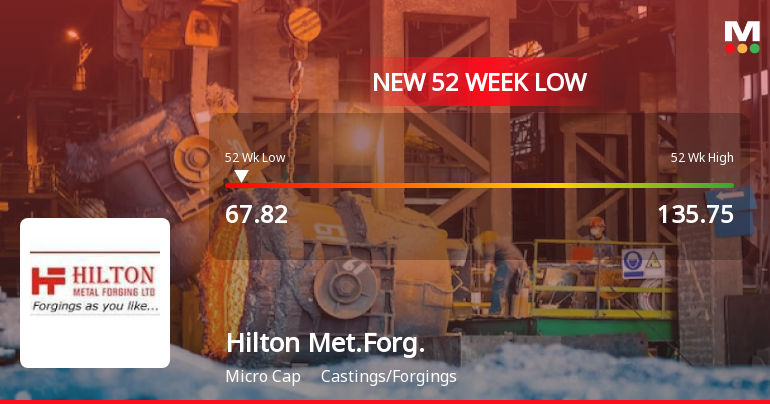

Hilton Metal Forging Faces Financial Struggles Amid Significant Stock Volatility

2025-03-17 10:10:32Hilton Metal Forging has faced notable volatility, reaching a new 52-week low and showing a significant decline over the past year. The company has consistently traded below its moving averages, indicating a bearish trend, while financial metrics reveal challenges, including low ROCE and high debt levels. Promoter holding has also decreased.

Read More

Hilton Metal Forging Faces Significant Challenges Amidst Market Volatility and Declining Performance

2025-03-17 10:10:24Hilton Metal Forging, a microcap in the castings and forgings sector, has faced notable volatility, reaching a new 52-week low. The company has experienced a significant decline over the past year, with concerning financial metrics, including low ROCE and sluggish sales growth, alongside a high Debt to EBITDA ratio.

Read More

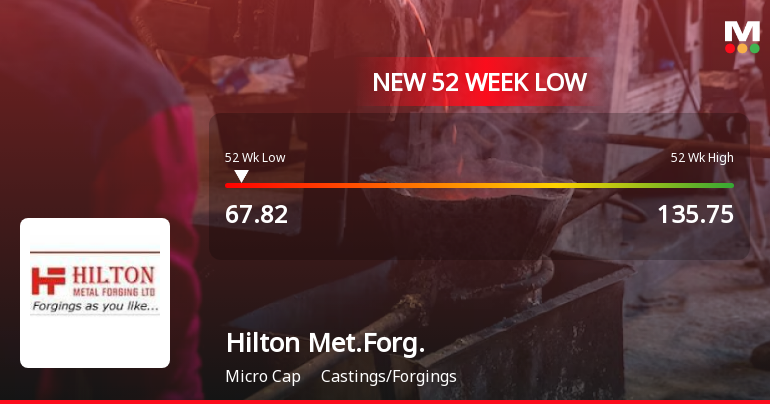

Hilton Metal Forging Faces Financial Challenges Amidst Market Volatility and Declining Performance

2025-03-13 12:07:06Hilton Metal Forging has faced notable volatility, reaching a new 52-week low amid a four-day decline. Over the past year, it has significantly underperformed the broader market, with concerning financial metrics, including a low Return on Capital Employed and a high Debt to EBITDA ratio, raising stability concerns.

Read More

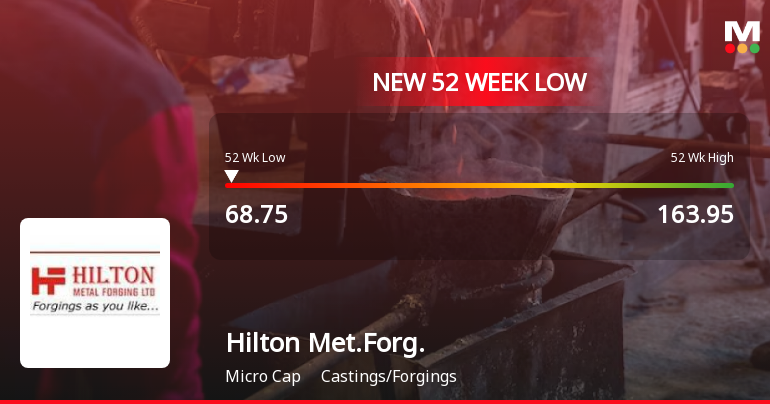

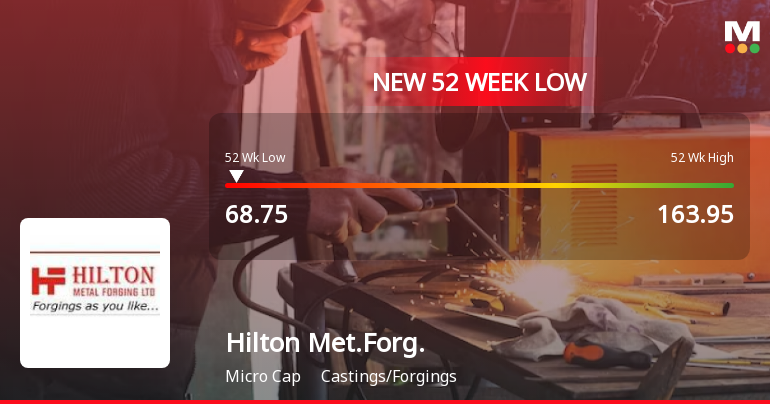

Hilton Metal Forging Faces Market Activity Amid Weak Long-Term Fundamentals and Declining Profits

2025-03-12 13:06:52Hilton Metal Forging, a microcap in the castings and forgings sector, is nearing its 52-week low, trading slightly above it. Despite a recent outperformance against its sector, the company faces long-term challenges, including weak fundamentals, high debt levels, and a significant decline in profits over the past year.

Read MoreHilton Metal Forging Faces Stock Volatility Amidst Industry Challenges and High P/E Ratio

2025-03-04 18:00:30Hilton Metal Forging Ltd, operating in the Castings/Forgings industry, has experienced significant fluctuations in its stock performance recently. With a market capitalization of Rs 180.00 crore, the company currently holds a price-to-earnings (P/E) ratio of 80.75, notably higher than the industry average of 31.59. Over the past year, Hilton Metal Forging has seen a decline of 53.68%, contrasting sharply with the Sensex, which has only dipped by 1.19%. In the last day alone, the stock fell by 2.62%, while the Sensex experienced a minor decrease of 0.13%. The one-week performance shows a more pronounced drop of 20.40%, compared to the Sensex's 2.16% decline. Looking at longer-term trends, the stock has faced challenges, with a year-to-date performance down by 24.11% against the Sensex's 6.59%. However, the company has shown resilience over the longer term, boasting a remarkable 762.66% increase over the pa...

Read More

Hilton Metal Forging Faces Financial Struggles Amid Declining Profit and Ownership Changes

2025-02-27 18:47:42Hilton Metal Forging has recently experienced a change in its evaluation due to ongoing financial challenges, including four consecutive quarters of negative results and a significant decline in profit after tax. Key metrics indicate weak long-term fundamentals, with concerns about debt servicing and a decrease in promoter holding.

Read MoreHilton Metal Forging Shows Mixed Technical Trends Amid Market Challenges

2025-02-25 10:31:42Hilton Metal Forging, a microcap player in the castings and forgings industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 92.00, slightly down from its previous close of 92.64. Over the past year, Hilton Metal Forging has faced challenges, with a notable decline of 34.59% compared to a modest gain of 2.07% in the Sensex. The technical summary indicates a mixed performance across various indicators. The MACD shows bearish signals on both weekly and monthly charts, while the Bollinger Bands present a bullish outlook on the weekly scale but bearish on the monthly. Moving averages suggest a mildly bullish trend on a daily basis, contrasting with the mildly bearish signals from the KST and Dow Theory on a monthly basis. Despite the recent fluctuations, Hilton Metal Forging has demonstrated resilience over longer periods, with a remarka...

Read MoreHilton Metal Forging Adjusts Valuation Amidst Competitive Industry Landscape

2025-02-25 10:23:11Hilton Metal Forging has recently undergone a valuation adjustment, reflecting changes in its financial metrics and market position within the castings and forgings industry. The company's price-to-earnings ratio stands at 100.25, indicating a significant valuation relative to its earnings. Additionally, its enterprise value to EBITDA ratio is recorded at 25.46, suggesting a premium valuation compared to some peers. In terms of return on capital employed, Hilton Metal Forging reports an 8.11% rate, while its return on equity is at 2.29%. These figures highlight the company's performance in generating returns relative to its capital and equity. When compared to its peers, Hilton Metal Forging's valuation metrics appear elevated. For instance, Nelcast and Pradeep Metals, both classified as attractive, exhibit lower price-to-earnings ratios of 36.14 and 15.66, respectively. This contrast underscores the com...

Read More

Hilton Metal Forging Faces Financial Challenges Amidst Declining Profit and High Debt Levels

2025-02-20 18:05:58Hilton Metal Forging has recently experienced a change in evaluation, reflecting its challenging financial situation. The company reported a decline in profit after tax for Q3 FY24-25, limited growth in sales and operating profit over five years, and a high debt-to-EBITDA ratio, indicating difficulties in debt servicing.

Read MoreUpdates Of Board Meeting

04-Apr-2025 | Source : BSEPlease find attached Updates of Board Meeting.

Announcement under Regulation 30 (LODR)-Newspaper Publication

31-Mar-2025 | Source : BSEPlease find attached Copy of Newspaper Publication.

EGM On 21St April 2025 At 12.00 PM Through VC

28-Mar-2025 | Source : BSEPlease find attached Notice of EGM.

Corporate Actions

No Upcoming Board Meetings

Hilton Metal Forging Ltd has declared 2% dividend, ex-date: 21 Sep 15

No Splits history available

No Bonus history available

Hilton Metal Forging Ltd has announced 2:5 rights issue, ex-date: 20 Oct 22