Radico Khaitan Shows Strong Financial Performance Amid Evolving Market Dynamics

2025-04-03 08:07:22Radico Khaitan, a key player in the Breweries & Distilleries sector, has recently experienced an evaluation adjustment reflecting its strong market position. The company reported impressive Q3 FY24-25 financials, including record net sales and a solid Debt to EBITDA ratio, while maintaining significant institutional investor interest.

Read More

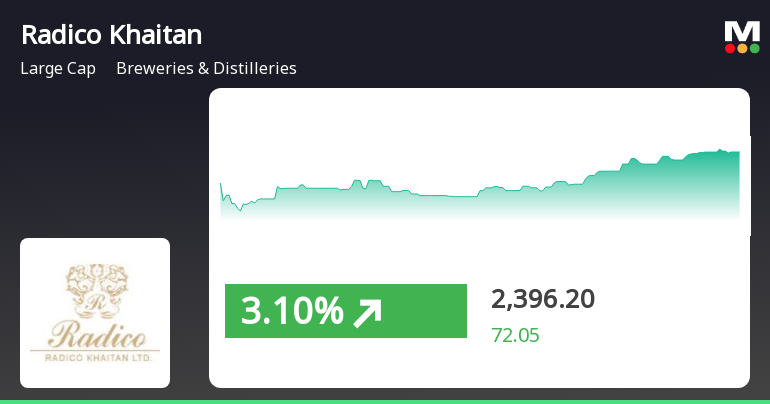

Radico Khaitan Demonstrates Strong Market Resilience Amid Broader Sector Trends

2025-04-02 12:15:20Radico Khaitan, a key player in the Breweries & Distilleries sector, demonstrated strong market performance on April 2, 2025, with significant gains. The stock has consistently traded above various moving averages and has shown impressive long-term growth, outperforming the Sensex over the past year and three to five years.

Read MoreRadico Khaitan's Technical Indicators Show Mixed Signals Amid Strong Performance Trends

2025-04-02 08:03:02Radico Khaitan, a prominent player in the Breweries & Distilleries sector, has recently undergone an evaluation revision reflecting its current market dynamics. The company's stock is currently priced at 2,324.15, with a previous close of 2,427.40. Over the past year, Radico Khaitan has demonstrated a notable return of 34.48%, significantly outperforming the Sensex, which recorded a return of 2.72% in the same period. In terms of technical indicators, the weekly MACD and monthly MACD both signal a bullish trend, while the daily moving averages also reflect a positive outlook. However, the KST shows a bearish signal on a weekly basis, contrasting with its monthly bullish stance. The Bollinger Bands indicate a mildly bullish trend on both weekly and monthly scales, suggesting some volatility in the stock's price movements. Looking at the company's performance over various time frames, Radico Khaitan has sho...

Read More

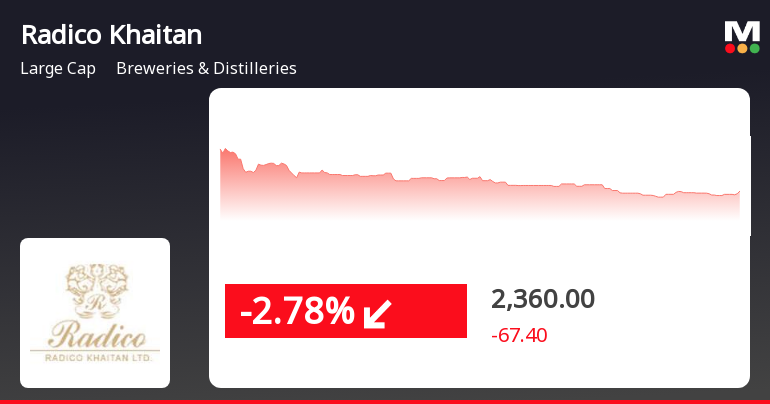

Radico Khaitan Faces Setback Amid Broader Market Pressure and Trend Reversal Signals

2025-04-01 12:15:21Radico Khaitan, a key player in the Breweries & Distilleries sector, saw a decline on April 1, 2025, following a four-day gain streak. Despite today's drop, the stock remains above several moving averages, indicating a generally positive long-term trend, while the broader market faces significant pressure.

Read MoreRadico Khaitan Shows Mixed Technical Indicators Amid Strong Long-Term Performance

2025-04-01 08:01:04Radico Khaitan, a prominent player in the Breweries & Distilleries sector, has recently undergone an evaluation revision reflecting its current market dynamics. The company's stock is currently priced at 2,427.40, showing a notable increase from the previous close of 2,384.00. Over the past year, Radico Khaitan has demonstrated a strong performance, with a return of 40.60%, significantly outpacing the Sensex's return of 5.11% during the same period. In terms of technical indicators, the company exhibits a mixed outlook. The MACD shows a bullish trend on a monthly basis, while the weekly perspective indicates a mildly bearish stance. The Bollinger Bands and daily moving averages suggest a bullish sentiment, contrasting with the KST, which reflects a bearish trend on a weekly basis. The overall technical summary indicates a complex market position, with various indicators providing differing signals. Notabl...

Read MoreRadico Khaitan Shows Mixed Technical Trends Amid Strong Long-Term Performance

2025-03-27 08:00:54Radico Khaitan, a prominent player in the Breweries & Distilleries sector, has recently undergone an evaluation revision reflecting its current market dynamics. The company’s stock is currently priced at 2,352.30, showing a slight increase from the previous close of 2,335.30. Over the past year, Radico Khaitan has demonstrated significant resilience, with a remarkable return of 40.57%, compared to the Sensex's 6.65% during the same period. In terms of technical indicators, the company exhibits a mixed performance across various metrics. The Moving Averages indicate a bullish sentiment on a daily basis, while the MACD shows a mildly bearish trend on a weekly scale but bullish on a monthly basis. The Bollinger Bands also reflect a bullish stance for both weekly and monthly evaluations, suggesting a positive outlook in terms of volatility and price movement. Notably, Radico Khaitan has outperformed the Sense...

Read MoreRadico Khaitan Shows Significant Volatility Amid Strong Long-Term Performance Trends

2025-03-25 08:01:45Radico Khaitan, a prominent player in the Breweries & Distilleries sector, has recently undergone an evaluation revision reflecting its current market dynamics. The company, which is classified as a large-cap entity, has shown a notable performance trajectory over various time frames. As of the latest data, Radico Khaitan's stock price stands at 2299.10, slightly down from the previous close of 2305.35. The stock has experienced a 52-week high of 2,637.00 and a low of 1,428.95, indicating significant volatility within the year. Today's trading saw a high of 2338.40 and a low of 2285.00, further illustrating the stock's active movement. In terms of returns, Radico Khaitan has demonstrated resilience, particularly over the long term. Over the past year, the stock has returned 39.52%, significantly outperforming the Sensex, which recorded a return of 7.07%. Over three years, the company has achieved a remar...

Read More

Radico Khaitan Adjusts Evaluation Amid Strong Financial Performance and Market Outperformance

2025-03-24 08:05:17Radico Khaitan, a key player in the Breweries & Distilleries sector, has experienced a recent evaluation adjustment reflecting improved market conditions. The company showcases strong financial health with a low Debt to EBITDA ratio, impressive quarterly net sales, and a notable return on capital employed, indicating operational efficiency and market outperformance.

Read MoreRadico Khaitan's Technical Trends Indicate Mixed Outlook Amid Strong Performance

2025-03-24 08:00:44Radico Khaitan, a prominent player in the Breweries & Distilleries sector, has recently undergone an evaluation revision reflecting its current market dynamics. The stock is currently priced at 2305.35, showing a slight increase from the previous close of 2288.40. Over the past year, Radico Khaitan has demonstrated a robust performance, with a return of 43.01%, significantly outpacing the Sensex's return of 5.87% during the same period. The technical summary indicates a mixed outlook, with the MACD showing a bullish trend on a monthly basis, while the weekly indicators present a more cautious stance. Notably, the Bollinger Bands and daily moving averages are signaling bullish conditions, suggesting positive momentum in the stock's performance. In terms of returns, Radico Khaitan has excelled over longer periods, with a remarkable 658.21% return over five years compared to the Sensex's 157.07%. This perfo...

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

08-Apr-2025 | Source : BSECertificate under Regulation 74(5) of the SEBI (Depositories and Participants) Regulations 2018

Closure of Trading Window

25-Mar-2025 | Source : BSEIntimation for Closure of Trading Window

Announcement under Regulation 30 (LODR)-Allotment of ESOP / ESPS

20-Mar-2025 | Source : BSEAllotment of Equity Shares on exercise of stock options under Employee Stock Option Scheme 2006.

Corporate Actions

No Upcoming Board Meetings

Radico Khaitan Ltd. has declared 150% dividend, ex-date: 25 Jul 24

No Splits history available

No Bonus history available

No Rights history available