JM Financial's Technical Indicators Show Mixed Signals Amid Market Evaluation Revision

2025-03-25 08:00:37JM Financial, a midcap player in the Finance/NBFC sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 98.21, showing a slight increase from the previous close of 97.64. Over the past year, JM Financial has demonstrated a notable return of 32.47%, significantly outperforming the Sensex, which recorded a return of 7.07% in the same period. In terms of technical indicators, the weekly MACD remains bearish, while the monthly perspective shows a mildly bearish trend. The Relative Strength Index (RSI) indicates no signal for both weekly and monthly assessments. Bollinger Bands also reflect a mildly bearish stance on a monthly basis. Moving averages present a bearish outlook on a daily basis, while the KST shows a contrasting bullish trend on a monthly scale. The company's performance over various time frames reveals a mixed picture. Whil...

Read More

JM Financial Adjusts Evaluation Amid Mixed Performance and Institutional Confidence

2025-03-25 08:00:13JM Financial has recently adjusted its evaluation, reflecting changes in the stock's technical landscape. Over the past year, the company achieved a return of 32.47%, outperforming the broader market. However, recent quarterly results show a decline in operating profit, profit before tax, and net sales, indicating underlying pressures.

Read More

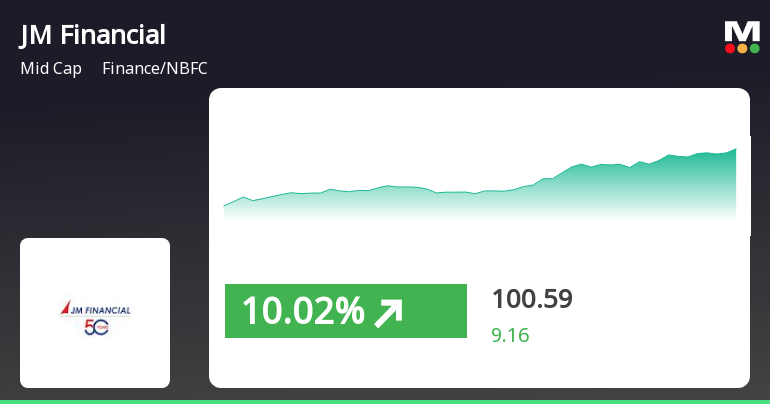

JM Financial Shows Strong Short-Term Gains Amid Broader Market Resilience

2025-03-21 10:00:16JM Financial saw a significant rise on March 21, 2025, outperforming its sector. The stock reached an intraday high and is positioned above its short-term moving averages. Despite recent challenges, it has shown positive performance over the past week and year, while facing year-to-date and quarterly declines.

Read More

JM Financial Faces Significant Stock Decline Amid Broader Market Trends and Performance Challenges

2025-03-17 13:30:14JM Financial's stock has seen a notable decline, underperforming the sector average. Currently trading below key moving averages, the stock has dropped significantly over the past week and month. While it has shown some positive performance over the past year, its longer-term growth lags behind the broader market.

Read More

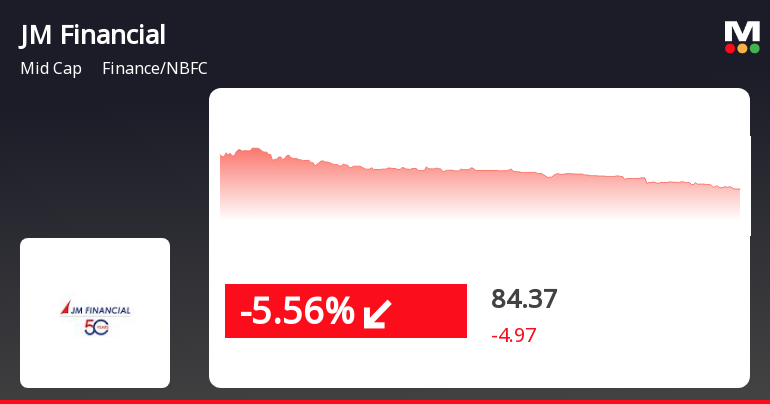

JM Financial Faces Significant Stock Decline Amid Broader Market Trends and Sector Underperformance

2025-03-10 10:45:13JM Financial, a midcap finance and NBFC player, saw a notable decline on March 10, 2025, underperforming its sector. The stock is trading below key moving averages and has experienced significant drops over the past month and three months, despite a modest weekly gain and a yearly increase.

Read More

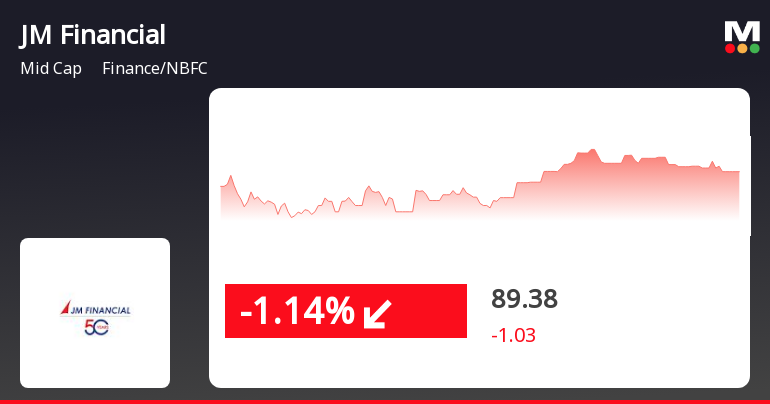

JM Financial Shows Strong Short-Term Gains Amid Mixed Market Trends

2025-03-05 15:00:15JM Financial has seen a significant rise, outperforming its sector and achieving consecutive gains over two days. The stock's price is currently above its 5-day moving average but below longer-term averages. Meanwhile, the broader market, led by small-cap stocks, has also experienced notable gains.

Read More

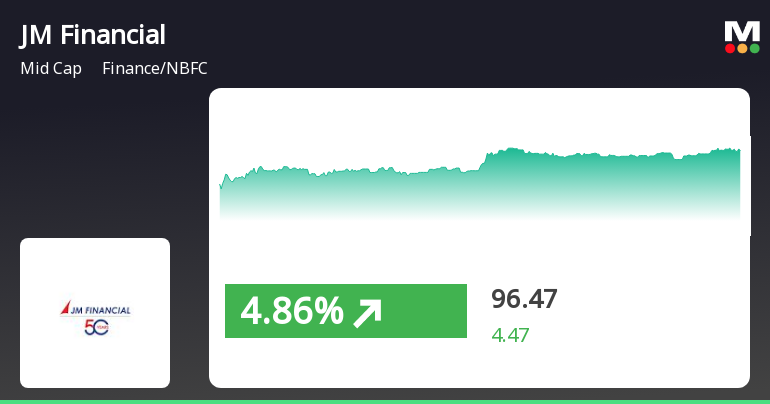

JM Financial Faces Decline in Key Financial Metrics Amid Market Sentiment Shift

2025-03-03 18:30:13JM Financial has recently experienced a change in evaluation, reflecting its current market position amid declining financial metrics in Q3 FY24-25. Key indicators such as operating profit, profit before tax, and profit after tax have all decreased, while net sales also showed a reduction. Despite these challenges, the company maintains a solid return on equity and high institutional holdings.

Read MoreJM Financial Faces Stock Volatility Amid Broader Market Trends and Technical Indicators

2025-03-03 10:28:10JM Financial Ltd, a mid-cap player in the Finance/NBFC sector, has experienced significant stock activity today, reflecting broader market trends. With a market capitalization of Rs 8,495.80 crore, the company currently holds a price-to-earnings (P/E) ratio of 7.15, notably lower than the industry average of 20.24. Over the past year, JM Financial has seen a decline of 10.31%, contrasting with the Sensex's drop of just 1.19%. The stock's performance has been particularly challenging in recent weeks, with a 12.21% decrease over the last month, compared to the Sensex's 2.05% decline. Year-to-date, JM Financial's stock is down 31.36%, while the Sensex has fallen 6.67%. Technical indicators suggest a bearish outlook in the short term, with moving averages and Bollinger Bands reflecting negative trends. However, the three-year performance shows a gain of 35.81%, outpacing the Sensex's 32.35% increase during th...

Read MoreJM Financial Faces Mixed Technical Trends Amid Broader Market Challenges

2025-03-03 08:00:50JM Financial, a midcap player in the Finance/NBFC sector, has recently undergone an evaluation revision reflecting shifts in its technical indicators. The stock is currently priced at 92.05, down from a previous close of 95.75, with a notable 52-week high of 168.85 and a low of 69.00. Today's trading saw a high of 95.50 and a low of 91.80. The technical summary indicates a mixed performance across various metrics. The MACD shows bearish signals on a weekly basis while remaining bullish monthly. Bollinger Bands and moving averages are both indicating bearish trends, suggesting some caution in the short term. The KST presents a similar divergence, being bearish weekly but bullish monthly. Meanwhile, the On-Balance Volume (OBV) reflects a mildly bullish stance over both weekly and monthly periods. In terms of returns, JM Financial has faced challenges compared to the Sensex. Over the past week, the stock has...

Read MoreAnnouncement under Regulation 30 (LODR)-Change in Directorate

30-Mar-2025 | Source : BSEPlease find enclosed intimation under Regulation 30 of SEBI LODR. We wish to inform you that Ms. Jagi Mangat Panda (DIN: 00304690) has ceased to be an Independent Director of the Company with effect from close of business hours on March 30 2025 upon completion of her second term.

Announcement under Regulation 30 (LODR)-Acquisition

29-Mar-2025 | Source : BSEPlease find enclosed disclosure under Regulation 30 of SEBI LODR

Closure of Trading Window

26-Mar-2025 | Source : BSEPlease find enclosed intimation of closure of trading window

Corporate Actions

No Upcoming Board Meetings

JM Financial Ltd has declared 200% dividend, ex-date: 07 Jun 24

JM Financial Ltd has announced 1:10 stock split, ex-date: 08 Sep 08

JM Financial Ltd has announced 3:2 bonus issue, ex-date: 08 Sep 08

No Rights history available