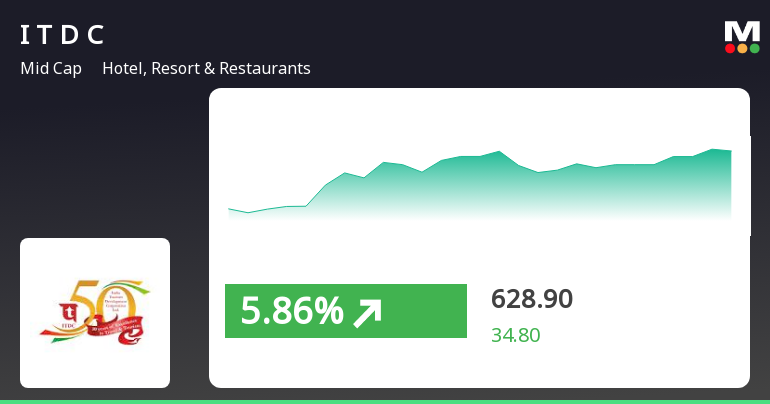

ITDC Stock Outperforms Sector Amid Broader Market Decline and Small-Cap Gains

2025-03-21 09:35:14India Tourism Development Corporation (ITDC) has experienced notable gains, outperforming its sector and showing a positive trend over recent days. The stock has consistently positioned above several moving averages, while the broader market reflects mixed performance, with small-cap stocks leading despite a slight decline in the Sensex.

Read MoreITDC Stock Shows Mixed Technical Trends Amid Strong Market Performance

2025-03-19 08:01:26India Tourism Development Corporation (ITDC), a midcap player in the Hotel, Resort & Restaurants industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 592.85, showing a notable increase from the previous close of 567.45. Over the past week, ITDC has reached a high of 624.90 and a low of 571.00, indicating some volatility in its trading activity. In terms of technical indicators, the MACD shows a bearish trend on a weekly basis, while the monthly perspective is mildly bearish. The Bollinger Bands also reflect a mildly bearish stance for both weekly and monthly evaluations. The KST aligns with this sentiment, indicating bearish trends in the short term and mildly bearish in the longer term. However, the On-Balance Volume (OBV) suggests a bullish trend on a monthly basis, indicating some positive momentum. When comparing the stock's p...

Read More

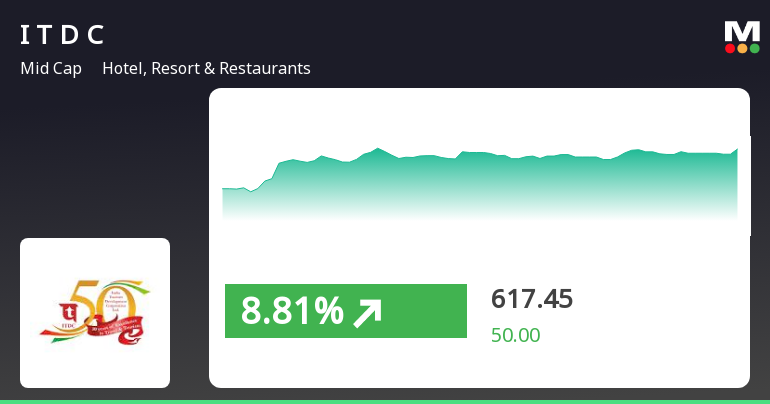

ITDC Shows Resilience Amid Market Volatility and Sector Gains

2025-03-18 09:45:14India Tourism Development Corporation (ITDC) experienced a notable rebound, gaining 7.42% on March 18, 2025, after two days of decline. The stock reached an intraday high of Rs 614.4 amid high volatility, outperforming its sector while remaining below its 200-day moving average.

Read MoreITDC Faces Bearish Technical Trends Amidst Mixed Performance Indicators

2025-03-18 08:01:09India Tourism Development Corporation (ITDC), a small-cap player in the Hotel, Resort & Restaurants industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 567.45, down from a previous close of 580.60, with a notable 52-week high of 930.80 and a low of 470.30. Today's trading saw a high of 588.05 and a low of 556.30. The technical summary indicates a bearish sentiment in various indicators. The MACD shows a bearish trend on a weekly basis, while the monthly perspective is mildly bearish. Similarly, Bollinger Bands and Moving Averages also reflect bearish conditions. The KST aligns with this trend, indicating bearishness on a weekly basis and a mildly bearish stance monthly. Notably, the On-Balance Volume (OBV) presents a bullish signal on a monthly basis, suggesting some underlying strength despite the overall bearish indicators. In ...

Read MoreITDC Experiences Mixed Technical Trends Amidst Market Evaluation Revision

2025-03-13 08:00:51India Tourism Development Corporation (ITDC), a midcap player in the Hotel, Resort & Restaurants industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 606.60, showing a notable increase from the previous close of 535.00. Over the past year, ITDC has experienced a 5.68% decline, contrasting with a slight gain of 0.49% in the Sensex during the same period. The technical summary indicates a mixed performance across various indicators. The MACD shows bearish trends on both weekly and monthly scales, while the Bollinger Bands reflect bullish conditions. Moving averages suggest a mildly bearish stance, and the KST aligns with the bearish sentiment observed in the MACD. However, the On-Balance Volume (OBV) indicates a bullish trend on a monthly basis, suggesting some underlying strength. In terms of returns, ITDC has outperformed the Sens...

Read MoreITDC Experiences Mixed Technical Trends Amidst Market Evaluation Revision

2025-03-13 08:00:51India Tourism Development Corporation (ITDC), a midcap player in the Hotel, Resort & Restaurants industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 606.60, showing a notable increase from the previous close of 535.00. Over the past year, ITDC has experienced a 5.68% decline, contrasting with a slight gain of 0.49% in the Sensex during the same period. The technical summary indicates a mixed performance across various indicators. The MACD shows bearish trends on both weekly and monthly scales, while the Bollinger Bands reflect bullish conditions. Moving averages suggest a mildly bearish stance, and the KST aligns with the bearish sentiment observed in the MACD. However, the On-Balance Volume (OBV) indicates a bullish trend on a monthly basis, suggesting some underlying strength. In terms of returns, ITDC has outperformed the Sens...

Read More

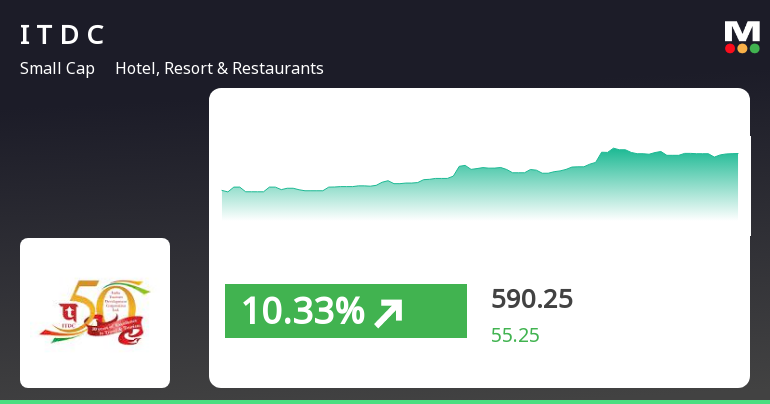

ITDC's Strong Performance Signals Potential Recovery Amid Market Volatility

2025-03-12 10:35:13India Tourism Development Corporation (ITDC) experienced a notable uptick today, reversing a three-day decline. The stock reached an intraday high, showcasing significant volatility. ITDC's performance has outpaced its sector, while broader market indices have faced downward pressure, highlighting the company's relative strength in a challenging environment.

Read MoreITDC Faces Bearish Technical Trends Amidst Mixed Performance Indicators

2025-03-11 08:01:23India Tourism Development Corporation (ITDC), a small-cap player in the Hotel, Resort & Restaurants industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 544.65, down from a previous close of 572.20, with a notable 52-week high of 930.80 and a low of 470.30. Today's trading saw a high of 575.35 and a low of 543.85. The technical summary indicates a bearish sentiment across various indicators. The MACD shows a bearish trend on a weekly basis, while the monthly outlook is mildly bearish. Similarly, the Bollinger Bands and KST also reflect bearish tendencies on a weekly scale, with moving averages indicating a bearish stance as well. The On-Balance Volume (OBV) presents a bullish signal on a monthly basis, contrasting with the overall bearish indicators. In terms of performance, ITDC's stock return over the past year has been notably ...

Read MoreITDC Faces Mixed Technical Trends Amidst Market Challenges and Long-Term Resilience

2025-03-07 08:01:34India Tourism Development Corporation (ITDC), a small-cap player in the Hotel, Resort & Restaurants industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 576.50, showing a slight increase from the previous close of 570.85. Over the past year, ITDC has faced challenges, with a return of -18.63%, contrasting sharply with a modest gain of 0.34% in the Sensex during the same period. The technical summary indicates a mixed outlook, with various indicators suggesting a cautious stance. The MACD shows bearish signals on a weekly basis, while the monthly perspective leans towards a mildly bearish trend. The Bollinger Bands and KST also reflect similar sentiments, indicating a cautious market environment. However, the On-Balance Volume (OBV) remains bullish on both weekly and monthly scales, suggesting some underlying strength. In terms of ...

Read MoreCertificate Under Regulation 74(5) Of The SEBI (Depositories And Participants) Regulations 2018 For The Quarter Ended 31St March 2025.

09-Apr-2025 | Source : BSEWe are enclosing the Confirmation Certificate received from Kfin Technologies Limited Registrar & share transfer agent of ITDC as per Regulation 74(5) of the SEBI (Depositories and Participants) Regulations 2018 for the quarter ended 31st March 2025

Certificate Under Regulation 74(5) Of The SEBI (Depositories And Participants) Regulations 2018 For The Quarter Ended 31St March 2025.

09-Apr-2025 | Source : BSEWe are enclosing the Confirmation Certificate received from Kfin Technologies Limited Registrar & share transfer agent of ITDC as per Regulation 74(5) of the SEBI (Depositories and Participants) Regulations 2018 for the quarter ended 31st March 2025

Closure of Trading Window

26-Mar-2025 | Source : BSEPlease find enclosed the notice regarding closure of Trading window for Designated Persons under SEBI (PIT) Regulations 2015.

Corporate Actions

No Upcoming Board Meetings

India Tourism Development Corporation Ltd has declared 25% dividend, ex-date: 30 Aug 24

No Splits history available

No Bonus history available

No Rights history available