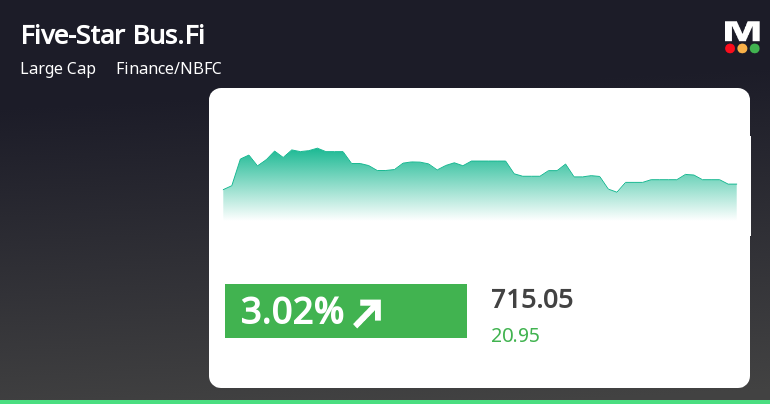

Five-Star Business Finance Adjusts Evaluation Amid Strong Long-Term Fundamentals and Growth Metrics

2025-04-02 08:41:16Five-Star Business Finance has recently adjusted its evaluation, indicating a change in its technical trend. Despite this, the company showcases strong long-term fundamentals, with a notable average Return on Equity of 15.92% and impressive growth metrics, including significant increases in net sales and operating profit over nine consecutive quarters.

Read MoreFive-Star Business Finance Faces Technical Trend Shifts Amid Market Volatility

2025-04-02 08:10:13Five-Star Business Finance, a prominent player in the Finance/NBFC sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock, currently priced at 697.20, has seen fluctuations with a previous close of 716.20. Over the past year, it reached a high of 943.20 and a low of 625.80, indicating significant volatility. The technical summary reveals a bearish sentiment across various indicators. The MACD and Bollinger Bands both reflect bearish trends on a weekly basis, while the daily moving averages also align with this sentiment. The Relative Strength Index (RSI) shows a bearish trend weekly, with no signal on a monthly basis. Interestingly, the KST indicator presents a bullish outlook weekly, contrasting with the overall bearish indicators. In terms of performance, Five-Star Business Finance has faced challenges compared to the Sensex. Over the past week, the stock...

Read More

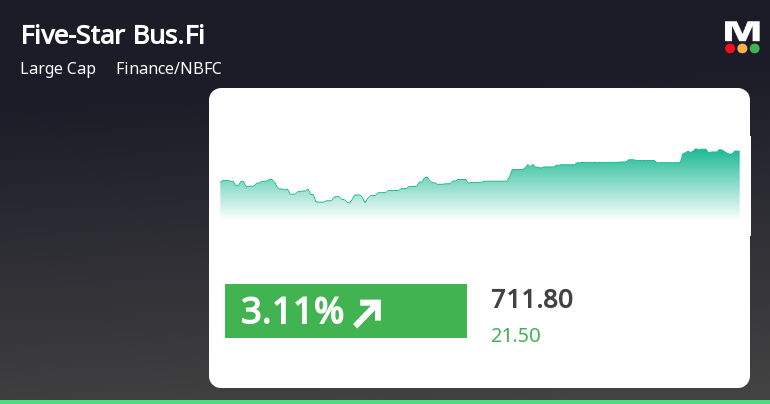

Five-Star Business Finance Shows Strong Short-Term Gains Amid Broader Market Recovery

2025-03-27 15:35:32Five-Star Business Finance has demonstrated significant activity, outperforming its sector and achieving consecutive gains over two days. The stock is currently above several moving averages, while the broader market, represented by the Sensex, has rebounded after a negative start, with small-cap stocks leading the way.

Read More

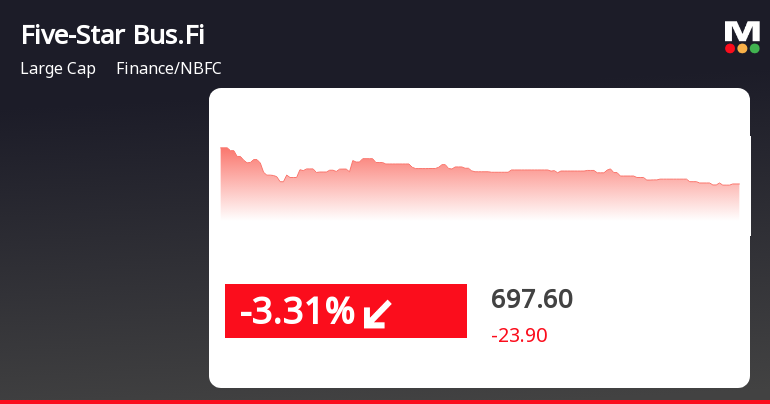

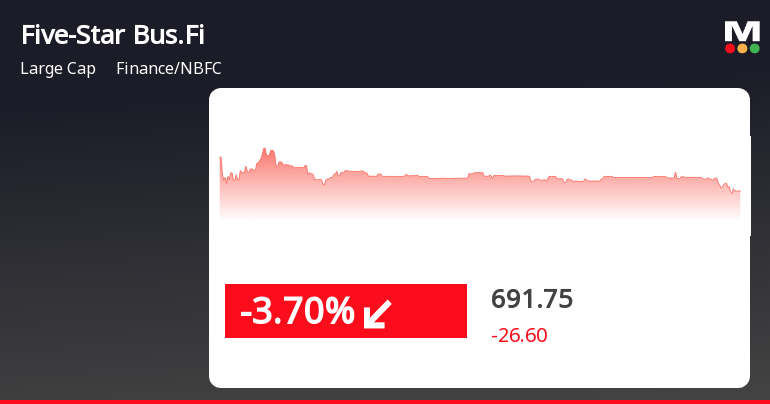

Five-Star Business Finance Faces Continued Decline Amid Broader Market Resilience

2025-03-25 11:45:47Five-Star Business Finance has faced a decline of 3.23% on March 25, 2025, marking its second consecutive day of losses. The stock is currently above its 5-day and 20-day moving averages but below longer-term averages. In contrast, the Sensex has shown resilience with a 6.51% gain over the past three weeks.

Read More

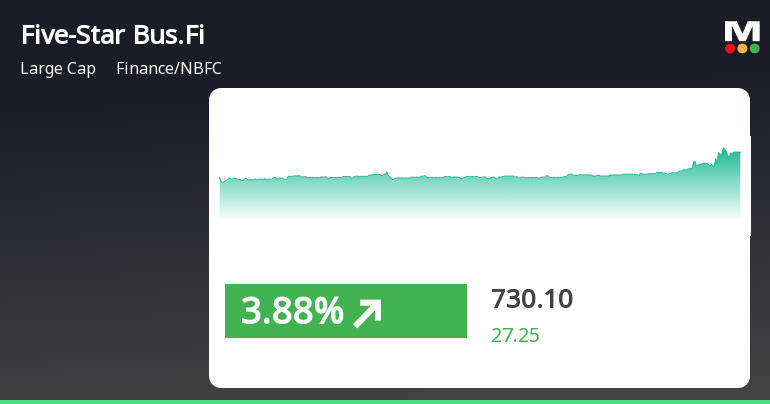

Five-Star Business Finance Shows Strong Short-Term Gains Amid Mixed Long-Term Trends

2025-03-20 12:35:27Five-Star Business Finance has experienced a positive trend, achieving consecutive gains over four days and outperforming its sector. While currently above several short-term moving averages, it remains below the 200-day average. In the broader market, the Sensex is also showing upward momentum, led by mega-cap stocks.

Read More

Five-Star Business Finance Shows Strong Rebound Amid Broader Market Trends

2025-03-05 09:35:34Five-Star Business Finance experienced notable activity on March 5, 2025, reversing a two-day decline with a significant intraday high. The stock outperformed its sector and the Sensex, showing gains over various time frames while trading above several moving averages, though still below its 200-day average.

Read More

Five-Star Business Finance Faces Continued Stock Decline Amid Broader Market Challenges

2025-03-04 15:35:24Five-Star Business Finance's stock has declined for two consecutive days, totaling a 7.91% drop. It is currently trading below key moving averages and has underperformed its sector. Meanwhile, the broader market shows mixed results, with small-cap stocks gaining while the Sensex continues to struggle near its 52-week low.

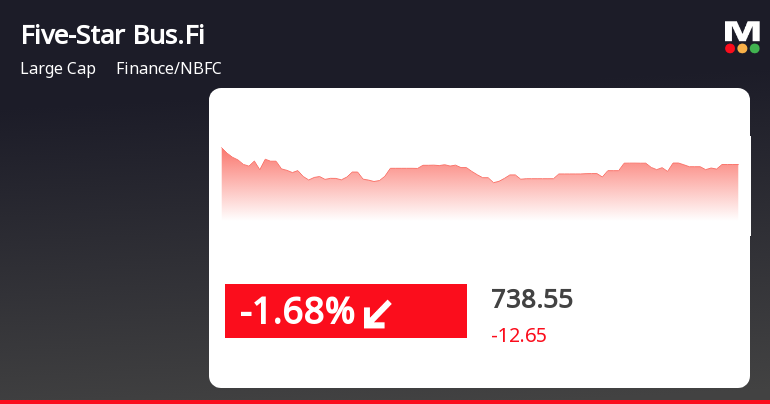

Read MoreFive-Star Business Finance Shows Mixed Technical Trends Amid Market Evaluation Revision

2025-03-04 08:01:16Five-Star Business Finance, a prominent player in the finance and non-banking financial company (NBFC) sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 718.35, down from a previous close of 751.20, with a notable 52-week high of 943.20 and a low of 601.00. Today's trading saw a high of 761.95 and a low of 711.75. In terms of technical indicators, the weekly MACD shows a mildly bullish trend, while the monthly Bollinger Bands indicate a bearish sentiment. The daily moving averages suggest a bearish outlook, and the KST on a weekly basis also reflects a mildly bullish trend. However, both the RSI and OBV show no significant trends at this time. When comparing the stock's performance to the Sensex, Five-Star Business Finance has shown a 1.48% return over the past week, contrasting with a -1.84% return for the Sensex. Over the past ...

Read More

Five-Star Business Finance Faces Volatility Amid Broader Market Challenges

2025-03-03 09:50:23Five-Star Business Finance, a key player in the NBFC sector, saw a decline on March 3, 2025, following a six-day gain streak. The stock's intraday low of Rs 726.95 reflects market volatility, while its performance over the past month contrasts with broader market trends.

Read MoreAnnouncement under Regulation 30 (LODR)-Credit Rating

04-Apr-2025 | Source : BSEIntimation of re-affirmation of credit rating

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

02-Apr-2025 | Source : BSECertificate under Regulation 74(5) of SEBI (DP) Regulations 2018

Closure of Trading Window

26-Mar-2025 | Source : BSEIntimation on Closure of Trading Window

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available