Paragon Finance Faces Intense Selling Pressure Amid Significant Price Declines

2025-03-27 15:05:03Paragon Finance Ltd is currently facing significant selling pressure, with the stock showing only sellers today. The company has experienced a consecutive decline over the past four days, resulting in a total loss of 18.07% during this period. Today alone, Paragon Finance's stock price dropped by 8.77%, starkly contrasting with the Sensex, which gained 0.51%. Over the past week, the stock has plummeted by 18.59%, while the Sensex has risen by 1.75%. In the last month, Paragon Finance has seen a decline of 8.02%, compared to a 4.11% increase in the Sensex. Year-to-date, the stock has underperformed significantly, down 34.40%, while the Sensex has only dipped by 0.59%. The stock is trading below its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, indicating a persistent downward trend. Contributing factors to this selling pressure may include broader market conditions and sector-specific challe...

Read MoreParagon Finance Faces Intense Selling Pressure Amid Consecutive Losses and Market Underperformance

2025-03-25 10:50:03Paragon Finance Ltd is currently facing significant selling pressure, with the stock showing only sellers today. The company has experienced consecutive losses, falling nearly 17% over the last two days alone. Today, the stock opened with a notable decline of 9.99%, reaching an intraday low of Rs 48.2, while the day's high was Rs 56.79, reflecting high volatility with an intraday fluctuation of 8.17%. In terms of performance relative to the Sensex, Paragon Finance has underperformed across various time frames. Over the past week, the stock has dropped 8.71%, while the Sensex gained 3.97%. The one-month performance shows a decline of 2.82% for Paragon Finance compared to a 4.95% increase in the Sensex. Year-to-date, the stock is down 29.12%, contrasting sharply with the Sensex's modest gain of 0.20%. Several factors may be contributing to this selling pressure, including broader market trends and potential...

Read MoreParagon Finance Faces Intense Selling Pressure Amid Significant Price Declines

2025-03-24 09:35:02Paragon Finance Ltd is currently facing significant selling pressure, with the stock showing only sellers today. The stock has experienced a notable decline of 9.98%, contrasting sharply with the Sensex, which has gained 0.52% on the same day. This marks a trend reversal for Paragon Finance, which had seen two consecutive days of gains prior to today’s downturn. Over the past week, Paragon Finance has performed positively with an increase of 8.07%, outpacing the Sensex's 4.23% rise. However, the stock's longer-term performance reveals a more troubling picture, with a 22.34% decline over the past three months, compared to the Sensex's modest drop of 1.48%. Year-to-date, Paragon Finance has fallen by 21.25%, while the Sensex has decreased by only 1.06%. The stock opened at Rs 53.55 and reached an intraday low of the same price, indicating a lack of trading range today. Additionally, while the stock is above...

Read MoreParagon Finance Adjusts Valuation Grade Amid Competitive Finance Sector Landscape

2025-03-24 08:00:02Paragon Finance, a microcap player in the finance/NBFC sector, has recently undergone a valuation adjustment. The company currently reports a price-to-earnings (PE) ratio of 16.00 and a price-to-book value of 0.78, indicating its market valuation relative to its book value. Additionally, the enterprise value to EBITDA stands at 23.41, while the enterprise value to sales is recorded at 9.21. In terms of performance metrics, Paragon Finance shows a return on capital employed (ROCE) of 4.63% and a return on equity (ROE) of 4.87%. These figures provide insight into the company's efficiency in generating profits from its capital and equity. When compared to its peers, Paragon Finance's valuation metrics reflect a competitive landscape. For instance, while it maintains a fair valuation, other companies in the sector exhibit a range of valuations, with some positioned significantly higher. This context highligh...

Read MoreParagon Finance Adjusts Valuation Grade Amid Mixed Performance and Competitive Metrics

2025-03-17 08:00:03Paragon Finance, a microcap player in the finance/NBFC sector, has recently undergone a valuation adjustment, reflecting its current financial standing. The company's price-to-earnings ratio stands at 13.85, while its price-to-book value is notably low at 0.68. Other key metrics include an EV to EBIT ratio of 21.66 and an EV to EBITDA ratio of 20.24, indicating its operational efficiency relative to its enterprise value. In terms of returns, Paragon Finance has shown a mixed performance against the Sensex. Over the past year, the stock has returned 18.34%, significantly outperforming the index's 1.47% return. However, year-to-date, it has faced a decline of 24.26%, contrasting with the Sensex's drop of 5.52%. Over longer periods, such as three and five years, Paragon Finance has demonstrated robust growth, with returns of 166.84% and 251.54%, respectively. When compared to its peers, Paragon Finance's val...

Read MoreParagon Finance Adjusts Valuation Grade Amidst Competitive Market Dynamics

2025-03-10 08:00:03Paragon Finance, a microcap player in the finance/NBFC sector, has recently undergone a valuation adjustment. The company's current price stands at 54.82, reflecting a slight increase from the previous close of 53.98. Over the past year, Paragon Finance has demonstrated a stock return of 24.56%, significantly outperforming the Sensex, which recorded a modest gain of 0.29%. Key financial metrics for Paragon Finance include a PE ratio of 14.75 and an EV to EBITDA ratio of 21.56. The company's return on capital employed (ROCE) is reported at 4.63%, while the return on equity (ROE) stands at 4.87%. These figures provide insight into the company's operational efficiency and profitability. In comparison to its peers, Paragon Finance's valuation metrics reveal a diverse landscape. For instance, Vardhman Holdings is noted for its attractive valuation, while other competitors like Oswal Green Tech and Nisus Financ...

Read MoreParagon Finance Ltd Experiences Significant Buying Activity Amid Ongoing Price Volatility

2025-02-20 10:33:21Paragon Finance Ltd is currently witnessing significant buying activity, with the stock showing a consecutive gain over the last two days, rising by 9.89%. Despite this recent uptick, the stock's overall performance remains under pressure, with a one-day decline of 10.97%, contrasting sharply with the Sensex's minor drop of 0.34%. Over the past week, Paragon Finance has experienced a notable decline of 21.29%, while the Sensex has only decreased by 0.60%. This trend continues across longer time frames, with the stock down 28.91% over the past month and 35.29% year-to-date, compared to the Sensex's respective declines of 1.80% and 3.14%. The price summary indicates that Paragon Finance opened with a gap up but is currently trading below its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages. The stock's microcap status within the finance/NBFC sector may contribute to its volatility, and the rece...

Read More

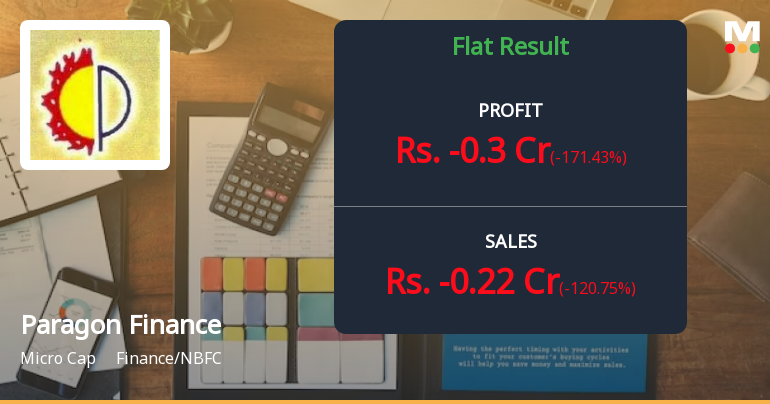

Paragon Finance Reports Mixed Financial Results Amidst Profitability Challenges in December 2024

2025-02-17 13:34:17Paragon Finance has released its financial results for the quarter ending December 2024, showing a mixed performance. While the Profit After Tax for the nine-month period increased to Rs 1.13 crore, the company faced challenges with a significant decline in both Operating Profit and Profit Before Tax for the quarter.

Read MoreUpdates on Open Offer

28-Mar-2025 | Source : BSEMark Corporate Advisors Pvt Ltd (Manager to the Offer) has submitted to BSE a copy of Announcement under Regulation 23(2) of Securities and Exchange Board of India (Substantial Acquisition of Shares and Takeovers) Regulations 2011 and subsequent amendments thereto for the attention of the public shareholders of Paragon Finance Ltd (Target Company).

Disclosures under Reg. 29(2) of SEBI (SAST) Regulations 2011

27-Mar-2025 | Source : BSEThe Exchange has received the disclosure under Regulation 29(2) of SEBI (Substantial Acquisition of Shares & Takeovers) Regulations 2011 for Vidul Gupta

Closure of Trading Window

24-Mar-2025 | Source : BSEIntimation of Closure of Trading Window of the company

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available