Epigral Shows Strong Technical Trends Amidst Market Dynamics in Chemicals Sector

2025-04-02 08:09:55Epigral, a midcap player in the chemicals industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1904.55, showing a slight increase from the previous close of 1883.70. Over the past year, Epigral has demonstrated a robust performance with a return of 63.45%, significantly outpacing the Sensex, which recorded a return of 2.72% during the same period. In terms of technical indicators, the weekly MACD suggests a bullish sentiment, while the monthly outlook remains mildly bearish. The Bollinger Bands indicate a bullish trend on both weekly and monthly scales, reinforcing the stock's positive momentum. Additionally, the KST shows a mildly bullish trend weekly and a bullish stance monthly, suggesting underlying strength in the stock's performance. Epigral's recent performance metrics highlight its resilience, particularly in the one-month...

Read MoreEpigral's Technical Indicators Show Mixed Signals Amid Market Volatility

2025-03-26 08:04:59Epigral, a midcap player in the chemicals industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1885.00, down from a previous close of 1981.60, with a notable 52-week high of 2408.35 and a low of 1038.50. Today's trading saw a high of 2008.35 and a low of 1880.00, indicating some volatility. The technical summary reveals mixed signals across various indicators. The MACD shows a bullish trend on a weekly basis but leans mildly bearish monthly. The RSI indicates no significant signals for both weekly and monthly assessments. Bollinger Bands present a mildly bullish outlook weekly and bullish monthly, while moving averages suggest a mildly bearish trend daily. The KST shows bearish weekly but bullish monthly signals, and Dow Theory reflects a mildly bullish weekly and mildly bearish monthly stance. The On-Balance Volume (OBV) remains m...

Read More

Epigral's Stock Evaluation Shift Signals Potential Market Sentiment Change

2025-03-25 08:25:54Epigral, a midcap chemicals company, has recently seen a change in its evaluation, indicating a shift in market sentiment. The firm reported strong net sales growth of 33.87% in the first half of FY24-25 and has maintained a high return on capital employed, reflecting solid management efficiency.

Read MoreEpigral's Technical Indicators Reflect Mixed Signals Amid Strong Performance Metrics

2025-03-25 08:06:16Epigral, a midcap player in the chemicals industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock, priced at 1981.60, has shown notable performance metrics, particularly in its recent returns compared to the Sensex. Over the past week, Epigral has delivered a return of 11.26%, significantly outperforming the Sensex, which returned 5.14%. This trend continues with a one-month return of 14.81% against the Sensex's 4.74%. The company's performance over the past year has been impressive, with a return of 87.05%, while the Sensex managed only 7.07%. Over a three-year period, Epigral's return stands at 100.75%, compared to the Sensex's 35.40%. These figures highlight Epigral's strong market position and resilience in the chemicals sector. In terms of technical indicators, the stock exhibits a mixed picture, with weekly metrics showing bullish signals in MACD and...

Read More

Epigral Faces Volatility Amidst Mixed Performance Against Broader Market Trends

2025-03-10 15:45:30Epigral, a midcap chemicals company, saw a significant decline on March 10, 2025, despite an initial gain. Over the past week, it outperformed the Sensex, but monthly and quarterly performance showed declines. However, the stock has increased notably over the past year, contrasting with the Sensex's minimal change.

Read More

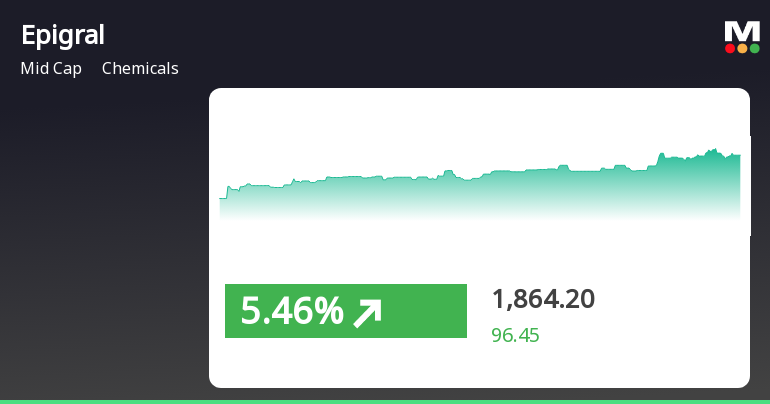

Epigral's Strong Performance Highlights Resilience Amid Broader Market Challenges

2025-03-07 18:00:37Epigral, a midcap chemicals company, experienced notable trading activity on March 7, 2025, with a significant increase in stock value. The company has shown a strong upward trend over the past four days and has outperformed both its sector and broader market indices over various timeframes.

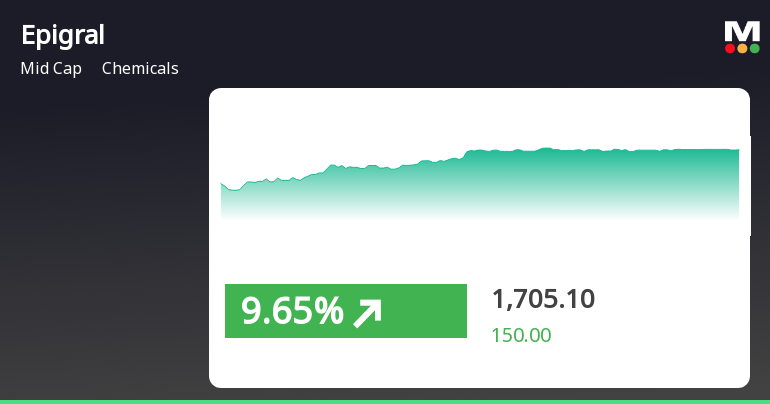

Read MoreEpigral's Technical Trends Show Mixed Signals Amid Strong Long-Term Performance

2025-03-05 08:03:35Epigral, a midcap player in the chemicals industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1708.15, showing a notable increase from the previous close of 1555.10. Over the past year, Epigral has demonstrated a strong performance with a return of 40.98%, significantly outperforming the Sensex, which recorded a mere -1.19% during the same period. In terms of technical indicators, the weekly MACD remains bearish, while the monthly outlook shows a mildly bearish trend. The Relative Strength Index (RSI) indicates no signal for both weekly and monthly assessments. Bollinger Bands present a mildly bearish trend on a weekly basis, contrasting with a bullish monthly perspective. Moving averages indicate a bearish stance on a daily basis, while the KST shows a bearish weekly trend but a bullish monthly outlook. The company's performance...

Read MoreEpigral Adjusts Valuation Grade Amid Competitive Chemicals Sector Landscape

2025-03-05 08:01:06Epigral, a midcap player in the chemicals industry, has recently undergone a valuation adjustment, reflecting its current market standing. The company's price-to-earnings ratio stands at 21.17, while its price-to-book value is noted at 5.26. Other key metrics include an EV to EBIT ratio of 14.65 and an EV to EBITDA ratio of 11.92, indicating its operational efficiency. In terms of returns, Epigral has shown a notable performance over the past year, with a stock return of 40.98%, significantly outpacing the Sensex's return of -1.19% during the same period. However, the company has faced challenges in the shorter term, with a year-to-date return of -10.1%, compared to the Sensex's -6.59%. When compared to its peers, Epigral's valuation metrics reveal a competitive landscape. Companies like Navin Fluorine International and Vinati Organics are positioned at higher valuation levels, while others such as Aarti ...

Read More

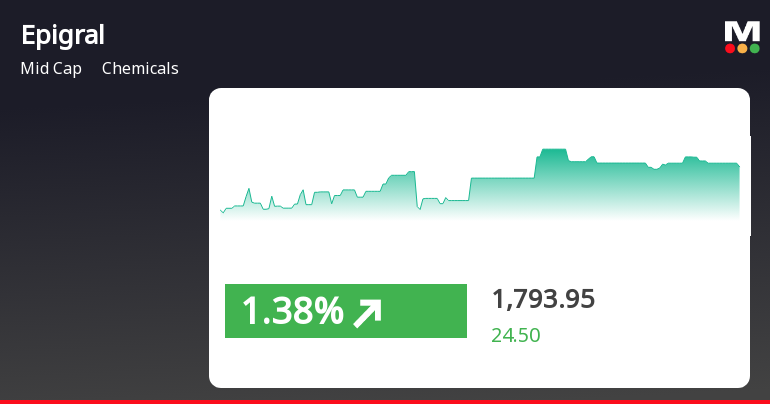

Epigral's Stock Surge Highlights Divergence from Broader Market Trends

2025-03-04 10:26:17Epigral, a midcap chemicals company, experienced significant intraday gains, outperforming its sector. However, it remains below key moving averages, suggesting challenges in sustaining this momentum. In contrast, the broader market, represented by the Sensex, has shown a bearish trend, nearing its 52-week low with a recent decline.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

05-Apr-2025 | Source : BSEEpigral Limited submits Certificate under Reg. 74(5) of SEBI (DP) Regulations for the quarter ended 31.03.2025.

Closure of Trading Window

27-Mar-2025 | Source : BSEEpigral Limited submits Notice of Closure of Trading Window.

Commissioning Of Chlorotoluenes Value Chain Facility

24-Mar-2025 | Source : BSEEpigral Limited announce the Commissioning of Chlorotoluenes Value Chain Facility.

Corporate Actions

No Upcoming Board Meetings

Epigral Ltd has declared 25% dividend, ex-date: 07 Feb 25

No Splits history available

No Bonus history available

No Rights history available