Grindwell Norton Faces Mixed Financial Performance Amid Market Sentiment Shift

2025-04-03 08:02:20Grindwell Norton, a midcap player in the abrasives sector, has recently experienced a change in its evaluation, reflecting shifts in market sentiment. Despite a five-year growth in net sales and operating profit, the company faces challenges, including a recent profit decline and potential liquidity concerns.

Read MoreGrindwell Norton Faces Mixed Technical Trends Amid Market Evaluation Revision

2025-04-03 08:00:11Grindwell Norton, a midcap player in the abrasives industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1,673.00, slightly down from the previous close of 1,688.80. Over the past year, the stock has experienced a decline of 17.17%, contrasting with a modest gain of 3.67% in the Sensex during the same period. The technical summary indicates a mixed performance across various indicators. The MACD shows a mildly bullish trend on a weekly basis but shifts to bearish on a monthly scale. The Relative Strength Index (RSI) is bearish weekly, while the monthly signal remains neutral. Bollinger Bands and KST both reflect bearish trends on both weekly and monthly charts, suggesting a cautious outlook. In terms of returns, Grindwell Norton has faced challenges, particularly in the year-to-date performance, where it has dropped by 13.02%, comp...

Read More

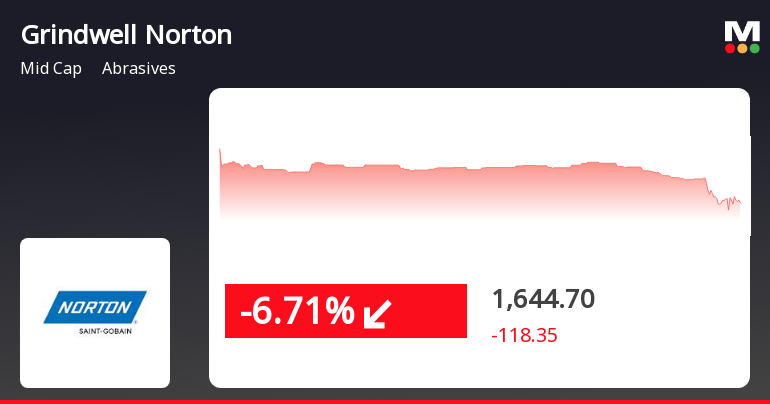

Grindwell Norton Faces Notable Stock Decline Amid Broader Market Resilience

2025-03-27 15:00:17Grindwell Norton, a midcap abrasives company, has seen a notable decline in its stock price, underperforming compared to its sector. The stock has faced consecutive losses over three days and is positioned variably against its moving averages. In contrast, the broader market index, Sensex, has shown resilience and growth over recent weeks.

Read More

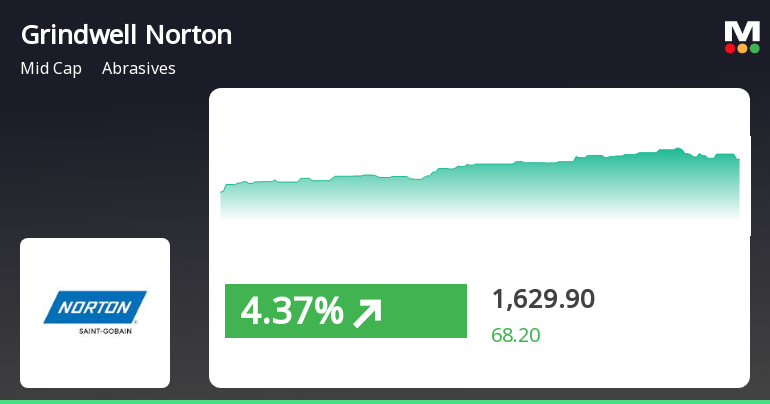

Grindwell Norton Faces Technical Shift Amid Mixed Financial Performance Indicators

2025-03-24 08:01:19Grindwell Norton, a midcap player in the abrasives industry, has recently seen a change in its evaluation, influenced by technical indicators and financial metrics. While the company has a strong historical performance, it faces challenges in profitability and has shifted into a mildly bearish technical trend.

Read MoreGrindwell Norton Faces Mixed Technical Trends Amid Market Evaluation Revision

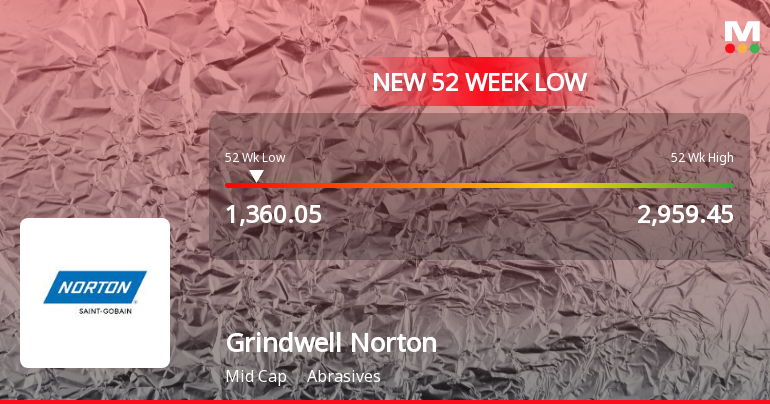

2025-03-24 08:00:08Grindwell Norton, a midcap player in the abrasives industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 1774.85, showing a notable increase from the previous close of 1661.30. Over the past year, the stock has experienced fluctuations, with a 52-week high of 2,959.45 and a low of 1,360.05. In terms of technical indicators, the weekly and monthly MACD readings are bearish, while the Bollinger Bands indicate a mildly bearish trend. The daily moving averages also reflect a mildly bearish sentiment. Notably, the Dow Theory presents a mixed view, with a mildly bullish signal on the weekly chart contrasted by a bearish outlook on the monthly chart. When examining the company's performance relative to the Sensex, Grindwell Norton has shown strong short-term returns, with a 1-week return of 16.41% compared to the Sensex's 4.17%. Over the...

Read More

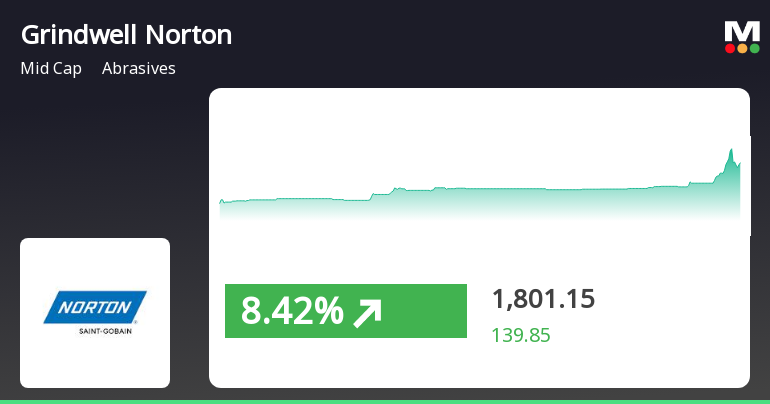

Grindwell Norton Shows Strong Short-Term Gains Amid Broader Market Recovery

2025-03-21 15:15:18Grindwell Norton Ltd., a midcap player in the abrasives industry, has experienced notable gains, outperforming its sector. The stock has shown a strong upward trend over the past week, reaching an intraday high today. However, its longer-term performance reflects a decline compared to the broader market.

Read More

Grindwell Norton Shows Strong Short-Term Gains Amid Mixed Long-Term Performance

2025-03-07 11:45:46Grindwell Norton, a midcap player in the abrasives sector, experienced significant trading activity on March 7, 2025, with a notable rebound after an initial loss. Despite recent challenges, the stock has shown strong long-term growth, outperforming the broader market over the past five years.

Read More

Grindwell Norton Faces Volatility Amid Broader Market Decline and Underperformance Concerns

2025-03-04 09:38:27Grindwell Norton, a midcap abrasives company, has faced notable volatility, reaching a new 52-week low. The stock has underperformed over the past year, with significant declines in key financial metrics. Despite some management efficiency, long-term growth prospects appear constrained, while institutional holdings indicate some investor confidence.

Read More

Grindwell Norton Faces Significant Market Challenges Amidst Ongoing Volatility

2025-03-03 09:35:20Grindwell Norton, a midcap player in the abrasives sector, has hit a new 52-week low amid significant volatility, underperforming its sector. The stock has declined consecutively over three days and is trading below multiple moving averages, reflecting ongoing challenges and a notable drop of 32.63% over the past year.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

04-Apr-2025 | Source : BSEPlease find attached the Certificate under Regulation 74(5) of SEBI (Depositories and Participants) Regulations 2018 for the quarter ended March 31 2025

Shareholder Meeting / Postal Ballot-Outcome of Postal_Ballot

27-Mar-2025 | Source : BSEPlease find attached the Voting Results of Postal Ballot and Scrutinizers Report dated March 27 2025.

Details Of Key Managerial Personnel Under Regulation 30(5) Of SEBI (Listing Obligations And Disclosure Requirements) Regulations 2015

27-Mar-2025 | Source : BSEPlease find attached the details of Key Managerial Personnel under Regulation 30(5) of SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015

Corporate Actions

No Upcoming Board Meetings

Grindwell Norton Ltd. has declared 340% dividend, ex-date: 09 Jul 24

Grindwell Norton Ltd. has announced 5:10 stock split, ex-date: 26 May 06

Grindwell Norton Ltd. has announced 1:1 bonus issue, ex-date: 14 Jul 16

No Rights history available