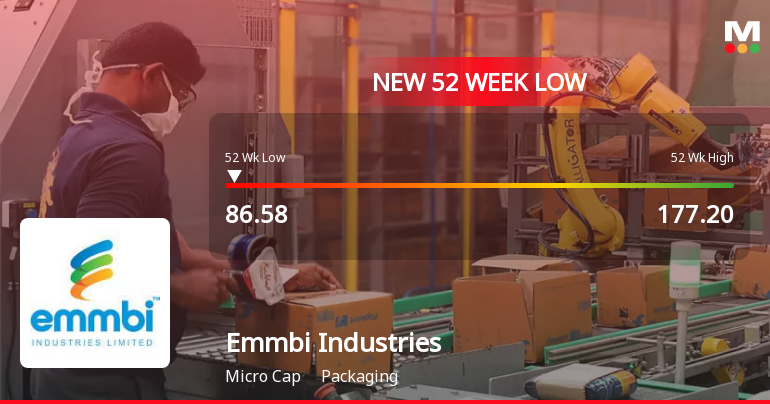

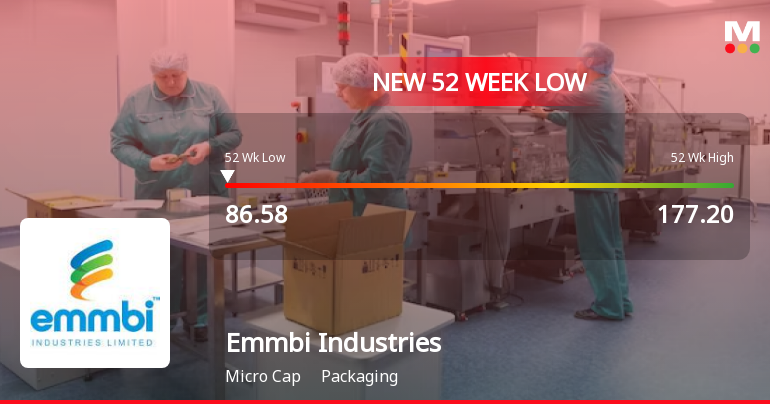

Emmbi Industries Faces Continued Volatility Amid Weak Fundamentals and Sector Underperformance

2025-03-27 15:40:38Emmbi Industries, a microcap in the packaging sector, has faced notable volatility, reaching a new 52-week low. The stock has underperformed its sector and experienced a significant decline over the past four days. Long-term fundamentals remain weak, with challenges in debt servicing and lackluster annual returns.

Read More

Emmbi Industries Faces Challenges Amidst Significant Stock Volatility and Underperformance

2025-03-27 15:40:20Emmbi Industries has faced notable volatility, reaching a new 52-week low and experiencing a decline over the past four days. The stock is trading below key moving averages, reflecting a bearish trend. Long-term fundamentals indicate stagnant operating profit growth and high debt levels, raising concerns about financial stability.

Read MoreEmmbi Industries Adjusts Valuation Grade, Highlighting Competitive Position in Packaging Sector

2025-03-26 08:00:38Emmbi Industries, a microcap player in the packaging industry, has recently undergone a valuation adjustment, reflecting its financial metrics and market position. The company's price-to-earnings ratio stands at 18.30, while its price-to-book value is notably low at 0.95. Additionally, Emmbi's enterprise value to EBITDA ratio is recorded at 8.34, indicating a competitive valuation relative to its peers. In terms of profitability, Emmbi Industries has a return on capital employed (ROCE) of 8.12% and a return on equity (ROE) of 5.18%. The company also offers a dividend yield of 0.31%, which may appeal to certain investors. When compared to its peers, Emmbi Industries showcases a more favorable PEG ratio of 0.68, suggesting a potentially better growth valuation relative to earnings. In contrast, competitors like Sh. Jagdamba Pol and Sh. Rama Multi. exhibit higher valuation metrics, indicating a divergence i...

Read More

Emmbi Industries Adjusts Valuation Amid Shifts in Financial Metrics and Market Position

2025-03-20 08:06:43Emmbi Industries has recently experienced a valuation adjustment reflecting changes in its financial metrics and market position. The company's valuation grade has shifted, with key metrics indicating competitive positioning. Despite a bearish technical outlook, Emmbi has demonstrated resilience in performance indicators, including returns on equity and capital employed.

Read MoreEmmbi Industries Adjusts Valuation Grade Amidst Competitive Packaging Sector Dynamics

2025-03-20 08:00:52Emmbi Industries, a microcap player in the packaging industry, has recently undergone a valuation adjustment, reflecting a shift in its financial standing. The company currently reports a price-to-earnings (P/E) ratio of 19.79 and a price-to-book value of 1.02, indicating a moderate valuation relative to its earnings and assets. Additionally, its enterprise value to EBITDA stands at 8.71, while the enterprise value to sales is notably low at 0.83, suggesting efficient revenue generation relative to its market valuation. In terms of performance metrics, Emmbi Industries has a return on capital employed (ROCE) of 8.12% and a return on equity (ROE) of 5.18%. The company's dividend yield is recorded at 0.28%, which may appeal to income-focused investors. When compared to its peers, Emmbi Industries presents a competitive P/E ratio, particularly against companies like Shree TirupatiBa and Sh. Rama Multi., whic...

Read More

Emmbi Industries Faces Financial Stability Challenges Amid Attractive Valuation Metrics

2025-03-19 08:08:23Emmbi Industries has recently adjusted its evaluation, reflecting its current market position. The company reported stable financial performance for the quarter ending December 2024, but faces challenges in long-term growth and debt management. Despite these issues, it maintains an attractive valuation and modest profitability metrics.

Read More

Emmbi Industries Faces Continued Decline Amid Weak Fundamentals and Market Volatility

2025-03-17 15:42:15Emmbi Industries, a microcap in the packaging sector, has faced notable volatility, reaching a new 52-week low. The stock has declined over six consecutive days and is trading below key moving averages. Financially, it shows weak long-term fundamentals, with low profitability and high debt levels.

Read More

Emmbi Industries Faces Continued Volatility Amid Weak Fundamentals and Sector Underperformance

2025-03-17 15:42:06Emmbi Industries has faced notable volatility, reaching a new 52-week low and underperforming its sector. The stock has declined significantly over the past week and is trading below key moving averages. Financially, the company shows weak long-term fundamentals, with low profitability and a high debt-to-EBITDA ratio.

Read MoreEmmbi Industries Adjusts Valuation Grade Amid Competitive Packaging Industry Landscape

2025-03-13 08:00:41Emmbi Industries, a microcap player in the packaging industry, has recently undergone a valuation adjustment, reflecting a reassessment of its financial metrics. The company currently boasts a price-to-earnings (PE) ratio of 18.57 and a price-to-book value of 0.96, indicating a favorable valuation relative to its assets. Additionally, its enterprise value to EBITDA stands at 8.41, while the enterprise value to sales ratio is notably low at 0.80, suggesting efficient revenue generation. In terms of profitability, Emmbi Industries reports a return on capital employed (ROCE) of 8.12% and a return on equity (ROE) of 5.18%. The company's PEG ratio is 0.69, further emphasizing its valuation appeal. When compared to its peers, Emmbi Industries demonstrates a competitive edge with a lower PE ratio than several companies in the sector, such as Sh. Rama Multi. and Kanpur Plastics, which are classified as expensive...

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

09-Apr-2025 | Source : BSECertificate under Reg. 74(5) of SEBI (DP) Regulation 2018 is attached herewith.

Announcement under Regulation 30 (LODR)-Change in Directorate

31-Mar-2025 | Source : BSEIntimation attached.

Board Meeting Outcome for Outcome Of Board Meeting Held On 29Th March 2025

29-Mar-2025 | Source : BSEOutcome of Board meeting is attached.

Corporate Actions

No Upcoming Board Meetings

Emmbi Industries Ltd has declared 3% dividend, ex-date: 13 Sep 24

No Splits history available

No Bonus history available

No Rights history available