Lincoln Pharmaceuticals Shows Mixed Technical Trends Amid Market Evaluation Revision

2025-04-03 08:01:25Lincoln Pharmaceuticals, a small-cap player in the Pharmaceuticals & Drugs industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 558.30, showing a slight increase from the previous close of 550.65. Over the past year, Lincoln Pharma has experienced a decline of 8.53%, contrasting with a 3.67% gain in the Sensex, highlighting the stock's underperformance relative to the broader market. In terms of technical indicators, the weekly MACD and KST are bearish, while the monthly indicators show a mildly bearish trend. The Relative Strength Index (RSI) indicates bullish momentum on a weekly basis, but lacks a clear signal on a monthly scale. The Bollinger Bands and moving averages also reflect a mildly bearish sentiment, suggesting cautious market behavior. Despite recent challenges, Lincoln Pharmaceuticals has demonstrated resilience over...

Read MoreLincoln Pharmaceuticals Faces Mixed Technical Trends Amidst Market Challenges

2025-03-25 08:01:19Lincoln Pharmaceuticals, a small-cap player in the Pharmaceuticals & Drugs industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 558.55, showing a slight increase from the previous close of 557.90. Over the past year, Lincoln Pharma has experienced a decline of 7.10%, contrasting with a 7.07% gain in the Sensex, highlighting a challenging performance relative to the broader market. The technical summary indicates a bearish sentiment in the weekly MACD and moving averages, while the monthly indicators show a mildly bearish trend. The Relative Strength Index (RSI) presents a bullish signal on a weekly basis, yet lacks a definitive signal on a monthly scale. Additionally, the Bollinger Bands and KST metrics reflect a mildly bearish stance, suggesting a cautious outlook. In terms of returns, Lincoln Pharmaceuticals has shown notable re...

Read MoreLincoln Pharmaceuticals Faces Mixed Technical Trends Amidst Market Challenges

2025-03-21 08:00:29Lincoln Pharmaceuticals, a small-cap player in the Pharmaceuticals & Drugs industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 551.90, slightly down from its previous close of 557.25. Over the past year, Lincoln Pharma has experienced a stock return of -8.48%, contrasting with a 5.89% return from the Sensex, indicating a challenging performance relative to the broader market. In terms of technical indicators, the weekly MACD remains bearish, while the monthly outlook shows a mildly bearish trend. The Relative Strength Index (RSI) indicates bullish momentum on a weekly basis but shows no signal for the monthly period. Bollinger Bands and KST metrics also reflect a mildly bearish stance, suggesting a cautious market sentiment. Despite these technical trends, Lincoln Pharmaceuticals has demonstrated resilience over longer periods, w...

Read MoreLincoln Pharmaceuticals Faces Bearish Technical Trends Amid Market Volatility

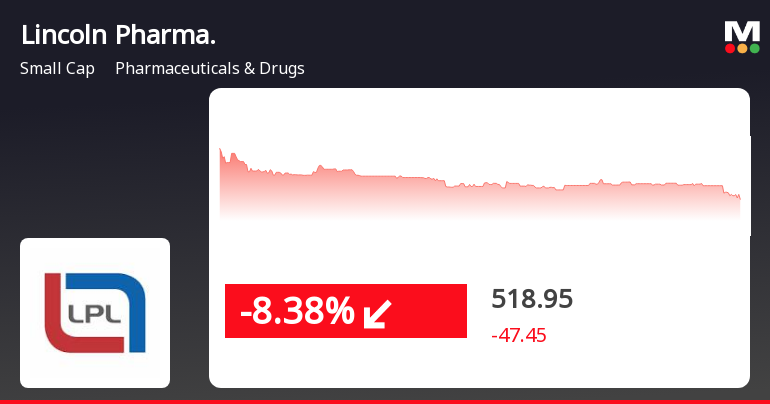

2025-03-12 08:00:41Lincoln Pharmaceuticals, a small-cap player in the Pharmaceuticals & Drugs industry, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 522.35, down from a previous close of 540.00, with a 52-week range between 498.00 and 975.00. The technical summary indicates a bearish sentiment in various indicators, including the MACD and Bollinger Bands on both weekly and monthly scales. The moving averages also reflect a bearish trend, while the KST shows a mildly bearish outlook on a monthly basis. The Relative Strength Index (RSI) presents a bullish signal on a weekly basis, but lacks a definitive signal on a monthly basis. In terms of performance, Lincoln Pharmaceuticals has faced challenges compared to the Sensex. Over the past week, the stock returned -4.13%, while the Sensex gained 1.52%. The one-month return stands at -23.49% against a -2.87...

Read MoreLincoln Pharmaceuticals Faces Stock Volatility Amidst Broader Market Trends

2025-03-11 18:00:14Lincoln Pharmaceuticals, a small-cap player in the Pharmaceuticals & Drugs industry, has experienced significant stock activity today. The company, with a market capitalization of Rs 1,067.00 crore, currently has a price-to-earnings (P/E) ratio of 11.71, notably lower than the industry average of 35.52. Over the past year, Lincoln Pharmaceuticals has seen a decline of 15.74%, contrasting sharply with the Sensex, which has gained 0.82% during the same period. Today's performance reflects a drop of 3.27%, while the Sensex experienced a slight decrease of 0.02%. In the past week, the stock has fallen by 4.13%, compared to a 1.52% increase in the Sensex. Looking at longer-term trends, Lincoln Pharmaceuticals has faced a challenging year-to-date performance, down 33.96%, while the Sensex is down only 5.17%. However, the company has shown resilience over a three-year period, with a gain of 64.03%, outperforming...

Read More

Lincoln Pharmaceuticals Faces Sustained Downward Trend Amid Sector Challenges

2025-02-28 15:00:14Lincoln Pharmaceuticals has seen a notable decline in its stock price, underperforming against the broader sector. Currently trading below key moving averages, the company has experienced a significant drop over the past month, reflecting ongoing challenges within the Pharmaceuticals & Drugs industry and heightened market volatility.

Read MoreLincoln Pharmaceuticals Adjusts Valuation Grade Amid Competitive Industry Landscape

2025-02-28 08:00:23Lincoln Pharmaceuticals has recently undergone a valuation adjustment, reflecting its current standing in the pharmaceuticals and drugs sector. The company's price-to-earnings ratio stands at 12.69, while its price-to-book value is recorded at 1.77. Key metrics such as EV to EBIT and EV to EBITDA are noted at 11.62 and 10.08, respectively, indicating a solid operational performance. In terms of return on capital employed (ROCE) and return on equity (ROE), Lincoln Pharmaceuticals showcases figures of 19.67% and 15.12%, respectively, highlighting its efficiency in generating profits from its capital and equity. However, the PEG ratio is at 5.25, suggesting that growth expectations may be priced in at a higher multiple. When compared to its peers, Lincoln Pharmaceuticals presents a more attractive valuation profile. For instance, Orchid Pharma and Unichem Labs are positioned at significantly higher valuation...

Read MoreLincoln Pharmaceuticals Faces Mixed Technical Trends Amid Market Challenges

2025-02-25 10:28:07Lincoln Pharmaceuticals, a small-cap player in the Pharmaceuticals & Drugs sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 565.50, showing a slight increase from the previous close of 558.30. Over the past year, Lincoln Pharma has faced challenges, with a stock return of -23.29%, contrasting sharply with a positive return of 2.05% from the Sensex. The technical summary indicates a mixed performance across various indicators. The MACD shows bearish trends on both weekly and monthly scales, while the Bollinger Bands also reflect bearish conditions. However, the daily moving averages suggest a mildly bullish sentiment. Notably, the On-Balance Volume (OBV) indicates a bullish trend on a monthly basis, despite the overall bearish signals from other indicators. In terms of returns, Lincoln Pharmaceuticals has experienced significant ...

Read More

Lincoln Pharmaceuticals Faces Declining Profits Amidst Challenging Market Conditions in September 2023

2025-02-14 18:27:39Lincoln Pharmaceuticals has recently experienced a change in evaluation, reflecting its current financial situation. The company reported a challenging Q3 FY24-25, with declines in key performance indicators, including profit before and after tax. Despite a history of growth, recent results indicate significant challenges ahead.

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

05-Apr-2025 | Source : BSEPursuant to provision of Regulation 74(5) of SEBI (Depository and Participant) Regulations 2018 we hereby submit the confirmation certificate as received from M/S. MUFG Intime India Private Limited Register and Share Transfer Agent (RTA) for the Quarter ended March 31 2025.

Disclosure Under Regulation 30 Of SEBI (Listing Obligations And Disclosure Requirements) Regulation 2015.

28-Mar-2025 | Source : BSEDissemination of cautionary letter/mail dated 28.03.2025 received from National Stock Exchange of India Limited and BSE Limited.

Closure of Trading Window

26-Mar-2025 | Source : BSEIntimation of Trading Window Closure for the Quarter and Year ended March 31 2025.

Corporate Actions

No Upcoming Board Meetings

Lincoln Pharmaceuticals Ltd has declared 15% dividend, ex-date: 15 Sep 23

Lincoln Pharmaceuticals Ltd has announced 10:2 stock split, ex-date: 19 Mar 09

No Bonus history available

No Rights history available