Go Digit General Insurance Faces Technical Trend Challenges Amid Market Volatility

2025-04-02 08:10:52Go Digit General Insurance, a prominent player in the Finance/NBFC sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 288.60, slightly down from the previous close of 289.20. Over the past year, the stock has seen a high of 407.55 and a low of 276.80, indicating significant volatility. In terms of technical indicators, the weekly MACD and Bollinger Bands are showing bearish signals, while the daily moving averages also reflect a bearish stance. The Dow Theory presents a mixed picture, with a mildly bearish outlook on a weekly basis and a mildly bullish perspective on a monthly basis. The On-Balance Volume (OBV) shows no clear trend, suggesting a lack of strong buying or selling pressure. When comparing the company's performance to the Sensex, Go Digit has faced challenges. Over the past week, the stock returned -0.93%, while the S...

Read MoreGo Digit General Insurance Faces Technical Challenges Amid Market Volatility

2025-03-25 08:06:42Go Digit General Insurance, a prominent player in the Finance/NBFC sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 296.00, slightly down from the previous close of 297.80. Over the past year, the stock has seen a high of 407.55 and a low of 276.80, indicating significant volatility. In terms of technical indicators, the weekly MACD suggests a mildly bullish sentiment, while the monthly indicators present a more cautious outlook. The Bollinger Bands and moving averages indicate bearish trends, highlighting potential challenges in the stock's performance. The Dow Theory shows no clear trend on a weekly basis, but a bearish stance on a monthly scale. When comparing the company's returns to the Sensex, Go Digit has faced notable headwinds. Over the past week, the stock has returned -1.82%, while the Sensex has gained 5.14%. Similar...

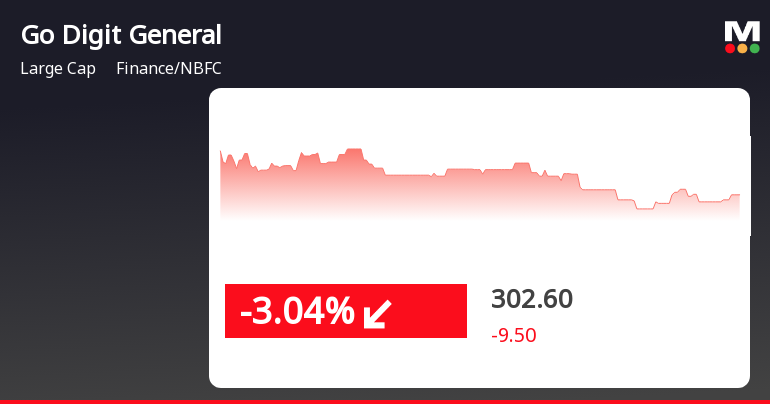

Read MoreGo Digit General Insurance Faces Mixed Technical Signals Amid Market Volatility

2025-03-18 08:04:54Go Digit General Insurance, a prominent player in the Finance/NBFC sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 301.50, showing a notable increase from the previous close of 291.60. Over the past year, the stock has experienced a 52-week high of 407.55 and a low of 276.80, indicating significant volatility. In terms of technical indicators, the weekly MACD suggests a mildly bullish sentiment, while the moving averages and Bollinger Bands indicate a mildly bearish outlook. The KST and Dow Theory present mixed signals, with the former showing bearish tendencies and the latter reflecting a mildly bullish stance. The RSI remains neutral, indicating a lack of strong momentum in either direction. When comparing the stock's performance to the Sensex, Go Digit has faced challenges. Over the past week, the stock returned -3.4%, while...

Read More

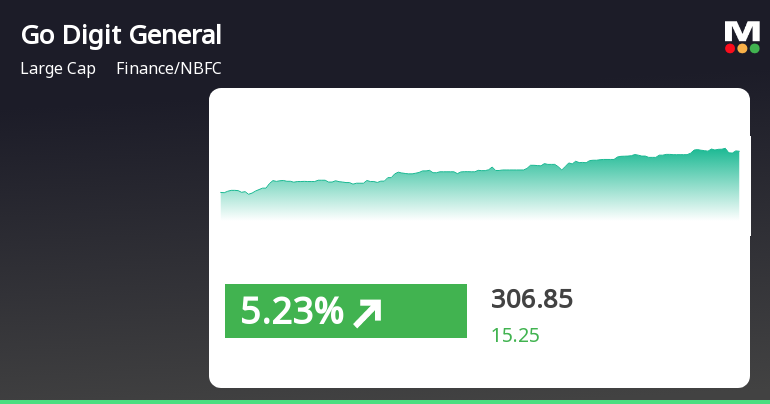

Go Digit General Insurance Shows Short-Term Gains Amid Long-Term Underperformance Concerns

2025-03-17 11:05:27Go Digit General Insurance experienced significant activity, gaining 3.74% on March 17, 2025, and outperforming its sector. Despite this uptick, the stock remains below key moving averages, indicating potential long-term underperformance. Meanwhile, the broader market saw the Sensex rise, although it also trades below its 50-day moving average.

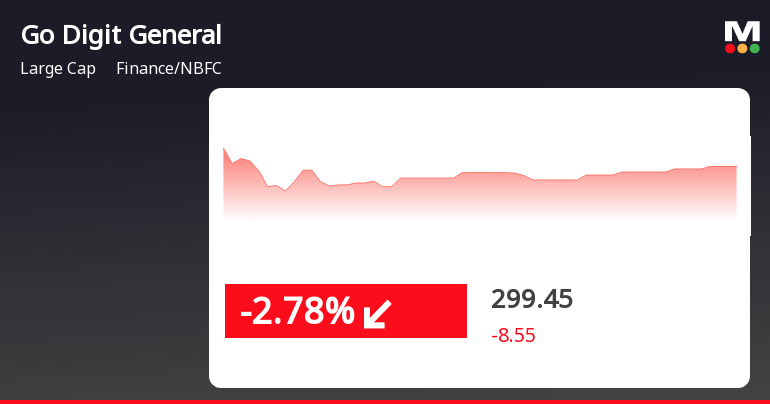

Read MoreGo Digit General Insurance Faces Bearish Technical Trends Amid Market Volatility

2025-03-17 08:01:41Go Digit General Insurance, a prominent player in the Finance/NBFC sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 291.60, down from a previous close of 308.00, with a notable 52-week high of 407.55 and a low of 276.80. Today's trading saw a high of 305.50 and a low of 291.45, indicating some volatility. The technical summary for Go Digit reveals a bearish sentiment across various indicators. The MACD shows a bearish trend on a weekly basis, while the Bollinger Bands also reflect a bearish outlook. Daily moving averages further support this sentiment. The Dow Theory indicates no trend on a weekly basis, but a bearish stance on a monthly scale. In terms of performance, Go Digit's stock return over the past week has been -4.19%, compared to a -0.69% return for the Sensex. Over the past month, the stock has returned -2.02%, while ...

Read More

Go Digit General Insurance Faces Continued Challenges Amid Broader Market Gains

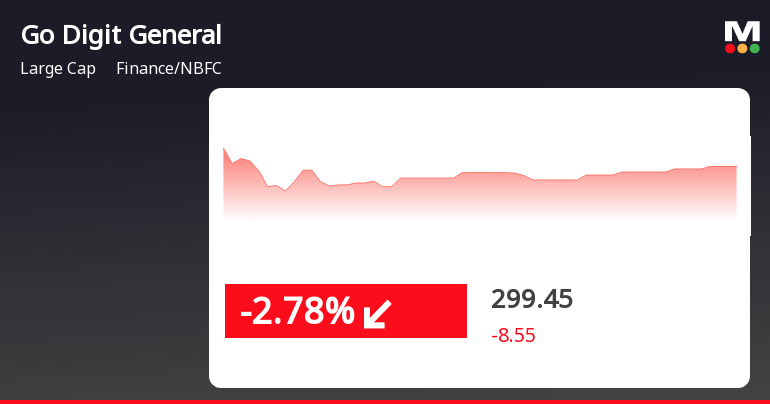

2025-03-13 09:35:24Go Digit General Insurance saw a significant decline on March 13, 2025, underperforming against the broader market. The stock is trading below all major moving averages, indicating a bearish trend. Year-to-date, it has performed worse than the Sensex, reflecting ongoing challenges in the finance and NBFC sector.

Read More

Go Digit General Insurance Faces Continued Challenges Amid Broader Market Gains

2025-03-13 09:35:24Go Digit General Insurance saw a significant decline on March 13, 2025, underperforming against the broader market. The stock is trading below all major moving averages, indicating a bearish trend. Year-to-date, it has performed worse than the Sensex, reflecting ongoing challenges in the finance and NBFC sector.

Read More

Go Digit General Insurance Faces Ongoing Challenges Amid Broader Market Decline

2025-03-11 11:50:27Go Digit General Insurance's stock has declined for two consecutive days, reflecting ongoing challenges in the market. Currently positioned above its 20-day moving average but below other key averages, the stock's performance contrasts with the broader market, which is experiencing bearish sentiment, while the BSE Mid Cap index shows slight resilience.

Read More

Go Digit General Insurance Faces Mixed Performance Amid Broader Market Trends

2025-03-10 10:05:29Go Digit General Insurance saw a decline on March 10, 2025, following two days of gains, underperforming its sector. The stock remains above several short-term moving averages but below longer-term ones. Despite a recent weekly increase, it has struggled over the past three months and year-to-date.

Read MoreAnnouncement under Regulation 30 (LODR)-Change in Management

28-Mar-2025 | Source : BSEChange in Management as per the attached disclosure

Closure of Trading Window

26-Mar-2025 | Source : BSEClosure of Trading Window from 1st April 2025

Announcement under Regulation 30 (LODR)-Analyst / Investor Meet - Intimation

10-Mar-2025 | Source : BSESchedule of Analyst meet and presentation thereto as per the attached intimation

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available