Jay Ushin's Valuation Adjustment Highlights Competitive Position in Auto Ancillary Sector

2025-03-19 08:00:31Jay Ushin, a microcap player in the auto ancillary sector, has recently undergone a valuation adjustment, reflecting its current financial standing. The company's price-to-earnings ratio stands at 18.96, while its price-to-book value is recorded at 2.12. Key performance indicators such as the EV to EBITDA ratio are at 12.11, and the EV to sales ratio is notably low at 0.47. The company also boasts a return on equity of 11.20% and a return on capital employed of 6.60%. In comparison to its peers, Jay Ushin's valuation metrics present a mixed picture. While it maintains an attractive valuation, competitors like The Hi-Tech Gear and Rico Auto Industries also show strong performance indicators, albeit with higher price-to-earnings ratios. Conversely, companies such as Sar Auto Products and Enkei Wheels exhibit significantly higher valuations, indicating a disparity in market positioning within the industry. O...

Read MoreJay Ushin Adjusts Valuation Grade Amidst Competitive Auto Ancillary Landscape

2025-03-13 08:00:30Jay Ushin, a microcap player in the auto ancillary sector, has recently undergone a valuation adjustment. The company's current price stands at 628.00, reflecting a notable increase from the previous close of 560.15. Over the past year, Jay Ushin has experienced a stock return of -10.40%, contrasting with a slight gain of 0.49% in the Sensex. Key financial metrics for Jay Ushin include a PE ratio of 18.99 and an EV to EBITDA ratio of 12.12, which positions it within a competitive landscape. The company also reports a return on equity (ROE) of 11.20% and a return on capital employed (ROCE) of 6.60%. In comparison to its peers, Jay Ushin's valuation metrics indicate a more favorable position relative to companies like Z F Steering and Enkei Wheels, which are classified at higher valuation levels. Meanwhile, Rane (Madras) and RACL Geartech share a similar valuation status, highlighting the diverse financial...

Read MoreJay Ushin Adjusts Valuation Grade Amidst Competitive Auto Ancillary Landscape

2025-03-13 08:00:30Jay Ushin, a microcap player in the auto ancillary sector, has recently undergone a valuation adjustment. The company's current price stands at 628.00, reflecting a notable increase from the previous close of 560.15. Over the past year, Jay Ushin has experienced a stock return of -10.40%, contrasting with a slight gain of 0.49% in the Sensex. Key financial metrics for Jay Ushin include a PE ratio of 18.99 and an EV to EBITDA ratio of 12.12, which positions it within a competitive landscape. The company also reports a return on equity (ROE) of 11.20% and a return on capital employed (ROCE) of 6.60%. In comparison to its peers, Jay Ushin's valuation metrics indicate a more favorable position relative to companies like Z F Steering and Enkei Wheels, which are classified at higher valuation levels. Meanwhile, Rane (Madras) and RACL Geartech share a similar valuation status, highlighting the diverse financial...

Read MoreJay Ushin Adjusts Valuation Amidst Challenging Auto Ancillary Market Dynamics

2025-03-05 08:00:35Jay Ushin, a microcap player in the auto ancillary sector, has recently undergone a valuation adjustment. The company's current price stands at 610.00, reflecting a notable shift from its previous close of 565.00. Over the past year, Jay Ushin has experienced a stock return of -15.75%, contrasting with a modest -1.19% return from the Sensex, indicating a challenging performance relative to the broader market. Key financial metrics for Jay Ushin include a price-to-earnings (PE) ratio of 18.45 and an EV to EBITDA ratio of 11.90. The company also reports a return on equity (ROE) of 11.20% and a return on capital employed (ROCE) of 6.60%. In comparison to its peers, Jay Ushin's valuation metrics present a mixed picture. For instance, while Rane (Madras) is loss-making, Sar Auto Products shows a significantly high PE ratio, suggesting a more volatile position in the market. Meanwhile, companies like Rico Auto I...

Read More

Jay Ushin Faces Significant Volatility Amidst Declining Performance in Auto Ancillary Sector

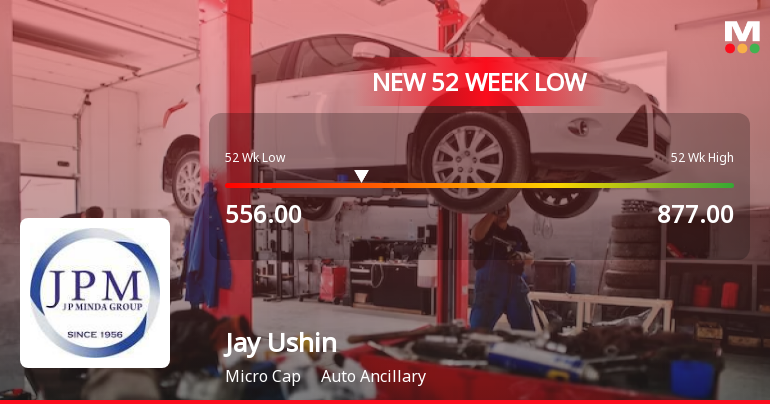

2025-03-03 14:20:45Jay Ushin, a microcap in the auto ancillary sector, has faced notable volatility, hitting a new 52-week low. The stock has declined significantly over the past two days and is currently below all major moving averages, reflecting a sustained downward trend compared to the broader market.

Read More

Jay Ushin Reports Record Sales Amid Rising Interest Expenses and Profit Concerns in February 2025

2025-02-14 18:50:42Jay Ushin has reported its financial results for the quarter ending December 2024, revealing record quarterly net sales of Rs 218.51 crore, indicating consistent growth. However, rising interest expenses and a high proportion of non-operating income raise concerns about the company's financial stability and business model sustainability.

Read More

Jay Ushin Hits 52-Week Low Amid Broader Challenges in Auto Ancillary Sector

2025-02-14 14:05:39Jay Ushin, a microcap in the auto ancillary sector, has reached a new 52-week low, reversing a two-day gain with a notable intraday decline. Over the past year, the stock has struggled, significantly underperforming against the Sensex, while the broader sector also faces challenges.

Read More

Jay Ushin Faces Continued Volatility Amid Broader Market Gains in October 2023

2025-02-12 11:05:17Jay Ushin, a microcap in the auto ancillary sector, reached a new 52-week low today, continuing a downward trend with a notable decline over the past two days. Despite recent challenges, the stock outperformed its sector today, though it remains significantly lower over the past year compared to the Sensex.

Read MoreClosure of Trading Window

04-Apr-2025 | Source : BSEPursuant to the internal code of conduct for prevention of insider trading framed by the Company under SEBI (Prohibition of Insider Trading ) Regulations 2015 (as amended) the trading window of the Company shall remain closed for all designated persons and their immediate relatives from April 1 2025 till 48 hours after declaration of financial results to the stock exchange for the quarter ending March 31 2025

Announcement under Regulation 30 (LODR)-Newspaper Publication

15-Feb-2025 | Source : BSEPursuant to the Regulation 30 of SEBI (Listing Obligation and Disclosure Requirement) Regulations 2015 we are enclosing herewith copy of advertisement for unaudited Financial Results for the quarter ended December 31 2024 published in Financial Express (English Newspaper) and Jansatta (Hindi Newspaper) on February 15 2025

Board Meeting Outcome for Outcome Of Board Meeting Held On 14-02-2025

14-Feb-2025 | Source : BSEThe Board of Directors of the Company in its Meeting held on February 14 2025 has approved the Un-audited Financial Results for the Quarter ended on December 31 2024 has been approved by the Board of Directors. A Copy of above results along with Limited Review report is enclosed.

Corporate Actions

No Upcoming Board Meetings

Jay Ushin Ltd has declared 30% dividend, ex-date: 20 Sep 24

No Splits history available

No Bonus history available

No Rights history available