Godawari Power & Ispat Shows Mixed Technical Trends Amid Market Evaluation Changes

2025-04-03 08:04:36Godawari Power & Ispat, a midcap player in the Steel/Sponge Iron/Pig Iron industry, has recently undergone an evaluation revision reflecting its current market dynamics. The company's stock price has shown notable fluctuations, currently standing at 201.80, with a previous close of 189.95. Over the past year, Godawari Power has achieved a return of 34.46%, significantly outperforming the Sensex, which recorded a return of 3.67% in the same period. In terms of technical indicators, the weekly MACD suggests a mildly bullish sentiment, while the monthly perspective leans mildly bearish. The Bollinger Bands indicate a bullish trend on both weekly and monthly charts, suggesting potential volatility. The daily moving averages, however, reflect a mildly bearish stance, indicating mixed signals in the short term. The company's performance over various time frames highlights its resilience, particularly over the l...

Read More

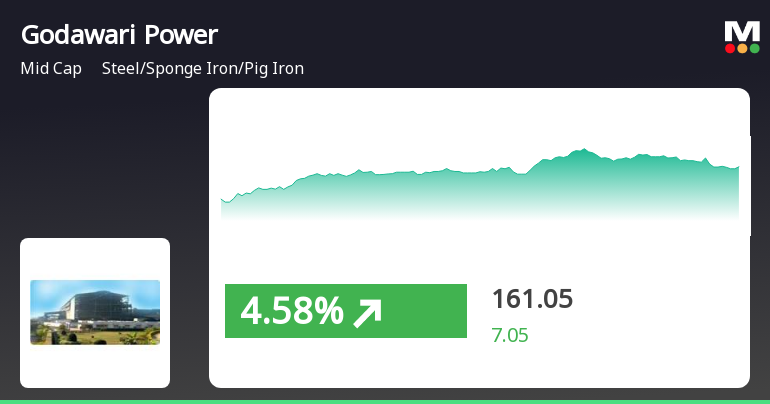

Godawari Power & Ispat Shows Strong Performance Amid Broader Market Gains

2025-04-02 14:35:20Godawari Power & Ispat has demonstrated strong performance, gaining 5.5% on April 2, 2025, and achieving consecutive gains over two days with a total return of 11.19%. The stock is trading above key moving averages and has significantly outperformed the Sensex over the past year.

Read More

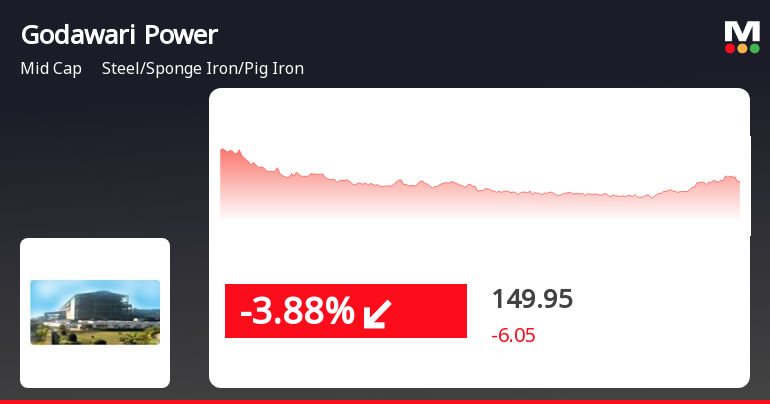

Godawari Power & Ispat Outperforms Market Amid Broader Decline, Shows Strong Long-Term Growth

2025-04-01 15:35:22Godawari Power & Ispat has experienced notable trading activity, with significant gains today, contrasting with a broader market decline. The stock has consistently performed well against various moving averages and has shown impressive growth over the past year and five years, despite a year-to-date decrease.

Read MoreGodawari Power & Ispat Shows Mixed Technical Trends Amid Strong Long-Term Performance

2025-03-20 08:02:26Godawari Power & Ispat, a midcap player in the Steel/Sponge Iron/Pig Iron industry, has recently undergone an evaluation revision reflecting its current market dynamics. The company's stock is currently priced at 181.30, showing a slight increase from the previous close of 178.00. Over the past year, Godawari Power has demonstrated a robust performance with a return of 36.18%, significantly outperforming the Sensex, which recorded a return of 4.77% in the same period. In terms of technical indicators, the weekly MACD remains bearish, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) shows no signal for both weekly and monthly assessments. Bollinger Bands indicate a mildly bearish trend on a weekly basis, contrasting with a bullish monthly perspective. Moving averages also reflect a mildly bearish sentiment, while the On-Balance Volume (OBV) suggests a mildly bullish trend on a ...

Read More

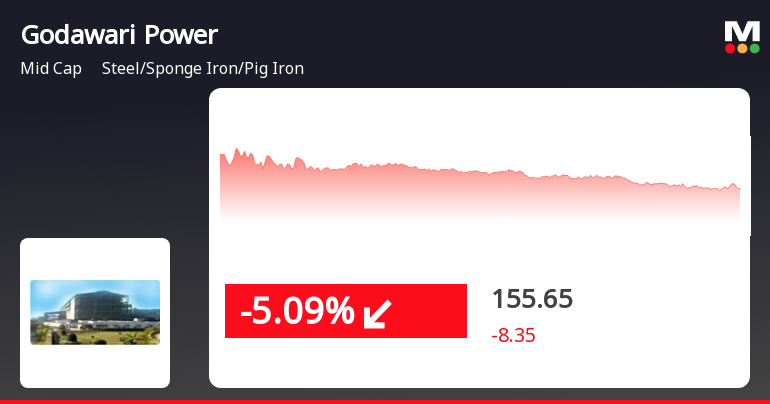

Godawari Power & Ispat Faces Market Challenges Amidst Declining Stock Performance

2025-03-12 12:50:18Godawari Power & Ispat has faced a significant decline, underperforming its sector and experiencing a two-day losing streak. The stock is trading below key moving averages, reflecting a bearish trend. Year-to-date, it has decreased notably, contrasting with the broader market's performance.

Read More

Godawari Power & Ispat Shows Strong Short-Term Gains Amid Mixed Long-Term Performance

2025-03-06 12:05:18Godawari Power & Ispat has experienced notable activity, achieving consecutive gains over three days and outperforming its sector. The stock opened higher and reached an intraday peak, while its performance relative to moving averages indicates mixed results. The broader market also showed positive trends, particularly in the small-cap segment.

Read More

Godawari Power & Ispat Shows Strong Short-Term Gains Amid Broader Market Trends

2025-03-05 10:55:24Godawari Power & Ispat has experienced notable trading activity, outperforming its sector and achieving a cumulative return over two days. The stock is currently positioned above its 5-day moving average but below longer-term averages. Meanwhile, the broader market shows a modest rise, with small-cap stocks leading gains.

Read More

Godawari Power & Ispat Faces Significant Stock Decline Amid Market Volatility

2025-03-03 11:15:37Godawari Power & Ispat's stock has faced significant declines, dropping 5.61% today and 14.31% over the past five days. The stock has shown high volatility, trading below key moving averages, and its performance contrasts with the broader market, which has experienced milder fluctuations.

Read More

Godawari Power & Ispat Faces Continued Decline Amid Broader Market Challenges

2025-02-28 13:20:18Godawari Power & Ispat's shares fell significantly today, marking a fourth consecutive day of decline. The stock underperformed its sector and is trading below key moving averages, reflecting ongoing bearish trends. Over the past month, the company has faced notable challenges, with a decline greater than the broader market.

Read MoreAnnouncement under Regulation 30 (LODR)-Analyst / Investor Meet - Intimation

01-Apr-2025 | Source : BSEPlease find attached intimation regarding investor meet scheduled to be held on 04.04.2025.

Suspension Of Mining Operations At CompanyS Boria Tibu Iron Ore Mines At Village: Boria Tibu Dist: Rajnandgaon Chhattisgarh.

01-Apr-2025 | Source : BSEPlease find attached disclosure regarding suspension of Mining operations at Boria Tibu Mines.

Disclosure Under Regulation 30 Of SEBI (Listing Obligations And Disclosure Requirements) Regulations 2015 As Amended (SEBI Listing Regulations) Regarding Dilution Of CompanyS Stake In Jammu Pigments Limited

29-Mar-2025 | Source : BSEPlease find attached herewith the disclosure regarding dilution of stake in Jammu Pigments Limited.

Corporate Actions

No Upcoming Board Meetings

Godawari Power & Ispat Ltd has declared 100% dividend, ex-date: 16 Aug 24

Godawari Power & Ispat Ltd has announced 1:5 stock split, ex-date: 04 Oct 24

Godawari Power & Ispat Ltd has announced 1:1 bonus issue, ex-date: 26 Oct 21

No Rights history available