Karur Vysya Bank Adjusts Evaluation Amid Strong Financial Performance and Cautious Outlook

2025-03-26 08:00:16Karur Vysya Bank has recently experienced a change in its evaluation, reflecting a shift in the technical landscape. The bank's strong financial metrics include a low Gross NPA ratio of 0.83% and a Capital Adequacy Ratio of 15.42%. It has also reported significant net profit growth and consistent positive stock performance.

Read MoreKarur Vysya Bank Shows Mixed Technical Trends Amid Strong Long-Term Performance

2025-03-25 08:00:12Karur Vysya Bank, a midcap player in the private banking sector, has recently undergone an evaluation revision reflecting its current market dynamics. The bank's stock is currently priced at 209.30, showing a slight increase from the previous close of 208.75. Over the past year, the bank has demonstrated a notable return of 14.78%, significantly outperforming the Sensex, which recorded a return of 7.07% in the same period. In terms of technical indicators, the bank's MACD shows a bearish trend on a weekly basis, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) indicates no significant signals for both weekly and monthly assessments. Bollinger Bands present a mildly bearish trend weekly, contrasting with a bullish stance monthly. Moving averages reflect a bearish sentiment on a daily basis, while the KST aligns with a bearish trend weekly and mildly bearish monthly. Karur Vysy...

Read More

Karur Vysya Bank Adjusts Valuation Amid Shifting Technical Indicators and Strong Performance

2025-03-21 08:00:13Karur Vysya Bank has recently adjusted its evaluation, reflecting changes in financial metrics and market position. The bank's technical indicators suggest a cautious outlook, while its valuation has shifted to a fair assessment. Despite this, it has shown consistent performance and strong lending practices over the past year.

Read MoreKarur Vysya Bank Shows Mixed Technical Trends Amid Strong Long-Term Performance

2025-03-21 08:00:03Karur Vysya Bank, a midcap player in the private banking sector, has recently undergone an evaluation revision reflecting its current market dynamics. The bank's stock price is currently at 204.55, showing a notable increase from the previous close of 201.15. Over the past year, the stock has reached a high of 246.15 and a low of 165.15, indicating a degree of volatility. In terms of technical indicators, the bank's performance is characterized by a bearish sentiment in the weekly MACD and KST metrics, while the monthly indicators show a mildly bearish trend. The moving averages also reflect a bearish stance on a daily basis. Notably, the Bollinger Bands present a mixed picture, with a mildly bearish outlook weekly and a bullish trend monthly. When comparing the bank's returns to the Sensex, Karur Vysya Bank has demonstrated strong performance over longer periods. Over the last three years, the stock has ...

Read MoreKarur Vysya Bank Faces Mixed Technical Trends Amid Strong Long-Term Performance

2025-03-20 08:00:08Karur Vysya Bank, a midcap player in the private banking sector, has recently undergone an evaluation revision reflecting its current market dynamics. The bank's stock is currently priced at 201.15, showing a slight increase from the previous close of 200.05. Over the past year, the bank has demonstrated a notable return of 15.01%, significantly outperforming the Sensex, which returned 4.77% in the same period. In terms of technical indicators, the bank's MACD signals a bearish trend on a weekly basis, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) shows no significant signals for both weekly and monthly periods. Bollinger Bands indicate a mildly bearish trend weekly, contrasting with a bullish stance monthly. The moving averages reflect a bearish sentiment on a daily basis, while the KST and OBV metrics also suggest a bearish trend in the short term. Karur Vysya Bank's per...

Read MoreKarur Vysya Bank Demonstrates Resilience Amidst Market Fluctuations and Competitive Pressures

2025-03-19 18:00:11Karur Vysya Bank, a mid-cap player in the private banking sector, has shown notable activity today, reflecting its ongoing market dynamics. The bank's market capitalization stands at Rs 16,103.00 crore. Over the past year, Karur Vysya Bank has outperformed the Sensex, delivering a return of 15.01% compared to the Sensex's 4.77%. In terms of daily performance, the stock has increased by 0.55%, while the Sensex has risen by 0.20%. The bank's performance over the past week also shows strength, with a 4.30% gain against the Sensex's 1.92%. However, the one-month and three-month metrics indicate some challenges, with declines of 6.68% and 12.12%, respectively, contrasting with the Sensex's smaller losses. Longer-term performance highlights a significant growth trajectory, with a remarkable 329.35% increase over three years and an impressive 614.56% rise over five years. Despite recent fluctuations, Karur Vysy...

Read MoreKarur Vysya Bank Adjusts Valuation Grade Amid Competitive Financial Landscape

2025-03-19 08:00:05Karur Vysya Bank has recently undergone a valuation adjustment, reflecting shifts in its financial metrics and market position. The bank's current price stands at 200.05, with a notable 52-week high of 246.15 and a low of 165.15. In terms of key performance indicators, the bank reports a price-to-earnings (PE) ratio of 8.55 and a price-to-book value of 1.48. The PEG ratio is recorded at 0.32, while the dividend yield is at 1.20%. Return on equity (ROE) is reported at 17.29%, and return on assets (ROA) is at 1.76%. The net non-performing assets (NPA) to book value ratio stands at 1.53, indicating the bank's asset quality. When compared to its peers, Karur Vysya Bank's valuation metrics show a competitive landscape. For instance, City Union Bank has a PE ratio of 10.6, while RBL Bank and Ujjivan Small Finance Bank exhibit stronger valuation grades. Over the past year, Karur Vysya Bank has delivered a retu...

Read MoreKarur Vysya Bank Faces Mixed Technical Trends Amid Market Volatility

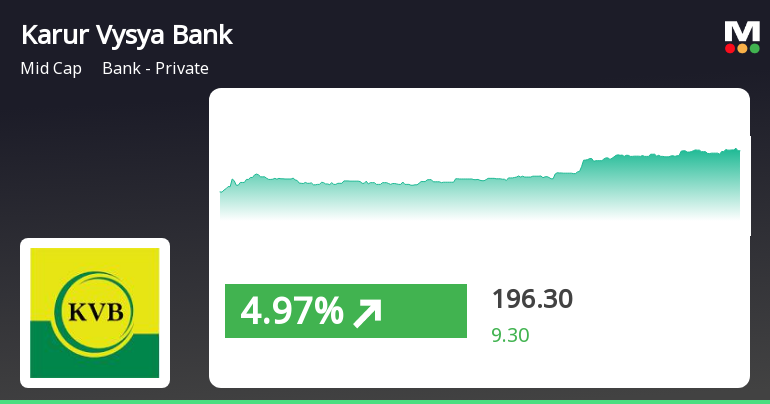

2025-03-18 08:00:10Karur Vysya Bank, a midcap player in the private banking sector, has recently undergone an evaluation revision reflecting its current market dynamics. The bank's stock price is currently at 197.15, showing a notable increase from the previous close of 187.00. Over the past year, the stock has reached a high of 246.15 and a low of 165.15, indicating a degree of volatility. In terms of technical indicators, the bank's MACD shows a bearish trend on a weekly basis, while the monthly perspective is mildly bearish. The Relative Strength Index (RSI) indicates no significant signals for both weekly and monthly evaluations. Bollinger Bands present a mildly bearish outlook weekly, contrasting with a mildly bullish stance monthly. Daily moving averages suggest a mildly bullish trend, while the KST reflects bearish conditions weekly and mildly bearish monthly. When comparing the bank's performance to the Sensex, it h...

Read More

Karur Vysya Bank's Recent Gains Signal Possible Trend Reversal Amid Market Challenges

2025-03-17 13:30:15Karur Vysya Bank experienced a notable increase on March 17, 2025, following a series of declines, suggesting a potential trend reversal. Despite this uptick, the stock remains below key moving averages and has seen a decline over the past week and month, although it has gained year-over-year.

Read MoreDisclosure under Regulation 30 of SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015

02-Apr-2025 | Source : BSEKarur Vysya Bank Ltd has informed BSE about Disclosure under Regulation 30 of SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015.

Intimation regarding the Superannuation of Senior Management Personnel

01-Apr-2025 | Source : BSEKarur Vysya Bank Ltd has informed BSE regarding Intimation regarding the Superannuation of Senior Management Personnel.

Intimation under SEBI (LODR) Regulation 2015 read with Prohibition of Insider Trading Regulations 2015

01-Apr-2025 | Source : BSEKarur Vysya Bank Ltd has informed BSE regarding Intimation under SEBI (Listing Obligations and Disclosure Requirements)

Regulation 2015 read with Prohibition of Insider Trading Regulations 2015.

Corporate Actions

No Upcoming Board Meetings

Karur Vysya Bank Ltd. has declared 120% dividend, ex-date: 01 Aug 24

Karur Vysya Bank Ltd. has announced 2:10 stock split, ex-date: 17 Nov 16

Karur Vysya Bank Ltd. has announced 1:10 bonus issue, ex-date: 14 Aug 18

Karur Vysya Bank Ltd. has announced 1:6 rights issue, ex-date: 12 Oct 17