James Warren Tea Faces Short-Term Challenges Amid Long-Term Growth Resilience

2025-03-27 18:00:31James Warren Tea Ltd., a microcap player in the tea and coffee industry, has experienced notable fluctuations in its stock performance today. The company's market capitalization stands at Rs 95.00 crore, with a price-to-earnings (P/E) ratio of 2.74, significantly lower than the industry average of 75.31. Over the past year, James Warren Tea has shown a performance increase of 20.22%, outperforming the Sensex, which rose by 6.32%. However, recent trends indicate a decline, with the stock down 3.40% today, contrasting with the Sensex's modest gain of 0.41%. In the past week, the stock has decreased by 4.94%, while the Sensex has increased by 1.65%. Looking at longer-term performance, James Warren Tea has faced challenges, with a year-to-date decline of 34.47% compared to the Sensex's slight drop of 0.68%. Despite these recent setbacks, the company has shown resilience over a five-year period, boasting a r...

Read More

James Warren Tea Faces Market Evaluation Shift Amid Mixed Financial Indicators

2025-03-26 08:01:03James Warren Tea, a microcap in the Tea/Coffee sector, has experienced a recent evaluation adjustment reflecting its market position. Despite positive net sales growth over three quarters, the company faces challenges with operating losses and debt management, while maintaining a high return on equity and outperforming market indices.

Read More

James Warren Tea Experiences Shift in Market Sentiment Amid Mixed Financial Indicators

2025-03-20 08:00:22James Warren Tea, a microcap in the Tea/Coffee sector, has recently adjusted its evaluation, indicating a shift in market sentiment. The company reported a 38.5% increase in net sales and consistent profitability over the last three quarters, though it faces challenges with operating losses and debt servicing.

Read More

James Warren Tea Reports Strong Sales Growth Amid Ongoing Financial Challenges

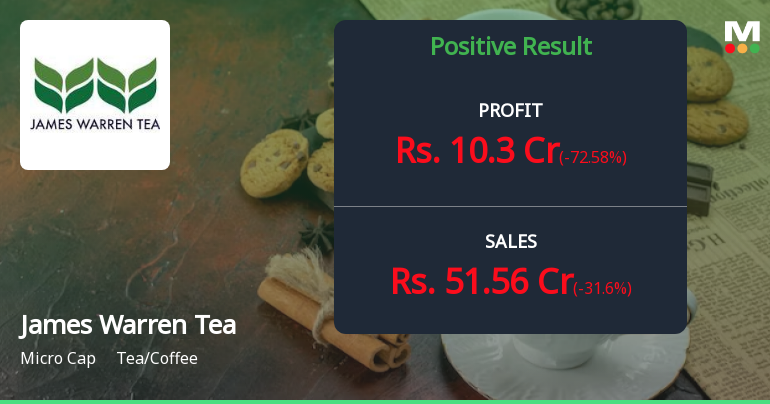

2025-03-11 08:01:47James Warren Tea, a microcap in the Tea/Coffee sector, recently adjusted its evaluation following a strong Q3 FY24-25, with net sales of Rs 51.56 crore, up 38.5%. Despite operating losses and debt servicing concerns, the company has shown consistent quarterly profits and a notable return on equity of 40.3%.

Read More

James Warren Tea Reports Strong Quarterly Growth Amid Long-Term Challenges

2025-03-06 08:00:42James Warren Tea, a microcap in the tea and coffee sector, has adjusted its evaluation following positive financial results over the last three quarters, including a profit after tax of Rs 33.07 crore. However, long-term growth challenges and debt management concerns persist, despite an attractive valuation profile.

Read More

James Warren Tea Reports Strong Sales Growth Amid Ongoing Financial Challenges

2025-02-28 18:21:12James Warren Tea, a microcap in the Tea/Coffee sector, has reported a strong third-quarter performance for FY24-25, with net sales of Rs 51.56 crore, up 38.5% from the previous average. However, the company faces challenges, including operating losses and a scrutinized debt servicing capability.

Read More

James Warren Tea Reports Strong Sales Growth Amid Declining Profitability in December 2024 Results

2025-02-17 17:52:28James Warren Tea has reported its financial results for the quarter ending December 2024, revealing net sales of Rs 51.56 crore, a 38.5% increase from previous quarters. However, the company faced challenges with a profit before tax of Rs -2.50 crore and a profit after tax of Rs -4.49 crore, indicating a complex financial situation.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

09-Apr-2025 | Source : BSECertificate under Regulation 74(5) of SEBI (DP) Regulations 2018

Announcement Under Regulation 30 Of SEBO (LODR) Regulations 2015- Disclosure By Larger Entities.

09-Apr-2025 | Source : BSEDisclosure by Larger Corporate Entities as on 31st March 2025.

Closure of Trading Window

22-Mar-2025 | Source : BSENotice for Closure of Trading Window

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available