Integra Engineering Faces Technical Trend Shifts Amid Market Fluctuations and Consolidation

2025-04-03 08:00:35Integra Engineering India, a microcap player in the textile machinery industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 226.00, showing a slight increase from the previous close of 222.50. Over the past year, Integra has experienced a decline of 8.17%, contrasting with a 3.67% gain in the Sensex, highlighting the challenges faced by the company in a fluctuating market. In terms of technical indicators, the MACD and KST suggest a bearish sentiment on both weekly and monthly scales, while the Bollinger Bands indicate a mildly bearish trend. The moving averages also reflect a mildly bearish stance on a daily basis. Notably, the Relative Strength Index (RSI) shows no significant signals, indicating a period of consolidation. Despite recent challenges, Integra Engineering has demonstrated resilience over longer periods, with a remar...

Read MoreIntegra Engineering Faces Technical Trend Challenges Amidst Volatile Market Conditions

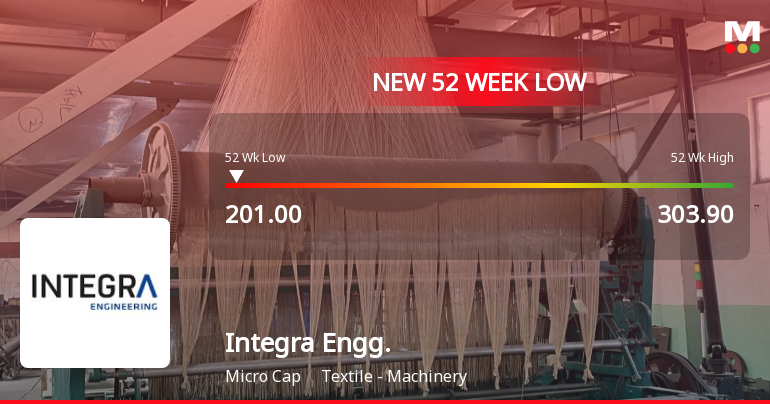

2025-03-25 08:00:40Integra Engineering India, a microcap player in the textile machinery industry, has recently undergone an evaluation revision reflecting its current market dynamics. The company's stock price is currently at 227.70, slightly down from the previous close of 230.30. Over the past year, Integra has experienced a 2.63% decline, contrasting with a 7.07% gain in the Sensex, highlighting a challenging performance relative to broader market trends. The technical summary indicates a bearish sentiment in the weekly MACD and Bollinger Bands, while the monthly indicators show a mildly bearish trend. The moving averages also reflect a mildly bearish stance on a daily basis. Notably, the stock has seen significant fluctuations, with a 52-week high of 303.90 and a low of 201.00, demonstrating volatility in its trading range. In terms of returns, Integra Engineering has shown a remarkable performance over the long term, ...

Read MoreIntegra Engineering Faces Technical Trend Adjustments Amid Strong Historical Performance

2025-03-21 08:00:15Integra Engineering India, a microcap player in the textile machinery industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 231.85, showing a slight increase from the previous close of 231.00. Over the past year, Integra has demonstrated a return of 5.12%, slightly trailing behind the Sensex's return of 5.89%. However, the company has outperformed the Sensex significantly over longer periods, with a remarkable 968.43% return over the last five years compared to the Sensex's 155.21%. In terms of technical indicators, the MACD and KST suggest a bearish sentiment on both weekly and monthly charts, while the Bollinger Bands and moving averages indicate a mildly bearish trend. The Relative Strength Index (RSI) shows no significant signals at this time. The recent performance metrics highlight the company's resilience, particularly in t...

Read More

Integra Engineering Faces Market Volatility Amid Mixed Financial Indicators and Low Mutual Fund Interest

2025-03-17 15:36:48Integra Engineering India, a microcap in the textile machinery sector, has reached a new 52-week low amid a six-day loss streak. Despite this, the company shows mixed financial indicators, including a strong ROCE and low debt to EBITDA ratio, alongside a notable liquidity position and limited mutual fund ownership.

Read More

Integra Engineering India Reports Strong Q4 Results, Signaling Positive Financial Trends

2025-01-31 22:00:44Integra Engineering India has announced its financial results for the quarter ending December 2024, highlighting significant growth in key metrics. Profit Before Tax reached Rs 8.52 crore, net sales hit Rs 46.77 crore, and operating profit improved to Rs 10.07 crore, reflecting enhanced operational efficiency and profitability.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

03-Apr-2025 | Source : BSEConfirmation certificate under Regulation 74(5) of Securities and Exchange Board of India (Depositories and Participants) Regulations 2018 for the quarter ended March 31 2025

Announcement under Regulation 30 (LODR)-Change in Management

29-Mar-2025 | Source : BSECessation of Directorship of Mr. Shalin Divatia (DIN:00749517) and Mr. Rahul Divan (DIN:00001178) due to completion of tenure.

Closure of Trading Window

28-Mar-2025 | Source : BSEClosure of trading window

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available