Grauer & Weil Adjusts Valuation Grade Amid Competitive Chemicals Sector Dynamics

2025-03-19 08:00:11Grauer & Weil (India), a small-cap player in the chemicals industry, has recently undergone a valuation adjustment. The company's current price stands at 90.62, slightly down from the previous close of 90.72. Over the past year, Grauer & Weil has shown a stock return of 12.71%, outperforming the Sensex, which recorded a return of 3.51% during the same period. Key financial metrics for Grauer & Weil include a PE ratio of 25.58 and an EV to EBITDA ratio of 18.12, indicating its market positioning within the sector. The company also boasts a robust return on capital employed (ROCE) of 51.02% and a return on equity (ROE) of 18.43%. In comparison to its peers, Grauer & Weil's valuation metrics reflect a more favorable position relative to companies like Neogen Chemicals and Fischer Medical, which are categorized at higher valuation levels. Meanwhile, firms such as Balaji Amines and India Glycols present a co...

Read MoreGrauer & Weil Adjusts Valuation Grade Amidst Competitive Chemicals Sector Landscape

2025-03-13 08:00:14Grauer & Weil (India), a small-cap player in the chemicals industry, has recently undergone a valuation adjustment. The company's current price stands at 88.59, reflecting a decline from the previous close of 91.15. Over the past year, Grauer & Weil has shown a stock return of 6.73%, outperforming the Sensex, which recorded a modest 0.49% return in the same period. Key financial metrics for Grauer & Weil include a PE ratio of 25.01 and an EV to EBITDA ratio of 17.65, indicating its market positioning within the sector. The company boasts a robust return on capital employed (ROCE) of 51.02% and a return on equity (ROE) of 18.43%, showcasing its operational efficiency and profitability. In comparison to its peers, Grauer & Weil's valuation metrics present a mixed picture. While it operates at a lower PE ratio than Neogen Chemicals, which is positioned at a significantly higher valuation, it also stands out...

Read MoreGrauer & Weil Adjusts Valuation Grade Amidst Competitive Chemicals Sector Landscape

2025-03-13 08:00:14Grauer & Weil (India), a small-cap player in the chemicals industry, has recently undergone a valuation adjustment. The company's current price stands at 88.59, reflecting a decline from the previous close of 91.15. Over the past year, Grauer & Weil has shown a stock return of 6.73%, outperforming the Sensex, which recorded a modest 0.49% return in the same period. Key financial metrics for Grauer & Weil include a PE ratio of 25.01 and an EV to EBITDA ratio of 17.65, indicating its market positioning within the sector. The company boasts a robust return on capital employed (ROCE) of 51.02% and a return on equity (ROE) of 18.43%, showcasing its operational efficiency and profitability. In comparison to its peers, Grauer & Weil's valuation metrics present a mixed picture. While it operates at a lower PE ratio than Neogen Chemicals, which is positioned at a significantly higher valuation, it also stands out...

Read MoreGrauer & Weil Adjusts Valuation Grade Amidst Competitive Chemicals Sector Landscape

2025-03-02 08:00:06Grauer & Weil (India), a small-cap player in the chemicals industry, has recently undergone a valuation adjustment. The company currently exhibits a price-to-earnings (PE) ratio of 24.33 and a price-to-book value of 4.49, indicating its market valuation relative to its earnings and assets. Other key metrics include an EV to EBITDA ratio of 17.11 and a return on capital employed (ROCE) of 51.02%, showcasing its operational efficiency. In comparison to its peers, Grauer & Weil's valuation metrics position it distinctly within the chemicals sector. For instance, Fischer Medical and Neogen Chemicals are noted for their significantly higher PE ratios, while Balaji Amines and Nocil present competitive valuations. The company's dividend yield stands at 0.58%, reflecting its approach to shareholder returns. Despite recent stock performance showing a decline over various periods, including a year-to-date drop of 1...

Read MoreGrauer & Weil's Stock Shows Resilience Amid Broader Market Decline and Mixed Performance Trends

2025-02-28 10:24:52Grauer & Weil (India) Ltd, a small-cap player in the chemicals industry, has shown notable activity in today's trading session, with a 1.38% increase in its stock price, contrasting with a decline in the broader Sensex, which fell by 1.17%. Despite this daily uptick, the company's one-year performance remains negative at -5.50%, underperforming the Sensex, which has gained 1.99% over the same period. The company's market capitalization stands at Rs 3,990.02 crore, with a price-to-earnings (P/E) ratio of 25.13, significantly lower than the industry average of 42.06. Over the past three years, Grauer & Weil has demonstrated impressive growth, with a return of 222.94%, far exceeding the Sensex's 31.10% increase. However, the stock has faced challenges recently, with a year-to-date decline of 15.14% compared to the Sensex's drop of 5.63%. Technical indicators suggest a bearish trend in the short term, with mo...

Read MoreGrauer & Weil Faces Technical Trend Shifts Amid Market Volatility and Performance Lag

2025-02-28 08:01:05Grauer & Weil (India), a small-cap player in the chemicals industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 86.80, showing a notable increase from the previous close of 84.18. Over the past year, the stock has experienced a high of 120.00 and a low of 72.16, indicating significant volatility. The technical summary reveals a bearish sentiment in the weekly MACD and moving averages, while the monthly indicators show a mildly bearish trend. The Bollinger Bands present a mixed picture, with a bearish outlook on the weekly scale and a mildly bullish stance monthly. The KST and Dow Theory also reflect bearish tendencies on a weekly basis, contributing to the overall evaluation adjustment. In terms of performance, Grauer & Weil's stock return has lagged behind the Sensex across various time frames. Over the past week, the stock retur...

Read More

Grauer & Weil Faces Continued Stock Volatility Amid Broader Market Challenges

2025-02-24 15:45:16Grauer & Weil (India), a small-cap chemicals company, has faced notable stock volatility, declining for two consecutive days and accumulating a significant loss. The stock is trading below multiple moving averages and has decreased by over 15% in the past month, underperforming compared to the broader market.

Read MoreGrauer & Weil Adjusts Valuation Grade Amid Competitive Chemicals Sector Landscape

2025-02-24 12:56:42Grauer & Weil (India), a small-cap player in the chemicals industry, has recently undergone a valuation adjustment. The company's current price stands at 87.52, reflecting a decline from its previous close of 89.90. Over the past year, Grauer & Weil has experienced a stock return of -9.98%, contrasting with a modest gain of 1.92% in the Sensex. Key financial metrics reveal a PE ratio of 25.38 and an EV to EBITDA of 17.95, indicating a competitive position within its sector. The company's return on capital employed (ROCE) is notably high at 51.02%, while the return on equity (ROE) is recorded at 18.43%. These figures suggest a robust operational efficiency relative to its peers. In comparison to other companies in the chemicals sector, Grauer & Weil's valuation metrics appear more favorable than some, such as Neogen Chemicals, which has a significantly higher PE ratio. However, it is positioned alongside p...

Read More

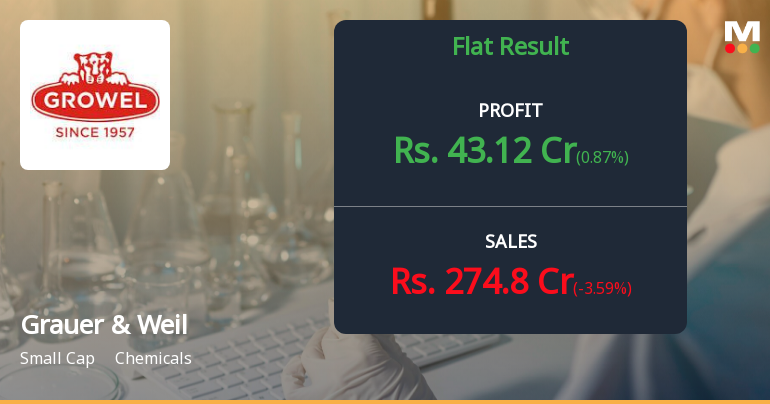

Grauer & Weil Reports Flat Q3 FY24-25 Results Amid Mixed Financial Indicators

2025-02-07 10:04:52Grauer & Weil (India) has reported its financial results for Q3 FY24-25, showing a flat performance. The company achieved its highest cash and cash equivalents in recent periods, totaling Rs 458.81 crore, while facing challenges with a decline in profit before tax, recorded at Rs 46.08 crore.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

09-Apr-2025 | Source : BSECertificate under regulation 74 (5) SEBI (DP) Regulation 2018 for quarter ended 31st March 2025

Announcement under Regulation 30 (LODR)-Credit Rating

02-Apr-2025 | Source : BSEUpdates on Press Release of CARE Rating Ltd.

Intimation Of Notice Received From Income Tax Department

02-Apr-2025 | Source : BSEIntimation of Notice received u/s 148A(1) of Income Tax Act 1961

Corporate Actions

No Upcoming Board Meetings

Grauer & Weil (India) Ltd has declared 50% dividend, ex-date: 20 Sep 24

Grauer & Weil (India) Ltd has announced 1:10 stock split, ex-date: 11 Aug 11

Grauer & Weil (India) Ltd has announced 1:1 bonus issue, ex-date: 10 Apr 24

No Rights history available