Real Touch Finance Faces Volatility Amid Mixed Financial Performance Indicators

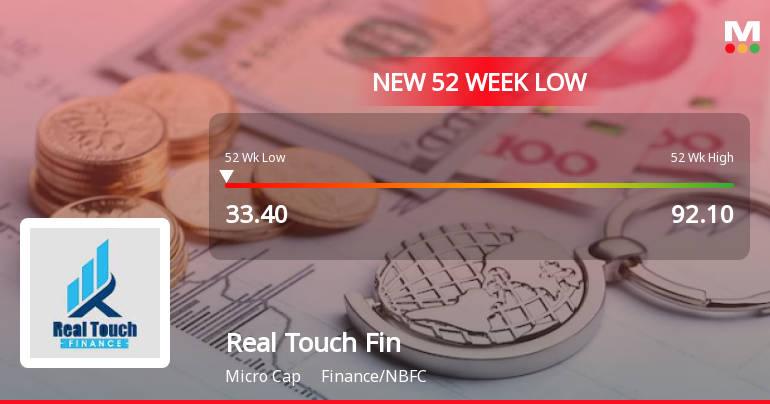

2025-04-03 15:05:33Real Touch Finance, a microcap in the finance/NBFC sector, has hit a new 52-week low amid significant volatility, experiencing a 23.41% decline over the past week. Despite this, the company reported a 47.01% growth in net profit for the December quarter, reflecting mixed financial performance.

Read MoreReal Touch Finance Ltd. Sees Increased Buying Activity Amidst Significant Price Declines

2025-04-03 14:50:05Real Touch Finance Ltd., a microcap player in the finance/NBFC sector, is currently witnessing significant buying activity despite its recent performance challenges. The stock has experienced a consecutive decline over the past seven days, with a notable drop of 23.41% during this period. Today, it opened at a new 52-week low of Rs. 33.4, reflecting a decrease of 4.98%, while the broader Sensex index fell by only 0.43%. In terms of longer-term performance, Real Touch Finance has faced substantial declines, with a 50.48% drop over the past month and a year-to-date decline of 59.52%. Comparatively, the Sensex has shown resilience, gaining 4.38% over the past month and 3.26% over the past year. The stock's current trading position is below its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, indicating a bearish trend. The buying pressure may be attributed to market participants capitalizing on ...

Read More

Real Touch Finance Faces Stock Volatility Despite Strong Profit Growth and Sales Increase

2025-04-02 13:35:16Real Touch Finance, a microcap in the finance/NBFC sector, hit a new 52-week low today, continuing a trend of underperformance. Despite a 47.01% net profit growth and a 39.63% increase in half-year sales, the stock has seen a one-year return of -28.12%, trailing behind broader market gains.

Read MoreReal Touch Finance Faces Intense Selling Pressure Amid Significant Price Declines

2025-04-02 13:05:07Real Touch Finance Ltd. is currently facing significant selling pressure, with the stock showing only sellers today. The company has experienced consecutive days of losses, with a notable decline of 5.00% in today's trading session. Over the past week, the stock has dropped 14.48%, and its performance over the last month reveals a staggering loss of 47.89%. In comparison, the Sensex has shown resilience, gaining 0.50% today and only declining 1.15% over the past week. The stock's performance relative to the Sensex highlights a troubling trend for Real Touch Finance. Year-to-date, the stock has plummeted 57.39%, while the Sensex has only dipped 2.22%. The stock has also hit a new 52-week low of Rs. 37 today, indicating a challenging market position. Furthermore, Real Touch Finance is trading below its 5-day, 20-day, 50-day, 100-day, and 200-day moving averages, suggesting a sustained downward trend. Poten...

Read MoreReal Touch Finance Ltd. Sees Increased Buying Activity Amidst Market Sentiment Shift

2025-04-02 11:25:11Real Touch Finance Ltd., a microcap player in the finance/NBFC sector, is witnessing significant buying activity today, marking a notable shift in market sentiment. The stock has recently hit a new 52-week low of Rs. 37, indicating a challenging period for the company. Over the past week, Real Touch Finance has experienced a decline of 9.98%, contrasting sharply with the Sensex, which fell by only 1.03%. In terms of longer-term performance, the stock has struggled, with a 1-month decline of 45.14% compared to the Sensex's gain of 4.50%. Over three months, it has dropped 56.85%, while the Sensex has decreased by 4.32%. Despite these setbacks, Real Touch Finance has shown resilience over a three-year period, with a gain of 44.81%, outperforming the Sensex's 29.04% increase. Today's trading performance indicates that Real Touch Finance is underperforming its sector by 0.26%. The stock is currently trading b...

Read More

Real Touch Finance Faces Market Challenges Despite Strong Profit Growth and Sales Performance

2025-04-01 15:36:10Real Touch Finance, a microcap in the finance/NBFC sector, reached a new 52-week low today after five consecutive days of decline. Despite this, the company reported a 47.01% net profit growth and a 39.63% increase in net sales for the half-year, although it has underperformed the broader market over the past year.

Read MoreReal Touch Finance Adjusts Valuation Grade Amid Competitive Market Landscape

2025-04-01 08:00:19Real Touch Finance, a microcap player in the finance and non-banking financial company (NBFC) sector, has recently undergone a valuation adjustment. The company's financial metrics reflect a price-to-earnings (P/E) ratio of 10.66 and an enterprise value to EBITDA ratio of 9.57, indicating a competitive positioning within its industry. The PEG ratio stands at a notably low 0.15, suggesting potential for growth relative to its earnings. In comparison to its peers, Real Touch Finance demonstrates a more favorable valuation profile. For instance, while companies like Fedders Holding and Indl. & Prud. Inv. maintain fair valuations, others such as Centrum Capital and Colab Platforms are categorized as very expensive, highlighting the disparity in market positioning. Despite recent stock performance showing a decline over various periods, including a year-to-date drop of 54.61%, Real Touch Finance's return metr...

Read MoreReal Touch Finance Ltd. Sees Buying Surge After 11-Day Decline, Signals Market Shift

2025-03-24 09:35:26Real Touch Finance Ltd., a microcap player in the finance/NBFC sector, is witnessing significant buying activity today, with a notable gain of 2.01%. This performance stands in contrast to the Sensex, which has increased by only 0.53%. The stock has experienced a trend reversal after 11 consecutive days of decline, indicating a potential shift in market sentiment. Despite today's positive movement, Real Touch Finance has faced challenges over the past week, with a decline of 16.63%, and a more substantial drop of 38.58% over the past month. Year-to-date, the stock is down 47.14%, while the Sensex has only decreased by 1.06%. However, over a three-year period, Real Touch Finance has shown resilience with a gain of 53.29%, outperforming the Sensex's 34.23% increase. In terms of price summary, the stock opened with a gap up today, reflecting the strong buying pressure. It is currently trading below its 5-day...

Read MoreReal Touch Finance Ltd. Faces Buying Surge Amidst Ongoing Price Declines and Market Challenges

2025-03-21 15:30:08Real Touch Finance Ltd., a microcap player in the finance/NBFC sector, is currently witnessing significant buying activity despite a challenging performance. The stock has experienced a consecutive decline over the past seven days, with a total drop of 29.92%. Today, it opened with a gap down, reaching an intraday low of Rs 42.75, reflecting a 5% decrease. In terms of performance relative to the Sensex, Real Touch Finance has underperformed across various time frames. Over the past day, it declined by 5.00%, while the Sensex rose by 0.83%. The one-week performance shows a stark contrast, with Real Touch down 22.36% compared to the Sensex's gain of 4.27%. Over the past month, the stock has plummeted by 39.79%, while the Sensex has managed a modest increase of 2.21%. Several factors may be contributing to the current buying pressure, including potential market corrections or sector-specific developments. Ho...

Read MoreCompliances-Certificate under Reg. 74 (5) of SEBI (DP) Regulations 2018

09-Apr-2025 | Source : BSEPlease find enclosed herewith a certificate under regulations 74(5) of SEBI (Depositories and Participants) regulations 2018 for the Quarter ended march 31 2025 received from niche Technologies private limited registrar and share transfer agent of our company. We request you to kindly take this on record.

Disclosure Under Regulation 31(4) Of SEBI (Substantial Acquisition Of Shares And Takeover) Regulation 2011 For The Year Ended On March 31 2025.

05-Apr-2025 | Source : BSEWe wish to submit the disclosure received from the promoter of the company pursuant to the provisions of Regulation 31(4) of Securities exchange board of India (Substantial Acquisition of Shares and Takeover)Regulations 2011 for the financial year ended 31st March 2025. You are requested to take the above information on record.

Shareholder Meeting / Postal Ballot-Outcome of Postal_Ballot

01-Apr-2025 | Source : BSEPursuant to Regulation 30 and 44 of SEBI (Listing Obligation and Disclosure Requirements) Regulations 2015 we wish to Inform you that above resolutions has been duly passed by the members of the company with Requisite Majority.

Corporate Actions

No Upcoming Board Meetings

No Dividend history available

No Splits history available

No Bonus history available

No Rights history available