Central Bank of India Sees Surge in Trading Activity Amid Market Challenges

2025-04-03 10:00:11Central Bank of India has emerged as one of the most active stocks today, with a total traded volume of 62,798,115 shares and a total traded value of approximately Rs 23,436.26 lakhs. The stock opened at Rs 38.99 and reached a day high of Rs 39.60, while the day low was recorded at Rs 36.46. As of the latest update, the last traded price (LTP) stands at Rs 36.78. Notably, the stock hit a new 52-week low of Rs 35.91 today. Despite this decline, the performance of Central Bank of India remains in line with the sector, which saw a slight increase of 0.12% today. The stock has not experienced any consecutive falls, maintaining a return of 0% over the recent period. Central Bank of India is currently trading below its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, indicating a bearish trend. However, there has been a significant rise in investor participation, with delivery volume increasing by ...

Read More

Central Bank of India Hits 52-Week Low Amid Broader Market Recovery

2025-04-03 09:38:39Central Bank of India reached a new 52-week low today after a three-day decline, although it showed signs of recovery. The bank has underperformed over the past year, but reported strong long-term fundamentals, including significant profit growth and improved asset quality, with low non-performing assets.

Read MoreCentral Bank of India Adjusts Valuation, Highlighting Competitive Position in Public Banking Sector

2025-04-03 08:00:31Central Bank of India has recently undergone a valuation adjustment, reflecting its current financial standing within the public banking sector. The bank's price-to-earnings ratio stands at 9.00, while its price-to-book value is recorded at 0.94. The PEG ratio is notably low at 0.17, indicating a potentially favorable valuation relative to growth expectations. In terms of profitability, the bank's return on equity (ROE) is 10.48%, and its return on assets (ROA) is 0.82%. The net non-performing assets (NPA) to book value ratio is at 4.58%, which provides insight into asset quality. When compared to its peers, Central Bank of India presents a competitive valuation profile. While some competitors are categorized as expensive, several others also exhibit attractive valuations. For instance, Bank of Baroda and Punjab National Bank are both noted for their strong performance metrics, contributing to a diverse ...

Read MoreCentral Bank of India Faces Increased Volatility Amid Rising Investor Participation

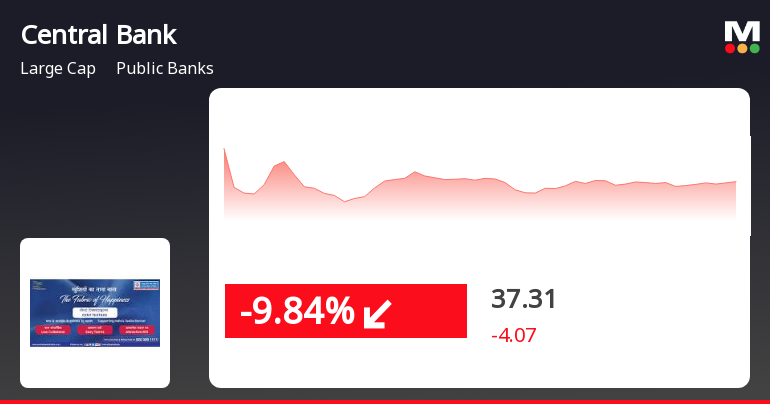

2025-04-02 11:00:06Central Bank of India has emerged as one of the most active equities today, with a total traded volume of 22,679,098 shares and a total traded value of approximately Rs 84.71 crore. The stock opened at Rs 38.99, reflecting a significant gap down of 5.62%, and reached a day’s low of Rs 36.46, marking a new 52-week low. The last traded price (LTP) stands at Rs 37.25, indicating a decline of 9.88% for the day, which is notably below the sector's average decline of 0.77%. The stock has been on a downward trend, having fallen consecutively for three days, resulting in a total return of -15.35% during this period. Central Bank of India is currently trading below its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, highlighting its underperformance in the market. Despite the challenges, there has been a notable increase in investor participation, with delivery volume rising by 80.25% against the 5-da...

Read More

Central Bank of India Faces Significant Stock Volatility Amid Broader Market Resilience

2025-04-02 09:35:18Central Bank of India faced notable volatility on April 2, 2025, with its stock hitting a new 52-week low and experiencing a cumulative decline over three days. The stock has underperformed its sector significantly and is trading below key moving averages, contrasting sharply with the broader market's positive performance.

Read More

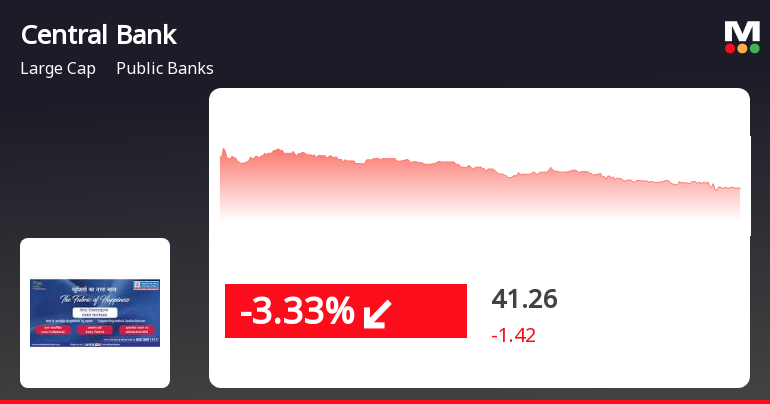

Central Bank of India Faces Significant Stock Decline Amid Broader Market Challenges

2025-04-01 15:35:21Central Bank of India’s stock has dropped significantly, reaching a new 52-week low and reflecting a consecutive decline over the past two days. The bank's performance has lagged behind its sector, and it is trading below all key moving averages. In the broader market, the Sensex has also experienced a notable decline.

Read More

Central Bank of India Hits 52-Week Low Amid Broader Market Decline and Resilient Small-Caps

2025-04-01 14:36:33Central Bank of India has reached a new 52-week low, reflecting a notable decline over recent days and underperformance compared to its sector. Despite this, the bank has shown strong long-term fundamentals, including significant growth in net profits and improved asset quality, contrasting with broader market challenges.

Read More

Central Bank of India Faces Decline Amid Broader Market Challenges and Underperformance

2025-03-28 15:50:19Central Bank of India faced a decline on March 28, 2025, trading above its 52-week low but underperforming its sector. The stock is below key moving averages, reflecting a bearish trend. Over the past year, it has significantly decreased, contrasting with the Sensex's modest gain.

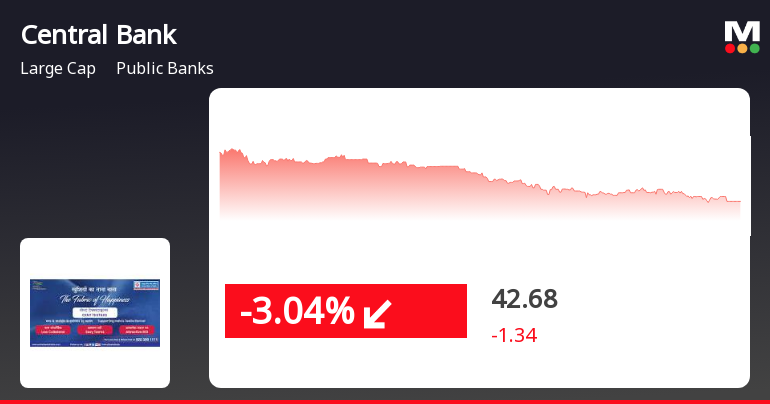

Read MoreCentral Bank of India Experiences Technical Trend Shift Amid Market Volatility

2025-03-27 08:02:32Central Bank of India, a prominent player in the public banking sector, has recently undergone a technical trend adjustment. The evaluation revision reflects a shift in the bank's performance indicators, which are critical for understanding its current market position. As of the latest data, the stock is trading at 43.11, down from a previous close of 44.65. Over the past year, the stock has experienced significant volatility, with a 52-week high of 72.99 and a low of 40.86. Today's trading saw a high of 45.16 and a low of 43.00, indicating ongoing fluctuations in investor sentiment. In terms of technical indicators, the MACD and Bollinger Bands suggest a bearish outlook on both weekly and monthly timeframes. The moving averages also reflect a bearish trend, while the On-Balance Volume (OBV) shows bullish signals on both weekly and monthly scales. When comparing the stock's performance to the Sensex, C...

Read MoreIntimation Under SEBI (Listing Obligations And Disclosure Requirements) Regulations 2015.

08-Apr-2025 | Source : BSEIntimation under SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015 regarding amalgamation of RRBs sponsored by Bank.

Disclosure Under Regulation 31(4) And 31(5) Of SEBI (Substantial Acquisition Of Shares And Takeovers) Regulations 2011

05-Apr-2025 | Source : BSEDisclosure Under Regulation 31(4) and 31(5) of SEBI (Substantial Acquisition of Shares and Takeovers) Regulations 2011

Statement Of Outstanding Bonds For The Half Year Ended 31.03.2025

05-Apr-2025 | Source : BSEStatement of Outstanding Bonds for the Half Year ended 31.03.2025

Corporate Actions

No Upcoming Board Meetings

Central Bank of India has declared 5% dividend, ex-date: 23 Jun 15

No Splits history available

No Bonus history available

Central Bank of India has announced 3:5 rights issue, ex-date: 17 Mar 11