Narayana Hrudayalaya Shows Strong Performance Amid Sector Trends and Market Dynamics

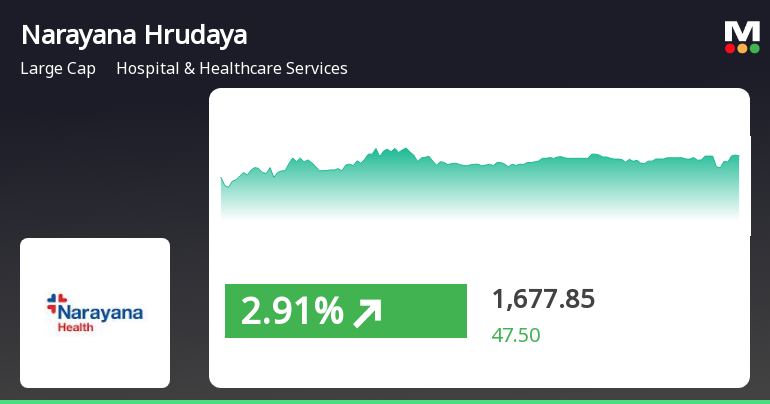

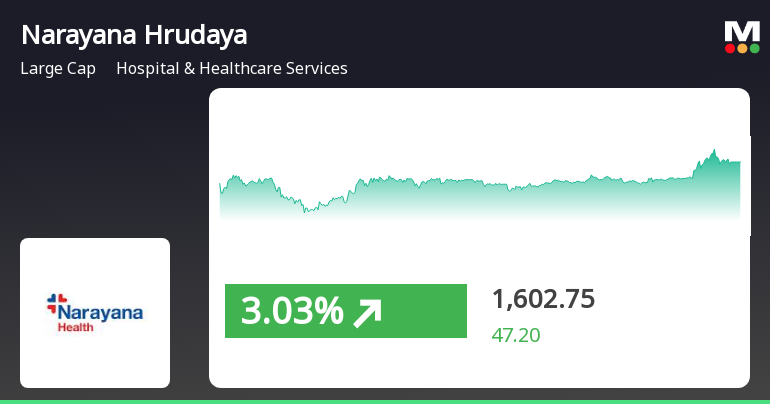

2025-03-27 10:05:25Narayana Hrudayalaya has exhibited strong performance in the Hospital & Healthcare Services sector, trading near its 52-week high. The stock has outperformed its sector and major indices over the past month and year-to-date, reflecting a robust upward trend across various moving averages.

Read More

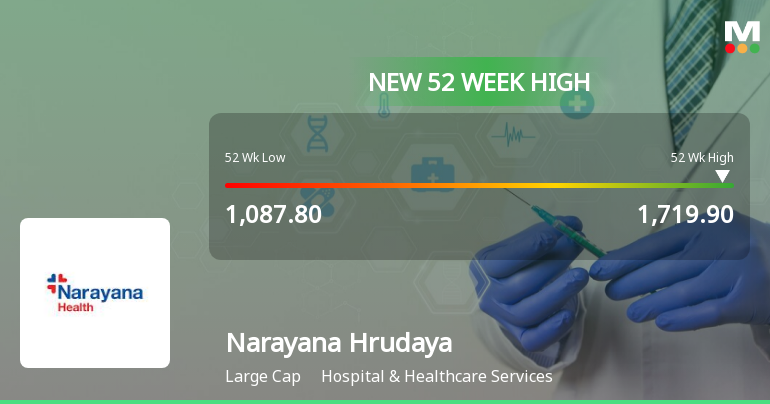

Narayana Hrudayalaya Achieves 52-Week High Amid Broader Market Gains

2025-03-24 14:35:39Narayana Hrudayalaya's stock reached a new 52-week high of Rs. 1725, reflecting strong performance as it trades above key moving averages. The broader market also saw gains, with the Sensex rising significantly over the past three weeks. Narayana Hrudayalaya's one-year performance notably outpaces the Sensex.

Read More

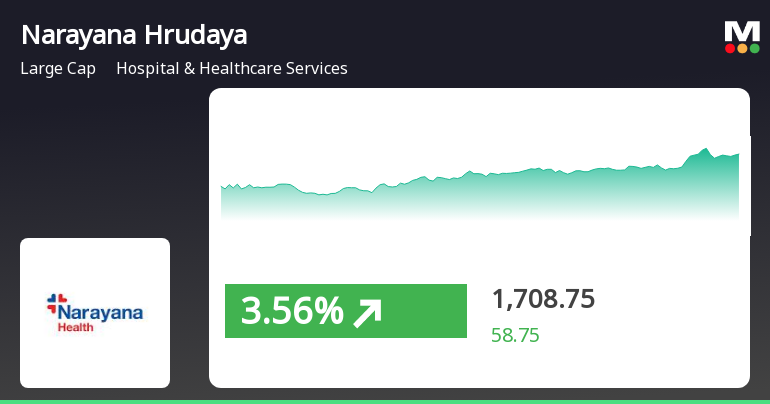

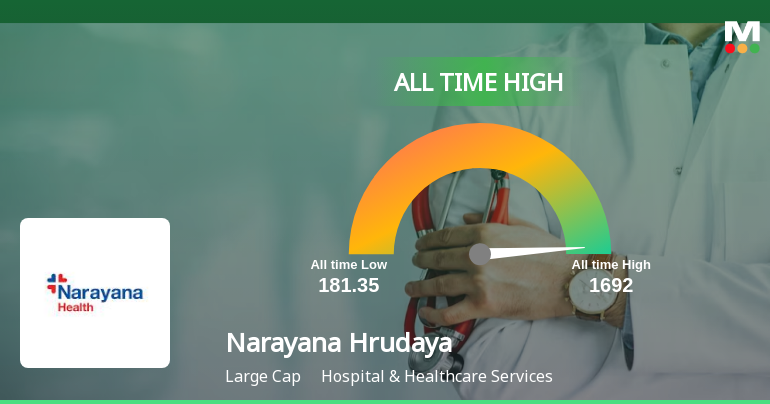

Narayana Hrudayalaya Reaches All-Time High Amid Strong Market Momentum

2025-03-24 14:21:48Narayana Hrudayalaya has demonstrated strong performance in the Hospital & Healthcare Services sector, reaching an intraday high and trading close to its 52-week peak. The stock has significantly outperformed the Sensex over various time frames, showcasing robust growth and maintaining an upward trend above key moving averages.

Read More

Narayana Hrudayalaya Achieves 52-Week High Amid Strong Healthcare Sector Momentum

2025-03-20 11:36:13Narayana Hrudayalaya has reached a new 52-week high of Rs. 1719.9, marking a significant achievement for the company. The stock has outperformed its sector and has shown a strong upward trend, trading above key moving averages. Over the past year, it has delivered impressive returns compared to the Sensex.

Read More

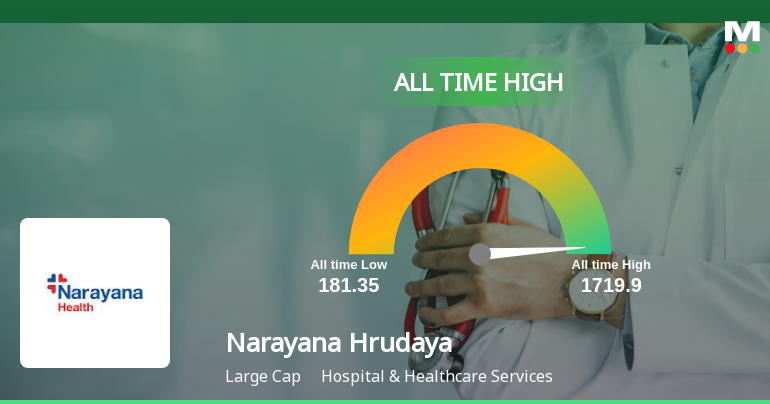

Narayana Hrudayalaya Achieves Record High Amid Strong Market Sentiment and Performance Metrics

2025-03-20 11:20:24Narayana Hrudayalaya has achieved a new all-time high, reflecting strong performance in the Hospital & Healthcare Services sector. The stock has shown a notable upward trend, with significant returns over both short and long-term periods, outperforming the broader market indices. The overall market sentiment remains positive.

Read More

Narayana Hrudayalaya Reaches All-Time High, Signaling Strong Market Momentum in Healthcare Sector

2025-03-20 11:11:50Narayana Hrudayalaya has achieved an all-time high, trading near its 52-week peak and outperforming its sector. The stock has gained consistently over four days, with significant returns over various time frames, indicating a strong upward trend and impressive long-term performance compared to the broader market.

Read MoreNarayana Hrudayalaya Adjusts Valuation Amid Strong Performance and Competitive Metrics

2025-03-19 08:00:54Narayana Hrudayalaya, a prominent player in the Hospital & Healthcare Services sector, has recently undergone a valuation adjustment. The company's current price stands at 1,618.00, reflecting a notable increase from the previous close of 1,576.05. Over the past year, Narayana Hrudayalaya has demonstrated strong performance, achieving a return of 28.38%, significantly outpacing the Sensex, which recorded a return of 3.51% during the same period. Key financial metrics for Narayana Hrudayalaya include a PE ratio of 42.19 and an EV to EBITDA ratio of 27.67. The company's return on capital employed (ROCE) is reported at 25.01%, while the return on equity (ROE) stands at 24.29%. These figures indicate a robust operational efficiency and profitability. In comparison to its peers, Narayana Hrudayalaya's valuation metrics suggest a competitive position within the industry. For instance, while it maintains a highe...

Read MoreNarayana Hrudayalaya Adjusts Valuation Grade Amid Competitive Healthcare Landscape

2025-03-12 08:00:43Narayana Hrudayalaya, a prominent player in the Hospital & Healthcare Services sector, has recently undergone a valuation adjustment. The company currently exhibits a price-to-earnings (P/E) ratio of 41.30 and a price-to-book value of 10.10, reflecting its market positioning. Additionally, its enterprise value to EBITDA stands at 27.09, while the enterprise value to EBIT is recorded at 34.53. In terms of performance metrics, Narayana Hrudayalaya boasts a return on capital employed (ROCE) of 25.01% and a return on equity (ROE) of 24.29%. The company also offers a modest dividend yield of 0.25%. When compared to its peers, Narayana Hrudayalaya's valuation metrics indicate a competitive stance within the industry. For instance, Max Healthcare shows a significantly higher P/E ratio, while Apollo Hospitals maintains a lower valuation. This comparison highlights Narayana Hrudayalaya's relative positioning in ...

Read More

Narayana Hrudayalaya's Stock Performance Reflects Resilience in Healthcare Sector

2025-03-05 15:50:39Narayana Hrudayalaya has experienced a significant rise in its stock price, outperforming the broader market. The stock is trading above multiple moving averages, indicating a strong upward trend. Over the past week, year, and five years, it has shown impressive growth, underscoring its resilience in the healthcare sector.

Read MoreRumour verification - Regulation 30(11)

08-Apr-2025 | Source : BSERumour Verification pursuant to Regulation 30 (11) of the SEBI LODR Regulations 2015 - Clarification on News.

Announcement under Regulation 30 (LODR)-Memorandum of Understanding /Agreements

05-Apr-2025 | Source : BSEIntimation about the execution of operation and management agreement on April 05 2025.

Intimation Regarding Agreement Between The Wholly Owned Subsidiary Of The Company- Narayana Vaishno Devi Specialty Hospitals Private Limited With Shri Mata Vaishnodevi Charitable Society

28-Mar-2025 | Source : BSEPursuant to the Regulation 30 of SEBI (LODR) Regulations 2015 this is to inform you that Narayana Vaishno Devi Specialty Hospitals Private Limited-wholly owned subsidiary of the Company has reached a revised understanding today i.e. 28th March 2025 with Shri Mata Vaishno Devi Shrine Board with regard to its operating and running the Hospital of the Shrine Board at Katra Jammu.

Corporate Actions

No Upcoming Board Meetings

Narayana Hrudayalaya Ltd has declared 40% dividend, ex-date: 02 Aug 24

No Splits history available

No Bonus history available

No Rights history available