RBL Bank Sees Surge in Open Interest Amid Increased Trading Activity

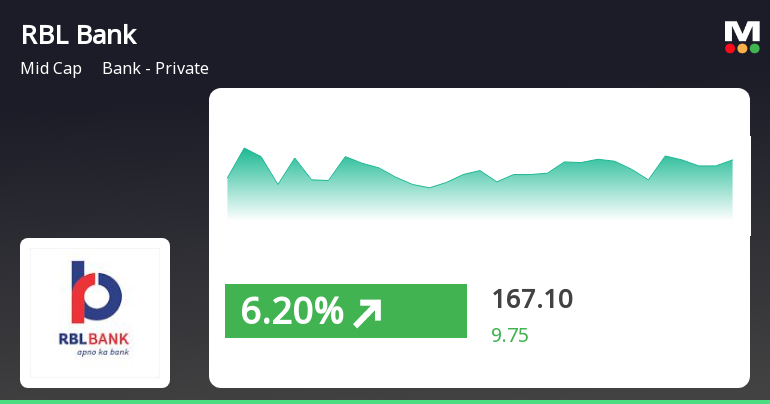

2025-03-24 15:00:50RBL Bank Ltd, a mid-cap player in the private banking sector, has experienced a significant increase in open interest today, reflecting heightened trading activity. The latest open interest stands at 37,350 contracts, up from the previous 33,545, marking a change of 3,805 contracts or an 11.34% increase. The trading volume for the day reached 37,177 contracts, contributing to a futures value of approximately Rs 93,929.30 lakhs. In terms of price performance, RBL Bank has outperformed its sector by 2.48%, with the stock gaining 6.95% over the last two days. Today, it reached an intraday high of Rs 176.56, reflecting a 4.91% increase. The stock is currently trading above its 5-day, 20-day, 50-day, and 100-day moving averages, although it remains below the 200-day moving average. The private banking sector overall has seen a gain of 2.01%, while RBL Bank's delivery volume surged to 52.51 lakh shares, a notab...

Read MoreRBL Bank Sees Surge in Open Interest Amid Increased Trading Activity

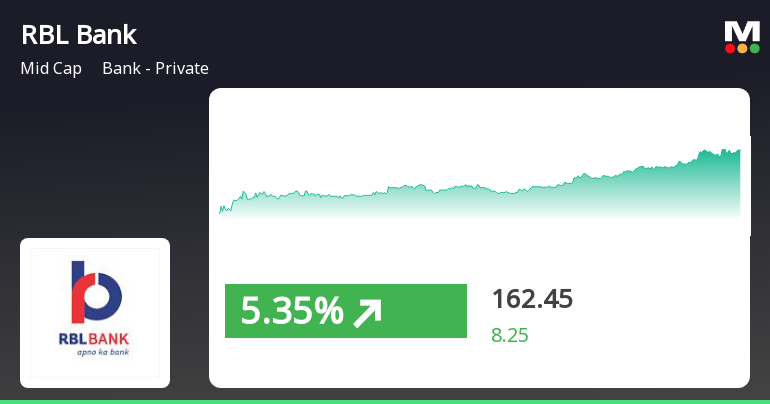

2025-03-24 14:00:33RBL Bank Ltd has experienced a notable increase in open interest today, reflecting heightened activity in its trading. The latest open interest stands at 36,991 contracts, marking an increase of 3,446 contracts or 10.27% from the previous open interest of 33,545. The trading volume for the day reached 33,360 contracts, contributing to a total futures value of approximately Rs 83,071.76 lakhs and an options value of Rs 6,355.62 lakhs, bringing the total to Rs 84,522.93 lakhs. In terms of price performance, RBL Bank has outperformed its sector by 2.73%, with a 1-day return of 4.68%. The stock has shown consistent gains over the past two days, accumulating a total return of 6.88%. Today, RBL Bank reached an intraday high of Rs 176.49, reflecting a rise of 4.87%. The stock is currently trading above its 5-day, 20-day, 50-day, and 100-day moving averages, although it remains below the 200-day moving average. O...

Read MoreRBL Bank Sees Surge in Open Interest Amid Increased Trading Activity

2025-03-24 13:00:37RBL Bank Ltd, a mid-cap player in the private banking sector, has experienced a significant increase in open interest (OI) today. The latest OI stands at 37,201 contracts, reflecting a rise of 3,656 contracts or 10.9% from the previous OI of 33,545. This uptick in OI comes alongside a trading volume of 28,198 contracts, indicating heightened activity in the stock. In terms of price performance, RBL Bank has outperformed its sector by 2.24%, with the stock gaining 4.75% on the day. It has shown a consistent upward trend, recording gains for the last two consecutive days, amounting to a total return of 6.51% during this period. The stock reached an intraday high of Rs 175.5, marking a 4.28% increase. Additionally, the stock's weighted average price suggests that more volume was traded closer to its low price, while it remains above its 5-day, 20-day, 50-day, and 100-day moving averages, although it is below...

Read More

RBL Bank Outperforms Sector Amid Broader Market Gains and Mixed Moving Averages

2025-03-18 15:30:56RBL Bank has experienced notable activity, outperforming its sector and reaching an intraday high. The stock is above several short-term moving averages but below longer-term ones. In the broader market, the Bank - Private sector and Sensex have also shown gains, although the Sensex remains below key moving averages.

Read MoreRBL Bank Faces Mixed Technical Signals Amidst Market Volatility and Declining Performance

2025-03-03 08:00:47RBL Bank, a midcap player in the private banking sector, has recently undergone an evaluation revision reflecting its current market dynamics. The bank's stock price is currently at 158.85, down from a previous close of 162.75, with a 52-week high of 277.30 and a low of 146.00. Today's trading saw a high of 162.70 and a low of 155.50, indicating some volatility. The technical summary reveals mixed signals across various indicators. The MACD shows a mildly bullish trend on a weekly basis but turns bearish on a monthly scale. The Relative Strength Index (RSI) presents no clear signal for both weekly and monthly assessments. Bollinger Bands indicate a bearish stance, consistent across both time frames. Daily moving averages also reflect a bearish trend, while the KST shows a mildly bullish weekly trend but leans bearish monthly. In terms of performance, RBL Bank's returns have varied significantly compared t...

Read MoreRBL Bank Faces Mixed Technical Trends Amid Market Volatility and Performance Challenges

2025-03-02 08:00:47RBL Bank, a midcap player in the private banking sector, has recently undergone an evaluation revision reflecting its current market dynamics. The bank's stock price is currently at 158.85, down from a previous close of 162.75, with a notable 52-week high of 277.30 and a low of 146.00. Today's trading saw a high of 162.70 and a low of 155.50, indicating some volatility. The technical summary reveals a mixed picture. The MACD indicates a mildly bullish trend on a weekly basis but shifts to bearish on a monthly scale. The Relative Strength Index (RSI) shows no significant signals for both weekly and monthly periods. Bollinger Bands and moving averages are predominantly bearish, suggesting caution in the short term. The KST presents a mildly bullish outlook weekly but leans bearish monthly, while Dow Theory and On-Balance Volume (OBV) both reflect a mildly bearish stance. In terms of performance, RBL Bank's ...

Read MoreRBL Bank Faces Mixed Technical Signals Amid Market Volatility and Performance Challenges

2025-03-01 08:00:45RBL Bank, a midcap player in the private banking sector, has recently undergone an evaluation revision reflecting its current market dynamics. The bank's stock price is currently at 158.85, down from a previous close of 162.75, with a 52-week high of 277.30 and a low of 146.00. Today's trading saw a high of 162.70 and a low of 155.50, indicating some volatility. The technical summary for RBL Bank reveals mixed signals across various indicators. The MACD shows a mildly bullish trend on a weekly basis, while the monthly perspective leans bearish. The Relative Strength Index (RSI) indicates no significant signals for both weekly and monthly periods. Bollinger Bands and moving averages are predominantly bearish, suggesting caution in the short term. The KST presents a mildly bullish outlook weekly but shifts to bearish on a monthly basis, while Dow Theory and On-Balance Volume (OBV) also reflect mildly bearish...

Read MoreRBL Bank's Technical Indicators Reflect Mixed Signals Amid Market Dynamics

2025-02-28 08:00:39RBL Bank, a midcap player in the private banking sector, has recently undergone an evaluation revision reflecting its current market dynamics. The bank's stock price is currently at 162.75, showing a notable increase from the previous close of 157.35. Over the past week, RBL Bank has experienced a stock return of 1.66%, contrasting with a decline of 1.48% in the Sensex, indicating a relative outperformance in the short term. In terms of technical indicators, the bank's MACD shows a mildly bullish trend on a weekly basis, while the monthly perspective remains bearish. The Relative Strength Index (RSI) does not signal any significant movement in either timeframe. Bollinger Bands and moving averages suggest a mildly bearish outlook on a daily basis, with the KST reflecting mixed signals across weekly and monthly evaluations. RBL Bank's performance over various periods reveals a complex picture. While it has ...

Read More

RBL Bank's Stock Rebounds, Signaling Potential Resilience Amid Market Trends

2025-02-27 09:35:23RBL Bank's stock experienced a notable rebound on February 27, 2025, following two days of decline. The bank outperformed its sector and has shown a significant monthly gain, while its current position relative to moving averages indicates short-term strength amidst a mixed longer-term outlook.

Read MoreShareholder Meeting / Postal Ballot-Outcome of Postal_Ballot

09-Apr-2025 | Source : BSERBL Bank Limited informs the exchange about outcome of Postal Ballot.

Shareholder Meeting / Postal Ballot-Scrutinizers Report

09-Apr-2025 | Source : BSERBL Bank Limited informs the exchange about scrutinizers report of Postal Ballot.

Compliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

08-Apr-2025 | Source : BSECertificate under regulation 74_5_of SEBI_DPR Regulation 2018 for the quarter ended March 31 2025

Corporate Actions

No Upcoming Board Meetings

RBL Bank Ltd has declared 15% dividend, ex-date: 26 Jul 24

No Splits history available

No Bonus history available

No Rights history available