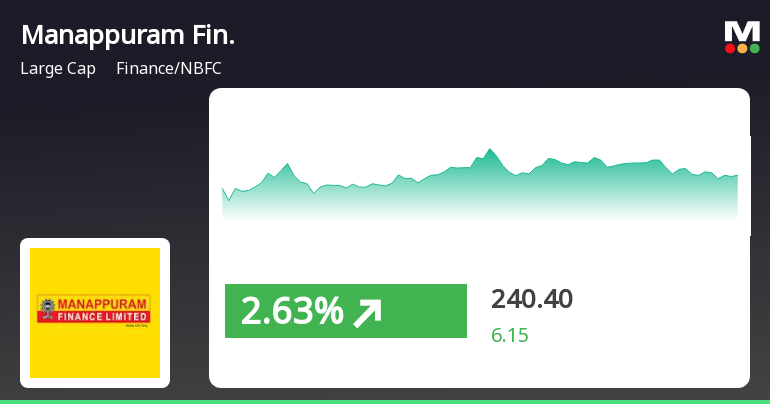

Manappuram Finance Shows Strong Market Performance Amid Broader Sensex Gains

2025-03-24 10:05:19Manappuram Finance has demonstrated strong market performance, gaining 3.12% and trading close to its 52-week high. Over the past eight days, it has achieved a notable 20.14% return. The stock has consistently outperformed its sector and is trading above key moving averages, reflecting a robust upward trend.

Read More

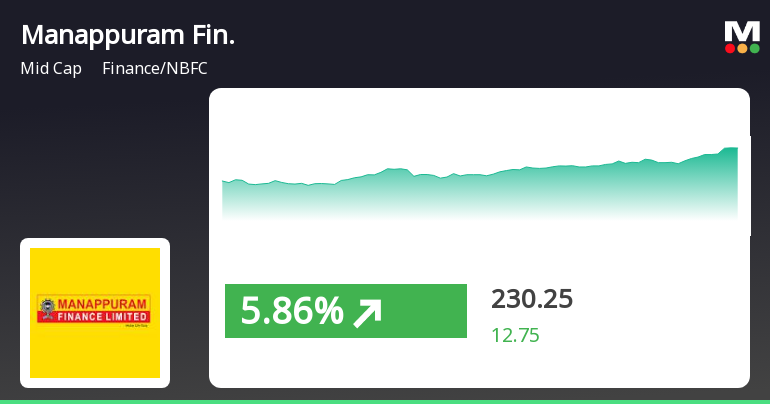

Manappuram Finance Achieves 52-Week High Amid Strong Market Sentiment and Performance

2025-03-21 11:05:16Manappuram Finance's stock has reached a new 52-week high of Rs. 231, reflecting strong performance with a 14.51% increase over the past week. The stock has consistently outperformed its sector and is trading above key moving averages, indicating a robust upward trend amid positive market sentiment.

Read More

Manappuram Finance Shows Strong Market Performance Amid Broader Sensex Recovery

2025-03-21 10:30:20Manappuram Finance has experienced notable market activity, gaining 5.03% and trading close to its 52-week high. The stock has shown a strong upward trend, with a 12.62% increase over the past week. It is currently outperforming its sector and has a year-to-date gain of 21.35%.

Read MoreManappuram Finance Opens Strong with 4.14% Gain, Approaching 52-Week High

2025-03-21 09:50:08Manappuram Finance, a midcap player in the finance and non-banking financial company (NBFC) sector, has shown significant activity today, opening with a gain of 4.14%. The stock is currently trading just 2.7% below its 52-week high of Rs 230.25, reflecting strong performance in the market. Today, Manappuram Finance outperformed its sector by 1.69%, continuing a positive trend with a notable 11.63% increase over the past week. The stock reached an intraday high of Rs 228.6, marking a 5.1% rise during the trading session. In terms of technical indicators, Manappuram Finance is trading above its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, suggesting a bullish trend. Over the past month, the stock has delivered a return of 10.48%, significantly outperforming the Sensex, which recorded a 1.68% gain. With a beta of 1.11, Manappuram Finance is classified as a high beta stock, indicating that...

Read MoreManappuram Finance Shows Mixed Technical Trends Amid Strong Long-Term Performance

2025-03-20 08:00:57Manappuram Finance, a midcap player in the Finance/NBFC sector, has recently undergone an evaluation revision reflecting its current market dynamics. The company's stock is currently priced at 213.80, showing a slight increase from the previous close of 211.15. Over the past year, Manappuram Finance has demonstrated a robust performance, with a return of 28.56%, significantly outperforming the Sensex, which recorded a return of 4.77% in the same period. The technical summary indicates a mixed outlook, with the MACD showing bullish signals on a weekly basis, while the monthly perspective remains mildly bearish. Bollinger Bands and moving averages also reflect bullish trends, suggesting positive momentum in the short term. However, the KST and Dow Theory metrics present a more cautious stance on a monthly basis. In terms of stock performance, Manappuram Finance has consistently outperformed the Sensex acros...

Read MoreManappuram Finance Experiences Technical Trend Adjustments Amid Strong Performance Metrics

2025-03-11 08:01:20Manappuram Finance, a midcap player in the Finance/NBFC sector, has recently undergone a technical trend adjustment. The company's current stock price stands at 205.30, slightly down from the previous close of 208.30. Over the past year, Manappuram Finance has demonstrated a notable performance, with a return of 19.05%, significantly outperforming the Sensex, which remained nearly flat at -0.01%. In terms of technical indicators, the weekly MACD remains bullish, while the monthly outlook shows a mildly bearish trend. The Bollinger Bands indicate a mildly bullish stance on a weekly basis, with a bullish signal on the monthly chart. Moving averages reflect a bullish trend on a daily basis, suggesting positive momentum in the short term. The company's performance over various time frames highlights its resilience, particularly in the three-year period, where it achieved a return of 70.16%, compared to the Se...

Read MoreManappuram Finance Shows Mixed Technical Trends Amid Strong Yearly Performance

2025-03-06 08:00:32Manappuram Finance, a midcap player in the Finance/NBFC sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 203.65, showing a notable performance against its previous close of 197.60. Over the past year, Manappuram Finance has demonstrated resilience with a return of 9.34%, significantly outperforming the Sensex, which recorded a mere 0.07% during the same period. The technical summary indicates a mixed outlook, with weekly indicators such as MACD, Bollinger Bands, and On-Balance Volume signaling bullish trends. However, monthly metrics present a more cautious stance, with some indicators reflecting a mildly bearish sentiment. This divergence suggests that while short-term momentum is favorable, longer-term trends may warrant closer scrutiny. In terms of stock performance, Manappuram Finance has shown a robust return of 75.18% over...

Read MoreManappuram Finance Shows Mixed Technical Trends Amidst Market Evaluation Revision

2025-03-04 08:01:31Manappuram Finance, a midcap player in the Finance/NBFC sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 198.95, having closed at 200.85 previously. Over the past year, it has reached a high of 230.25 and a low of 138.40, indicating a notable range of performance. The technical summary reveals a mixed outlook across various indicators. The MACD shows a bullish trend on a weekly basis, while the monthly perspective leans mildly bearish. The Bollinger Bands indicate a mildly bullish stance for both weekly and monthly assessments. Daily moving averages are bullish, suggesting short-term strength, while the KST reflects a similar pattern on a weekly basis but is mildly bearish monthly. In terms of returns, Manappuram Finance has demonstrated resilience compared to the Sensex. Over the past month, the stock has returned 1.74%, contra...

Read More

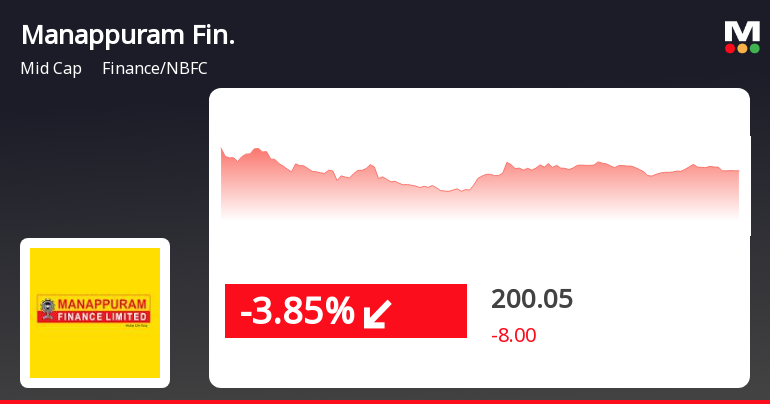

Manappuram Finance Faces Notable Decline Amidst Market Volatility and Sector Underperformance

2025-02-28 10:05:19Manappuram Finance, a midcap NBFC, saw a significant decline on February 28, 2025, following three days of gains. The stock reached an intraday low and underperformed its sector. Despite this drop, it remains above several moving averages, indicating recent volatility in its market performance.

Read MoreDraft Letter of Offer

05-Apr-2025 | Source : BSEKotak Mahindra Capital Company Ltd (Manager to the Offer) has submitted to BSE a copy of Draft Letter of Offer to the Public Shareholders of Manappuram Finance Ltd (Target Company).

Board Meeting Outcome for Outcome Of The Board Meeting In Terms Of Regulations 30 And 51 Of The SEBI (Listing Obligations And Disclosure Requirements) Regulations 2015 As Amended (Listing Regulations)

29-Mar-2025 | Source : BSEOutcome of the Board Meeting in terms of Regulations 30 and 51 of the SEBI (Listing Obligations and Disclosure Requirements) Regulations 2015 as amended (Listing Regulations)

Announcement under Regulation 30 (LODR)-Open Offer - Updates

27-Mar-2025 | Source : BSEPlease find attached the Detailed Public Statement under Take Over Regulations

Corporate Actions

No Upcoming Board Meetings

Manappuram Finance Ltd has declared 50% dividend, ex-date: 21 Feb 25

Manappuram Finance Ltd has announced 2:10 stock split, ex-date: 03 May 10

Manappuram Finance Ltd has announced 1:1 bonus issue, ex-date: 09 Jun 11

No Rights history available