Embassy Developments Faces Technical Shift Amid Declining Operating Profits and Debt Concerns

2025-04-02 08:09:47Embassy Developments, a midcap construction and real estate firm, has experienced a shift in its technical outlook, now reflecting a more pronounced bearish position. Despite a 13.23% growth in net sales, the company faces challenges with declining operating profits and poor debt management, alongside underwhelming stock performance.

Read MoreEmbassy Developments Faces Bearish Technical Trends Amid Market Evaluation Revision

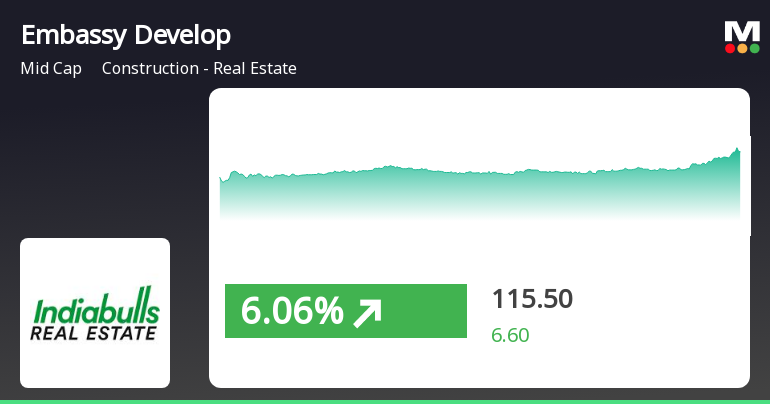

2025-04-02 08:00:29Embassy Developments, a midcap player in the construction and real estate sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 113.85, down from a previous close of 115.80, with a 52-week range between 105.10 and 164.40. The technical summary indicates a bearish sentiment across various indicators. The MACD shows a bearish trend on a weekly basis, while the monthly outlook remains mildly bearish. Bollinger Bands and moving averages also reflect bearish conditions, suggesting a cautious market environment. Notably, the KST aligns with this sentiment, indicating bearish trends on a weekly basis and mildly bearish on a monthly basis. In terms of performance, Embassy Developments has faced challenges compared to the Sensex. Over the past week, the stock returned -0.09%, while the Sensex saw a decline of 2.55%. On a monthly basis, the s...

Read MoreEmbassy Developments Faces Technical Trend Shifts Amidst Mixed Market Indicators

2025-04-01 08:00:10Embassy Developments, a midcap player in the construction and real estate sector, has recently undergone an evaluation revision reflecting shifts in its technical indicators. The company's current stock price stands at 115.80, slightly down from the previous close of 116.00. Over the past year, Embassy Developments has experienced a 0.13% decline, contrasting with a 5.11% gain in the Sensex, highlighting a challenging performance relative to the broader market. In terms of technical metrics, the MACD indicates a bearish trend on a weekly basis, while the monthly perspective shows a mildly bearish stance. The Relative Strength Index (RSI) remains neutral, with no significant signals detected in both weekly and monthly evaluations. Bollinger Bands present a mixed picture, showing bearish tendencies weekly but bullish on a monthly basis. Moving averages also reflect a bearish sentiment, while the On-Balance V...

Read MoreEmbassy Developments Faces Market Challenges Amid Mixed Performance Indicators

2025-03-28 18:00:12Embassy Developments Ltd, a mid-cap player in the construction and real estate sector, has shown notable activity today, reflecting a slight decline of 0.17% in its stock price. The company's market capitalization stands at Rs 13,528.00 crore, with a price-to-earnings (P/E) ratio of -48.17, significantly higher than the industry average of 27.75. Over the past year, Embassy Developments has experienced a marginal decline of 0.13%, contrasting with the Sensex's positive performance of 5.11%. In the short term, the stock has seen a 2.93% drop over the past week, while the Sensex has gained 0.66%. In terms of longer-term performance, Embassy Developments has delivered a 14.54% return over three years and an impressive 189.14% over five years, outpacing the Sensex's respective returns of 34.42% and 159.65%. However, the stock's performance over the last decade remains subdued at 75.06%, compared to the Sens...

Read MoreEmbassy Developments Shows Mixed Technical Trends Amid Market Evaluation Revision

2025-03-28 08:00:07Embassy Developments, a midcap player in the construction and real estate sector, has recently undergone an evaluation revision reflecting its current market dynamics. The company's stock is currently priced at 116.00, showing a notable increase from the previous close of 108.90. Over the past year, Embassy Developments has recorded a stock return of 1.27%, while the Sensex has returned 6.32% in the same period. In terms of technical indicators, the company presents a mixed picture. The Moving Averages indicate a mildly bullish sentiment on a daily basis, while the MACD and Bollinger Bands show bearish tendencies on a weekly scale. However, the monthly outlook for Bollinger Bands appears bullish, suggesting some positive momentum. The On-Balance Volume (OBV) reflects a bullish trend on a monthly basis, indicating potential accumulation. When comparing the company's performance to the Sensex, it is notewor...

Read More

Embassy Developments Shows Recovery Amid Broader Market Resilience and Mixed Performance Indicators

2025-03-27 14:30:17Embassy Developments saw a significant increase on March 27, 2025, reversing three days of decline and reaching an intraday high. Despite this uptick, the stock remains below key moving averages. In the broader market, the Sensex has shown resilience, recovering from an initial drop and gaining over the past three weeks.

Read MoreEmbassy Developments Faces Mixed Technical Trends Amid Market Evaluation Revision

2025-03-26 08:00:17Embassy Developments, a midcap player in the construction and real estate sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 113.95, down from a previous close of 117.40, with a 52-week range between 105.10 and 164.40. Today's trading saw a high of 119.40 and a low of 113.05. The technical summary indicates a mixed performance across various indicators. The MACD shows bearish tendencies on a weekly basis, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) presents no signals for both weekly and monthly periods, suggesting a lack of momentum. Bollinger Bands reflect a bearish trend weekly, transitioning to sideways on a monthly basis. Daily moving averages indicate a mildly bullish stance, while the KST and Dow Theory metrics are mildly bearish on a weekly basis but show a similar trend monthly. In terms...

Read More

Embassy Developments Faces Mixed Technical Trends Amid Fundamental Challenges

2025-03-25 08:06:58Embassy Developments, a midcap construction and real estate firm, has experienced a recent evaluation adjustment reflecting a shift in its technical outlook. While some indicators show a more favorable environment, challenges persist with long-term fundamental strength and debt servicing, creating a complex market position for the company.

Read MoreEmbassy Developments Shows Mixed Technical Trends Amid Market Volatility

2025-03-21 08:00:06Embassy Developments, a midcap player in the construction and real estate sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 115.75, showing a notable increase from the previous close of 110.10. Over the past week, the stock has reached a high of 119.90 and a low of 111.30, indicating some volatility in its trading range. In terms of technical indicators, the company exhibits a mixed performance across various metrics. The Moving Averages suggest a mildly bullish sentiment on a daily basis, while the MACD and KST indicators reflect a bearish to mildly bearish outlook on weekly and monthly scales. The Bollinger Bands present a contrasting view, indicating a bullish trend on a monthly basis, which may suggest potential for upward movement. When comparing the stock's performance to the Sensex, Embassy Developments has shown a 6.10% r...

Read MoreClosure of Trading Window

31-Mar-2025 | Source : BSEThis is to inform that the trading window for dealing in securities of the Company shall be closed with effect from April 01 2025 and shall remain closed till 48 hours after the declaration of audited financial results of the company for the quarter & financial year ending on March 31 2025. For further information please refer attachment.

Announcement under Regulation 30 (LODR)-Change in Directorate

30-Mar-2025 | Source : BSEPlease find attached herewith the intimation with respect to cessation of Mr. Praveen Kumar Tripathi as Independent Director of the Company upon completion of second consecutive term.

Disclosures under Reg. 29(1) of SEBI (SAST) Regulations 2011

28-Mar-2025 | Source : BSEThe Exchange has received the disclosure under Regulation 29(1) of SEBI (Substantial Acquisition of Shares & Takeovers) Regulations 2011 for Florence Investment Ltd

Corporate Actions

No Upcoming Board Meetings

Embassy Developments Ltd has declared 50% dividend, ex-date: 06 May 14

No Splits history available

No Bonus history available

No Rights history available