K E C International Faces Continued Stock Decline Amid Broader Market Resilience

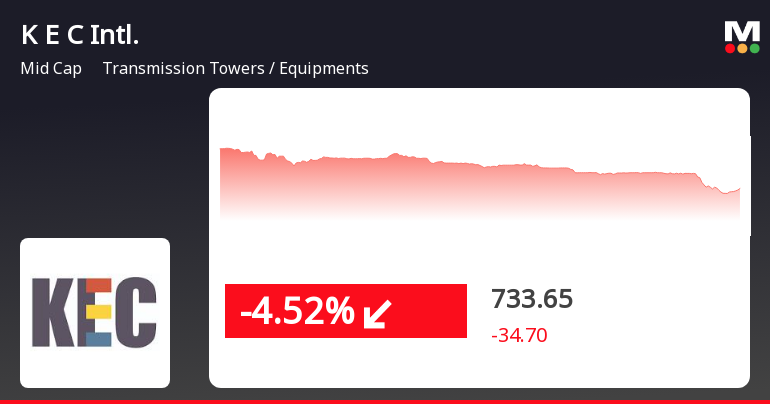

2025-04-03 13:20:20K E C International's stock has declined for two consecutive days, dropping 5.16% today and totaling a 6.95% decrease over this period. The stock is trading below multiple moving averages, indicating a difficult market position, while the broader Sensex has shown some resilience despite its own losses.

Read MoreK E C International Faces Bearish Technical Trends Amid Mixed Performance Indicators

2025-04-03 08:03:10K E C International, a prominent player in the Transmission Towers and Equipment industry, has recently undergone an evaluation revision reflecting its current market dynamics. The company's stock price is currently at 768.35, down from the previous close of 789.05, with a notable 52-week high of 1,312.00 and a low of 648.45. Today's trading saw a high of 805.25 and a low of 764.15. In terms of technical indicators, the weekly MACD and Bollinger Bands are signaling bearish trends, while the monthly indicators show a mildly bearish stance. The daily moving averages also reflect a bearish sentiment. Notably, the KST indicates a bearish trend on a weekly basis, while both the weekly and monthly RSI show no signals. The Dow Theory and OBV metrics indicate no discernible trends at this time. When comparing the company's performance to the Sensex, K E C International has shown a mixed return profile. Over the p...

Read MoreK E C International Shows Mixed Technical Trends Amid Strong Long-Term Performance

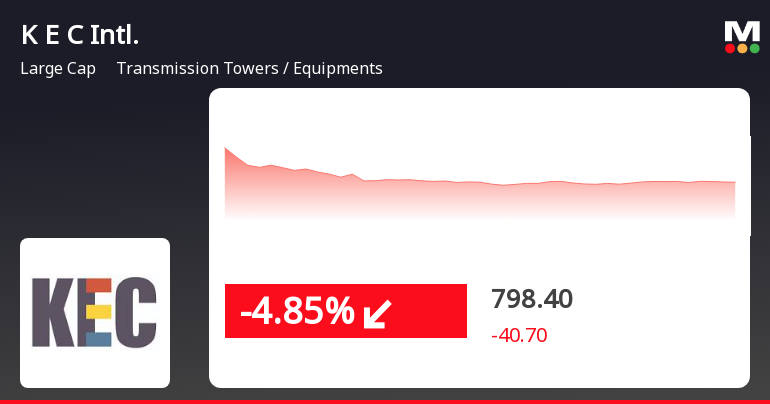

2025-03-28 08:01:46K E C International, a prominent player in the Transmission Towers and Equipment industry, has recently undergone an evaluation revision reflecting its current market dynamics. The company's stock is currently priced at 798.65, showing a notable increase from the previous close of 760.35. Over the past year, K E C International has experienced a stock return of 17.60%, outperforming the Sensex, which recorded a return of 6.32% in the same period. In terms of technical indicators, the MACD shows a bearish trend on a weekly basis, while the monthly perspective indicates a mildly bearish stance. The Relative Strength Index (RSI) currently presents no signals for both weekly and monthly evaluations. Bollinger Bands also reflect a bearish trend on a weekly basis, transitioning to mildly bearish on a monthly scale. The daily moving averages suggest a mildly bearish outlook, while the KST indicates a bearish tren...

Read More

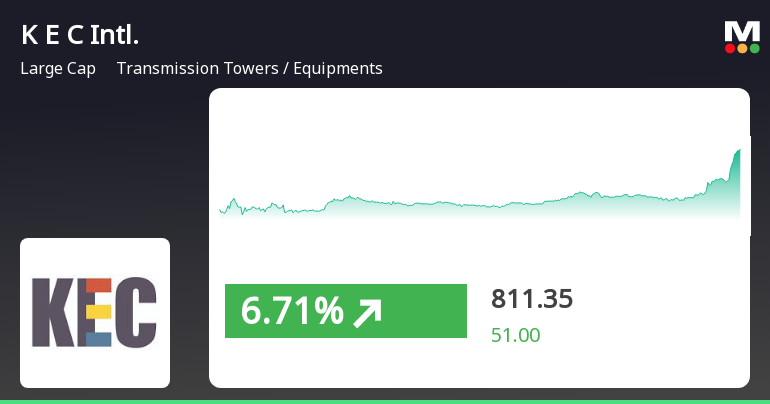

K E C International Shows Signs of Trend Reversal Amid Broader Market Recovery

2025-03-27 15:15:22K E C International has experienced a notable uptick today, reversing a three-day decline. The stock's current price is above its 20-day moving average but below several longer-term averages, indicating mixed short-term signals. Over the past year, it has seen a 15.45% increase, despite a year-to-date decline.

Read More

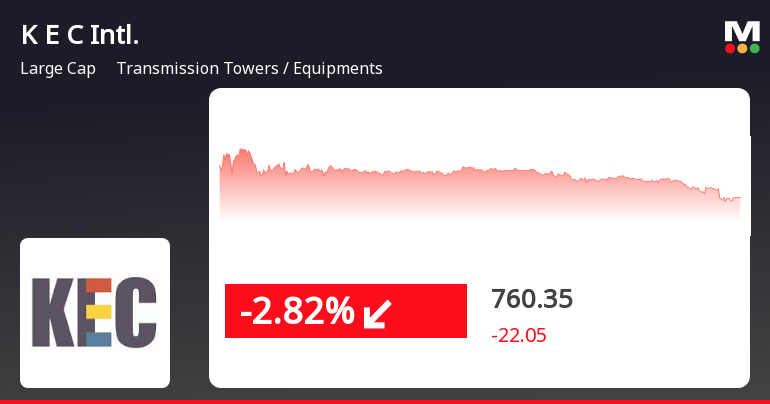

K E C International Faces Continued Stock Decline Amid Broader Market Fluctuations

2025-03-26 15:35:18K E C International has faced a decline in its stock performance, marking its third consecutive day of losses. The stock is currently positioned above its 20-day moving average but below several longer-term averages. In contrast, the broader market has shown resilience despite recent fluctuations.

Read MoreK E C International Faces Bearish Technical Trends Amid Mixed Market Signals

2025-03-26 08:02:17K E C International, a prominent player in the Transmission Towers and Equipment industry, has recently undergone an evaluation revision reflecting its current market dynamics. The company's stock is currently priced at 782.40, down from a previous close of 800.70, with a notable 52-week high of 1,312.00 and a low of 648.45. Today's trading saw a high of 813.00 and a low of 778.00. In terms of technical indicators, the weekly MACD and Bollinger Bands suggest a bearish sentiment, while the monthly indicators show a mildly bearish trend. The daily moving averages also reflect a bearish stance. The KST presents a mixed picture with a bearish weekly outlook but a bullish monthly perspective. Overall, the technical summary indicates a cautious market environment for K E C International. When comparing the company's performance to the Sensex, K E C International has shown varied returns over different periods. ...

Read More

K E C International Faces Potential Trend Reversal Amid Recent Stock Decline

2025-03-24 09:35:18K E C International, a key player in the transmission sector, saw a decline on March 24, 2025, following a five-day gain streak. Despite this drop, the company has shown strong long-term performance, with significant increases over the past five and ten years, while recently outperforming the broader market.

Read More

K E C International Shows Strong Performance Amid Mixed Market Trends

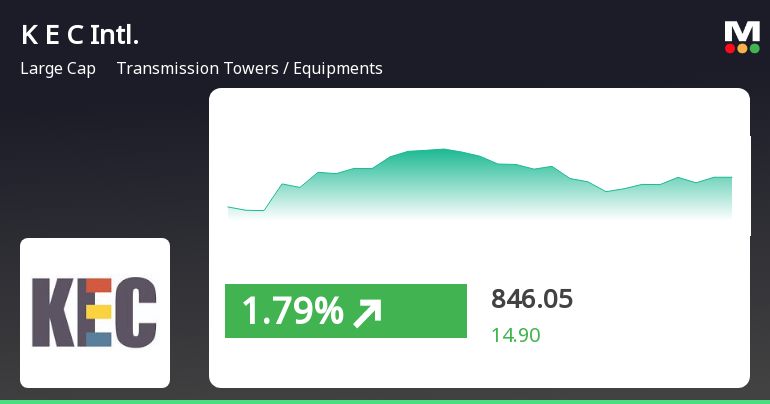

2025-03-21 09:35:18K E C International has demonstrated strong performance, achieving consecutive gains over five days and a notable return. The stock is currently above its short-term moving averages, indicating a mixed trend. Meanwhile, the broader market shows a slight decline, with small-cap stocks leading gains.

Read MoreK E C International Adjusts Valuation Amid Strong Market Performance and Competitive Metrics

2025-03-21 08:00:21K E C International, a prominent player in the Transmission Towers and Equipment industry, has recently undergone a valuation adjustment. The company's current price stands at 831.15, reflecting a notable increase from the previous close of 767.45. Over the past year, K E C International has demonstrated a stock return of 27.07%, significantly outperforming the Sensex, which recorded a return of 5.89% in the same period. Key financial metrics for K E C International include a PE ratio of 48.70 and an EV to EBITDA ratio of 19.16, indicating a robust market position. The company's return on capital employed (ROCE) is reported at 12.40%, while the return on equity (ROE) stands at 8.34%. Additionally, the PEG ratio is noted at 0.76, suggesting a favorable growth outlook relative to its earnings. In comparison to its peers, K E C International's valuation metrics highlight a competitive stance within the indus...

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

04-Apr-2025 | Source : BSEWe are enclosing herewith certificate dated April 03 2025 issued by MUFG Intime India Private Limited our Registrar and Transfer Agents confirming compliance under Regulation 74(5) of the SEBI (Depositories and Participants) Regulations 2018.

Announcement under Regulation 30 (LODR)-Press Release / Media Release

01-Apr-2025 | Source : BSEWe are pleased to enclose a copy of the press release with respect to new orders of Rs. 1236 crores secured by the Company. All the orders mentioned in the enclosed press release have been received in the normal course of business.

Announcement under Regulation 30 (LODR)-Change in Management

31-Mar-2025 | Source : BSEIntimation on superannuation of Senior Management Personnel is enclosed herewith.

Corporate Actions

No Upcoming Board Meetings

K E C International Ltd has declared 200% dividend, ex-date: 09 Aug 24

K E C International Ltd has announced 2:10 stock split, ex-date: 30 Dec 10

No Bonus history available

No Rights history available