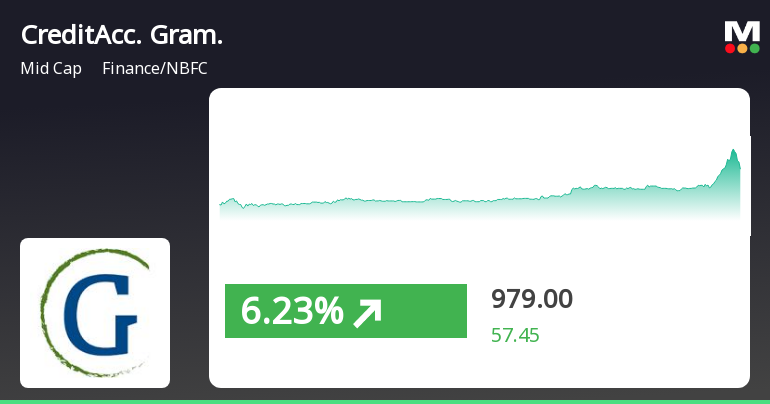

CreditAccess Grameen's Resilience Highlights Stock Performance Amid Market Fluctuations

2025-03-27 15:20:33CreditAccess Grameen has rebounded today after three days of decline, reaching an intraday high and showing a mixed trend in moving averages. The stock has outperformed its sector and the broader market over the past week and year-to-date, reflecting its resilience amid market fluctuations.

Read More

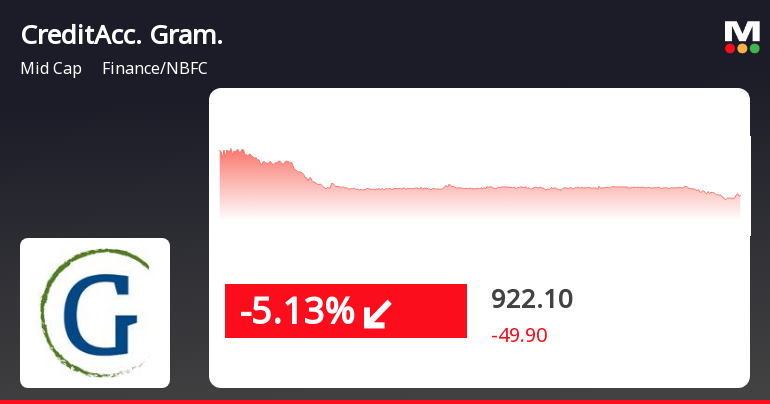

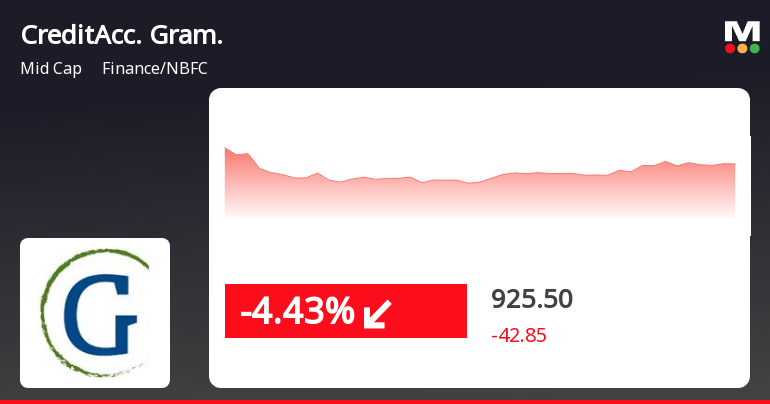

CreditAccess Grameen Faces Continued Decline Amid Broader Market Fluctuations

2025-03-26 15:20:27CreditAccess Grameen, a midcap finance and NBFC company, has faced a decline, marking its third consecutive day of losses. The stock is trading below key moving averages, indicating a bearish trend. While it has seen a year-to-date increase, it has also experienced a significant year-over-year decline.

Read More

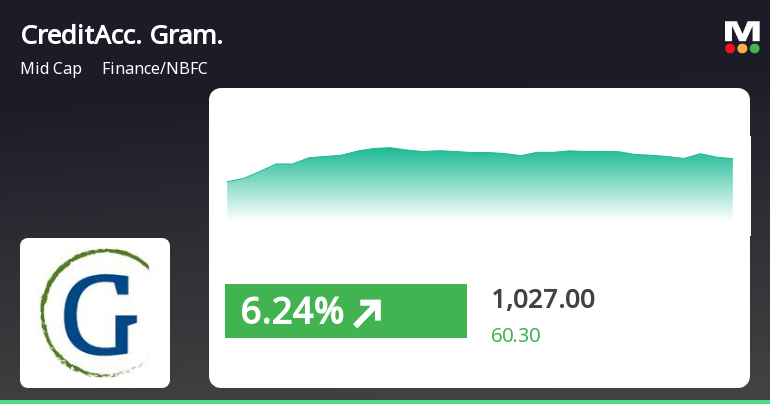

CreditAccess Grameen Outperforms Sector Amid Broader Market Volatility and Small-Cap Gains

2025-03-21 09:35:33CreditAccess Grameen has demonstrated strong performance, with a notable increase over the past four days. The stock is currently positioned above several key moving averages, indicating a mixed trend. Meanwhile, the broader market, represented by the Sensex, opened lower but is seeing gains in small-cap stocks.

Read MoreCreditAccess Grameen Shows Strong Market Activity Amid Mixed Performance Indicators

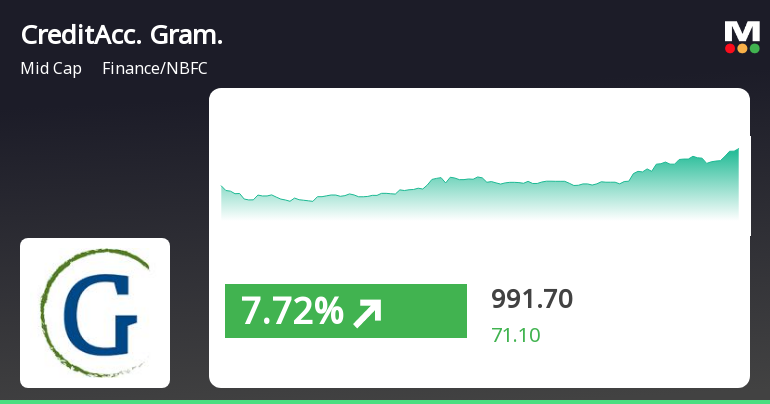

2025-03-07 10:00:47CreditAccess Grameen Ltd, a prominent player in the Finance/NBFC sector, has emerged as one of the most active equities today, with a total traded volume of 10,877,617 shares and a total traded value of approximately Rs 1,081.10 crore. The stock opened at Rs 940.25, reaching a day high of Rs 1,021.95 before settling at a last traded price of Rs 979.80. This marks a slight decline of 0.25% for the day, following three consecutive days of gains. Despite the day's downturn, CreditAccess Grameen's performance remains aligned with sector trends, which saw a modest increase of 0.11%. The stock's moving averages indicate a mixed performance, as it is currently above the 5-day, 20-day, 50-day, and 100-day averages but below the 200-day average. Notably, investor participation has risen, with a delivery volume of 705,000 shares on March 6, reflecting a 7.53% increase compared to the 5-day average. With a market ca...

Read MoreCreditAccess Grameen Shows Strong Market Activity Amid Declining Investor Participation

2025-03-06 13:00:04CreditAccess Grameen Ltd, a prominent player in the Finance/NBFC sector, has emerged as one of the most active equities today, with a total traded volume of 4,850,536 shares and a total traded value of approximately Rs 477.46 crore. The stock opened at Rs 940.25, reflecting a gain of 2.17%, and reached an intraday high of Rs 1009.85, marking a notable increase of 9.74% during the trading session. As of the latest update, the last traded price stands at Rs 989.60, showcasing an impressive 8.23% return for the day, significantly outperforming the sector's return of 1.36% and the Sensex's return of 0.49%. Over the past three days, CreditAccess Grameen has shown a consistent upward trend, accumulating a total return of 11.08%. Despite this positive performance, there has been a decline in investor participation, with delivery volume dropping by 69.46% compared to the five-day average. The stock remains liquid...

Read More

CreditAccess Grameen Shows Resilience Amid Broader Market Challenges and Mixed Trends

2025-03-06 11:05:27CreditAccess Grameen has demonstrated notable performance, achieving gains for three consecutive days and outperforming its sector. The stock is positioned above several moving averages, indicating a mixed trend. Meanwhile, the broader market shows modest increases, with small-cap stocks leading amid a challenging environment.

Read MoreCreditAccess Grameen Faces Mixed Technical Trends Amidst Market Fluctuations

2025-03-06 08:02:55CreditAccess Grameen, a midcap player in the finance and non-banking financial company (NBFC) sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 920.60, showing a slight increase from the previous close of 903.00. Over the past year, the stock has faced challenges, with a return of -35.85%, contrasting sharply with a marginal gain of 0.07% in the Sensex during the same period. In terms of technical indicators, the weekly MACD suggests a mildly bullish sentiment, while the monthly outlook remains bearish. The Bollinger Bands and moving averages indicate a mildly bearish trend on a weekly basis, with the daily moving averages reflecting a bearish stance. Notably, the KST shows a mildly bullish trend weekly, but bearish on a monthly basis, indicating mixed signals in the short and long term. When comparing the stock's performance to ...

Read MoreCreditAccess Grameen Faces Mixed Technical Signals Amidst Market Volatility

2025-03-04 08:01:40CreditAccess Grameen, a midcap player in the Finance/NBFC sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 896.50, down from a previous close of 918.80, with a notable 52-week high of 1,553.00 and a low of 750.05. Today's trading saw a high of 961.95 and a low of 890.55, indicating some volatility. The technical summary reveals mixed signals across various indicators. The MACD shows a mildly bullish trend on a weekly basis but is bearish on a monthly scale. Bollinger Bands and moving averages indicate bearish conditions, while the KST presents a mildly bullish outlook weekly, contrasting with its monthly bearish stance. The RSI shows no significant signals, and both the Dow Theory and OBV indicate no clear trends. In terms of performance, CreditAccess Grameen has shown a 5.05% return over the past week, significantly outperformi...

Read More

CreditAccess Grameen Faces Market Challenges Amid Significant Stock Decline

2025-02-28 09:35:31CreditAccess Grameen's stock has seen a notable decline, losing 6.53% on February 28, 2025, after two days of gains. The stock opened lower and reached an intraday low, underperforming compared to the broader market. Over the past month, it has declined more than the Sensex.

Read MoreAnnouncement under Regulation 30 (LODR)-Analyst / Investor Meet - Intimation

09-Apr-2025 | Source : BSEIntimation of Investors Meeting

Interim Business Update - March 2025

08-Apr-2025 | Source : BSEInterim Business Update - March 2025

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

04-Apr-2025 | Source : BSECertificate under Reg. &4(5) of the SEBI (DP) Regulations 2018 for the quarter ended March 31 2025

Corporate Actions

No Upcoming Board Meetings

CreditAccess Grameen Ltd has declared 100% dividend, ex-date: 26 Jul 24

No Splits history available

No Bonus history available

No Rights history available