Marathon Nextgen Realty Shows Mixed Technical Trends Amidst Market Volatility

2025-03-26 08:01:36Marathon Nextgen Realty, a small-cap player in the construction and real estate sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 522.85, showing a notable increase from its previous close of 497.00. Over the past year, the stock has reached a high of 736.40 and a low of 343.00, indicating significant volatility. In terms of technical indicators, the weekly MACD remains bearish, while the monthly outlook is mildly bearish. The Relative Strength Index (RSI) shows no signal for both weekly and monthly assessments. Bollinger Bands indicate a mildly bearish trend on a weekly basis, contrasting with a bullish monthly perspective. Moving averages also reflect a mildly bearish sentiment, while the On-Balance Volume (OBV) suggests a mildly bullish trend on a weekly basis. When comparing the company's performance to the Sensex, Marathon N...

Read More

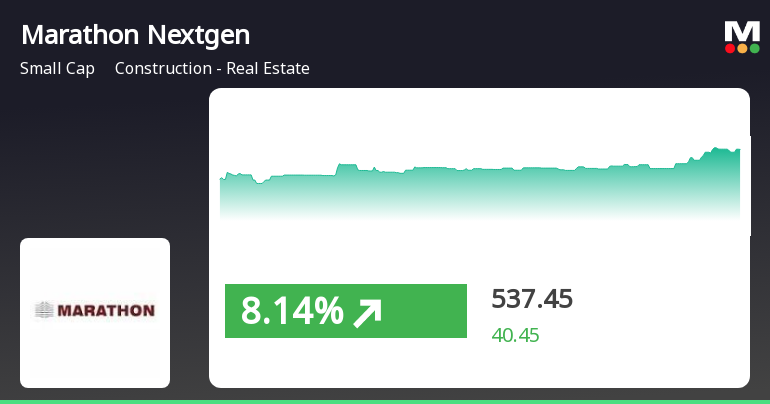

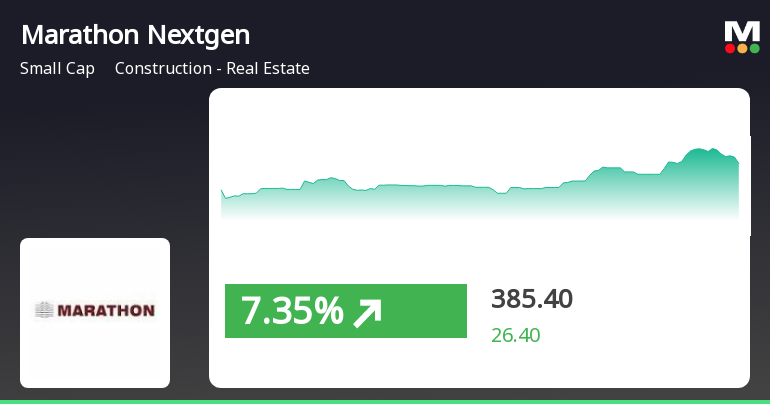

Marathon Nextgen Realty Exhibits Strong Performance Amid Broader Market Resilience

2025-03-25 14:05:16Marathon Nextgen Realty has experienced notable activity, gaining 7.44% on March 25, 2025, and outperforming its sector. The stock has shown consecutive gains over three days, with a total return of 14.2%. It remains above several short-term moving averages, reflecting strong performance metrics over various time frames.

Read More

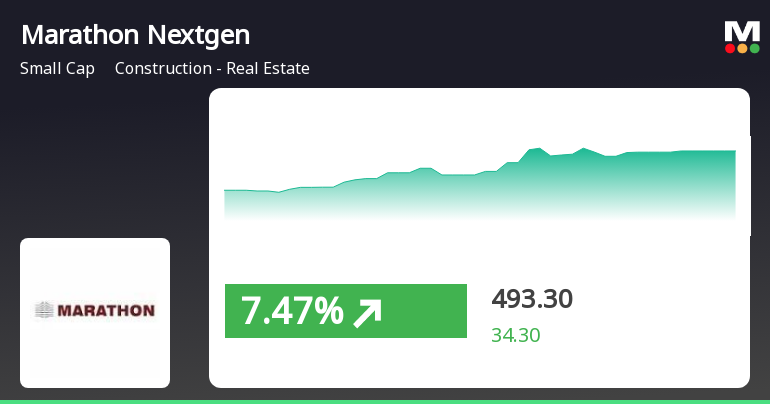

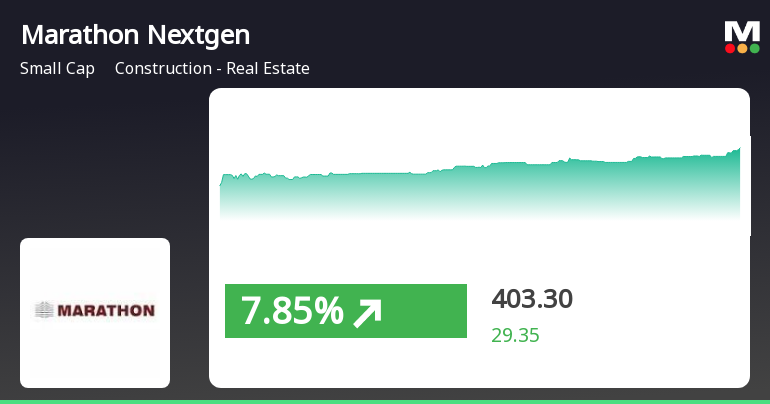

Marathon Nextgen Realty Shows Strong Short-Term Gains Amid Mixed Long-Term Trends

2025-03-21 09:45:16Marathon Nextgen Realty experienced notable trading activity, gaining 7.63% on March 21, 2025, outperforming the broader construction and real estate sector. The stock has shown mixed trends in moving averages and significant fluctuations over various time frames, including a substantial long-term growth of 913.33% over five years.

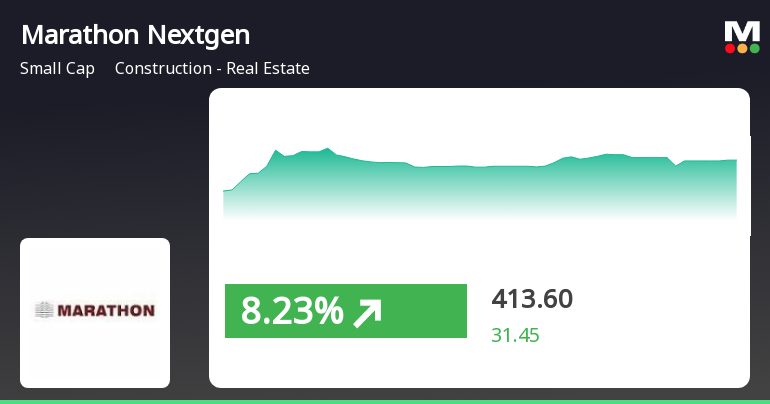

Read MoreMarathon Nextgen Realty Adjusts Valuation Grade Amid Strong Market Positioning

2025-03-20 08:00:14Marathon Nextgen Realty, a small-cap player in the construction and real estate sector, has recently undergone a valuation adjustment, reflecting its current financial metrics and market position. The company's price-to-earnings ratio stands at 14.08, while its price-to-book value is recorded at 2.25. Additionally, the enterprise value to EBITDA ratio is 16.96, and the PEG ratio is noted at 1.27. In terms of profitability, Marathon Nextgen boasts a return on capital employed (ROCE) of 12.83% and a return on equity (ROE) of 16.15%. The company also offers a modest dividend yield of 0.21%. When compared to its peers, Marathon Nextgen's valuation appears notably higher, particularly against companies like Ceigall India and Ajmera Realty, which have varying valuation standings. While some peers are categorized as risky or attractive, Marathon Nextgen's metrics suggest a stronger market position. The company...

Read More

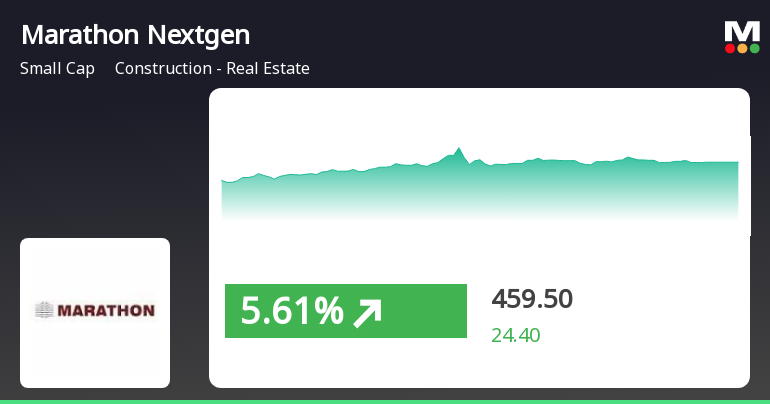

Marathon Nextgen Realty Shows Strong Short-Term Gains Amid Broader Market Trends

2025-03-19 10:05:17Marathon Nextgen Realty has experienced notable activity, gaining 7.19% on March 19, 2025, and outperforming its sector. The stock has shown consecutive gains over two days, with a total return of 19.84%. It is currently positioned above its short-term moving averages, indicating mixed performance overall.

Read More

Marathon Nextgen Realty Surges Amid Positive Market Sentiment and Mixed Momentum Indicators

2025-03-18 09:35:15Marathon Nextgen Realty saw a notable increase today, outperforming its sector and the broader market. Despite a strong intraday performance, the stock's longer-term metrics indicate a decline year-to-date and over the past three months, though it has shown significant growth over the past several years.

Read More

Marathon Nextgen Realty Shows Resilience Amid Broader Market Volatility and Declines

2025-03-12 11:05:16Marathon Nextgen Realty saw a significant increase on March 12, 2025, following two days of decline, with the stock outperforming the Sensex. Despite today's gains, it remains below key moving averages and has experienced notable declines over the past month and three months, though it shows substantial growth over the past five years.

Read More

Marathon Nextgen Realty Shows Short-Term Gains Amid Long-Term Challenges in Market

2025-03-06 14:15:16Marathon Nextgen Realty, a small-cap construction and real estate firm, experienced a notable stock price increase today, outperforming the broader market. Despite this uptick, the stock remains below key moving averages and has shown mixed performance over various time frames, including a significant decline year-to-date.

Read MoreMarathon Nextgen Realty Faces Short-Term Challenges Amid Long-Term Growth Potential

2025-02-27 10:31:12Marathon Nextgen Realty Ltd, a small-cap player in the construction and real estate sector, has shown significant activity today, reflecting broader market trends. The company's market capitalization stands at Rs 2,189.00 crore, with a price-to-earnings (P/E) ratio of 12.70, notably lower than the industry average of 27.75. Over the past year, Marathon Nextgen Realty has experienced a decline of 13.26%, contrasting sharply with the Sensex, which has gained 2.03% during the same period. Today's performance saw the stock decrease by 1.75%, while the Sensex fell slightly by 0.03%. The one-week performance indicates a drop of 11.61%, and the month-to-date performance shows a significant decline of 29.03%. Despite these short-term challenges, Marathon Nextgen Realty has demonstrated resilience over the longer term, with impressive three-year and five-year performance figures of 335.24% and 444.19%, respectivel...

Read MoreRevised Disclosures under Reg. 31(1) and 31(2) of SEBI (SAST) Regulations 2011.

01-Apr-2025 | Source : BSEThe Exchange has received revised Disclosure under Regulation 31(1) and 31(2) of SEBI (Substantial Acquisition of Shares & Takeovers) Regulations 2011 on March 28 2025 for Marathon Realty Pvt Ltd

Revised Disclosures of reasons for encumbrance by promoter of listed companies under Reg. 31(1) read with Regulation 28(3) of SEBI (SAST) Regulations 2011.

01-Apr-2025 | Source : BSEThe Exchange has received the revised Disclosures of reasons for encumbrance by promoter of listed companies under Reg. 31(1) read with Regulation 28(3) of SEBI (SAST) Regulations 2011 on March 28 2025 for Marathon Realty Pvt Ltd

Announcement under Regulation 30 (LODR)-Scheme of Arrangement

31-Mar-2025 | Source : BSEApproval of Composite Scheme of Amalgamation and Arrangement

Corporate Actions

No Upcoming Board Meetings

Marathon Nextgen Realty Ltd has declared 20% dividend, ex-date: 17 Sep 24

Marathon Nextgen Realty Ltd has announced 5:10 stock split, ex-date: 05 Apr 18

Marathon Nextgen Realty Ltd has announced 1:2 bonus issue, ex-date: 21 Dec 15

No Rights history available