Kopran's Technical Outlook Shifts Amid Mixed Market Signals and Financial Challenges

2025-03-21 08:02:42Kopran, a microcap in the Pharmaceuticals & Drugs sector, has experienced a recent evaluation adjustment reflecting changes in its technical outlook. Key metrics indicate a bearish sentiment, while the company's financial health remains strong despite challenges such as decreased institutional participation and recent negative results.

Read MoreKopran Experiences Technical Trend Shifts Amidst Market Volatility and Historical Performance

2025-03-21 08:01:38Kopran, a microcap player in the Pharmaceuticals & Drugs industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 181.90, showing a notable increase from the previous close of 175.15. Over the past year, Kopran has experienced significant volatility, with a 52-week high of 369.20 and a low of 157.00. In terms of technical indicators, the weekly MACD remains bearish, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) shows no signals for both weekly and monthly assessments. Bollinger Bands indicate a mildly bearish trend on both timeframes, and moving averages are bearish on a daily basis. However, the KST presents a mildly bullish signal weekly, while remaining mildly bearish monthly. The On-Balance Volume (OBV) reflects a mildly bullish trend in both weekly and monthly evaluations. When comparing Kopran's ...

Read More

Kopran Faces Financial Struggles Amid Declining Stock Performance and Investor Interest

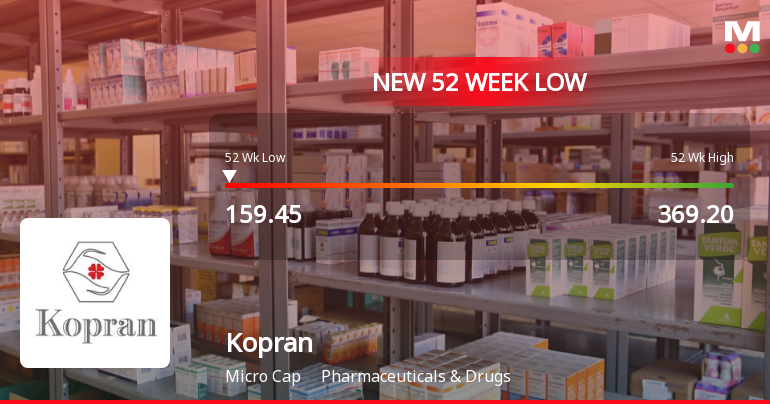

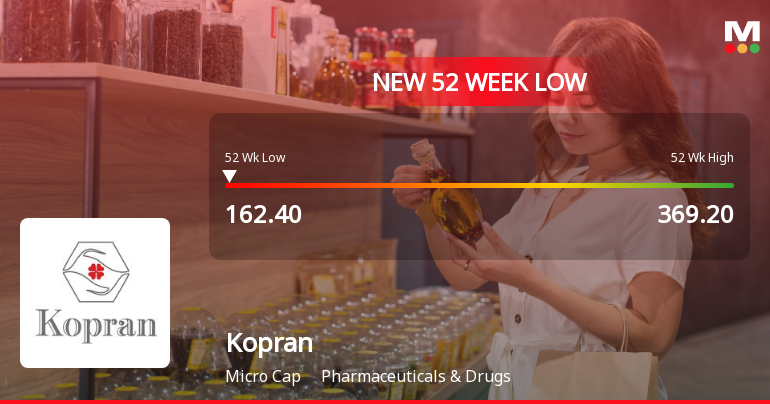

2025-03-17 15:38:58Kopran, a microcap pharmaceutical company, is nearing its 52-week low, reflecting a challenging performance with a significant decline over the past year. Recent financial metrics show slow growth in sales and profits, while institutional investor participation has decreased. However, the company maintains a low debt-to-EBITDA ratio, indicating some financial stability.

Read More

Kopran Faces Significant Volatility Amid Declining Financial Performance and Investor Participation

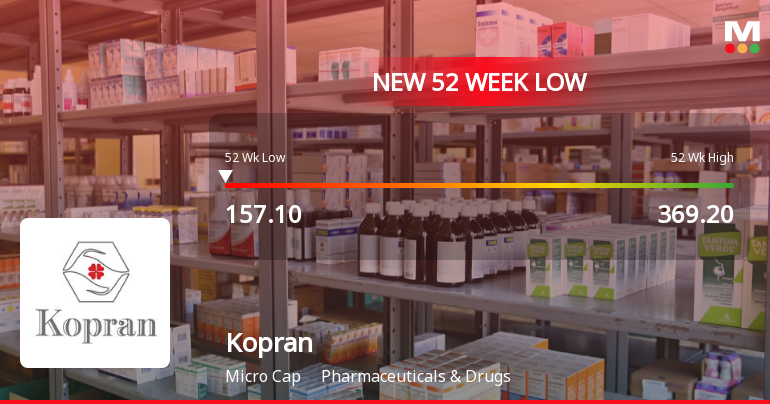

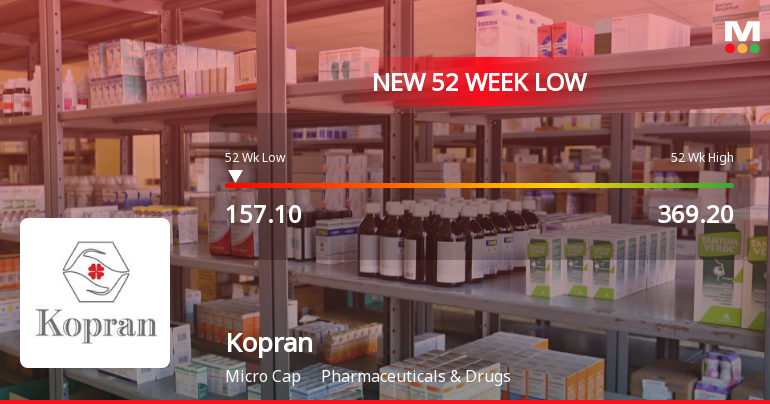

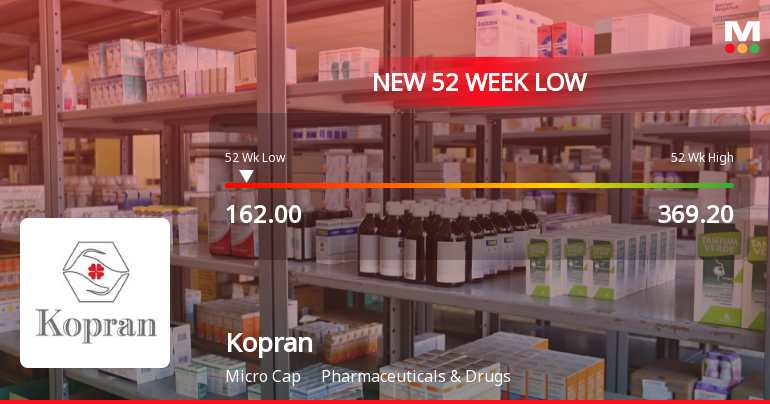

2025-03-13 10:06:33Kopran, a microcap in the Pharmaceuticals & Drugs sector, has faced notable volatility, reaching a new 52-week low. The company reported disappointing growth in net sales and operating profit over five years, alongside recent declines in quarterly profits. Institutional investor participation has decreased, though Kopran maintains a low debt-to-EBITDA ratio.

Read More

Kopran Faces Continued Volatility Amid Broader Market Decline and Weak Growth Prospects

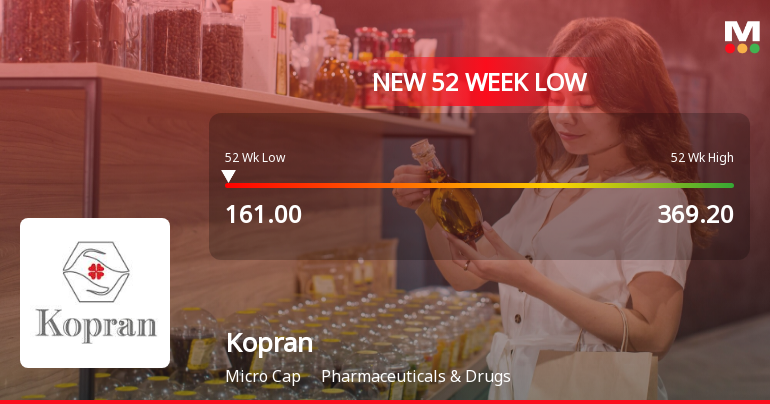

2025-03-12 11:37:34Kopran, a microcap pharmaceutical company, has hit a new 52-week low amid ongoing volatility and underperformance in its sector. The stock's technical outlook remains bearish, with declining sales and profit figures. Despite challenges, the company shows some financial stability with a low debt-to-EBITDA ratio and a reasonable return on capital employed.

Read More

Kopran Faces Significant Stock Volatility Amidst Ongoing Market Challenges

2025-03-03 10:06:41Kopran, a microcap in the Pharmaceuticals & Drugs sector, has shown significant stock volatility, nearing its 52-week low. Over the past week, it has declined notably, underperforming its sector. The stock is currently trading below all major moving averages, reflecting ongoing challenges in a competitive market.

Read More

Kopran Hits New Low Amid Ongoing Downward Trend in Pharmaceuticals Sector

2025-02-17 09:38:26Kopran, a microcap in the Pharmaceuticals & Drugs sector, has reached a new 52-week low, continuing a downward trend with a 6.93% decline over three days. Its one-year performance shows a significant drop of 39.43%, contrasting with the Sensex's gains, indicating ongoing challenges in the market.

Read More

Kopran Hits 52-Week Low Amidst High Volatility and Persistent Downward Trend

2025-02-12 09:36:35Kopran, a microcap in the Pharmaceuticals & Drugs sector, has reached a new 52-week low amid significant volatility, with an intraday decline of 5.5%. The stock has faced consecutive losses over four days, trailing its sector and showing a 35.66% decline over the past year.

Read More

Kopran Reports Q3 FY24-25 Financial Results Amid Ongoing Challenges and Stable Evaluation

2025-02-11 18:17:34Kopran has announced its financial results for the quarter ending February 2025, revealing a challenging performance for Q3 FY24-25. Despite these difficulties, the company's evaluation score has remained stable over the past three months, indicating no significant changes in its overall financial assessment. Stakeholders should monitor future developments closely.

Read MoreFormat of the Initial Disclosure to be made by an entity identified as a Large Corporate : Annexure A

09-Apr-2025 | Source : BSEFormat of Initial Disclosure to be made by an entity identified as a Large Corporate.

| Sr. No. | Particulars | Details |

| 1 | Name of Company | Kopran Ltd |

| 2 | CIN NO. | L24230MH1958PLC011078 |

| 3 | Outstanding borrowing of company as on 31st March / 31st December as applicable (in Rs cr) | 0.00 |

| 4 | Highest Credit Rating during the previous FY | BBB+ |

| 4a | Name of the Credit Rating Agency issuing the Credit Rating mentioned in (4) | CRISIL LTD. |

| 5 | Name of Stock Exchange# in which the fine shall be paid in case of shortfall in the required borrowing under the framework | BSE |

Designation: Company Secretary and Compliance Officer

EmailId: sunil@kopran.com

Designation: Chief Financial Officer

EmailId: bksoni@kopran.com

Date: 09/04/2025

Note: In terms para of 3.2(ii) of the circular beginning F.Y 2022 in the event of shortfall in the mandatory borrowing through debt securities a fine of 0.2% of the shortfall shall be levied by Stock Exchanges at the end of the two-year block period. Therefore an entity identified as LC shall provide in its initial disclosure for a financial year the name of Stock Exchange to which it would pay the fine in case of shortfall in the mandatory borrowing through debt markets.

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

08-Apr-2025 | Source : BSECompliance Certificate under Reg.74(5) of SEBI (DP) Regulation 2018 for the Quarter ended March 31 2025

Announcement under Regulation 30 (LODR)-Analyst / Investor Meet - Outcome

27-Mar-2025 | Source : BSETranscript and audio recording of Investors Meet held on March 25 2025.

Corporate Actions

No Upcoming Board Meetings

Kopran Ltd has declared 30% dividend, ex-date: 02 Sep 24

No Splits history available

No Bonus history available

No Rights history available