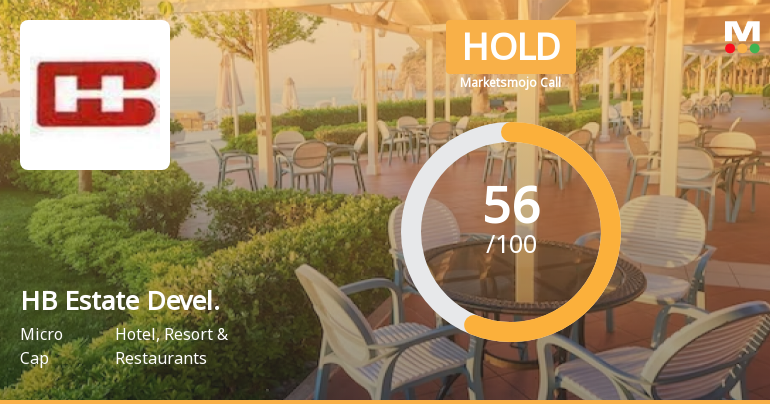

HB Estate Developers Adjusts Valuation Grade Amid Strong Market Performance Metrics

2025-04-02 08:01:32HB Estate Developers has recently undergone a valuation adjustment, reflecting its performance metrics within the hotel, resort, and restaurant industry. The company currently exhibits a price-to-earnings (PE) ratio of 18.12 and an EV to EBITDA ratio of 11.33, indicating a competitive position in the market. Its PEG ratio stands at a notably low 0.10, suggesting potential for growth relative to its earnings. In terms of financial returns, HB Estate Developers has shown resilience, with a year-to-date return of 2.04%, outperforming the Sensex, which has seen a decline of 2.71% in the same period. Over the past year, the company's stock has surged by 58.60%, significantly outpacing the Sensex's modest gain of 2.72%. Furthermore, the company's performance over three and five years has been remarkable, with returns of 442.01% and 1714.88%, respectively. When compared to its peers, HB Estate Developers maintai...

Read More

HB Estate Developers Reports Significant Profit Growth Amid Long-Term Financial Challenges

2025-03-05 08:04:05HB Estate Developers has recently adjusted its evaluation, highlighting a significant net profit growth of 883.67% for the quarter ending December 2024, marking 14 consecutive quarters of positive results. However, the company faces long-term challenges, including a modest sales growth rate and a high Debt to EBITDA ratio.

Read More

HB Estate Developers Reports Significant Profit Growth Amid Long-Term Financial Concerns

2025-02-27 18:49:39HB Estate Developers has recently adjusted its evaluation, reflecting its financial metrics and market position. The company reported a significant net profit growth in Q3 FY24-25 and has maintained favorable results for 14 consecutive quarters, although it faces challenges with long-term fundamentals and modest growth rates.

Read More

HB Estate Developers Reports Strong Financial Growth Amid Liquidity Challenges in December 2024 Results

2025-02-12 17:42:54HB Estate Developers has announced its financial results for the quarter ending December 2024, revealing notable growth in Profit Before Tax and Profit After Tax. The company also reported improvements in its operating profit to interest ratio and inventory turnover, while facing challenges with cash equivalents and debtor turnover.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

05-Apr-2025 | Source : BSECertificate under Regulation 74(5) of SEBI (DP) Regulations 2018 for the quarter ended March 31 2025

Disclosures under Reg. 29(2) of SEBI (SAST) Regulations 2011

28-Mar-2025 | Source : BSEThe Exchange has received the disclosure under Regulation 29(2) of SEBI (Substantial Acquisition of Shares & Takeovers) Regulations 2011 for Lalit Bhasin

Disclosures under Reg. 29(2) of SEBI (SAST) Regulations 2011

28-Mar-2025 | Source : BSEThe Exchange has received the disclosure under Regulation 29(2) of SEBI (Substantial Acquisition of Shares & Takeovers) Regulations 2011 for HB Stockholdings Ltd

Corporate Actions

No Upcoming Board Meetings

HB Estate Developers Ltd has declared 5% dividend, ex-date: 13 Nov 13

No Splits history available

No Bonus history available

No Rights history available