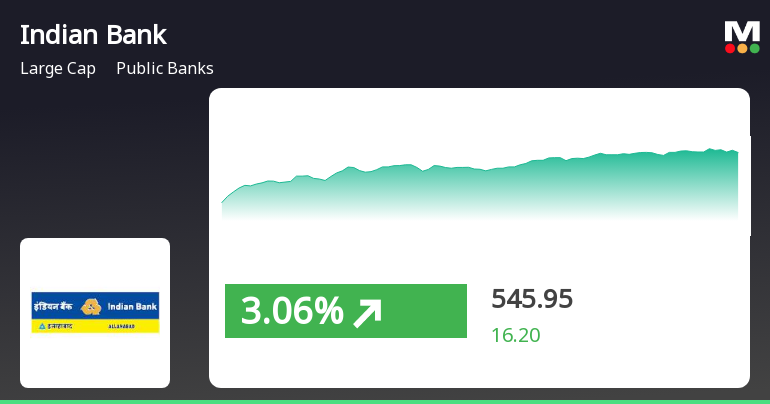

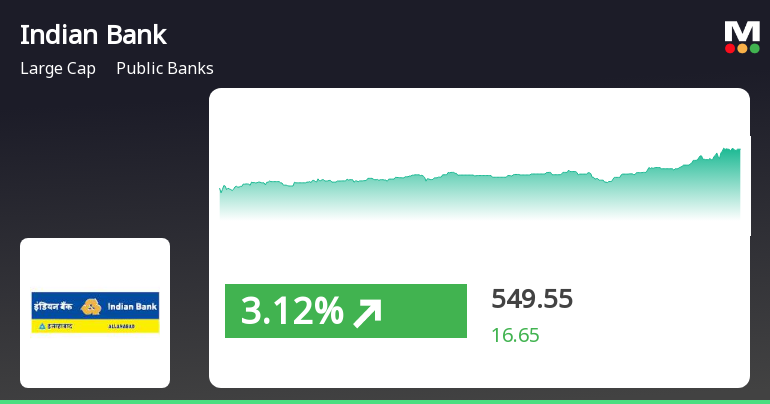

Indian Bank's Stock Rebounds, Signaling Strong Market Position Amid Sector Challenges

2025-04-03 10:35:22Indian Bank has rebounded after three days of decline, outperforming its sector and reaching an intraday high. The stock is trading above key moving averages, reflecting a positive trend. Over the past month, it has significantly outperformed the Sensex, showcasing impressive long-term growth in the public banking sector.

Read MoreIndian Bank's Technical Indicators Show Mixed Signals Amid Market Fluctuations

2025-04-01 08:01:47Indian Bank, a prominent player in the public banking sector, has recently undergone an evaluation revision reflecting its current market dynamics. The bank's stock is currently priced at 542.20, down from a previous close of 550.05. Over the past year, Indian Bank has experienced a stock return of 4.14%, slightly trailing behind the Sensex's return of 5.11%. However, when looking at a longer timeframe, the bank has shown remarkable resilience, with a three-year return of 263.40%, significantly outperforming the Sensex, which recorded a return of 34.42% in the same period. In terms of technical indicators, the bank's weekly MACD suggests a mildly bullish trend, while the monthly outlook indicates a mildly bearish stance. The Bollinger Bands reflect a mildly bullish trend on a weekly basis and a bullish trend monthly, indicating some volatility in price movements. The moving averages present a mildly bearis...

Read MoreSurge in Open Interest for Indian Bank Signals Increased Market Activity and Liquidity

2025-03-28 15:00:21Indian Bank has experienced a significant increase in open interest today, reflecting heightened activity in its trading. The latest open interest stands at 7,393 contracts, up from the previous 6,358 contracts, marking a change of 1,035 contracts or a 16.28% increase. The trading volume for the day reached 6,795 contracts, contributing to a total futures value of approximately Rs 10,503.81 lakhs and an options value of Rs 2,619.52 crores, bringing the total to Rs 11,211.35 lakhs. In terms of price performance, Indian Bank's stock has underperformed its sector by 0.95%, with an intraday low of Rs 538, reflecting a decline of 2.69%. Despite this, the stock is currently trading above its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, indicating a generally positive trend in the longer term. Additionally, the delivery volume has seen a notable rise of 26.77% compared to the 5-day average, sugges...

Read MoreIndian Bank Sees Surge in Open Interest Amid Increased Trading Activity

2025-03-28 14:00:19Indian Bank has experienced a significant increase in open interest today, reflecting heightened activity in its trading. The latest open interest stands at 7,387 contracts, marking a rise of 1,029 contracts or 16.18% from the previous open interest of 6,358. The trading volume for the day reached 5,985 contracts, contributing to a total futures value of approximately Rs 9,039.12 lakhs. In terms of price performance, Indian Bank's stock has underperformed its sector by 1.15%, with an intraday low of Rs 540.05, representing a decline of 2.32%. The stock is currently positioned above its 20-day, 50-day, 100-day, and 200-day moving averages, although it is trading below its 5-day moving average. Notably, the delivery volume has increased by 26.77% compared to the 5-day average, reaching 941,000 shares. With a market capitalization of Rs 74,581 crore, Indian Bank remains a significant player in the public ban...

Read MoreIndian Bank Sees Surge in Open Interest Amid Increased Trading Activity

2025-03-28 13:00:15Indian Bank has experienced a significant increase in open interest today, reflecting heightened trading activity. The latest open interest stands at 7,311 contracts, up from the previous figure of 6,358, marking a change of 953 contracts or a 14.99% increase. The trading volume for the day reached 5,306 contracts, contributing to a futures value of approximately Rs 78.47 crore. In terms of performance, Indian Bank has underperformed its sector by 1.59%, with a one-day return of -1.44%. However, the stock is currently trading above its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, indicating a positive trend in the short to medium term. Notably, delivery volume has seen a rise, with 941,000 shares delivered on March 27, reflecting a 26.77% increase compared to the 5-day average. With a market capitalization of Rs 74,581 crore, Indian Bank remains a significant player in the public banking s...

Read MoreIndian Bank Sees Surge in Open Interest Amid Increased Trading Activity

2025-03-28 12:00:19Indian Bank has experienced a significant increase in open interest (OI) today, reflecting heightened activity in its trading. The latest OI stands at 7,300 contracts, up from the previous OI of 6,358, marking a change of 942 contracts or a 14.82% increase. The trading volume for the day reached 4,214 contracts, indicating robust participation in the market. In terms of financial performance, Indian Bank's stock is currently trading at a price that is higher than its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, suggesting a positive trend in its short to long-term performance metrics. However, it has underperformed its sector by 1.57% today, with a 1-day return of -1.49%, compared to a sector return of -0.01% and a Sensex return of -0.06%. The bank's market capitalization is approximately Rs 73,362.39 crore, classifying it as a large-cap entity within the public banking industry. Notably, ...

Read MoreIndian Bank Sees Surge in Open Interest Amid Increased Trading Activity

2025-03-28 11:00:11Indian Bank has experienced a notable increase in open interest today, signaling heightened activity in its trading. The latest open interest stands at 7,061 contracts, up from the previous 6,358, marking a change of 703 contracts or an 11.06% increase. The trading volume for the day reached 3,225 contracts, contributing to a futures value of approximately Rs 2,895.06 lakhs and an options value of Rs 1,467.60 crore, bringing the total value to Rs 3,346.87 lakhs. In terms of price performance, Indian Bank has underperformed its sector by 0.64%, with a slight decline of 0.03% in its stock price today. The stock has been on a gaining streak for one consecutive day, reflecting a modest return of -0.13% during this period. Notably, Indian Bank is currently trading above its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, indicating a positive trend in its short to long-term performance metrics. Ad...

Read MoreIndian Bank Shows Mixed Technical Trends Amid Strong Long-Term Performance

2025-03-28 08:01:55Indian Bank, a prominent player in the public banking sector, has recently undergone an evaluation revision reflecting its current market dynamics. The bank's stock is currently priced at 550.05, showing a notable increase from the previous close of 542.80. Over the past year, Indian Bank has demonstrated a robust performance, with a stock return of 9.96%, significantly outpacing the Sensex return of 6.32% during the same period. In terms of technical indicators, the bank's weekly MACD suggests a mildly bullish sentiment, while the monthly outlook leans mildly bearish. The Bollinger Bands indicate a bullish trend on both weekly and monthly scales, which may suggest a degree of stability in price movements. However, the daily moving averages reflect a mildly bearish stance, indicating mixed signals in the short term. The bank's performance over various time frames highlights its resilience, particularly in...

Read More

Indian Bank's Strong Performance Highlights Resilience Amid Mixed Market Signals

2025-03-21 15:35:22Indian Bank's stock has shown strong performance, rising significantly on March 21, 2025, and outperforming its sector. The bank has demonstrated a robust upward trend over the past week and is trading above multiple moving averages, reflecting solid short- to long-term performance. Year-to-date, it has also seen notable gains.

Read MoreAnnouncement under Regulation 30 (LODR)-Interest Rates Updates

09-Apr-2025 | Source : BSERevision in Repo Benchmark Rate

Intimation Under SEBI (Listing Obligations And Disclosure Requirements) Regulations 2015

08-Apr-2025 | Source : BSEAmalgamation of Saptagiri Grameena Bank sponsored by Indian Bank into Andhra Pradesh Grameena Bank

Announcement under Regulation 30 (LODR)-Change in Management

05-Apr-2025 | Source : BSEChange in assignments of Senior Managment of the Bank

Corporate Actions

No Upcoming Board Meetings

Indian Bank has declared 120% dividend, ex-date: 07 Jun 24

No Splits history available

No Bonus history available

No Rights history available