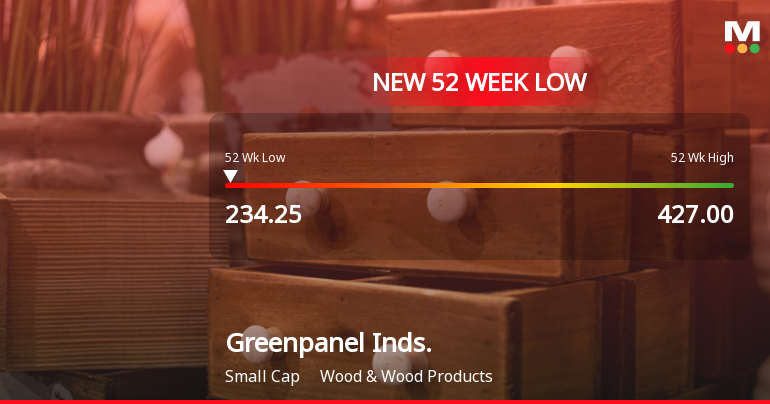

Greenpanel Industries Faces Continued Volatility Amid Declining Sales and Profit Trends

2025-03-17 09:55:27Greenpanel Industries has faced notable volatility, reaching a new 52-week low and declining for five consecutive days. The company has underperformed the market over the past year, with declining net sales and profits. However, it maintains a low debt-to-EBITDA ratio and stable institutional interest.

Read More

Greenpanel Industries Faces Continued Volatility Amid Declining Sales and Performance Concerns

2025-03-17 09:55:26Greenpanel Industries has faced significant volatility, reaching a new 52-week low and declining for five consecutive days. The company has reported a drop in net sales and negative results for seven quarters, raising concerns about its financial health. However, it maintains a low debt-to-EBITDA ratio and fair valuation.

Read More

Greenpanel Industries Faces Continued Decline Amidst Financial Health Concerns and Volatility

2025-03-17 09:55:25Greenpanel Industries has faced significant volatility, reaching a new 52-week low and experiencing a notable decline over the past year. The company reported a decrease in net sales and has struggled with negative results for seven consecutive quarters, although it maintains a low Debt to EBITDA ratio and stable institutional holdings.

Read More

Greenpanel Industries Faces Continued Volatility Amid Declining Sales and Underperformance

2025-03-17 09:55:24Greenpanel Industries has faced notable volatility, reaching a new 52-week low and declining for five consecutive days. The company has struggled with a decrease in net sales and negative results over the past seven quarters, while maintaining a low debt-to-EBITDA ratio and attractive valuation metrics.

Read More

Greenpanel Industries Faces Significant Volatility Amid Broader Market Bearish Sentiment

2025-03-13 10:09:17Greenpanel Industries has faced notable volatility, reaching a new 52-week low and experiencing a four-day decline. The company's financial performance shows a significant drop in net sales and profit after tax, while it maintains a low debt-to-EBITDA ratio and strong institutional support.

Read MoreGreenpanel Industries Opens Strong with 5.54% Gain Amid Broader Market Decline

2025-03-06 09:40:30Greenpanel Industries, a small-cap player in the Wood & Wood Products sector, has shown significant activity today, opening with a gain of 5.54%. The stock has outperformed its sector by 3%, marking a notable performance amidst a broader market context where the Sensex has dipped by 0.08%. Over the past two days, Greenpanel Industries has recorded an impressive 8.89% increase, reflecting a positive short-term trend. Despite today's gains, the stock remains below its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, indicating a bearish technical outlook. The stock reached an intraday high of Rs 261, showcasing its volatility. However, its one-month performance reveals a decline of 31.66%, contrasting sharply with the Sensex's decrease of 5.62%. In terms of technical indicators, the MACD and Bollinger Bands suggest a bearish trend on both weekly and monthly scales. Additionally, Greenpanel Indus...

Read More

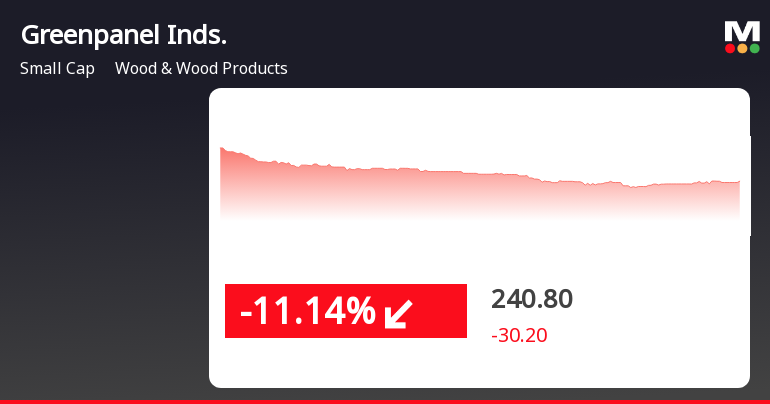

Greenpanel Industries Faces Significant Volatility Amid Ongoing Financial Challenges

2025-03-04 14:07:38Greenpanel Industries has faced significant volatility, reaching a new 52-week low amid a 23.2% decline over six days. Recent financial results show a drop in net sales and a substantial decrease in profit after tax. Despite low debt levels and stable institutional interest, technical indicators suggest a bearish trend.

Read MoreGreenpanel Industries Adjusts Valuation Grade Amidst Competitive Market Landscape

2025-03-04 08:00:16Greenpanel Industries, a small-cap player in the Wood & Wood Products sector, has recently undergone a valuation adjustment. The company's financial metrics reveal a PE ratio of 21.61 and an EV to EBITDA ratio of 12.74, indicating its current market positioning. The price to book value stands at 2.34, while the EV to sales ratio is recorded at 2.00. Additionally, Greenpanel's return on capital employed (ROCE) is at 12.62%, and its return on equity (ROE) is 10.83%. In comparison to its peer, Greenply Industries, Greenpanel's valuation metrics appear more favorable, with Greenply showing a significantly higher PE ratio of 32.69 and an EV to EBITDA of 16.48. This suggests that Greenpanel may be positioned competitively within the industry, despite its recent stock performance, which has seen declines over various time frames. Over the past year, Greenpanel's stock has decreased by 34.11%, contrasting with th...

Read More

Greenpanel Industries Faces Significant Stock Decline Amid Challenging Market Conditions

2025-03-03 10:50:31Greenpanel Industries has seen a notable decline in its stock price, reaching a new 52-week low. The company has faced consecutive losses over the past week, significantly underperforming its sector. Additionally, it has experienced high volatility and is trading below various moving averages, reflecting ongoing challenges in the market.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

07-Apr-2025 | Source : BSEGreenpanel Industries Limited hereby submitted the certificate under regulation 74(5) of SEBI (DP) Regulations 2018

Disclosures under Reg. 10(6) of SEBI (SAST) Regulations 2011

01-Apr-2025 | Source : BSEThe Exchange has received the disclosure under Regulation 10(6) of SEBI (Substantial Acquisition of Shares & Takeovers) Regulations 2011 for Shobhan Mittal

Disclosures under Reg. 29(2) of SEBI (SAST) Regulations 2011

01-Apr-2025 | Source : BSEThe Exchange has received the disclosure under Regulation 29(2) of SEBI (Substantial Acquisition of Shares & Takeovers) Regulations 2011 for Shobhan Mittal & Other

Corporate Actions

No Upcoming Board Meetings

Greenpanel Industries Ltd has declared 30% dividend, ex-date: 18 Feb 25

No Splits history available

No Bonus history available

No Rights history available