Krystal Integrated Services Faces Technical Challenges Amidst Market Dynamics

2025-04-02 08:10:50Krystal Integrated Services, a microcap company in the miscellaneous industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 448.00, showing a slight increase from the previous close of 431.00. Over the past year, the stock has faced significant challenges, with a return of -43.96%, contrasting sharply with a positive return of 2.72% for the Sensex during the same period. The technical summary indicates a bearish sentiment in various indicators, including the MACD and moving averages, while the Bollinger Bands suggest a mildly bearish outlook. Notably, the stock's performance over different time frames reveals a decline of 38.16% year-to-date, while the Sensex has only seen a modest drop of 2.71%. In the short term, the stock has experienced a weekly return of -4.59%, compared to the Sensex's decline of 2.55%. This performance highl...

Read MoreKrystal Integrated Services Experiences Valuation Grade Change Amidst Competitive Industry Landscape

2025-04-01 08:00:57Krystal Integrated Services has recently undergone a valuation adjustment, reflecting a notable shift in its financial standing within the miscellaneous industry. The company currently boasts a price-to-earnings (P/E) ratio of 14.05 and an enterprise value to EBITDA ratio of 8.58, indicating a competitive position in terms of profitability metrics. Additionally, its return on capital employed (ROCE) stands at 15.82%, while the return on equity (ROE) is recorded at 10.19%, showcasing effective management of resources. In comparison to its peers, Krystal Integrated Services demonstrates a more favorable valuation profile. For instance, companies like Sh. Pushkar Chemicals and Taneja Aerospace exhibit higher P/E ratios of 15.47 and 57.69, respectively, suggesting that Krystal may be positioned more attractively in terms of valuation. Furthermore, the enterprise value to sales ratio of 0.55 highlights its effi...

Read More

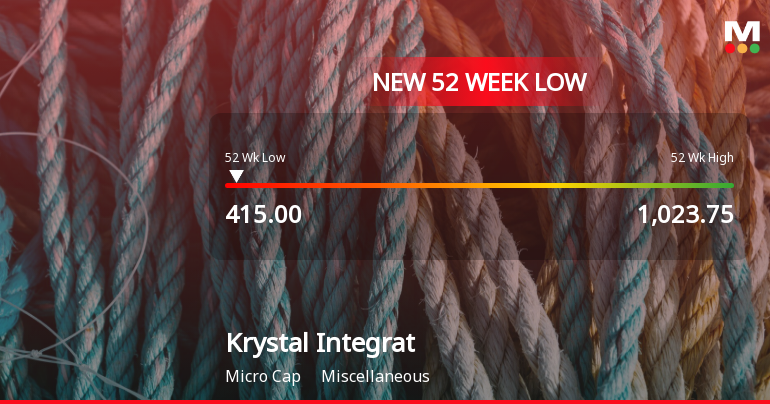

Krystal Integrated Services Hits 52-Week Low Amid Broader Sector Decline

2025-03-03 14:21:16Krystal Integrated Services has reached a new 52-week low, continuing a downward trend over the past five days with a total decline of 5%. The stock is trading below multiple moving averages, indicating ongoing underperformance in a volatile market environment, particularly within the miscellaneous sector.

Read More

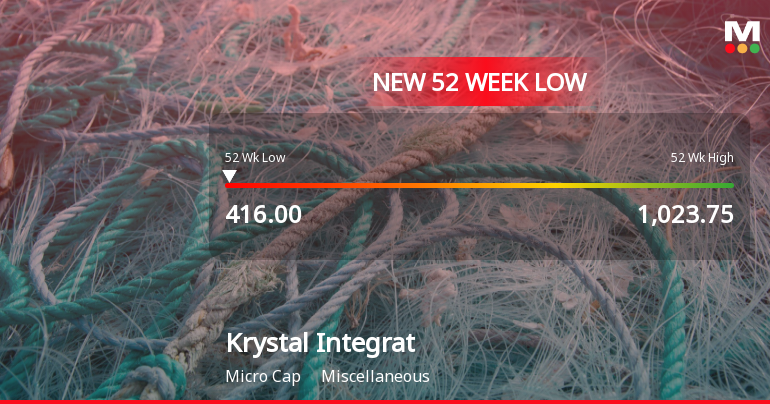

Krystal Integrated Services Faces Sustained Decline Amid Industry Challenges

2025-02-18 11:57:27Krystal Integrated Services has faced notable volatility, hitting a new 52-week low and experiencing a significant decline over the past nine trading days. The stock opened lower and continued to drop, underperforming compared to its sector, while trading below multiple moving averages, indicating ongoing challenges.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

07-Apr-2025 | Source : BSECompliance under Regulation 74(5) of SEBI (Depositories and Participants) Regulations 2018

Closure of Trading Window

26-Mar-2025 | Source : BSEThe company will intimate the closure of trading window end date to the stock exchanges after finalization of the date of Board Meeting for consideration of Audited Financial Results for the quarter and year ended March 31 2025

Intimation Under Regulation 30 Of SEBI (Listing Obligations And Disclosure Requirements) Regulations 2015

25-Mar-2025 | Source : BSEIntimation Under Regulation 30 of SEBI (Listing Obligations And Disclosure Requirements) Regulations 2015

Corporate Actions

No Upcoming Board Meetings

Krystal Integrated Services Ltd has declared 15% dividend, ex-date: 02 Sep 24

No Splits history available

No Bonus history available

No Rights history available