Greenlam Industries Adjusts Valuation Grade Amidst Competitive Market Landscape

2025-04-01 08:00:34Greenlam Industries has recently undergone a valuation adjustment, reflecting its current financial standing within the miscellaneous industry. The company exhibits a price-to-earnings (PE) ratio of 55.45 and a price-to-book value of 5.41, indicating a premium valuation relative to its book value. Its enterprise value to EBITDA stands at 24.35, while the EV to EBIT ratio is recorded at 38.22, suggesting a robust operational performance. In terms of returns, Greenlam Industries has faced challenges over the past year, with a stock return of -5.81%, contrasting with a positive return of 5.11% for the Sensex. However, the company has shown significant growth over a five-year period, boasting a return of 404.81%, which outpaces the Sensex's 159.65% during the same timeframe. When compared to its peers, Greenlam Industries maintains a more attractive valuation profile, particularly in relation to companies lik...

Read MoreGreenlam Industries Adjusts Valuation Grade Amid Competitive Market Landscape

2025-03-26 08:00:42Greenlam Industries has recently undergone a valuation adjustment, reflecting its current market position within the miscellaneous industry. The company's price-to-earnings ratio stands at 58.09, while its price-to-book value is noted at 5.67. Additionally, the enterprise value to EBITDA ratio is recorded at 25.33, indicating a robust valuation framework. In terms of performance metrics, Greenlam Industries has a return on capital employed (ROCE) of 8.88% and a return on equity (ROE) of 10.89%. The dividend yield is relatively modest at 0.33%. These figures suggest a stable operational performance, although the stock has faced some challenges recently, with a year-to-date return of -14.42%, contrasting with a slight decline in the broader Sensex index. When compared to its peers, Greenlam Industries presents a more favorable valuation profile. Competitors such as Cams Services and Brookfield India are cat...

Read More

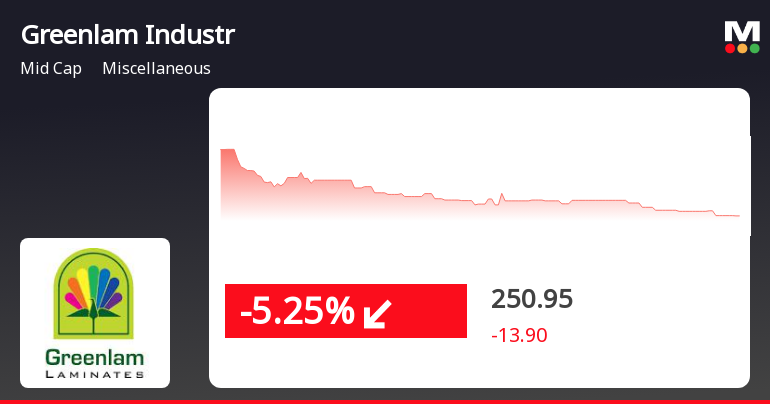

Greenlam Industries Faces Significant Share Decline Amid Broader Market Fluctuations

2025-03-25 11:45:38Greenlam Industries' shares have declined significantly today, marking a 5.23% drop. The company has faced consecutive losses over the past three days, totaling 15.22%. Year-to-date, the stock is down 13.10%, while the broader Sensex has shown a 7.01% increase over the last year.

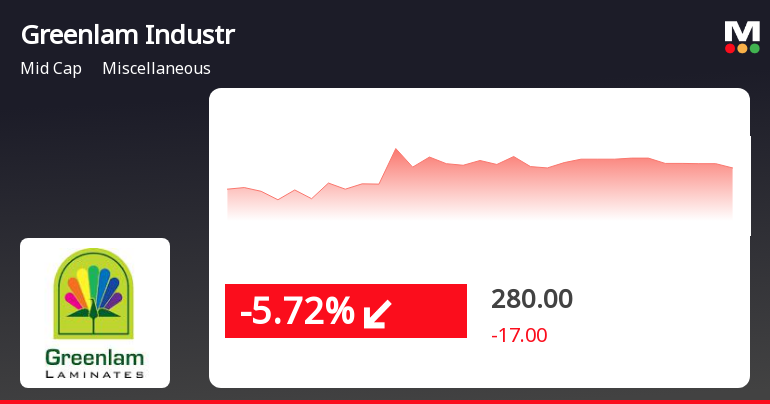

Read MoreGreenlam Industries Faces Bearish Technical Trends Amid Market Volatility

2025-03-25 08:05:08Greenlam Industries, a midcap player in the miscellaneous sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 264.85, down from a previous close of 274.85, with a notable 52-week high of 330.83 and a low of 218.25. Today's trading saw a high of 279.95 and a low of 264.85, indicating some volatility. The technical summary reveals a bearish sentiment in various indicators. The MACD shows a bearish trend on a weekly basis, while the monthly perspective is mildly bearish. Similarly, Bollinger Bands and KST also reflect bearish tendencies, with moving averages indicating a bearish outlook on a daily basis. The On-Balance Volume (OBV) presents a mixed picture, showing no trend weekly but mildly bullish on a monthly scale. In terms of performance, Greenlam Industries has demonstrated resilience compared to the Sensex. Over the past week, ...

Read More

Greenlam Industries Faces Potential Trend Reversal Amidst Recent Market Volatility

2025-03-21 09:35:27Greenlam Industries saw a notable decline on March 21, 2025, following a five-day gain streak. Despite this downturn, the stock has shown strong long-term performance, significantly outperforming the Sensex over the past five years. Currently, it trades below key moving averages, suggesting short-term challenges.

Read More

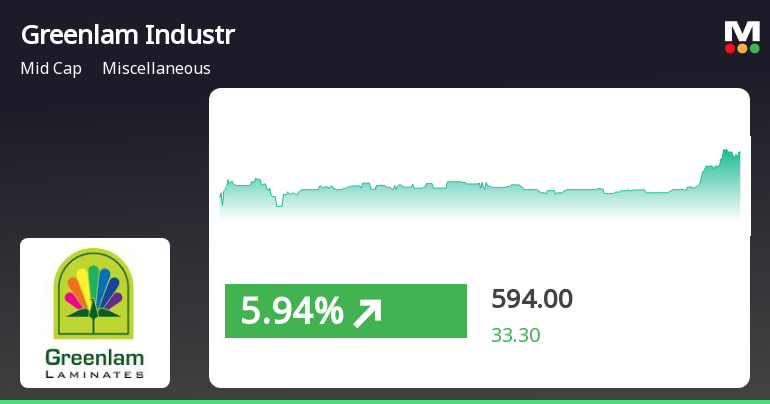

Greenlam Industries Shows Strong Momentum with Consecutive Gains and Outperformance in Market

2025-03-20 15:30:53Greenlam Industries has experienced notable gains, outperforming its sector and achieving a significant return over the past five days. The stock has consistently traded above multiple moving averages, indicating strong momentum. In the broader market, the Sensex has also risen, reflecting positive market conditions.

Read MoreGreenlam Industries Experiences Technical Trend Adjustments Amid Mixed Market Indicators

2025-03-19 08:04:12Greenlam Industries, a midcap player in the miscellaneous sector, has recently undergone a technical trend adjustment. This revision reflects the company's current market position and performance indicators, which are essential for understanding its trajectory in the competitive landscape. The technical summary indicates a mixed outlook across various metrics. The MACD shows bearish tendencies on a weekly basis while leaning mildly bearish on a monthly scale. The Relative Strength Index (RSI) remains neutral, indicating no significant momentum in either direction. Bollinger Bands present a mildly bearish stance weekly, contrasting with a bullish outlook monthly. Daily moving averages also suggest a mildly bearish trend, while the KST reflects bearish conditions weekly and mildly bearish monthly. Notably, the Dow Theory indicates a mildly bullish trend on a weekly basis, although it shifts to mildly bearish...

Read More

Greenlam Industries Shows Resilience Amid Broader Market Gains and Mixed Trends

2025-03-18 11:45:28Greenlam Industries has experienced significant activity, achieving its third consecutive day of gains and outperforming its sector. The stock is currently positioned above its short-term moving averages but below longer-term ones, indicating a mixed performance trend. Over the past year, it has notably outperformed the Sensex.

Read MoreGreenlam Industries Adjusts Valuation Amid Competitive Market Dynamics and Peer Comparisons

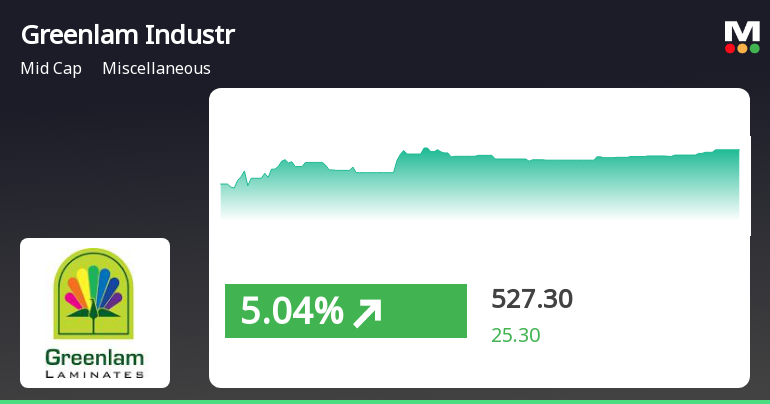

2025-03-18 08:00:54Greenlam Industries, a midcap player in the miscellaneous sector, has recently undergone a valuation adjustment. The company's current price stands at 502.00, reflecting a notable shift from its previous close of 470.00. Over the past year, Greenlam has shown a return of 8.60%, outperforming the Sensex, which recorded a return of 2.10% in the same period. Key financial metrics for Greenlam include a PE ratio of 58.99 and an EV to EBITDA ratio of 25.67, indicating its market positioning relative to its peers. The company's return on equity (ROE) is reported at 10.89%, while its return on capital employed (ROCE) is at 8.88%. In comparison to its peers, Greenlam Industries presents a more favorable valuation profile, especially when contrasted with companies like Sagility India and Brookfield India, which are positioned at significantly higher valuation metrics. This evaluation revision reflects the ongoin...

Read MoreAnnouncement under Regulation 30 (LODR)-Allotment

24-Mar-2025 | Source : BSEPlease find attached intimation regarding Allotment of Bonus Share.

Announcement under Regulation 30 (LODR)-Newspaper Publication

12-Mar-2025 | Source : BSEPlease find enclosed Newspaper clippings for fixation of Record Date for issue of Bonus Shares

Intimation Of Record Date For Bonus Issue

11-Mar-2025 | Source : BSEPlease find attached herewith intimation of record date for Bonus Issue

Corporate Actions

No Upcoming Board Meetings

Greenlam Industries Ltd has declared 165% dividend, ex-date: 21 Jun 24

Greenlam Industries Ltd has announced 1:5 stock split, ex-date: 10 Feb 22

Greenlam Industries Ltd has announced 1:1 bonus issue, ex-date: 21 Mar 25

No Rights history available