Ksolves India Shows Mixed Technical Trends Amidst Outperformance in Short-Term Returns

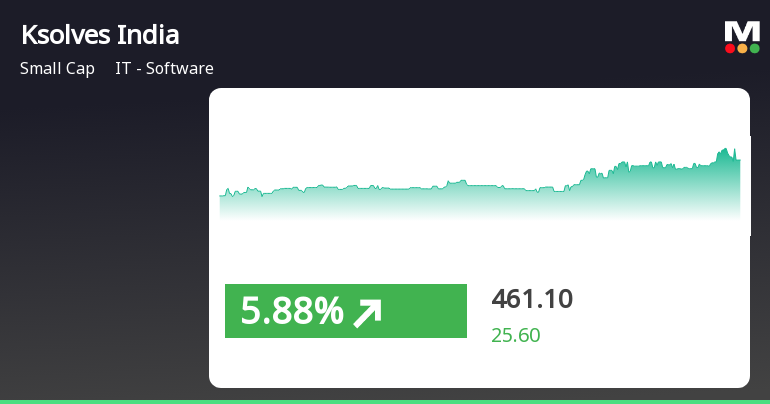

2025-04-03 08:06:16Ksolves India, a small-cap player in the IT software industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 461.10, showing a notable increase from the previous close of 435.50. Over the past week, Ksolves India has demonstrated a stock return of 4.32%, contrasting with a decline of 0.87% in the Sensex, indicating a positive short-term performance relative to the broader market. In terms of technical indicators, the weekly MACD remains bearish, while the monthly signal is not specified. The Relative Strength Index (RSI) shows no signal for both weekly and monthly assessments. Bollinger Bands indicate a mildly bearish trend on both weekly and monthly scales, and moving averages also reflect a mildly bearish stance on a daily basis. The KST and Dow Theory metrics show no discernible trends. Looking at the company's performance over va...

Read MoreKsolves India Adjusts Valuation Grade Amid Strong Financial Performance Metrics

2025-04-03 08:00:50Ksolves India, a small-cap player in the IT software sector, has recently undergone a valuation adjustment, reflecting a shift in its financial standing. The company currently exhibits a price-to-earnings (P/E) ratio of 28.88 and a price-to-book value of 33.85, indicating a premium valuation relative to its earnings and book value. Additionally, Ksolves India shows strong performance metrics, including a remarkable return on capital employed (ROCE) of 276.50% and a return on equity (ROE) of 112.94%. In comparison to its peers, Ksolves India stands out with a competitive edge in certain financial ratios. For instance, while it maintains a P/E ratio lower than that of Zaggle Prepaid, which is significantly higher, it also surpasses companies like Cigniti Technologies and R Systems International in terms of ROE. The company's dividend yield of 3.36% adds to its attractiveness in the current market landscape. ...

Read More

Ksolves India Shows Strong Performance Amid Broader Market Gains and High Dividend Yield

2025-04-02 15:35:27Ksolves India, a small-cap IT software company, experienced significant activity on April 2, 2025, with a notable intraday high. The stock is currently above several short-term moving averages and offers a high dividend yield. In the broader market, the Sensex continues to rise, led by mid-cap stocks.

Read MoreKsolves India Faces Bearish Technical Trends Amid Mixed Performance Indicators

2025-04-02 08:09:40Ksolves India, a small-cap player in the IT software industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 435.50, slightly down from the previous close of 435.80. Over the past year, Ksolves India has faced challenges, with a notable decline of 25.91% in stock return, contrasting with a modest gain of 2.72% in the Sensex during the same period. The technical summary indicates a bearish sentiment across various indicators. The MACD shows a bearish trend on a weekly basis, while Bollinger Bands also reflect bearish conditions for both weekly and monthly assessments. Moving averages on a daily basis align with this sentiment, further emphasizing the prevailing market conditions. The RSI and KST metrics currently show no signals, indicating a lack of momentum in either direction. In terms of performance, Ksolves India has experienced ...

Read MoreKsolves India Adjusts Valuation Amidst Notable Underperformance in IT Sector

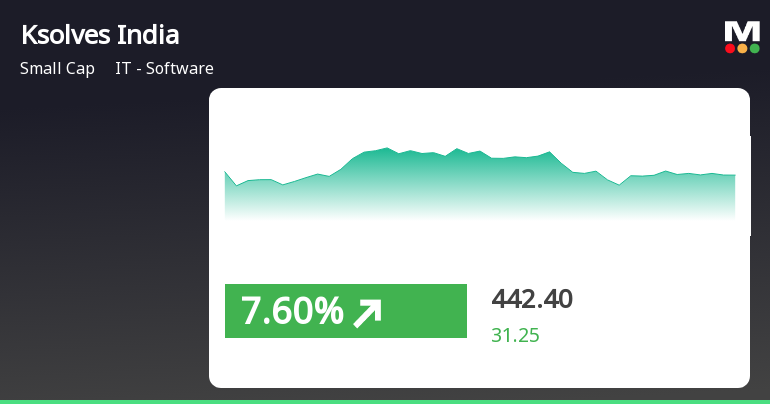

2025-03-27 08:01:00Ksolves India, a small-cap player in the IT software sector, has recently undergone a valuation adjustment. The company's current price stands at 442.00, reflecting a decline from its previous close of 463.30. Over the past year, Ksolves India has experienced a stock return of -22.62%, contrasting with a 6.65% gain in the Sensex, indicating a notable underperformance relative to the broader market. Key financial metrics for Ksolves India include a PE ratio of 27.68 and an EV to EBITDA ratio of 19.77, which position it within a competitive landscape. The company's return on capital employed (ROCE) is exceptionally high at 276.50%, and its return on equity (ROE) is also impressive at 112.94%. However, the price-to-book value stands at 32.45, suggesting a premium valuation compared to some peers. In comparison, companies like Rategain Travel and Infibeam Avenues exhibit different valuation metrics, with PE r...

Read More

Ksolves India Surges Amid Strong Small-Cap Market Performance and Sector Outperformance

2025-03-24 10:50:26Ksolves India, a small-cap IT software company, experienced notable stock activity on March 24, 2025, with significant intraday gains. The stock has outperformed its sector recently and is currently above several key moving averages. The broader market also showed positive trends, particularly among small-cap stocks.

Read MoreKsolves India Shows Mixed Technical Trends Amid Strong Short-Term Performance

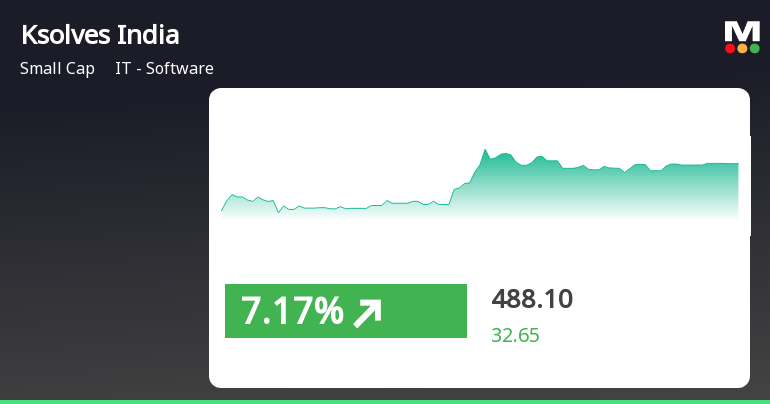

2025-03-21 08:03:07Ksolves India, a small-cap player in the IT software industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 461.35, showing a notable increase from the previous close of 411.15. Over the past week, Ksolves India has demonstrated a strong performance, with a return of 33.63%, significantly outpacing the Sensex's return of 3.41% during the same period. In terms of technical indicators, the weekly MACD remains bearish, while the monthly indicators show no signal. The Bollinger Bands indicate a mildly bearish trend on both weekly and monthly scales. Daily moving averages also reflect a mildly bearish sentiment. The On-Balance Volume (OBV) presents a mildly bearish outlook weekly, contrasting with a bullish monthly trend. Despite a challenging year-to-date return of -4.14%, Ksolves India has shown resilience compared to the Sensex, which...

Read More

Ksolves India Surges Amid Small-Cap Market Strength and High Volatility

2025-03-20 09:35:34Ksolves India, a small-cap IT software company, has experienced notable gains, outperforming its sector significantly. The stock has risen for three consecutive days, achieving a substantial return during this period. Despite today's positive performance, it has faced challenges over the past year, reflecting a decline.

Read MoreKsolves India Ltd Opens Strong with 9.19% Gain, Outperforming Sector Trends

2025-03-20 09:35:31Ksolves India Ltd, a small-cap player in the IT software industry, has shown significant activity today, opening with a gain of 9.19%. The stock has outperformed its sector by 10.96%, reflecting a robust performance amid a broader market backdrop. Over the past three days, Ksolves India has demonstrated a remarkable upward trend, accumulating returns of 43.08%. Today, the stock reached an intraday high of Rs 474.25, marking a 15.35% increase. However, it has also exhibited high volatility, with an intraday fluctuation of 6.42%. In terms of moving averages, Ksolves India is currently positioned above the 5-day, 20-day, and 50-day averages, but below the 100-day and 200-day averages, indicating mixed signals in its short- to medium-term performance. In comparison to the Sensex, Ksolves India has delivered a 1-day performance of 12.66% against the index's 0.70%, and a 1-month performance of 3.88% compared to...

Read MoreAnnouncement under Regulation 30 (LODR)-Dividend Updates

19-Mar-2025 | Source : BSEDear Sir/Madam Please find attached herewith the intimation. Thanks and Regards Manisha Kide Company Secretary and Compliance Officer

Record Date For 3Rd Interim Dividend For FY 2024-25.

19-Mar-2025 | Source : BSEDear Sir/Madam Please find attached herewith the intimation on record date. Thanks and Regards Manisha Kide Company Secretary and Compliance Officer

Board Meeting Outcome for Declaration Of 3Rd Interim Dividend For FY 2024-25

19-Mar-2025 | Source : BSEDear Sir/Madam Pursuant to the above-captioned subject kindly note that the Board of Directors of the Company at its meeting held today on March 19 2025 have inter alia considered and approved the following: 1. Declaration of 3rd interim dividend of Rs.7.50 per share for the FY 2024-25 with record date March 25 2025. The said meeting commenced at 03:30 p.m and concluded at 03:45 p.m. Further the Trading Window for dealing in its securities shall remain closed until March 24th 2025 for designated persons. The same is being duly communicated to all the Designated Persons. This is for your information and records. For Ksolves India Limited Manisha Kide Company Secretary & Compliance Officer

Corporate Actions

No Upcoming Board Meetings

Ksolves India Ltd has declared 150% dividend, ex-date: 25 Mar 25

Ksolves India Ltd has announced 5:10 stock split, ex-date: 06 Feb 25

Ksolves India Ltd has announced 1:1 bonus issue, ex-date: 06 Sep 21

No Rights history available