ICICI Prudential Life Insurance Faces Bearish Technical Trends Amid Market Challenges

2025-04-01 08:03:21ICICI Prudential Life Insurance Company, a prominent player in the Finance/NBFC sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 566.00, down from a previous close of 591.85, with a notable 52-week high of 795.00 and a low of 516.45. In terms of technical indicators, the weekly MACD and Bollinger Bands are signaling bearish trends, while the monthly metrics show a mildly bearish stance. The daily moving averages also reflect a bearish outlook. The KST presents a mixed picture, with weekly readings indicating bearishness and monthly readings showing bullish tendencies. When comparing the company's performance to the Sensex, ICICI Prudential has faced challenges over various time frames. Over the past week, the stock has returned -2.76%, contrasting with a positive return of 0.66% for the Sensex. Year-to-date, the stock has decl...

Read MoreICICI Prudential Life Insurance Sees Surge in Open Interest Amid Increased Trading Activity

2025-03-28 15:00:38ICICI Prudential Life Insurance Company Ltd (ICICIPRULI) has experienced a significant increase in open interest today, reflecting heightened trading activity in the stock. The latest open interest stands at 21,475 contracts, up from the previous open interest of 18,511 contracts, marking a change of 2,964 contracts or a 16.01% increase. The trading volume for the day reached 10,526 contracts, contributing to a total futures value of approximately Rs 15,708.74 lakhs. In terms of price performance, ICICI Prudential underperformed its sector by 4.88%, with the stock hitting an intraday low of Rs 562.1, down 4.95%. The weighted average price indicates that more volume was traded closer to this low price. While the stock is currently above its 20-day moving averages, it remains below the 5-day, 50-day, 100-day, and 200-day moving averages. Additionally, delivery volume has surged to 21.09 lakh shares, reflect...

Read More

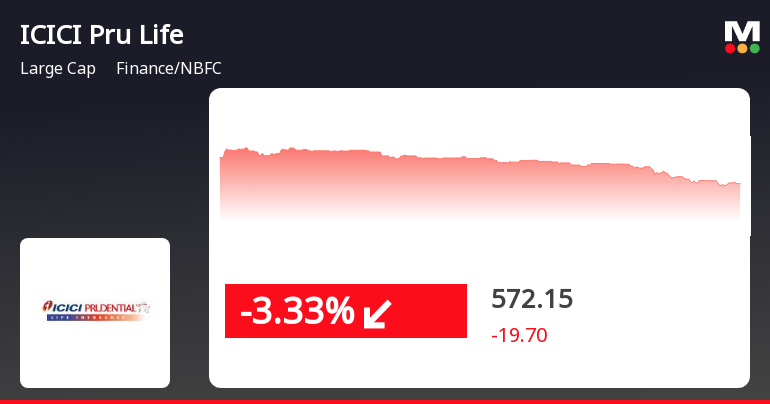

ICICI Prudential Life Insurance Faces Mixed Performance Amid Broader Market Volatility

2025-03-28 14:05:23ICICI Prudential Life Insurance Company saw a decline on March 28, 2025, underperforming its sector. The stock's intraday low was Rs 572.55, and it exhibited mixed performance relative to various moving averages. Meanwhile, the broader market, represented by the Sensex, experienced a reversal after an initial gain.

Read MoreICICI Prudential Sees Surge in Open Interest, Indicating Increased Trading Activity

2025-03-26 15:00:41ICICI Prudential Life Insurance Company Ltd (ICICIPRULI) has experienced a significant increase in open interest today, reflecting heightened activity in its trading. The latest open interest stands at 26,233 contracts, marking a rise of 4,036 contracts or 18.18% from the previous open interest of 22,197. The trading volume for the day reached 14,438 contracts, contributing to a futures value of approximately Rs 35,241.71 lakhs. In terms of price performance, ICICI Prudential has outperformed its sector by 0.54%, despite a slight decline of 1.13% over the last two days. The stock is currently trading above its 5-day, 20-day, and 50-day moving averages, yet remains below its 100-day and 200-day moving averages. Notably, investor participation has decreased, with a delivery volume of 6 lakhs on March 25, reflecting a decline of 13.73% compared to the 5-day average. With a market capitalization of Rs 86,133 ...

Read MoreICICI Prudential Sees Surge in Open Interest, Indicating Market Activity Shift

2025-03-26 14:00:30ICICI Prudential Life Insurance Company Ltd (ICICIPRULI) has experienced a notable increase in open interest today, reflecting heightened activity in the derivatives market. The latest open interest stands at 24,582 contracts, up from the previous figure of 22,197, marking a change of 2,385 contracts or a percentage increase of 10.74%. The trading volume for the day reached 10,300 contracts, contributing to a futures value of approximately Rs 24,607.67 lakhs. In terms of price performance, ICICI Prudential has underperformed its sector by 0.33%, with a 1-day return of -0.81%. The stock has been on a downward trend, having fallen for the last two consecutive days, resulting in a total decline of 2.04% during this period. While the stock is currently trading above its 5-day and 20-day moving averages, it remains below the 50-day, 100-day, and 200-day moving averages. Additionally, investor participation app...

Read MoreICICI Prudential Sees Surge in Open Interest Amid Mixed Price Momentum

2025-03-26 13:00:22ICICI Prudential Life Insurance Company Ltd (ICICIPRULI) has experienced a notable increase in open interest today, reflecting heightened activity in its derivatives market. The latest open interest stands at 24,593 contracts, up from the previous figure of 22,197, marking a change of 2,396 contracts or a 10.79% increase. The trading volume for the day reached 8,885 contracts, contributing to a futures value of approximately Rs 21,138.29 lakhs. In terms of price performance, ICICI Prudential has been under pressure, recording a decline of 1.65% over the past two days. Currently, the stock is trading at an underlying value of Rs 585. While it remains above its 5-day, 20-day, and 50-day moving averages, it is below the 100-day and 200-day moving averages, indicating mixed momentum in its price trend. Additionally, delivery volume has decreased by 13.73% compared to the 5-day average, suggesting a decline in ...

Read MoreICICI Prudential Sees Surge in Open Interest Amid Active Derivatives Trading

2025-03-25 15:01:06ICICI Prudential Life Insurance Company Ltd (symbol: ICICIPRULI) has experienced a notable increase in open interest today, reflecting heightened activity in the derivatives market. The latest open interest stands at 25,922 contracts, up from the previous open interest of 22,560, marking a change of 3,362 contracts or a 14.9% increase. The trading volume for the day reached 17,735 contracts, contributing to a futures value of approximately Rs 42,594.69 lakhs. In terms of price performance, ICICI Prudential has underperformed its sector by 0.27%, with a 1-day return of -0.39%. The stock has seen a trend reversal, falling after six consecutive days of gains. Currently, it is trading above its 5-day, 20-day, and 50-day moving averages, yet below its 100-day and 200-day moving averages. Notably, the delivery volume on March 24 was 7.3 lakh shares, reflecting a 14.91% increase compared to the 5-day average deli...

Read MoreICICI Prudential Life Insurance Sees Surge in Open Interest and Trading Activity

2025-03-25 14:00:47ICICI Prudential Life Insurance Company Ltd (ICICIPRULI) has experienced a significant increase in open interest today, reflecting heightened activity in the stock. The latest open interest stands at 25,144 contracts, up from the previous open interest of 22,560, marking a change of 2,584 contracts or an 11.45% increase. The trading volume for the day reached 15,124 contracts, contributing to a total futures value of approximately Rs 34,597.16 lakhs. In terms of price performance, ICICI Prudential has outperformed its sector by 0.89%, with a one-day return of 0.49%. The stock is currently trading above its 5-day, 20-day, and 50-day moving averages, although it remains below the 100-day and 200-day moving averages. Notably, the delivery volume has seen a rise of 14.91% compared to the 5-day average, indicating increased investor participation. With a market capitalization of Rs 86,740 crore, ICICI Prudenti...

Read MoreICICI Prudential Life Insurance Faces Mixed Technical Trends Amid Market Evaluation

2025-03-25 08:05:32ICICI Prudential Life Insurance Company, a prominent player in the Finance/NBFC sector, has recently undergone an evaluation revision reflecting its current market dynamics. The company's stock is currently priced at 599.90, showing a notable increase from the previous close of 582.05. Over the past year, ICICI Prudential has experienced a stock return of 3.16%, which is below the Sensex return of 7.07% for the same period. In terms of technical indicators, the weekly MACD remains bearish, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) shows no significant signals on both weekly and monthly charts. Bollinger Bands indicate a mildly bearish trend, and moving averages also reflect a similar sentiment on a daily basis. The KST presents a mixed picture, being bearish weekly but bullish monthly. The company's performance over various time frames reveals a 9.24% return over the p...

Read MoreAnnouncement under Regulation 30 (LODR)-Allotment of ESOP / ESPS

08-Apr-2025 | Source : BSEAllotment of shares under Employee Stock Option Scheme.

Update on board meeting

07-Apr-2025 | Source : BSEICICI Prudential Life Insurance Company Ltdhas informed BSE that the meeting of the Board of Directors of the Company is scheduled on 15/04/2025 inter alia to consider and approve We refer to our intimation dated March 26 2025 of the Board Meeting of the Company to be held on April 15 2025 for consideration of the audited standalone and consolidated financial results of the Company for the quarter and year ended March 31 2025. In continuation thereof please be informed that the Board of Directors of the Company at the same meeting shall also inter-alia consider recommendation of dividend if any for the financial year ended March 31 2025. The above is for your kind information and records.

Disclosure Under Regulation 30 And Regulation 51 Read With Schedule III Of Securities And Exchange Board Of India (Listing Obligations And Disclosure Requirements) Regulations 2015

28-Mar-2025 | Source : BSEDisclosure under Regulation 30 and Regulation 51 read with Schedule lll of Securities and Exchange Board of India (Listing Obligations and Disclosure Requirements) Regulations 2015

Corporate Actions

No Upcoming Board Meetings

ICICI Prudential Life Insurance Company Ltd has declared 6% dividend, ex-date: 13 Jun 24

No Splits history available

No Bonus history available

No Rights history available