Khadim India Faces Mixed Technical Trends Amid Market Evaluation Revision

2025-04-02 08:09:13Khadim India, a microcap player in the consumer durables sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 304.30, showing a notable increase from the previous close of 285.75. Over the past year, Khadim India has experienced a decline of 5.17%, contrasting with a 2.72% gain in the Sensex, indicating a challenging performance relative to the broader market. The technical summary reveals a bearish sentiment in the weekly MACD and KST indicators, while the monthly metrics show a mildly bearish trend. The Relative Strength Index (RSI) presents no signal on a weekly basis but indicates bullishness monthly. Moving averages are currently bearish, suggesting a cautious outlook in the short term. In terms of returns, Khadim India has shown a mixed performance. While it has delivered a 32.3% return over three years and an impressive 278.0...

Read MoreKhadim India Faces Mixed Technical Trends Amid Market Evaluation Revision

2025-03-28 08:03:48Khadim India, a microcap player in the consumer durables sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 291.00, slightly down from its previous close of 293.80. Over the past year, Khadim India has experienced a decline of 5.12%, contrasting with a 6.32% gain in the Sensex, indicating a challenging performance relative to the broader market. The technical summary reveals a mixed outlook, with various indicators showing bearish tendencies on both weekly and monthly scales. The MACD and Bollinger Bands suggest a bearish stance, while the Dow Theory indicates a mildly bullish trend on a weekly basis. Notably, the On-Balance Volume (OBV) metrics are bullish for both weekly and monthly periods, suggesting some underlying strength in trading volume. In terms of price movement, Khadim India has seen a 52-week high of 445.00 and a low...

Read MoreKhadim India Faces Bearish Technical Trends Amid Market Volatility and Declining Performance

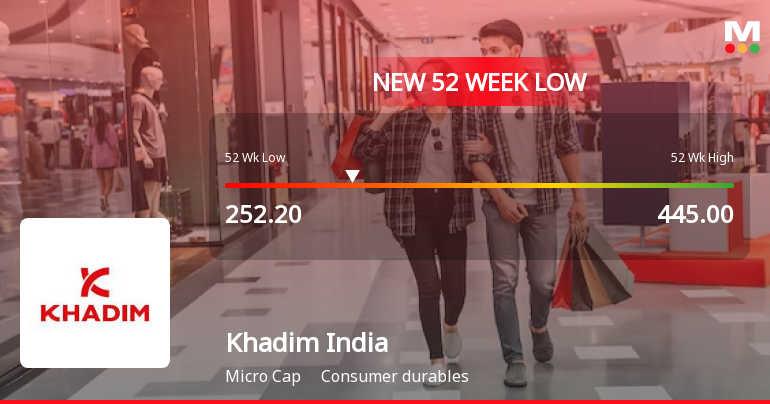

2025-03-27 08:03:42Khadim India, a microcap player in the consumer durables sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 293.80, down from a previous close of 315.00, with a notable 52-week high of 445.00 and a low of 252.20. Today's trading saw a high of 311.75 and a low of 291.00, indicating some volatility. The technical summary for Khadim India reveals a bearish sentiment across various indicators. The MACD shows a bearish trend on a weekly basis, while the monthly perspective is mildly bearish. Similarly, the Bollinger Bands and KST also reflect bearish tendencies in the weekly analysis. The moving averages indicate a bearish outlook, further corroborating the overall technical assessment. In terms of performance, Khadim India has faced challenges compared to the Sensex. Over the past week, the stock has returned -7.01%, while the Sensex ...

Read MoreKhadim India Faces Technical Trend Challenges Amidst Long-Term Resilience in Consumer Durables

2025-03-21 08:02:54Khadim India, a microcap player in the consumer durables sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 316.45, showing a slight increase from the previous close of 315.95. Over the past year, Khadim India has experienced a stock return of 3.16%, while the Sensex has returned 5.89%, indicating a relative underperformance in the broader market context. In terms of technical indicators, the MACD suggests a bearish trend on a weekly basis, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) shows no significant signals for both weekly and monthly periods. Bollinger Bands indicate a mildly bearish trend weekly, with a sideways movement monthly. The daily moving averages also reflect a mildly bearish sentiment. Despite these technical trends, Khadim India has demonstrated notable performance over longer p...

Read More

Khadim India Faces Significant Volatility Amid Broader Market Challenges

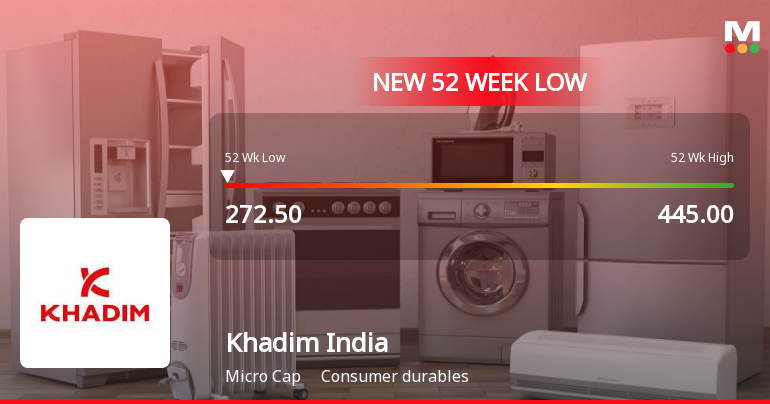

2025-02-28 09:39:10Khadim India, a microcap in the consumer durables sector, hit a new 52-week low today after five days of gains, reflecting broader market challenges. The stock showed significant intraday volatility and has underperformed its sector, with a notable decline over the past year compared to the Sensex.

Read More

Khadim India Hits 52-Week Low Amid Broader Market Challenges in Consumer Durables Sector

2025-02-18 11:56:55Khadim India, a microcap in the consumer durables sector, reached a new 52-week low today, reflecting a one-year performance decline of 22.90%. Despite this, the stock outperformed its sector slightly today, although it remains below key moving averages, indicating ongoing challenges in the market.

Read More

Khadim India Faces Significant Volatility Amid Challenging Market Conditions

2025-02-17 10:36:16Khadim India, a microcap in the consumer durables sector, reached a new 52-week low today, reflecting significant volatility and a cumulative drop of 8.63% over two days. The stock is trading below all major moving averages and has declined 21.26% over the past year, underperforming against the Sensex.

Read More

Khadim India Reports Mixed Financial Results Amidst Operational Challenges and Debt Reduction Efforts

2025-02-11 21:38:00Khadim India has released its financial results for the quarter ending December 2024, showcasing a mix of positive and negative trends. While the company achieved its lowest Debt-Equity Ratio in recent periods, it faced declines in Profit Before Tax and Profit After Tax, alongside reduced operational efficiency and a slower Debtors Turnover Ratio.

Read MoreClosure of Trading Window

29-Mar-2025 | Source : BSEClosure of Trading Window for the quarter and year ending on March 31 2025

NCLT Order Approving The Scheme Of Arrangement

28-Mar-2025 | Source : BSENCLT Order approving the Scheme of Arrangement

Announcement under Regulation 30 (LODR)-Change in Directorate

25-Mar-2025 | Source : BSEChange in deisgnation of Directors

Corporate Actions

No Upcoming Board Meetings

Khadim India Ltd has declared 10% dividend, ex-date: 31 Jul 19

No Splits history available

No Bonus history available

No Rights history available