capital Small Finance Bank has announced its third-quarter financial results for FY24-25, highlighting record quarterly interest earnings and growth in net interest income. The bank reported increased operating profit and profit before tax, while a significant portion of its income stemmed from non-operating activities, raising sustainability concerns.

Read MoreDisclosure Under Regulation 31 (4) Of (Substantial Acquisition Of Shares And Takeovers) Regulations 2011

08-Apr-2025 | Source : BSEDisclosure under Regulation 31(4) of SAST regulations 2011

Disclosure Under SEBI (Listing Obligations And Disclosure Requirements) Regulations 2015 - Key Business Highlights For The Quarter And Year Ended March 31 2025

03-Apr-2025 | Source : BSEKey Business highlights for the quarter and year ended March 31 2025

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

03-Apr-2025 | Source : BSECertificate under Regulation 74(5) of Securities and Exchange Board of India (Depositories and Participants) Regulations 2018

Corporate Actions

No Upcoming Board Meetings

Capital Small Finance Bank Ltd has declared 12% dividend, ex-date: 16 Aug 24

No Splits history available

No Bonus history available

No Rights history available