Grasim Industries Demonstrates Strong Performance Amidst Cement Sector Trends

2025-04-03 12:35:27Grasim Industries, a prominent player in the cement industry, has shown notable activity today, trading in line with sector performance. The stock is currently positioned above its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, indicating a strong upward trend in its recent performance. With a market capitalization of Rs 1,80,776.09 crore, Grasim Industries boasts a price-to-earnings (P/E) ratio of 41.54, which is slightly below the industry average of 44.26. Over the past year, the stock has delivered a robust return of 15.24%, significantly outperforming the Sensex, which has risen by only 3.33% during the same period. In terms of shorter-term performance, Grasim has gained 1.61% today, while the Sensex has dipped by 0.36%. The stock has also shown resilience over the past month, climbing 11.57% compared to the Sensex's 4.45% increase. Over the last three years, Grasim Industries has achie...

Read MoreGrasim Industries Adjusts Evaluation Amid Mixed Technical Indicators and Strong Market Resilience

2025-04-02 08:06:02Grasim Industries, a prominent player in the cement industry, has recently undergone an evaluation revision reflecting shifts in its technical indicators. The company's current stock price stands at 2,615.00, slightly above the previous close of 2,600.55. Over the past year, Grasim has demonstrated resilience, achieving a return of 14.14%, significantly outperforming the Sensex, which recorded a return of 2.72% in the same period. In terms of technical metrics, the weekly MACD indicates a mildly bullish trend, while the monthly perspective shows a mildly bearish stance. The Bollinger Bands suggest bullish conditions on both weekly and monthly charts, indicating potential price stability. However, moving averages on a daily basis reflect a mildly bearish outlook, which may influence short-term trading strategies. Grasim's performance over various time frames highlights its strong market position, with a re...

Read MoreGrasim Industries Shows Strong Performance Amid Cement Sector Stability and Market Trends

2025-03-28 09:20:46Grasim Industries, a prominent player in the cement industry, has shown notable activity today, maintaining performance in line with the sector. The stock has experienced a consecutive gain over the past six days, accumulating a total return of 6.4% during this period. Today, Grasim opened at Rs 2606.05 and has traded consistently at this price point. In terms of moving averages, Grasim Industries is currently trading above its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, indicating a strong upward trend. The company boasts a market capitalization of Rs 1,78,469.88 crore, categorizing it as a large-cap stock. Its price-to-earnings (P/E) ratio stands at 41.28, which is lower than the industry average of 50.94. Over the past year, Grasim Industries has delivered a performance of 14.61%, significantly outperforming the Sensex, which recorded a gain of 5.31%. In the short term, the stock has a...

Read MoreGrasim Industries Faces Sector Challenges Amidst Strong Long-Term Performance Metrics

2025-03-27 09:20:20Grasim Industries, a prominent player in the cement industry, has experienced notable activity today, underperforming its sector by 0.97%. After a streak of four consecutive days of gains, the stock has seen a reversal, maintaining a steady trading price of 2576.05. With a market capitalization of Rs 1,75,719.81 crore, Grasim Industries holds a price-to-earnings (P/E) ratio of 41.01, which is below the industry average of 49.89. This performance comes amid a challenging environment for the cement sector, where out of 37 stocks that have declared results, only one has reported positive outcomes, while 32 have shown negative results. In terms of performance metrics, Grasim Industries has demonstrated resilience over the past year, with a 17.06% increase, significantly outperforming the Sensex, which has risen by 5.76%. The stock has also shown strong performance over various time frames, including a 462.62...

Read MoreGrasim Industries Shows High Volatility Amid Mixed Short-Term Outlook in Cement Sector

2025-03-26 09:25:50Grasim Industries, a prominent player in the cement industry with a market capitalization of Rs 1,75,018.96 crore, has experienced notable activity today. The stock's performance has been in line with the sector, although it has seen a trend reversal after three consecutive days of gains. Today, Grasim Industries exhibited high volatility, with an intraday volatility rate of 256.36%, indicating significant price fluctuations. In terms of moving averages, the stock is currently positioned higher than its 5-day, 20-day, 50-day, and 100-day moving averages, yet remains below its 200-day moving average. This could suggest a mixed short-term outlook. Over the past year, Grasim Industries has delivered a return of 14.84%, outperforming the Sensex, which recorded a gain of 7.78%. The stock has also shown resilience over various time frames, including a 5-year performance of 447.66%, significantly surpassing the ...

Read MoreSurge in Open Interest Signals Increased Trading Activity for Grasim Industries

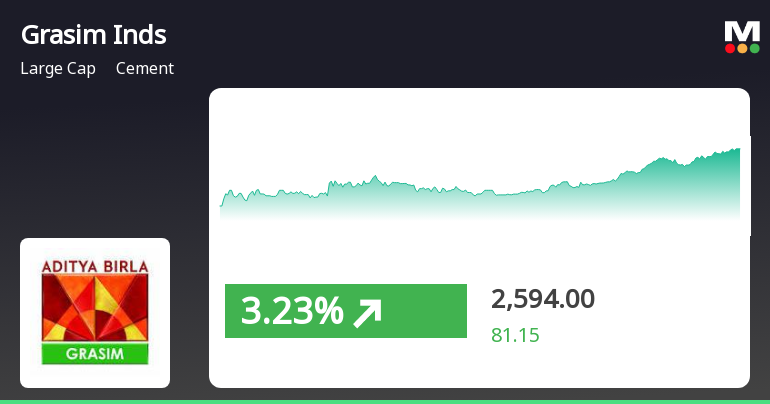

2025-03-25 15:00:42Grasim Industries Ltd, a prominent player in the cement industry, has experienced a significant increase in open interest today. The latest open interest stands at 77,098 contracts, marking a notable rise of 16,104 contracts or 26.4% from the previous open interest of 60,994. This surge coincides with a trading volume of 92,045 contracts, reflecting robust activity in the derivatives market. In terms of price performance, Grasim Industries has outperformed its sector by 0.57%, with the stock gaining 8.71% over the past week. Today, it reached an intraday high of Rs 2,595.90, representing a 3.29% increase. The stock is currently trading above its 5-day, 20-day, 50-day, and 100-day moving averages, although it remains below the 200-day moving average. Despite the positive price movement, there has been a decline in investor participation, with delivery volume dropping by 35.82% compared to the 5-day average...

Read MoreSurge in Open Interest Signals Dynamic Trading Environment for Grasim Industries

2025-03-25 14:00:29Grasim Industries Ltd, a prominent player in the cement industry, has experienced a significant increase in open interest today. The latest open interest stands at 76,062 contracts, marking a notable rise of 15,068 contracts or 24.7% from the previous open interest of 60,994. This surge in open interest coincides with a trading volume of 74,719 contracts, reflecting robust activity in the market. In terms of performance, Grasim Industries has outperformed its sector by 0.91%, continuing a positive trend with seven consecutive days of gains, resulting in a total return of 9.22% over this period. The stock reached an intraday high of Rs 2,591.55, representing a 3.12% increase for the day. Despite this upward momentum, the stock's delivery volume has seen a decline of 35.82% compared to the five-day average, with a current delivery volume of 2.89 lakh shares. Grasim Industries maintains a market capitalizat...

Read More

Grasim Industries Shows Strong Market Position Amid Broader Sensex Gains

2025-03-25 13:45:22Grasim Industries has shown strong performance in the cement sector, gaining 3.14% on March 25, 2025, and outperforming its sector. The stock has consistently risen over three days, reaching an intraday high and trading above key moving averages, while also reflecting a notable one-year increase compared to the broader market.

Read MoreGrasim Industries Sees Surge in Open Interest Amid Active Market Participation

2025-03-25 13:00:20Grasim Industries Ltd, a prominent player in the cement industry, has experienced a significant increase in open interest today. The latest open interest stands at 69,412 contracts, reflecting a rise of 8,418 contracts or 13.8% from the previous open interest of 60,994. This uptick coincides with a trading volume of 44,336 contracts, indicating active market participation. In terms of performance, Grasim Industries has shown resilience, gaining 7.6% over the past week, despite underperforming its sector by 0.62% today. The stock's price summary reveals that it is currently above its 5-day, 20-day, 50-day, and 100-day moving averages, although it remains below the 200-day moving average. The cement sector overall has seen a gain of 2.18% today. Additionally, the stock's liquidity remains robust, with a delivery volume of 2.89 lakh shares, although this represents a decline of 35.82% compared to the 5-day a...

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

09-Apr-2025 | Source : BSECertificate under Regulation 74(5) of the SEBI (Depositories and Participants) Regulations 2018 for the quarter ended 31st March 2025

Compliances-Half Yearly Report (SEBI Circular No. CIR/IMD/DF-1/67/2017)

07-Apr-2025 | Source : BSESpecification related to ISIN for debt securities for the period 1st October 2024 to 31st March 2025

Compliances-Reg. 57 (1) - Certificate of interest payment/Principal in case of NCD

07-Apr-2025 | Source : BSEGrasim Industries Limited has informed the Exchange regarding the confirmation of payment of interest

Corporate Actions

No Upcoming Board Meetings

Grasim Industries Ltd has declared 500% dividend, ex-date: 06 Aug 24

Grasim Industries Ltd has announced 2:10 stock split, ex-date: 06 Oct 16

No Bonus history available

Grasim Industries Ltd has announced 6:179 rights issue, ex-date: 10 Jan 24