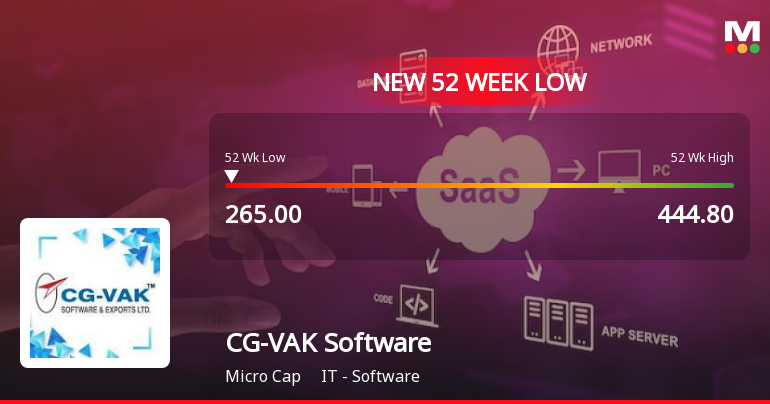

CG-VAK Software Hits 52-Week Low Amidst Declining Performance Metrics and Bearish Trend

2025-03-28 12:37:08CG-VAK Software & Exports has reached a new 52-week low, continuing a downward trend with a notable decline over the past four days. The company's one-year performance is significantly negative compared to the Sensex, while it shows a low return on capital employed and cash reserves. Despite these challenges, CG-VAK maintains a high return on equity and a low debt-to-equity ratio.

Read More

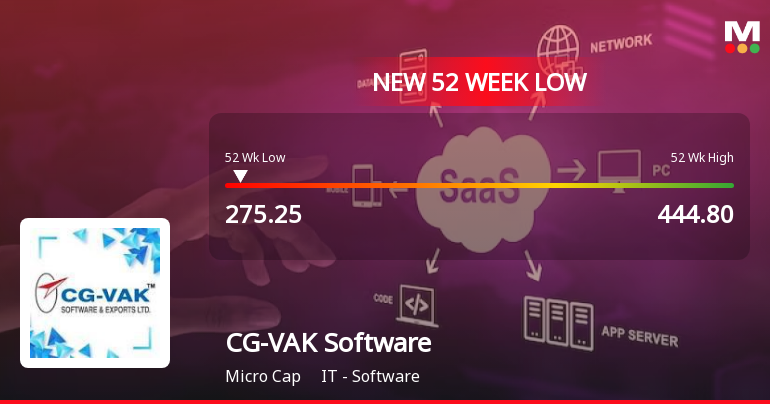

CG-VAK Software Faces Significant Volatility Amidst Declining Stock Performance

2025-03-27 09:50:34CG-VAK Software & Exports has faced notable volatility, hitting a new 52-week low and underperforming its sector. The stock has declined over the past three days and shows a bearish trend across various moving averages. Financial metrics indicate operational challenges, despite some management efficiency.

Read More

CG-VAK Software Faces Significant Volatility Amidst Declining Stock Performance

2025-03-27 09:50:23CG-VAK Software & Exports has faced notable volatility, hitting a new 52-week low and underperforming its sector. The stock has declined over three consecutive days and is trading below key moving averages. Financial metrics indicate challenges, though the company shows a high return on equity and low debt-to-equity ratio.

Read More

CG-VAK Software Faces Significant Volatility Amidst Declining Stock Performance

2025-03-27 09:50:22CG-VAK Software & Exports has faced notable volatility, hitting a new 52-week low and underperforming its sector. The stock has declined over the past three days and shows a bearish trend across various moving averages. Financial metrics indicate challenges, yet the company maintains a high return on equity.

Read More

CG-VAK Software & Exports Hits 52-Week Low Amid Broader Market Decline

2025-03-26 13:05:17CG-VAK Software & Exports has reached a new 52-week low, experiencing a notable decline over the past two days. The stock has underperformed its sector significantly, while the broader market, represented by the Sensex, has shown some resilience despite recent losses. Key financial metrics indicate challenges for the company.

Read MoreCG-VAK Software & Exports Adjusts Valuation Amidst Competitive IT Software Landscape

2025-03-17 08:00:11CG-VAK Software & Exports has recently undergone a valuation adjustment, reflecting a shift in its financial standing within the IT software industry. The company's current price stands at 291.00, showing a slight increase from the previous close of 284.65. Over the past year, CG-VAK has experienced a stock return of -19.48%, contrasting with a modest gain of 1.47% in the Sensex. Key financial metrics for CG-VAK include a PE ratio of 17.05 and an EV to EBITDA ratio of 11.38, which position the company within a competitive landscape. The company's return on capital employed (ROCE) is reported at 15.47%, while the return on equity (ROE) is at 11.64%. In comparison to its peers, CG-VAK's valuation metrics indicate a more favorable position relative to companies like NINtec Systems and Ksolves India, which exhibit significantly higher PE ratios. However, CG-VAK's performance has lagged behind some peers, par...

Read MoreCG-VAK Software & Exports Adjusts Valuation Amid Competitive IT Sector Landscape

2025-03-11 08:00:05CG-VAK Software & Exports has recently undergone a valuation adjustment, reflecting its current standing in the IT software industry. The company, categorized as a microcap, showcases a price-to-earnings (P/E) ratio of 17.28 and an enterprise value to EBITDA ratio of 11.54, indicating a competitive position within its sector. In comparison to its peers, CG-VAK's valuation metrics stand out, particularly when juxtaposed with companies like Blue Cloud Software and Ksolves India, which exhibit significantly higher P/E ratios. Additionally, CG-VAK's return on capital employed (ROCE) is reported at 15.47%, while its return on equity (ROE) is at 11.64%, suggesting effective management of resources relative to its peers. Despite a challenging year, with a stock return of -23.69% compared to a negligible change in the Sensex, CG-VAK has demonstrated resilience over longer periods, notably achieving an impressive...

Read MoreCG-VAK Software & Exports Adjusts Valuation Amidst Shifting IT Sector Dynamics

2025-03-05 08:00:13CG-VAK Software & Exports has recently undergone a valuation adjustment, reflecting a shift in its financial standing within the IT software industry. The company's current price stands at 295.40, showing a slight increase from the previous close of 289.00. Over the past year, CG-VAK has experienced a stock return of -27.17%, contrasting with a modest -1.19% return from the Sensex, indicating a significant underperformance relative to the broader market. Key financial metrics for CG-VAK include a PE ratio of 17.31 and an EV to EBITDA ratio of 11.56, which position it differently compared to its peers. For instance, Ksolves India is noted for its higher valuation metrics, with a PE ratio of 24.11, while NINtec Systems is categorized as having a notably higher valuation. In contrast, CG-VAK's return on capital employed (ROCE) stands at 15.47%, and its return on equity (ROE) is at 11.64%, reflecting its opera...

Read More

CG-VAK Software Faces Significant Volatility Amid Broader IT Sector Challenges

2025-03-03 10:06:17CG-VAK Software & Exports, a microcap IT software firm, has hit a new 52-week low, reflecting significant volatility and underperformance compared to its sector. The stock has faced consecutive losses over three days and is trading below key moving averages, indicating ongoing challenges in a tough market environment.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

03-Apr-2025 | Source : BSEPlease find enclosed the certificate under Regulation 74(5) of SEBI DP Regulations 2018 for the quarter ended 31.03.2025 received from MUFG Intime India Private Limited Registrar and Share Transfer Agent (RTA) of the Company.

Closure of Trading Window

26-Mar-2025 | Source : BSEPursuant to the Provisions of SEBI(PIT) Regulations 2015 as amended by SEBI (PIT) Regulations 2018 we wish to inform you that the Trading Window for dealing in securities of the Company will remain closed from Tuesday 01st April 2025 till the expiry of 48 hours after the declaration of the Financial Results for the quarter/year ended 31st March 2025.

Announcement under Regulation 30 (LODR)-Newspaper Publication

14-Feb-2025 | Source : BSEWe are enclosing herewith the press release issued on 13.02.2025 in Makkal Kural & Trinity Mirror publishing the financial results for the period ended 31.12.2024.

Corporate Actions

No Upcoming Board Meetings

CG-VAK Software & Exports Ltd has declared 10% dividend, ex-date: 02 Sep 24

No Splits history available

No Bonus history available

No Rights history available