IDFC First Bank Ltd. Sees Surge in Call Options with 10,348 Contracts Traded

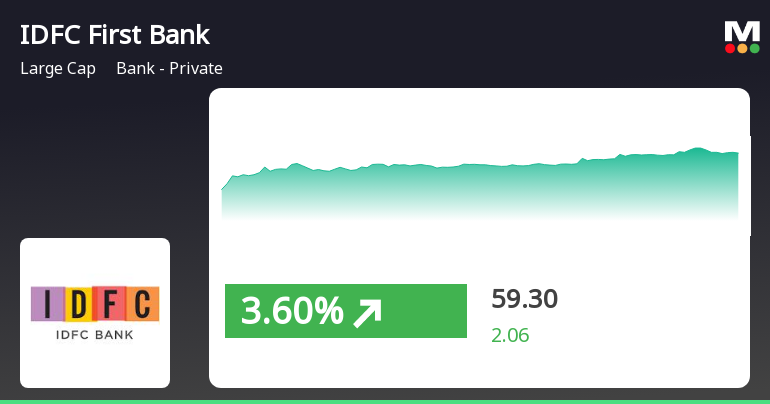

2025-04-03 15:00:07IDFC First Bank Ltd. has emerged as one of the most active stocks in the market today, particularly in the options segment. The bank's underlying stock, IDFCFIRSTB, has seen significant activity with 10,348 call contracts traded, reflecting a turnover of Rs 1,267.977 lakhs. The options have an expiry date set for April 24, 2025, with a strike price of Rs 60. Today, IDFC First Bank's stock price reached an intraday high of Rs 60.90, marking a 6.49% increase. The stock has outperformed its sector by 5.67% and has shown a consecutive gain over the past three days, accumulating a total return of 9.93%. The underlying value currently stands at Rs 60.65, indicating a strong market position. Despite the positive performance, there has been a noted decline in investor participation, with delivery volume dropping by 12.97% compared to the five-day average. The stock remains liquid, with a trade size of Rs 8.94 cr...

Read More

IDFC First Bank Shows Resilience Amid Market Volatility and Sector Outperformance

2025-04-03 10:50:25IDFC First Bank has demonstrated strong performance, achieving gains for three consecutive days and outperforming its sector. The stock is currently above its short-term moving averages, while the broader market shows volatility, with small-cap stocks leading. This reflects the bank's resilience in a fluctuating market.

Read MoreIDFC First Bank Shows Strong Trading Activity Amidst Mixed Market Conditions

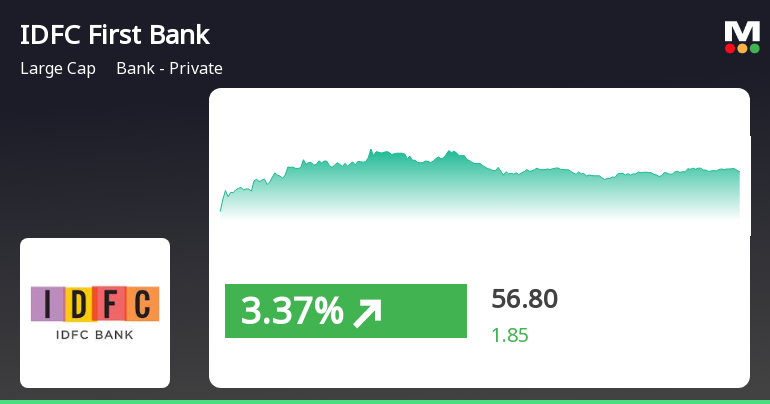

2025-04-03 10:00:14IDFC First Bank Ltd. has emerged as one of the most active equities today, with a total traded volume of 60,058,400 shares and a total traded value of approximately Rs 34,263.32 lakhs. The stock opened at Rs 57.97, reaching a day high of Rs 58.66, before settling at a last traded price of Rs 57.43. This performance marks a 2.45% increase for the day, significantly outperforming its sector, which saw a slight decline of 0.13%. Over the past three days, IDFC First Bank has shown a consistent upward trend, accumulating a total return of 6.26%. However, it is noteworthy that the stock's delivery volume has decreased by 12.97% compared to the five-day average, indicating a decline in investor participation. Despite this, the stock remains liquid enough for trading, with a liquidity level based on 2% of the five-day average traded value sufficient for a trade size of Rs 8.94 crores. In terms of moving averages,...

Read MoreIDFC First Bank Sees Surge in Trading Activity Amid Mixed Performance Indicators

2025-04-02 10:00:15IDFC First Bank Ltd., a prominent player in the private banking sector, has emerged as one of the most active equities today, with a total traded volume of 74,364,099 shares and a total traded value of approximately Rs 423.50 crores. The stock opened at Rs 55.05 and reached a day high of Rs 57.66, while the day low matched the previous close of Rs 54.96. As of the latest update, the last traded price stands at Rs 57.20. Despite this activity, IDFC First Bank has underperformed its sector by 1.02% today. The stock is currently above its 5-day and 20-day moving averages but below the 50-day, 100-day, and 200-day moving averages, indicating mixed performance in the short to medium term. Notably, the delivery volume has increased to 4.03 crore shares, reflecting a 6.64% rise compared to the 5-day average, suggesting a growing interest in the stock. With a market capitalization of Rs 41,733.77 crores, IDFC Fir...

Read More

IDFC First Bank Shows Signs of Recovery Amid Broader Market Decline

2025-04-01 11:40:51IDFC First Bank has rebounded today after four days of decline, outperforming its sector amid a challenging market. The stock reached an intraday high, showing mixed signals in moving averages. Despite recent short-term declines, the bank has experienced substantial growth over the past three and five years.

Read MoreIDFC First Bank Shows Strong Trading Activity Amid Market Challenges

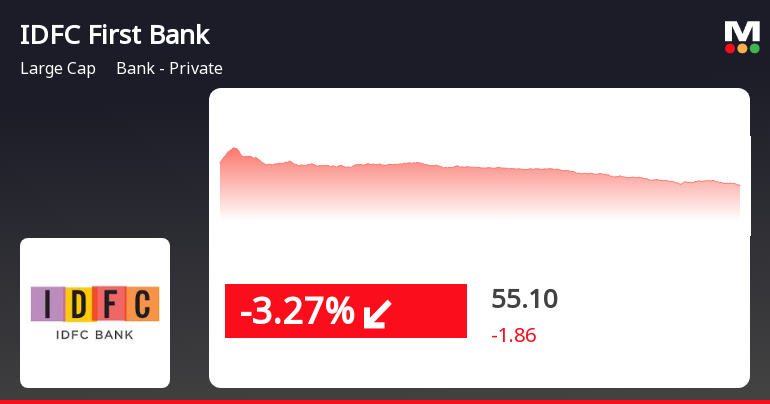

2025-04-01 11:00:13IDFC First Bank Ltd. has emerged as one of the most active equities today, with a total traded volume of 48,926,649 shares and a total traded value of approximately Rs 273.35 crores. The stock opened at Rs 56.50 and reached a day high of Rs 57.85, marking a notable intraday gain of 4.91%. However, it closed at Rs 54.86, reflecting a 4.53% return for the day. The bank's performance today stands out as it outperformed its sector by 5.23%, reversing a trend of four consecutive days of decline. The stock's delivery volume on March 28 increased by 8.41% compared to the five-day average, indicating rising investor participation. Additionally, IDFC First Bank's liquidity remains robust, with trading activity based on 2% of the five-day average traded value, supporting a trade size of Rs 7.41 crores. In terms of moving averages, the stock is currently above its 5-day and 20-day moving averages but below the 50-da...

Read More

IDFC First Bank Faces Continued Stock Decline Amid Broader Market Gains

2025-03-28 13:50:26IDFC First Bank's stock has declined for four consecutive days, with a total drop of 4.54%. Currently trading above its 52-week low, the bank has underperformed the broader market, showing significant declines over various time frames compared to the Sensex, which has seen gains.

Read MoreIDFC First Bank Sees Surge in Trading Activity Amid Increased Investor Participation

2025-03-28 10:00:14IDFC First Bank Ltd. has emerged as one of the most active equities today, with a total traded volume of 6,984,817 shares and a total traded value of approximately Rs 39.93 crore. The stock opened at Rs 56.50 and reached a day high of Rs 57.85, while the day low was also Rs 56.50. As of the latest update, the last traded price stands at Rs 56.60. In terms of performance, IDFC First Bank has outperformed its sector by 0.6%, despite a slight decline of 0.56% in its one-day return. The stock has shown resilience, maintaining a position above its 5-day and 20-day moving averages, although it remains below the 50-day, 100-day, and 200-day moving averages. Notably, there has been a significant increase in investor participation, with delivery volume on March 27 rising by 539.17% compared to the 5-day average. With a market capitalization of Rs 41,455.55 crore, IDFC First Bank continues to demonstrate liquidity,...

Read MoreIDFC First Bank Sees Surge in Open Interest Amidst Trading Activity Challenges

2025-03-27 15:00:21IDFC First Bank Ltd. has experienced a significant increase in open interest today, reflecting notable activity in its trading. The latest open interest stands at 112,093, up from the previous figure of 98,745, marking a change of 13,348, or a 13.52% increase. The trading volume for the stock reached 51,030, contributing to a futures value of approximately Rs 135,940.16 lakhs and an options value of around Rs 8,596.77 crores, bringing the total value to Rs 138,297.90 lakhs. Despite this surge in open interest, IDFC First Bank has underperformed its sector by 2.13% today, continuing a downward trend with a 2.88% decline over the past three days. The stock is currently trading below its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, indicating a challenging market position. Additionally, the delivery volume has decreased by 8.2% compared to the 5-day average, suggesting a decline in investor pa...

Read MoreProvisional Numbers For Year Ended March 31 2025

03-Apr-2025 | Source : BSEPlease refer the enclosed attachment .

Closure of Trading Window

27-Mar-2025 | Source : BSEClosure of Trading Window - April 01 2025 to April 28 2025 (Both days inclusive)

Board Meeting Intimation for Considering And Approving The Audited Standalone And Consolidated Financial Results Of The Bank For The Quarter And Year Ended March 31 2025.

27-Mar-2025 | Source : BSEIDFC First Bank Ltdhas informed BSE that the meeting of the Board of Directors of the Company is scheduled on 26/04/2025 inter alia to consider and approve The audited Standalone and Consolidated Financial Results of the Bank for the quarter and year ended March 31 2025.

Corporate Actions

No Upcoming Board Meetings

IDFC First Bank Ltd. has declared 7% dividend, ex-date: 23 Jul 18

No Splits history available

No Bonus history available

No Rights history available