G R Infraprojects Faces Mixed Technical Trends Amid Market Volatility

2025-03-21 08:03:10G R Infraprojects, a midcap player in the capital goods sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1008.85, down from a previous close of 1024.80, with a notable 52-week high of 1,859.95 and a low of 902.05. Today's trading saw a high of 1027.80 and a low of 990.10, indicating some volatility. The technical summary reveals a mixed picture. The MACD indicates bearish trends on a weekly basis, while the monthly perspective shows a mildly bearish stance. The Relative Strength Index (RSI) is bullish on a weekly basis but shows no signal monthly. Bollinger Bands reflect a mildly bearish trend for both weekly and monthly evaluations. Moving averages are bearish daily, while the KST presents a contrasting view with a bullish monthly signal. In terms of performance, G R Infraprojects has shown varied returns compared to the Sensex...

Read MoreG R Infraprojects Sees Increased Trading Activity Amid Declining Investor Participation

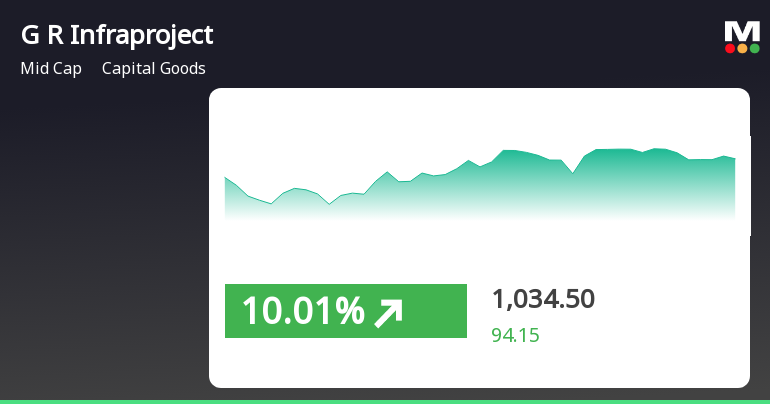

2025-03-19 11:00:05G R Infraprojects Ltd, a prominent player in the capital goods sector, has emerged as one of the most active equities today, with a total traded volume of 2,646,113 shares and a total traded value of approximately Rs 2,734.39 million. The stock opened at Rs 1,000, reflecting a gain of 6.31% from the previous close of Rs 940.65, and reached an intraday high of Rs 1,057.5, marking a 12.42% increase during the trading session. Over the past two days, G R Infraprojects has demonstrated a strong performance, gaining 16.07% in returns and outperforming its sector by 11%. However, there has been a notable decline in investor participation, with delivery volume dropping by 29.28% compared to the five-day average. The stock's liquidity remains robust, with trading activity sufficient for a trade size of Rs 0.73 crore. Currently, G R Infraprojects holds a market capitalization of Rs 10,223.52 crore, categorizing it...

Read MoreG R Infraprojects Opens Strong with 4.22% Gain, Outperforming Sector Trends

2025-03-19 09:55:15G R Infraprojects, a midcap player in the capital goods sector, has shown significant activity today, opening with a gain of 4.22%. The stock has outperformed its sector by 9.56%, reflecting a strong performance amid broader market trends. Over the past two days, G R Infraprojects has recorded a cumulative return of 12.73%, indicating a positive momentum. Today, the stock reached an intraday high of Rs 1,041.15, marking a 10.72% increase. In terms of moving averages, the stock is currently above its 5-day and 20-day averages but remains below the 50-day, 100-day, and 200-day averages, suggesting mixed signals in its short- to medium-term performance. On a broader scale, G R Infraprojects has experienced a 1-day performance of 10.58%, significantly outperforming the Sensex, which saw a mere 0.15% increase. However, over the past month, the stock has declined by 2.12%, while the Sensex has decreased by 0.69...

Read More

G R Infraprojects Shows Resilience Amid Broader Market Caution and Volatility

2025-03-19 09:35:27G R Infraprojects has experienced notable gains, outperforming its sector amid a bearish market. The stock opened higher and reached an intraday peak, marking its second consecutive day of increases. Despite mixed short-term momentum, the broader market shows cautious sentiment, with the BSE Small Cap index leading today.

Read More

G R Infraprojects Faces Significant Volatility Amid Broader Market Resilience

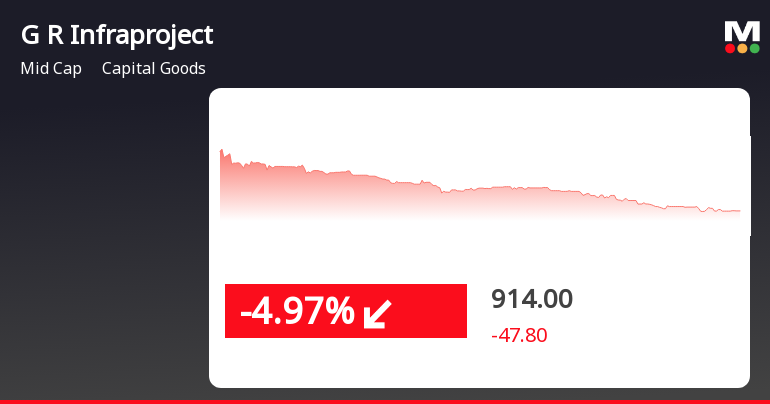

2025-03-17 13:35:25G R Infraprojects has faced notable volatility, hitting a 52-week low amid a consistent decline over the past week. Despite an initial gain, the stock closed lower, reflecting fluctuating investor sentiment. It is trading below key moving averages, indicating a bearish trend compared to the broader market's performance.

Read More

G R Infraprojects Hits All-Time Low Amid Ongoing Financial Challenges and Declining Sales

2025-03-17 12:42:07G R Infraprojects has faced notable volatility, hitting a new 52-week low after an initial gain. The company has reported declining net sales and operating profit over five years, with negative results for three consecutive quarters. Despite high management efficiency, the stock has underperformed against benchmarks.

Read More

G R Infraprojects Faces Ongoing Challenges Amid Broader Market Gains

2025-03-17 11:09:57G R Infraprojects has faced notable volatility, reaching a new 52-week low amid a downward trend and underperformance in its sector. Financial metrics reveal challenges, including declining net sales and operating profit. The company's return on capital employed remains low, indicating ongoing struggles despite broader market gains.

Read More

G R Infraprojects Faces Continued Volatility Amidst Declining Financial Performance

2025-03-13 09:51:26G R Infraprojects has faced notable volatility, reaching a new 52-week low and underperforming its sector. The company has reported negative financial results for three consecutive quarters, with declining net sales and low return on capital employed. Despite these challenges, it maintains strong management efficiency and significant institutional holdings.

Read MoreG R Infraprojects Faces Mixed Technical Trends Amid Market Evaluation Revision

2025-03-12 08:03:25G R Infraprojects, a midcap player in the capital goods sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 997.55, down from a previous close of 1010.50, with a notable 52-week high of 1,859.95 and a low of 965.05. Today's trading saw a high of 1,033.75 and a low of 986.15, indicating some volatility. The technical summary reveals a mixed picture. The MACD indicates bearish conditions on a weekly basis, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) shows bullish momentum weekly, but no significant signal on a monthly basis. Bollinger Bands and moving averages both reflect bearish trends, suggesting caution in the short term. In terms of performance, G R Infraprojects has faced challenges compared to the Sensex. Over the past week, the stock returned 2.41%, outperforming the Sensex's 1.52%. However...

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

05-Apr-2025 | Source : BSECertificate under Regulation 74(5) of SEBI (DP) Regulations 2018 for the quarter ended 31st March 2025.

Intimation Of Award Of Arbitration Proceedings.

03-Apr-2025 | Source : BSEIntimation of award of arbitration proceedings.

Intimation Of Sale And Transfer Of Wholly Owned Subsidiary.

29-Mar-2025 | Source : BSEIntimation of sale and transfer of Wholly Owned Subsidiary.

Corporate Actions

No Upcoming Board Meetings

G R Infraprojects Ltd has declared 250% dividend, ex-date: 13 Mar 25

No Splits history available

No Bonus history available

No Rights history available