Cyient DLM Experiences Technical Trend Adjustments Amidst Market Volatility

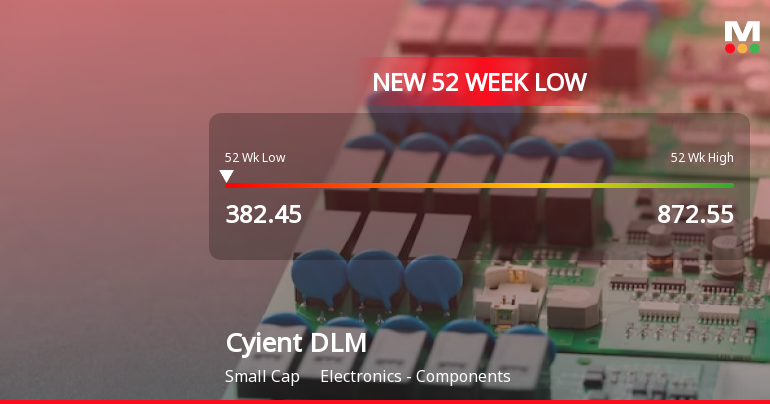

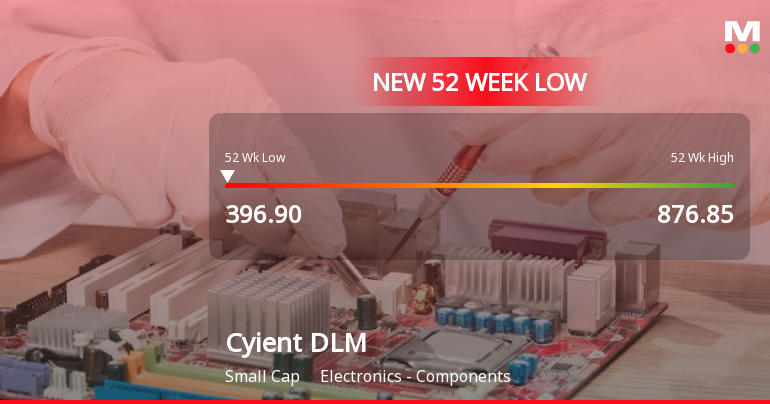

2025-04-02 08:10:20Cyient DLM, a small-cap player in the electronics components industry, has recently undergone a technical trend adjustment. The company's current stock price stands at 461.75, reflecting a slight increase from the previous close of 457.15. Over the past year, Cyient DLM has faced challenges, with a notable decline of 34.52% in stock return, contrasting sharply with a 2.72% gain in the Sensex during the same period. In terms of technical indicators, the MACD shows a bearish signal on a weekly basis, while the Bollinger Bands indicate a mildly bearish trend for both weekly and monthly assessments. The moving averages also reflect a mildly bearish stance on a daily basis. Notably, the stock's 52-week high is recorded at 872.55, while the low stands at 380.50, indicating significant volatility. Despite the recent evaluation revision, Cyient DLM has demonstrated resilience, particularly in the short term, with...

Read MoreCyient DLM Ltd Experiences Surge in Trading Activity Amid Mixed Investor Sentiment

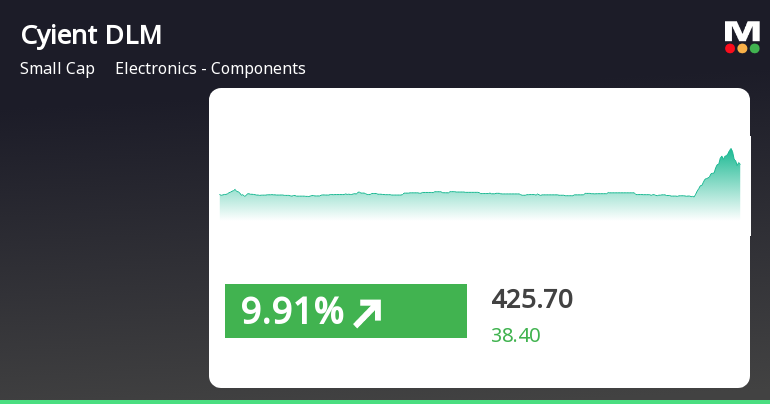

2025-03-28 10:00:38Cyient DLM Ltd, a small-cap player in the Electronics - Components industry, has made headlines today as its stock hit the upper circuit limit. The stock reached an intraday high of Rs 465.0, reflecting a notable change of Rs 52.45 or 13.54%. This surge comes amid a total traded volume of approximately 18.99 lakh shares, resulting in a turnover of Rs 81.05 crore. Despite the impressive performance, the stock underperformed its sector by 2.87%, with a day's low recorded at Rs 381.95. The weighted average price indicates that more volume was traded closer to the low price, suggesting varied investor sentiment throughout the trading session. Notably, the stock's delivery volume saw a significant increase of 307.8% compared to the five-day average, indicating rising investor participation. In terms of moving averages, Cyient DLM's stock is currently higher than its 5-day and 20-day moving averages but remains...

Read MoreCyient DLM Experiences Valuation Grade Change Amidst Competitive Electronics Sector Landscape

2025-03-28 08:00:55Cyient DLM, a small-cap player in the Electronics - Components sector, has recently undergone a valuation adjustment, reflecting a shift in its financial standing. The company's price-to-earnings (PE) ratio stands at 55.11, while its price-to-book value is recorded at 3.79. Other key metrics include an EV to EBIT ratio of 39.59 and an EV to EBITDA ratio of 30.70, indicating a robust valuation framework. In comparison to its peers, Cyient DLM's valuation metrics reveal a competitive landscape. Apollo Micro Systems, for instance, has a higher PE ratio of 68.6, while DCX Systems shows a PE of 50.08. Notably, RIR Power Electronics stands out with a significantly elevated PE ratio of 220.49, reflecting a different market positioning. Despite a challenging year-to-date return of -32.86%, Cyient DLM's recent performance over shorter periods has shown resilience, with a weekly return of 9.22% and a monthly return...

Read More

Cyient DLM Experiences Significant Volatility Amid Broader Market Rebound

2025-03-27 14:50:33Cyient DLM, a small-cap electronics components company, experienced significant trading activity on March 27, 2025, with notable volatility and a trend reversal after two days of decline. The stock's performance contrasts with the broader market, where the Sensex has rebounded, highlighting mixed trends for Cyient DLM.

Read MoreCyient DLM Adjusts Valuation Grade Amidst Competitive Electronics Sector Landscape

2025-03-10 08:01:03Cyient DLM, a small-cap player in the electronics components sector, has recently undergone a valuation adjustment, reflecting its current financial metrics. The company's price-to-earnings (P/E) ratio stands at 52.91, while its price-to-book value is recorded at 3.64. Additionally, the enterprise value to EBITDA ratio is 29.51, and the EV to EBIT ratio is 38.05. These figures indicate a premium valuation compared to its peers. In terms of performance, Cyient DLM has experienced a notable return of 6.66% over the past week, significantly outperforming the Sensex, which returned 1.55% in the same period. However, the company's year-to-date return shows a decline of 35.54%, contrasting with the Sensex's modest drop of 4.87%. Over the past year, Cyient DLM's performance has been challenging, with a return of -44.54%, while the Sensex has remained relatively stable with a slight gain. When compared to its pee...

Read More

Cyient DLM Faces Significant Volatility Amidst Persistent Downward Trend in Electronics Sector

2025-03-03 10:08:29Cyient DLM, a small-cap electronics components company, has faced significant volatility, hitting a new 52-week low of Rs. 390.1. The stock has declined 9.02% over the past five days and 52.52% over the past year, underperforming its sector and trading below key moving averages.

Read More

Cyient DLM Faces Significant Market Challenges Amid Sustained Decline in Stock Performance

2025-02-28 10:06:28Cyient DLM, a small-cap electronics components firm, has faced notable volatility, reaching a new 52-week low. The stock has declined significantly over the past year, underperforming its sector and trading below key moving averages, indicating ongoing challenges in the market environment.

Read More

Cyient DLM Faces Significant Volatility Amid Sustained Downward Trend in Electronics Sector

2025-02-27 11:35:30Cyient DLM, a small-cap electronics components firm, has hit a new 52-week low of Rs. 401 amid significant volatility. The stock has underperformed its sector and experienced consecutive losses over three days, contributing to a substantial decline over the past year, contrasting sharply with broader market gains.

Read MoreCyient DLM Adjusts Valuation Amidst Challenging Market Conditions and Peer Comparisons

2025-02-25 10:23:53Cyient DLM, a small-cap player in the Electronics - Components sector, has recently undergone a valuation adjustment. The company's current price stands at 419.70, reflecting a slight increase from the previous close of 418.25. Over the past year, Cyient DLM has faced challenges, with a return of -49.99%, contrasting sharply with a modest gain of 2.06% in the Sensex. Key financial metrics for Cyient DLM include a PE ratio of 51.39 and an EV to EBITDA ratio of 28.69. The company's return on capital employed (ROCE) is reported at 8.96%, while the return on equity (ROE) is at 6.88%. These figures indicate a competitive position within its industry, although they also highlight the pressures faced in the current market environment. In comparison to its peers, Cyient DLM's valuation appears more favorable than several companies in the sector, such as Apollo Micro Systems and DCX Systems, which are positioned a...

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

07-Apr-2025 | Source : BSEPlease find enclosed certificate from RTA under Reg. 74 (5) of SEBI(DP) Regulation

Board Meeting Intimation for Financial Results For The Quarter And Year Ended 31 March 2025

02-Apr-2025 | Source : BSECyient DLM Ltdhas informed BSE that the meeting of the Board of Directors of the Company is scheduled on 22/04/2025 inter alia to consider and approve the audited financial statements for the quarter and year ended 31 March 2025

Closure of Trading Window

31-Mar-2025 | Source : BSEIntimation of closure of trading window for Q4FY25

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available