Responsive Industries Faces Significant Volatility Amid Deteriorating Market Conditions

2025-03-27 12:38:02Responsive Industries, a small-cap in the plastic products sector, has faced notable volatility, nearing a 52-week low. The stock has declined significantly over the past three days and is trading below key moving averages. Its one-year performance contrasts sharply with broader market gains, indicating ongoing challenges.

Read More

Responsive Industries Faces Potential Trend Reversal Amid Broader Market Gains

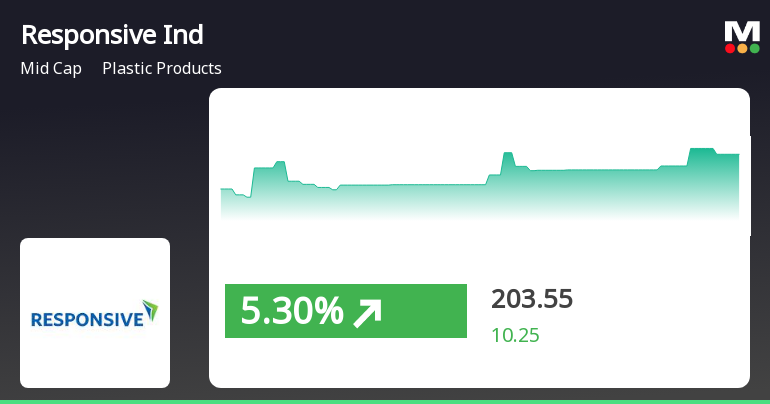

2025-03-25 14:05:23Responsive Industries, a midcap company in the plastic products sector, saw a significant decline on March 25, 2025, following a five-day gain streak. The stock has underperformed against the broader market, with a notable drop over the past year, highlighting ongoing challenges in its performance metrics.

Read MoreResponsive Industries Adjusts Valuation Grade Amid Competitive Plastic Products Landscape

2025-03-25 08:00:34Responsive Industries, a midcap player in the plastic products sector, has recently undergone a valuation adjustment, reflecting a shift in its financial standing. The company's current price stands at 203.35, slightly above its previous close of 198.40. Over the past year, the stock has experienced a decline of 30.54%, contrasting with a 7.07% increase in the Sensex. Key financial metrics for Responsive Industries include a PE ratio of 28.46 and an EV to EBITDA ratio of 19.77, indicating a robust valuation relative to its earnings. The company also boasts a PEG ratio of 0.71, suggesting a favorable growth outlook compared to its price. However, its dividend yield remains low at 0.05%, which may influence investor sentiment. In comparison to its peers, Responsive Industries is positioned at a higher valuation level, with competitors like Finolex Industries and Time Technoplast rated more favorably in term...

Read MoreResponsive Industries Adjusts Valuation Grade Amidst Competitive Market Landscape

2025-03-12 08:00:32Responsive Industries, a midcap player in the plastic products sector, has recently undergone a valuation adjustment, reflecting its financial metrics and market positioning. The company's price-to-earnings ratio stands at 27.90, while its price-to-book value is noted at 4.30. Additionally, the enterprise value to EBITDA ratio is recorded at 19.39, indicating a robust valuation framework. In terms of profitability, Responsive Industries showcases a return on capital employed (ROCE) of 14.64% and a return on equity (ROE) of 15.25%, which are significant indicators of its operational efficiency. The company's PEG ratio is 0.70, suggesting a favorable growth outlook relative to its earnings. When compared to its peers, Responsive Industries is positioned distinctly within the market. While it is classified as very expensive, competitors like Finolex Industries and Time Technoplast are rated differently, with...

Read More

Responsive Industries Faces Potential Trend Reversal Amid Broader Market Challenges

2025-03-10 15:30:34Responsive Industries, a midcap in the plastic products sector, saw a notable decline on March 10, 2025, following a four-day gain streak. The stock is currently trading below multiple moving averages and has underperformed its sector and the broader market over various timeframes.

Read MoreResponsive Industries Faces Market Challenges Amid Significant Stock Volatility

2025-03-10 14:20:15Responsive Industries, a midcap player in the plastic products sector, has experienced significant volatility today, opening with a loss of 6.31%. This decline marks a notable trend reversal after four consecutive days of gains. The stock's performance today has underperformed the sector by 0.78%, reflecting broader market challenges. Throughout the trading session, Responsive Industries reached an intraday low of Rs 193, contributing to a one-day performance decline of 2.91%, while the benchmark Sensex showed a marginal increase of 0.02%. Over the past month, the stock has faced a more pronounced downturn, with a decrease of 15.04%, compared to the Sensex's decline of 3.83%. In terms of technical indicators, the stock's moving averages indicate a mixed picture; it remains above the 5-day moving average but falls short of the 20-day, 50-day, 100-day, and 200-day moving averages. This performance highlight...

Read MoreResponsive Industries Adjusts Valuation Grade Amid Competitive Plastic Products Landscape

2025-03-06 08:00:49Responsive Industries, a midcap player in the plastic products sector, has recently undergone a valuation adjustment. The company's current price stands at 202.40, reflecting a notable increase from the previous close of 193.30. Over the past year, the stock has experienced a decline of 31.70%, contrasting with a slight gain of 0.07% in the Sensex. Key financial metrics for Responsive Industries include a PE ratio of 28.33 and an EV to EBITDA ratio of 19.68, indicating a robust valuation relative to its earnings. The company's return on capital employed (ROCE) is reported at 14.64%, while the return on equity (ROE) stands at 15.25%. These figures suggest a solid operational performance, although the stock's PEG ratio of 0.71 indicates potential growth relative to its price. In comparison to its peers, Responsive Industries exhibits a higher valuation profile, particularly when contrasted with companies li...

Read More

Responsive Industries Sees Short-Term Gains Amid Long-Term Challenges in Market Dynamics

2025-03-05 11:45:27Responsive Industries, a midcap player in the plastic products sector, experienced significant trading activity, outperforming the broader market. The stock has shown recent positive momentum with consecutive gains, although it has faced challenges over the longer term. The broader market also saw gains, particularly in midcap stocks.

Read More

Responsive Industries Hits 52-Week Low Amid Broader Market Bearish Sentiment

2025-03-04 10:14:43Responsive Industries, a midcap in the plastic products sector, reached a new 52-week low amid a three-day decline, despite an initial gain. The company has seen a 35.79% drop over the past year, though its operating profit rose by 39.7%. The stock's volatility and high valuation raise concerns.

Read MoreAnnouncement under Regulation 30 (LODR)-Newspaper Publication

27-Mar-2025 | Source : BSENewspaper advertisement of Postal ballot Notice and e-voting instructions

Closure of Trading Window

26-Mar-2025 | Source : BSEIntimation of closure of trading window

Shareholder Meeting / Postal Ballot-Notice of Postal Ballot

25-Mar-2025 | Source : BSENotice of Postal Ballot and e-voting information

Corporate Actions

No Upcoming Board Meetings

Responsive Industries Ltd has declared 10% dividend, ex-date: 06 Sep 24

Responsive Industries Ltd has announced 1:10 stock split, ex-date: 08 Oct 10

Responsive Industries Ltd has announced 3:1 bonus issue, ex-date: 22 Mar 07

No Rights history available